EUR/USD eased down for a fourth straight day on Monday.

Markets are hoping for easing tariff tensions from the Trump administration.

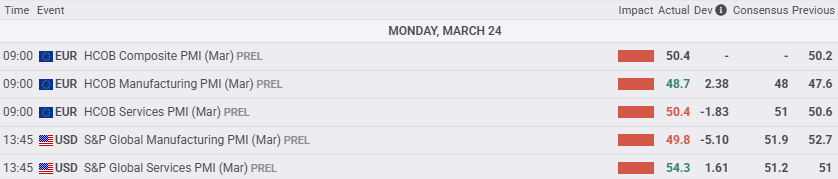

EU and US PMI survey results came in mixed as the economic outlook remains uncertain.

EUR/USD roiled on Monday, testing below the 1.0800 handle as market sentiment continues to grapple with mixed economic data and still-cooking tariff concerns. Investors found some relief after US President Donald Trump hinted that tariff exemptions to his own previously-unavoidable tariffs slated for April 2, but Purchasing Managers Index (PMI) survey results continues to warn that more problems may be on the horizon.

US President Donald Trump has again hit investors with a fresh batch of on-again, off-again tariff threats. Investors have latched onto the suggestion that Donald Trump might be looking at tariff exemptions for his own trade policy “strategy”, bolstering market sentiment enough to keep the Greenback under wraps.

Pan-European PMI data soured overall in March, with the Manufacturing PMI rising to 48.7 but still holding in contraction territory. The Services component ticked lower to 50.4, whereas median market forecasts were hoping for a rebound to 51.0

US Manufacturing PMI survey results sank faster than expected in March as tariff threats take a bite out of the physical production outlook. The Manufacturing PMI for March sank to a three-month low of 49.8, slipping back into economic contraction territory as businesses grow increasingly worried about the economic landscape. The Services PMI came in better than expected, rising to 54.3, it’s own three-month high as services operators expect to be able to fully pass on tariff cost increases to consumers.

The economic data docket remains firmly mid-tier heading through the midweek market sessions, but traders will be keeping an eye on looming US Personal Consumption Expenditure Price Index inflation figures due on Friday.

EUR/USD price forecast

EUR/USD has shed weight for four straight trading days, declining from it’s latest swing high into 1.0950. Fiber is testing back into the 1.0800 handle, but is still trading well north of the 200-day Exponential Moving Average (EMA) near 1.0675.

EUR/USD is still trading 5.8% above its last major swing low below 1.0200 in January, however the bull run may be set to end as technical oscillators accelerate to the downside.

EUR/USD daily chart

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.