XRP sustains bullish pressure following rumors of Donald Trump establishing US altcoin reserve

Donald Trump seeks to create a crypto reserve prioritizing assets made in the US, such as XRP, Solana and USDC.

The SEC appealed Judge Analisa Torres' ruling in its case against Ripple, inciting heavy criticism from the crypto community.

XRP eyes a new all-time high above $3.55 after sustaining an uptrend above the resistance near the $3.00 psychological level.

XRP continued trading above the $3 mark on Thursday as investors stepped on the accumulation gear following rumors of Donald Trump considering its addition to a US digital asset reserve. This optimism culminated in a defiance against potential selling after the Securities & Exchange Commission (SEC) filed its appeal against Ripple.

XRP maintains bullish momentum amid SEC appeal

The SEC filed a brief in its appeal to the appellate court on Wednesday, arguing that Judge Analisa Torres's ruling — which stated that the sale of XRP to retail investors was not a securities offering — was wrong.

Several market participants consider the latest appeal futile due to the SEC's "weak" arguments and the agency's changing administration.

"As expected, the SEC's appeal brief is a rehash of already failed arguments — and likely to be abandoned by the next administration," Ripple's Chief Legal Officer Stuart Alderoty noted in an X post.

He added that the appeal was "just noise" and would be replied to by Ripple in due time.

Likewise, attorney Jeremy Hougan suggested that the brief was unnecessary and would only be ignored by the court.

"This SEC brief was hard to work through because, [in my opinion], the case won't be ruled on," he wrote in an X post on Thursday.

Hougan noted that he believed the brief to be "lackluster" because it only argues that the sale of XRP to investors counts as securities, not that any of the investors were harmed.

XRP saw a brief decline following the appeal but quickly resumed its surge a few hours later, indicating that investors were unfazed by the outgoing SEC administration's efforts.

A likely reason for this strong confidence among investors is the buzz surrounding incoming president Donald Trump's crypto reforms.

Trump reportedly supports forming an American-first crypto reserve for crypto tokens founded in the US, including XRP, Solana and USDC.

The report from the New York Post suggested that Trump has been meeting with the founders of these companies in the past few weeks concerning the idea.

However, the New York Times reported that Ripple CEO Brad Garlinghouse only suggested to Trump that he include other digital assets in the country's potential first crypto reserve.

A digital asset reserve with XRP, could solidify its credibility as an asset, ending the five-year battle between Ripple and the SEC. Likewise, it could create a stronger adoption for the remittance-based and hasten the approval of XRP ETFs.

"To be clear, I view a Solana or an XRP ETF approval from the SEC as a matter of 'when' not 'if 'at this point," said Bloomberg ETF Analyst James Seyffart.

If approved, JPMorgan predicted that XRP ETFs could draw in $4.3 billion to $8.4 billion in inflows within six to twelve months.

Meanwhile, Unchained Crypto reported that in a recent meeting, Trump allegedly criticized Ripple executives for extending most of their support to Kamala Harris during the US elections.

XRP on-chain activity indicates strong buy-side bias

XRP market cap reached a new high above $190 billion on Thursday, even though prices are yet to reach an all-time high. This is largely because of a huge pile of locked XRP that's gradually getting unlocked over time. As a result, XRP has reached its highest price if adjusted for supply growth since its creation.

With the recent price uptick, XRP whale transaction count has surged to levels last seen since December 3. Additionally, the total number of XRP holders free by over 511,000 in the past two months, indicating sustained bullish momentum, per Santiment data.

XRP has just reached a new 7-year high, crossing a $3.39 market value for the first time since January, 2018. With this rise, we have just seen 2,365 $100K+ XRP transactions in the latest 8-hour span, the highest spike since December 34rd. Total holders are also skyrocketing.

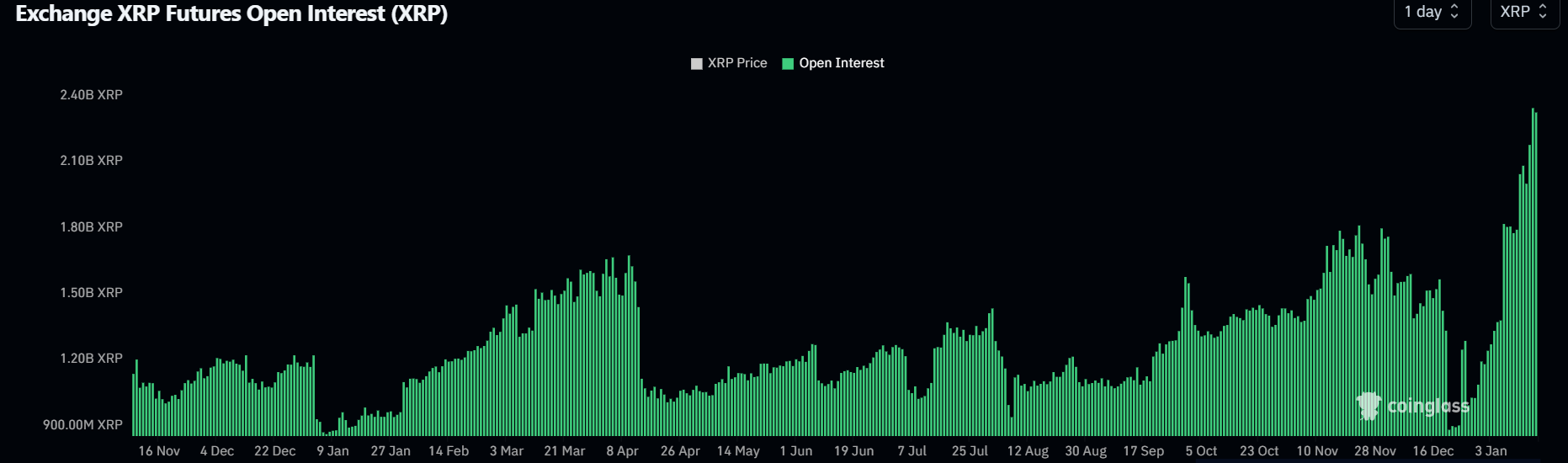

XRP's open interest has continued to climb to new highs alongside its price, reaching an all-time high of 2.34 billion XRP on December 16. This is over a 160% rise from its lows of 880 million XRP on December 21 following the holiday season.

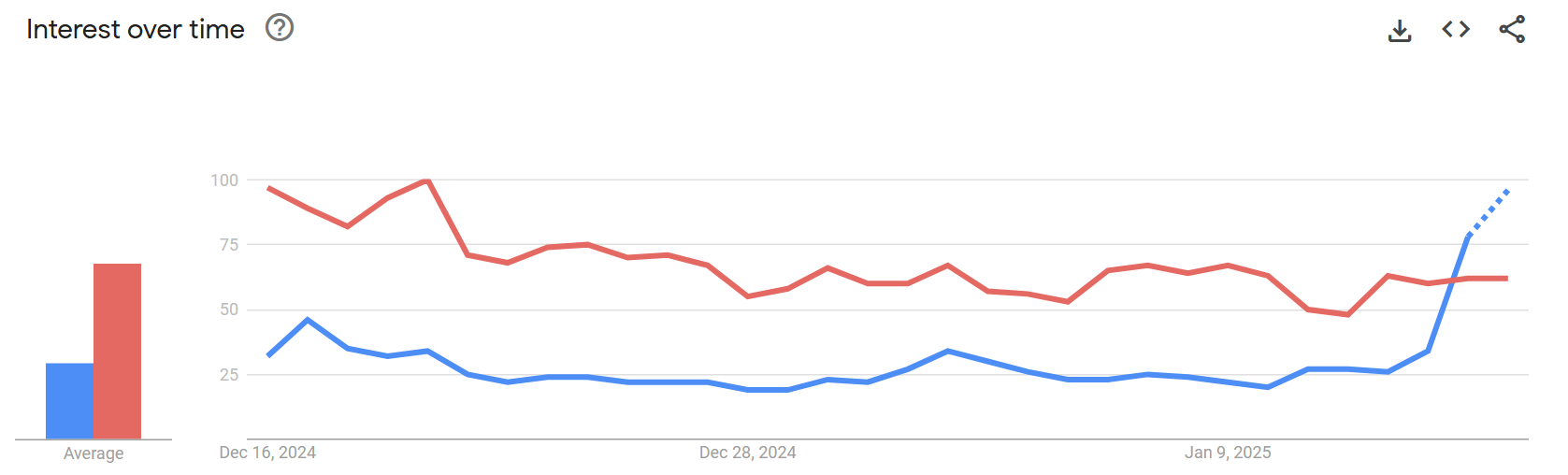

XRP flipped Bitcoin on Google search trends, skyrocketing to a high of 96 while Bitcoin hovers around 62. The high investor interest is partly responsible for the increased bullish momentum that XRP has been seeing.

XRP eyes a new all-time high above $4.5 after smashing $2.9 resistance

XRP has sustained over $37 million in liquidations in the past 24 hours, per Coinglass data. The total amount of liquidated long positions accounted for $18.02 million, while short liquidations accounted for $19.80 million.

XRP broke above the resistance near the $3.00 psychological level to reach a seven-year high of $3.4.

The surge above this resistance has strengthened XRP's quest to complete the target of a bullish pennant pattern by establishing a new all-time high above the $4.5 psychological level. The target is obtained by measuring the pole of the pennant and projecting it upward from the breakout point.

XRP/USDT 8-hour chart

However, the remittance-based token has to hold the $2.90 level as a key support to complete this move.

On the way up, it could face key resistances near its all-time high of $3.55 and a potential pullback around the $4.00 psychological level.

On the downside, XRP could bounce off the 23.6% Fibonacci Retracement level at $2.60 if it breaches the $2.90 support.

The Relative Strength Index (RSI) and Stochastic Oscillator (Stoch) are in their overbought region, signaling that XRP is likely to see a short-term correction.

A daily candlestick close below $1.96 will invalidate the thesis and send XRP to find support near $1.35.

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.