Ripple's XRP eyes new all-time high, key factors to consider after extending its uptrend by 25%

Ripple whales have accumulated over $1.8 billion worth of XRP tokens amid a 200% rise in weekly active addresses.

WisdomTree filed an S-1 registration with the SEC for an XRP ETF.

XRP investors across several cohorts realized over $2.7 billion in profits in past three days following heavy Ripple token unlock.

XRP eyes a new all-time high at $3.57 after sweeping the $2.58 resistance level.

Ripple's XRP continued its rally with a 25% surge on Monday, stretching its monthly gains to over 430%. Following the recent uptrend, the remittance-based token now ranks #3 among top cryptocurrencies despite witnessing a mix of bullish and somewhat bearish investor actions in the past few days.

XRP key updates to watch out for amid recent bullish charge

According to Santiment data, XRP has been seeing heightened buying activity from investors in the past three weeks following its recent surge.

Whales holding between 1M-10M of the remittance-based token bought 679.1 million XRP, now worth ~$1.8 billion. This comes as the non-empty XRP wallets surged above 5.5M for the first time since launch.

XRP investors have also woken up as weekly active addresses on the XRP Ledger increased nearly 200% to 307K in the past month — its highest level since August 2023.

XRP Supply Distribution (1M-10M), Weekly Active Addresses & Holders | Santiment

The bullish view is also evident in XRP Coinbase premium, which showed that US traders have likely been fueling the recent price surge. In November, the exchange's XRP premium ranged from 3% to 13%. However, Upbit, which holds the largest XRP reserve, maintained a moderate premium level.

Meanwhile, asset manager WisdomTree filed an S-1 registration statement with the SEC for an XRP ETF on Monday after an initial registration in the state of Delaware last week. With the latest filings, XRP has joined. Bitwise, 21Shares and Canary Capital.

This follows rumors of the New York government approving Ripple's stablecoin trending across several investment subgroups on social media platform X, with many speculating on how it could fuel the current XRP bull run.

However, market activity hasn’t been all green for XRP. Following the recent price surge over the weekend, XRP investors realized more than $2.7 billion in profits — the highest in the past eight years. This shows despite the recent whale accumulation, investors are increasingly booking profits as they ride the wave.

XRP Network Realized Profit/Loss | Santiment

The Mean Coin Age metric, which measures investors' accumulation/distribution activity, has been trending downwards across all age cohorts. This shows that selling activity has been constant among short-term and long-term investors in the past three weeks.

XRP Mean Coin Ages | Santiment

Additionally, Ripple unlocked 500 million XRP tokens worth over $1.35 billion on Sunday as part of its escrow unlock system. If this supply enters the market immediately, the current bullish momentum will slow down.

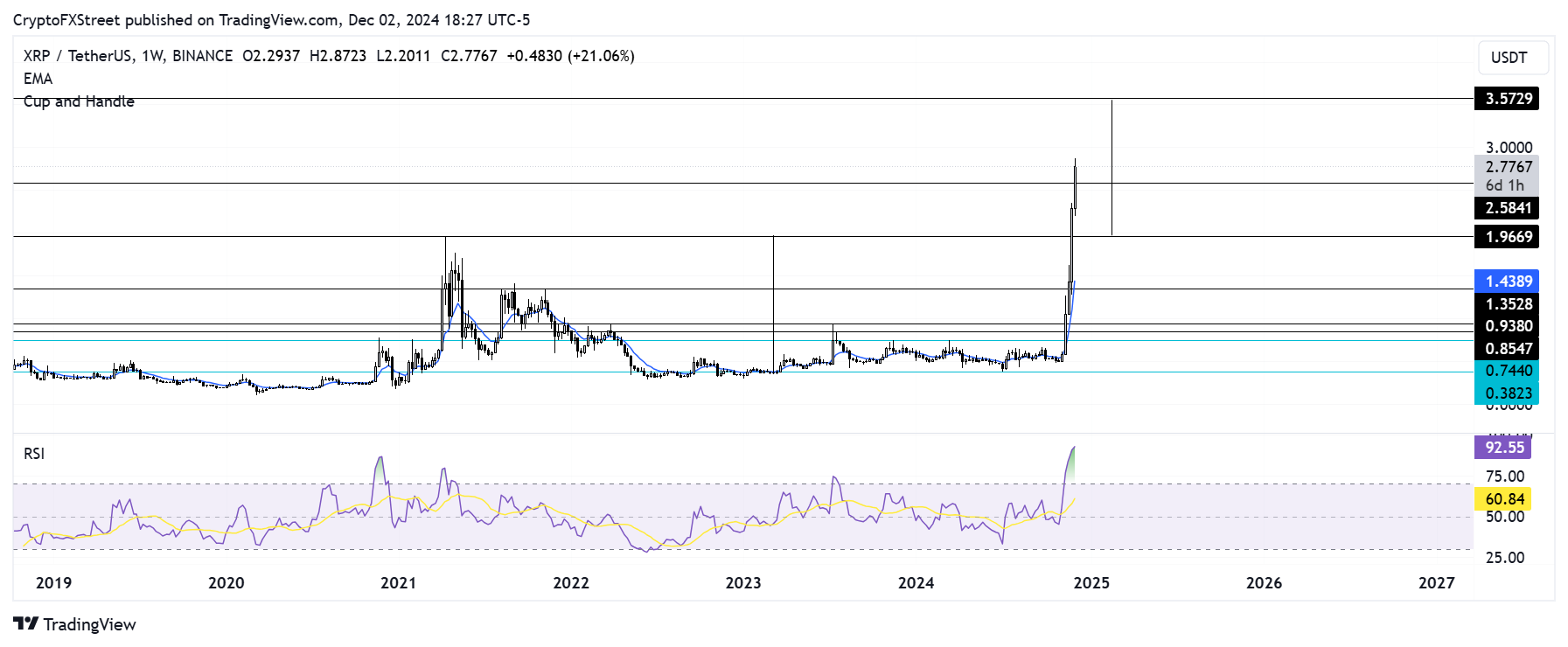

XRP bulls could target a new all-time high at $3.57

Ripple's XRP smashed the $2.58 resistance on Monday, sparking liquidations of more than $91 million in the past 24 hours, per Coinglass data. Liquidated long and short positions accounted for $38.67 million and $52.47 million, respectively.

XRP/USDT weekly chart

If XRP maintains the uptrend above the $2.58 level, it could rally as high as $3.57 to complete the maximum profit target of a rounded bottom pattern. The remittance-based token validated the pattern after rallying above the $1.96 level last week.

The bullish momentum is strengthened by XRP futures open interest (OI) surge to a new all-time high of $4.24 billion on Monday.

Open interest is the total amount of outstanding contracts in a derivatives market. An increase in OI during a price uptrend signifies new money is coming into the market in support of the bullish momentum.

XRP Open Interest | Coinglass

The Relative Strength Index (RSI) has remained at elevated levels in the oversold region in the past week, indicating a correction is imminent due to overheated prices.

A weekly candlestick close below $1.96 will invalidate the bullish thesis.

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.

[00.25.15, 03 Dec, 2024]-638687814960789599.png)

[00.26.34, 03 Dec, 2024]-638687816442403868.png)

[00.26.28, 03 Dec, 2024]-638687817110360896.png)