XRP investors have realized nearly $2 billion in profits in the past three days following Trump's tariff on Canada, Mexico and China.

XRP's weighted sentiment and funding rates have plunged to significant low levels, indicating a potential bottom.

XRP set to reclaim the $3.00 psychological level but faces a descending trendline resistance.

Ripple's XRP is up 30% in the early hours of Tuesday as bulls are looking to stage a recovery from the recent crypto market crash. While on-chain data shows prevailing bearish sentiment in the market, bulls could return to help the remittance-based token secure a move above the $3.00 psychological level.

XRP on-chain data reveals extent of recent market crash

Since the crypto market crash after Trump announced tariffs on Canada, Mexico and China, XRP investors have realized nearly $2 billion in profits in the past three days — one of the highest in its history.

XRP Network Realized Profit/Loss. Source: Santiment

The selling activity was dominated by whales across the long-term and short-term holders’ cohort, as indicated by spikes in the whale transaction count and Dormant Circulation.

XRP Whale Transaction Count (>$100K and >$1M). Source: Santiment

The high selling activity has sent XRP's Weighted Sentiment — which measures the overall average social volume relative to its negative/positive bias — to lows last seen in November.

XRP Weighted Sentiment. Source: Santiment

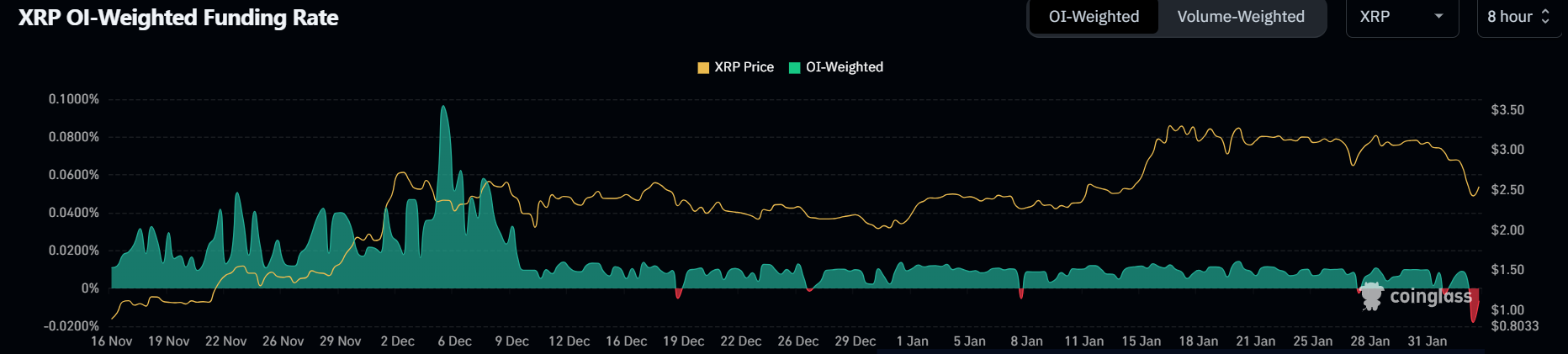

XRP Funding rates also plunged to lows last seen in August. Funding rates are periodic payments between traders to ensure crypto derivative contracts maintain parity with their underlying spot counterparts.

XRP Funding Rates. Source: Coinglass

It's important to note that prices often tend to go in the opposite direction when such high negative sentiments drive the crowd. This partly explains why XRP has staged a comeback, gaining over 30% in the past 24 hours.

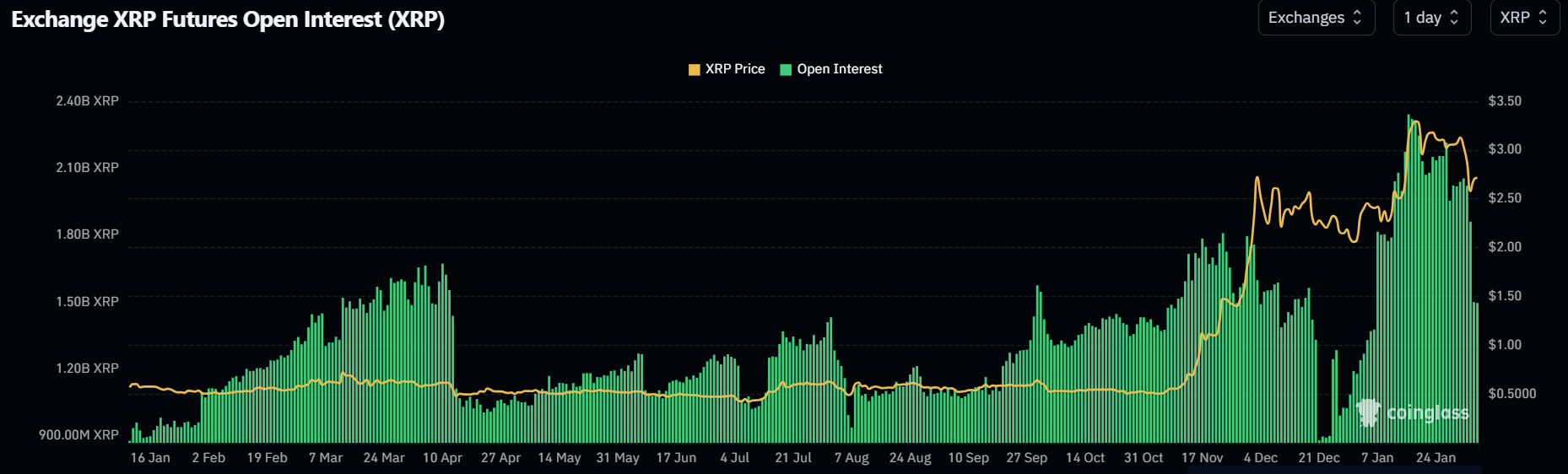

However, XRP bulls need to return to the market to strengthen the comeback as XRP's open interest has failed to rise with the market after plunging from 2.05 billion XRP to 1.50 billion XRP. The low interest rate shows a reluctance among investors to hold large positions in the remittance-based token.

XRP Open Interest. Source: Coinglass

XRP eyes recovery above $3.00 psychological level

XRP saw a sharp decline below the $2.00 psychological level on Monday, sparking $103 million in futures liquidations in the past 24 hours - its highest single-day futures liquidations in the current market cycle, per Coinglass data. The total amount of liquidated long and short positions accounted for $74.67 million and $28.28 million, respectively.

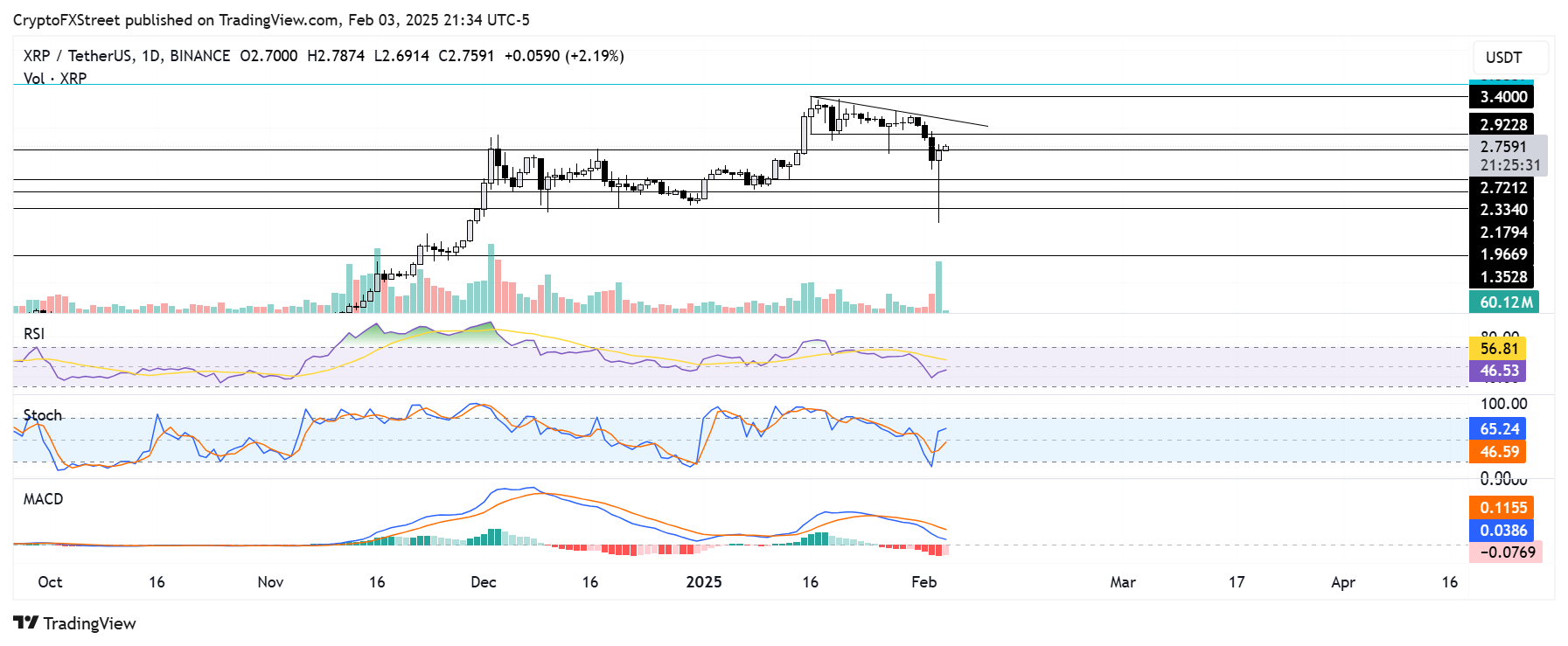

Following the general crypto market recovery, XRP is looking to reclaim the $3.00 psychological level. A successful move above this level could see the remittance-based token stage a move to tackle its seven-year high resistance of $3.40.

XRP/USDT daily chart

However, it faces a descending trendline resistance, extending from January 16. If XRP clears this resistance alongside the $3.40 level, it could rally to a new all-time high above $3.55.

The Relative Strength Index (RSI) and Stochastic Oscillator (Stoch) are trending upward, with the latter crossing above its neutral level. This indicates rising bullish momentum.

A daily candlestick close below the $1.96 support level will invalidate the bullish thesis.

Ripple FAQs

Ripple is a payments company that specializes in cross-border remittance. The company does this by leveraging blockchain technology. RippleNet is a network used for payments transfer created by Ripple Labs Inc. and is open to financial institutions worldwide. The company also leverages the XRP token.

XRP is the native token of the decentralized blockchain XRPLedger. The token is used by Ripple Labs to facilitate transactions on the XRPLedger, helping financial institutions transfer value in a borderless manner. XRP therefore facilitates trustless and instant payments on the XRPLedger chain, helping financial firms save on the cost of transacting worldwide.

XRPLedger is based on a distributed ledger technology and the blockchain using XRP to power transactions. The ledger is different from other blockchains as it has a built-in inflammatory protocol that helps fight spam and distributed denial-of-service (DDOS) attacks. The XRPL is maintained by a peer-to-peer network known as the global XRP Ledger community.

XRP uses the interledger standard. This is a blockchain protocol that aids payments across different networks. For instance, XRP’s blockchain can connect the ledgers of two or more banks. This effectively removes intermediaries and the need for centralization in the system. XRP acts as the native token of the XRPLedger blockchain engineered by Jed McCaleb, Arthur Britto and David Schwartz.

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.

[03.22.17, 04 Feb, 2025]-638742341217334189.png)

[03.35.51, 04 Feb, 2025]-638742341726695800.png)

[02.05.26, 04 Feb, 2025]-638742342172438574.png)