Bitcoin Mining Beginner Guide 2024: What Is Bitcoin Mining and How to Mine Bitcoin?

2024, a once-in-a-century year, miraculously sees the arrival of a triple boost: the SEC approves a Bitcoin spot ETF in January, BTC experiences its fourth halving event in April, and the Federal Reserve is expected to cut interest rates this year. Any one of these events would be enough to buoy BTC prices, let alone all three happening this year. As a result, Bitcoin prices have entered a frenzy mode right at the beginning of 2024, skyrocketing over 40% in just two months to breach $70,000.

Bitcoin price live Chart ▼ Mitrade

Register and trade Bitcoin with 0 commission and low spreads! Trade Demo with 50,000USD RISK-FREE virtual money!

Seeing this, don't you want to own a BTC? It would be even better if you could mine BTC for free. But can you still mine Bitcoin for free now? Next, we will guide you to understand what Bitcoin mining is, what the benefits of mining Bitcoin are, whether you can still mine Bitcoin for free, and how to mine Bitcoin.

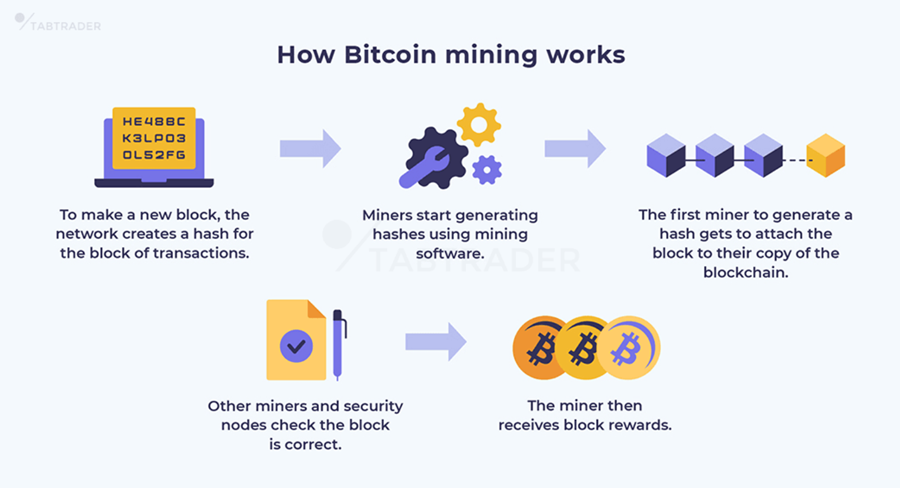

1. What is Bitcoin Mining? How Bitcoin mining works

'Bitcoin mining' refers to miners working for the Bitcoin network, and in return, they receive Bitcoin (BTC) rewards. 'Miners' refer to people who own mining rigs and work for the Bitcoin network. 'Mining rigs' refer to the tools used to work for the Bitcoin network, such as computers.

Source: tabtrader.com

When it comes to Bitcoin mining, we cannot but mention an important figure. If you are lucky enough to become a miner, you must remember to thank the progenitor of BTC mining - Satoshi Nakamoto, as he created the Bitcoin system and mined the first BTC.

To understand how Bitcoin mining works, here is the basic process to get started with Bitcoin mining that you can refer to:

Step 1: Create a Bitcoin Wallet

You cannot mine without a wallet to store the Bitcoin. There are two types of cryptocurrency wallets - cold wallets (hardware storage) and hot wallets (digital wallets). However, for Bitcoin mining, the best option is to have a cold wallet as it provides high security and can safely store large amounts of BTC.

Step 2: Set up a Bitcoin Mining System

The system includes: space, an electrical system, a network system, and Bitcoin mining ASIC (Application-Specific Integrated Circuit) devices which are specialized computers designed specifically for Bitcoin mining. Do not try to mine Bitcoin using a regular desktop or laptop, as they cannot generate enough profit to offset the electricity costs.

Step 3: Join a Mining Pool

The reason you need to join a mining pool is that mining Bitcoin alone is extremely difficult and will not generate sufficient returns. Instead, you can join a mining pool where miners collaborate and share the rewards. Your share of the rewards will be determined by your "hash rate" contribution to the pool.

Step 4: Install and Use Bitcoin Mining Software

The mining software will connect you to the mining pool and let you know your hash rate contribution within the mining group. The current mining software is compatible with all operating systems like Windows, Mac, and Linux.

Step 5: Find a Bitcoin Exchange

Once you have mined some BTC, you may need to sell them to cover your expenses. Choose reputable exchanges with high trading volume and fast transaction speeds to save time.

If you just want to chase opportunities from the changes of buying and selling price, trading Bitcoin CFDs may be an optimal choice for traders who prioritize daily Bitcoin trading or are confident in leveraged trading due to its low trading fees and flexible leverage options.

0 commission, low spreads

0 commission, low spreads Diverse risk management tools

Diverse risk management tools Flexible leverages and instant analysis

Flexible leverages and instant analysis Practice with $50,000 risk-free virtual money

Practice with $50,000 risk-free virtual money

2. BTC Mining Cost and Reward?

2.1 Costs:

Electricity: Mining requires significant computational power, which translates to high electricity consumption. Miners must consider their energy costs and efficiency when running mining hardware.

Hardware Investment: Acquiring specialized mining hardware (such as ASICs) involves an upfront investment. These machines are designed specifically for mining and can be expensive.

Maintenance and Cooling: Regular maintenance and cooling systems are essential to keep mining rigs operational. Overheating can lead to hardware failures.

Opportunity Cost: The time and effort spent on mining could be used for other activities. Miners need to weigh the opportunity cost against potential rewards.

2.2. Rewards:

Block Rewards: Miners receive newly minted Bitcoins as block rewards for successfully adding a new block to the blockchain. This reward decreases over time due to halving events (approximately every four years).

Transaction Fees: Miners also earn transaction fees for including transactions in the blocks they mine. As the network processes more transactions, fees become an increasingly important part of mining rewards.

Long-Term Appreciation: Some miners hold onto their mined Bitcoins, hoping for long-term price appreciation. If Bitcoin's value increases significantly, the rewards gained earlier become more valuable.

In summary, while mining can be profitable, it's essential to consider both costs and potential rewards. Research, stay informed, and adapt to changes in the mining landscape.

From the above description of the meaning of Bitcoin mining, we can see that mining is profitable and can earn BTC rewards. The rewards for Bitcoin miners are mainly divided into two parts: block rewards and transaction fees (also called "Gas fees"), as shown below:

Block reward | Transaction fee | |

Meaning | Every time you complete the accounting of a block, you will receive a certain amount of BTC. | Anyone who trades or transfers BTC needs to pay a fee |

Payer | Pre-configured Bitcoin system | BTC trading users |

Quantity | The block reward decreases every 4 years, which are 50, 25, 12.6, 6.25, 3.125, etc. | Not fixed |

What factors are mainly affected by | The size of the computing power is preset so that a single block is reduced by half every 4 years until 21 million coins are mined. | Network congestion; computing power |

Bitcoin Miner's BTC Reward Income - Compiled by Mitrade

Clearly, mining can bring miners certain economic income. In addition, there is an even more important benefit. What would happen if no one mined?

If all miners stop mining, it means that no one is keeping the Bitcoin network's accounts, and block generation will stop, causing the network to fall into a dead state. In simple terms, mining determines the stability and even the life or death of the Bitcoin network. In fact, as long as it is profitable, there will always be people willing to be miners to keep the Bitcoin network running, so there is no need to worry about its future.

3. What Changes Have Occurred in Bitcoin Mining?

With the rise in Bitcoin prices and the influx of more people, the mining industry has also undergone many changes, mainly reflected in three dimensions: mining rigs, mining methods, and mining rewards. It can be seen that Bitcoin has undergone significant changes.

Mining machine | CPU | From 2009 to 2012, mining could be done using the CPU of an ordinary computer . |

GPU | In the first quarter of 2013, GPU and graphics card mining became popular. | |

ASIC | In the second quarter of 2013, the use of application-specific integrated circuits (ASICs) as a specialized mining hardware device gradually dominated the entire mining market. Commonly used ASIC mining machines include Avalon and Antminer. | |

Mining form | Solo Mining | Independent mining refers to independent mining by individuals or institutions, which mainly occurred between 2009 and 2013. |

Pool Mining | As the computing power of the entire network increases, the effective mining probability of independent mining decreases significantly, and it gradually becomes difficult to recover costs. In order to solve this problem, many miners choose to combine mining machines to form mining farms and mine BTC together. | |

Cloud Mining | Cloud mining is another form of Heli Mining, which just builds the mine in the cloud. This kind of website that combines computing power to operate together is commonly known as a "Mining Pool". Currently, the more well-known mining pools include F2Pool, Poolin, BTC.com, and AntPool. | |

Mining rewards | unique | In the early days of independent mining, the rewards and transaction fees contained in a single block were given to a certain person or institution. |

shared | During the current joint effort period, the team/mining pool owners will be divided according to the proportion of computing power. |

Changes in mining machines, mining forms, and mining rewards - compiled by Mitrade

From the perspective of mining rigs, they have evolved from ordinary computers to specialized mining rigs, with equipment costs ranging from hundreds of dollars to thousands or even tens of thousands of dollars. The mining method has also changed from individual to collaborative, with a very high degree of clustering.

Correspondingly, the distribution of rewards has changed from individual to shared.

4. Can We Still Mine Bitcoin for Free in 2024?

Currently, it can be seen that Bitcoin mining is showing a trend of professionalization and industrialization, gradually being dominated by institutions or enterprises, which is what people often call the monopoly of big capital.

There is a question here: in 2024 and beyond, will individuals still be able to mine, and can they mine BTC for free?

In the early days, the network's computing power was relatively low, and individuals could easily mine a lot of BTC using their computers, and the difficulty was not high, so the early mining can be understood as a free activity.

However, if you now try to mine independently using a computer, you can hardly mine any BTC, because your computing power is too low to win the right to record transactions (the stronger the computing power, the more likely you are to obtain the right to record).

If you adopt joint mining, that is, join a mining pool, theoretically you can obtain a certain amount of BTC in proportion to your computing power, but the amount is extremely small, often not enough to offset the electricity costs and computer depreciation.

With the changing trend of mining, it is currently unlikely that individuals can "freely" mine BTC like in the early days, especially not being able to mine a large amount of BTC as easily as Satoshi Nakamoto. In the future, whether it's individuals or institutions, if they want to obtain more BTC through mining, they need to purchase professional mining rigs (the price is often between $1,000-$2,000, or even higher), and they need to join a mining pool.

It should be emphasized that in recent years, mining rigs have been updated and iterated very quickly, and the computing power of new mining rigs is very large. Therefore, if you purchase old mining rigs (with small computing power), it will severely affect the earnings. If you buy large-scale mining rigs, but don't join a mining pool, the computing power of a single mining rig is very small compared to the mining pool, and the chance of mining Bitcoin is also extremely small.

Note that this does not mean that individuals cannot mine at all. In fact, any individual can join the mining, but they may not be able to mine BTC due to insufficient computing power, and even if they do mine, the amount will be very small, so it cannot offset the mining costs including mining rigs, electricity, and maintenance.

5. How to Mine Bitcoin?

Currently, there are mainly two ways to mine Bitcoin - solo-mining or cloud mining. However, regardless of the choice, some preparatory work needs to be done to avoid illegal activities or getting scammed.

Platforms | Computing power | Price (per TH/s per day) | Suitable for the crowd |

NiceHash | 10 GH/s - hundreds of PH/s | Approximately US$0.05 - US$1.5 | Small miners or people who need short-term computing power |

Genesis Mining | 1 TH/s - 35 TH/s | $28-$979 | Miners with some experience in Bitcoin mining |

HashFlare | 100GH/s-10TH/s | $1.20 - $220 | Beginners or people looking for low risk investments |

Bitdeer | 1 TH/s - 50 TH/s | $20-$940 | People who want to mine multiple cryptocurrencies |

First, understand if mining is legal in the local area.

Mining is a power-intensive industry, especially the Proof of Work (PoW) mechanism, which consumes a large amount of electricity. Given the current global shortage of power resources, mining has been severely cracked down on or even banned in many countries or regions. Therefore, do not blindly engage in mining, otherwise the mining equipment may be confiscated, fines imposed, or even detention. In Taiwan, China, mining is legal, so this is not a concern at the moment.

Secondly, consider whether to buy mining rigs or rent computing power, self-mining or outsourcing.

If you have relatively professional mining capabilities, you can purchase mining rigs and operate and maintain them yourself, but you need to be aware of the noise generated by the operation of the machines that may affect others. If you are not very knowledgeable about mining, you can purchase mining rigs and entrust them to a third party, or directly rent computing power (with self-hosting). Beware of fraud, never buy mining rigs or computing power from unknown platforms, and should consider more common products in the market, such as:

Mining machine model | Advantage | Shortcoming | Suitable for the crowd |

Antminer S19 Pro | High energy consumption, high computing power, low power consumption | Expensive, noisy, requires cooling system | Professional miners, miners who require high efficiency |

WhatsMiner M30S++ | High computing power and low power consumption. No external cooling system required | Large size and noisy | Professional miners, miners who require high efficiency |

AvalonMiner 1246 | High computing power and good cost performance | Short warranty period and loud noise | Beginner/intermediate miners looking for affordable miners |

Innosilicon T3+ | High computing power, low energy consumption | Expensive and noisy | Professional miners, miners who require high efficiency |

Bitmain Antminer S9 | Low cost and high popularity | Low computing power and high energy consumption | Beginner/intermediate miners looking for affordable miners |

Current mainstream Bitcoin mining machines - compiled by Mitrade

Platforms | Computing power | Price (per TH/s per day) | Suitable for the crowd |

NiceHash | 10 GH/s - hundreds of PH/s | Approximately US$0.05 - US$1.5 | Small miners or people who need short-term computing power |

Genesis Mining | 1 TH/s - 35 TH/s | $28-$979 | Miners with some experience in Bitcoin mining |

HashFlare | 100GH/s-10TH/s | $1.20 - $220 | Beginners or people looking for low risk investments |

Bitdeer | 1 TH/s - 50 TH/s | $20-$940 | People who want to mine multiple cryptocurrencies |

BTC computing power rental platform - organized by Mitrade

After choosing the mining rigs or computing power platform and completing other preparatory work, you can now start mining officially. Once the mining pool successfully mines a block, the contributor's shares will be rewarded with a certain proportion of BTC. The recipient can then choose to sell or hold the BTC based on their own preferences.

If collecting the rewards through a wallet, it is crucial to properly safeguard the private key or recovery phrase. If these are lost, the associated assets will be irrecoverable. If there is a suspected leak of the private key or recovery phrase, the wallet should be immediately replaced.

6. What will happen when all Bitcoins are mined?

The total supply of Bitcoin is 21 million BTC. Currently, 18,907,443 coins have been mined and are in circulation. This means there are only 2,092,557 coins left to be mined, which is about 9.9% of the total Bitcoin supply. According to projections, the remaining Bitcoin will be mined by the year 2140.

Many people have asked: What will happen when all Bitcoins are mined? We can envision various scenarios for Bitcoin miners in the year 2140.

It's important to remember that miners profit from two sources: block rewards and transaction fees. So once all Bitcoins are mined, the block rewards will no longer exist. At that point, the only income for miners will be transaction fees.

The transaction fees for Bitcoin will depend on the transaction volume and the state of Bitcoin at that time. In other words, Bitcoin in 2140 could become a store of value asset (like physical gold) or revert to its original purpose as a medium of exchange.

If Bitcoin becomes a store of value, the transaction volume may be lower, as users will aim to hold Bitcoin. In this case, the transaction fees would need to be increased to provide profitability for miners.

If Bitcoin becomes a medium of exchange, the transaction volume will be very high. To support daily transactions, the transaction fees will need to be low. In this case, miners will earn from the high transaction volume.

However, it's possible that when all Bitcoins are mined, the profitability of miners will be severely impacted. At that point, miners may need to organize or the Bitcoin market may require mechanisms to control the supply and transaction volume to ensure acceptable miner profits. Without active miners, Bitcoin transactions will not be able to function. Regardless of the scenario, 2140 is likely to see a significant transformation in Bitcoin.

7. Conclusion

Bitcoin mining can be understood as miners using mining rigs to help the Bitcoin network keep track of transactions, and in return, they receive BTC rewards. Under this incentive mechanism, Bitcoin mining has attracted a large number of investors, and it has already become an industry, gradually dominated by large capital, while also showing a development trend of mining rig specialization, joint mining, and shared rewards.

In the future, individual users who want to mine independently using CPUs or GPUs will find it almost impossible to mine any BTC. If you want to mine BTC, you will need to purchase professional mining rigs or rent computing power to participate in joint mining. Additionally, before starting mining, you must investigate whether the local policies allow it and ensure the mining rigs are genuine and reliable, to avoid any risks.

#1. What is the best Bitcoin mining rig to mine Bitcoin?

#2. Can you mine Bitcoin on any regular computer?

#3. How long does it take to mine 1 BTC?

#4. Can Bitcoin mining never result in losses?

Before making any trading decisions, it is important to equip yourself with sufficient fundamental knowledge, have a comprehensive understanding of market trends, be aware of risks and hidden costs, carefully consider investment targets, level of experience, risk appetite, and seek professional advice if necessary.

Furthermore, the content of this article is solely the author's personal opinion and does not necessarily constitute investment advice. The content of this article is for reference purposes only, and readers should not use this article as a basis for any investment decisions.

Investors should not rely on this information as a substitute for independent judgment or make decisions solely based on this information. It does not constitute any trading activity and does not guarantee any profits in trading.

If you have any inquiries regarding the data, information, or content related to Mitrade in this article, please contact us via email: insights@mitrade.com. The Mitrade team will carefully review the content to continue improving the quality of the article.