EUR/USD rebounds from multi-week low, climbs to 1.0780 area amid USD downtick

EUR/USD gains some positive traction on Thursday and snaps a six-day losing streak.

A modest USD pullback from a multi-month top is seen lending support to spot prices.

Global trade war fears and a weaker risk tone could limit USD losses and cap the pair.

The EUR/USD pair rebounds from over a three-week low, around the 1.0735-1.0730 area touched during the Asian session on Thursday, and for now, seems to have snapped a six-day losing streak. The momentum lifts spot prices to the 1.0780 region, or a fresh daily high in the last hour, and is sponsored by renewed US Dollar (USD) selling bias.

In fact, the USD Index (DXY), which tracks the Greenback against a basket of currencies, retreated after touching a three-week top amid worries that economic growth was slowing considerably on the back of US President Donald Trump's trade policies. In the latest development, Trump unveiled a 25% tariff on imported cars and light trucks starting next week, though he allowed up to a one-month reprieve for auto parts imports.

This comes on top of the recent 25% flat import tax on all steel and aluminum, and the impending reciprocal tariffs on April 2, fueling uncertainty and overshadowing the better-than-expected release of US Durable Goods Orders on Wednesday. Apart from this, the Federal Reserve's (Fed) forecast for two 25-basis-point interest rate cuts by the end of this year weighs on the USD and lends support to the EUR/USD pair.

Meanwhile, the European Union (EU) has said it will retaliate by imposing tariffs on imports from the US. This raises the risk of a full-blown EU-US trade war, which might hold back traders from placing aggressive bullish bets around the shared currency. Moreover, the anti-risk flow – as depicted by a generally weaker tone around the equity markets – could underpin the safe-haven buck and cap the EUR/USD pair.

Traders now look forward to the US economic docket – featuring the release of the final Q4 GDP print, the usual Weekly Initial Jobless Claims, and Pending Home Sales data. Apart from this, speeches from influential FOMC members would drive the USD and provide some impetus to the EUR/USD pair. The market focus, however, remains glued to the US Personal Consumption Expenditure (PCE) Price Index on Friday.

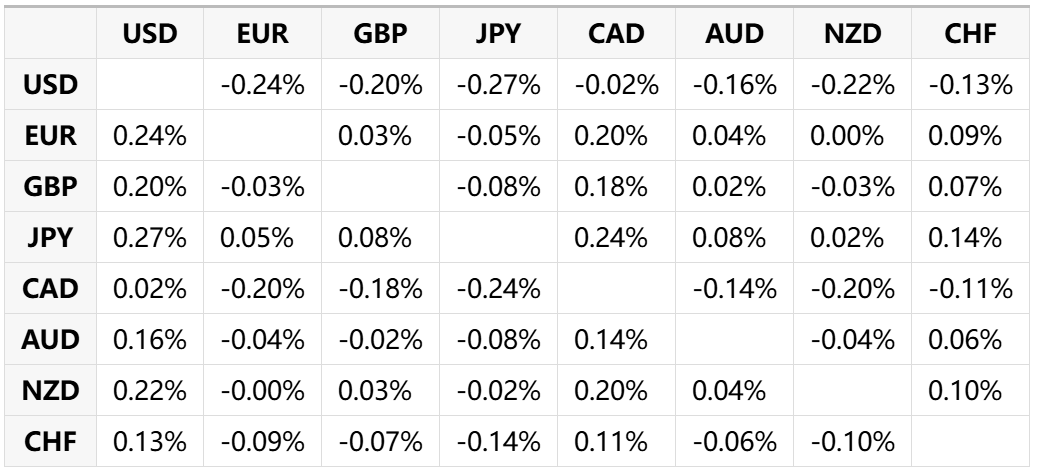

US Dollar PRICE Today

The table below shows the percentage change of US Dollar (USD) against listed major currencies today. US Dollar was the strongest against the Canadian Dollar.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.