AI Cryptocurrencies: Hype or Real Investment Opportunity? The Truth Revealed!

Introduction

The convergence of two major tech trends—Artificial Intelligence (AI) and Cryptocurrency—has given rise to a rapidly emerging sector: AI Cryptocurrencies. The explosive success of platforms like ChatGPT and DeepSeek has fuelled a surge in new tokens claiming to fuse AI + with Blockchain technology.

But are these projects truly groundbreaking—or simply the latest speculative bubble? How can investors separate genuine technological breakthroughs from empty hype? This article offers a critical analysis of current AI crypto’s landscape, examining market performance, and future prospects—equipping you with the insight to make more informed investment decisions.

What Are AI Cryptocurrencies?

AI cryptocurrencies are digital assets that integrate blockchain technology with artificial intelligence, aiming to address key challenges in the AI space—such as compute monopolies, data privacy, and model training—through decentralization. These projects typically issue native tokens to incentivize ecosystem participation or facilitate service payments.

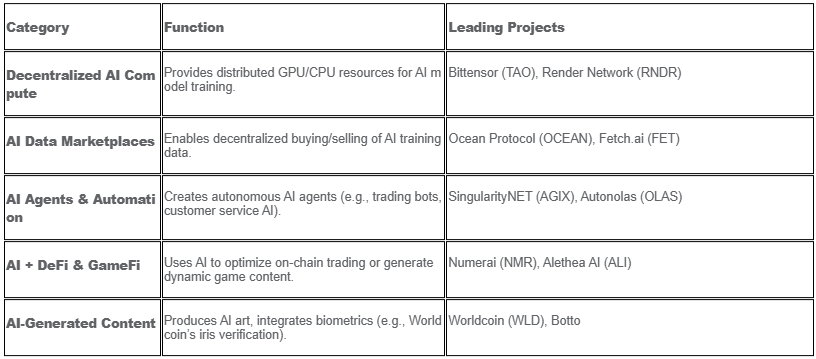

Based on functionality, AI cryptos can be categorized into four main types:

The Current Status of AI Cryptocurrencies

From 2021 to 2023, the total market capitalisation of AI cryptocurrencies fluctuated between $5 billion and $8 billion. In 2023-2024, driven by the ChatGPT boom, the sector experienced a significant surge, with market value soaring to $44 billion.

In January 2025, the launch of DeepSeek generated global excitement triggering a second wave of growth. The total market value peaked at $70 billion—an all-time high for the sector.

However, the broader cryptocurrency market is now undergoing a collective correction. AI cryptocurrencies have also been affected, with their combined market value declining to approximately $20 billion as of August 2024.

AI Cryptocurrency Market capitalization Changes (2021-2025). Source: CoinMarketCap.

According to CoinMarketCap, there are currently 243 AI cryptocurrencies. NEAR leads the market with a valuation of $2.49 billion, followed by ICP, TAO, and RENDER, each exceeding $2 billion in market value. However, the majority of AI cryptocurrencies—approximately 200—have a market value below $100 million.

Top 10 AI Cryptocurrencies by Market capitalization. Source: CoinMarketCap.

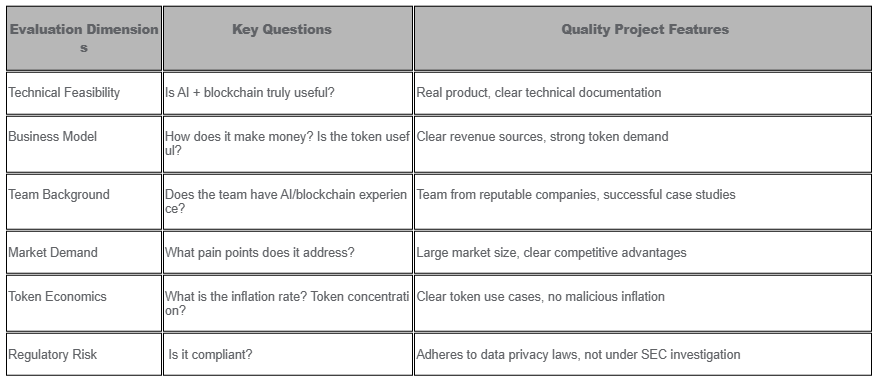

How to Evaluate the Investment Value of AI Cryptocurrencies?

While AI cryptocurrencies are rapidly evolving, the sector remains vulnerable to hype cycles and speculative bubbles. To assess their investment potential rationally, it is essential to evaluate several key dimensions: technical feasibility, business model, team background, market demand, and token economics.

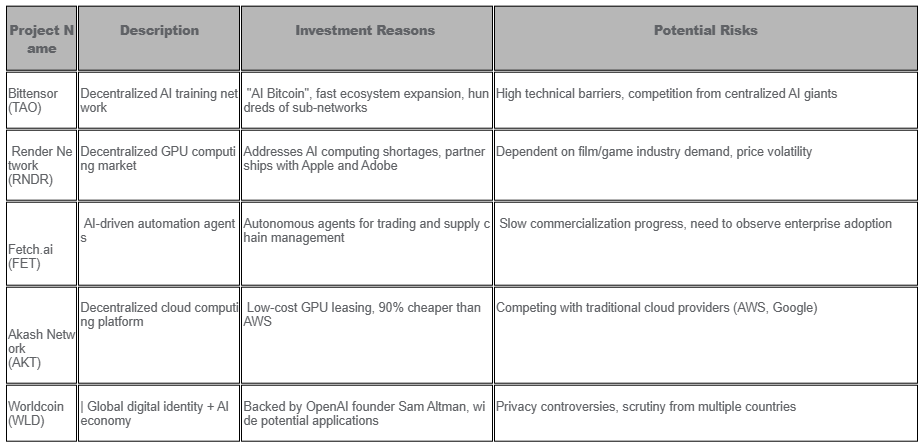

Which AI Cryptocurrencies are Worth Investing In?

The convergence of AI and blockchain represents a significant trend within the broader crypto landscape. Yet not all projects offer meaningful or lasting value. Below, we explore a selection of AI cryptocurrencies that demonstrate strong technical foundations, practical applications, and identifiable market demand—along with a breakdown of their investment rationale and associated risks.

Future Prospects and Risks of AI Cryptocurrencies

The future of AI cryptocurrencies is promising, but it comes with risks. Investors should objectively evaluate both prospects and risks, avoiding blind optimism.

Future Prospects

1. Technological Innovation: Advances in AI will enhance transaction efficiency, security, and application scenarios in cryptocurrencies.

2. Growing Market Demand: AI cryptocurrencies may become core tools for cross-border payments, data sharing, and decentralized applications.

3. Global Adoption: With improving regulatory frameworks, AI cryptocurrencies may gain acceptance in more countries and industries.

4. Emerging Applications: Applications in NFT valuation, data privacy protection, and automated trading will expand, bringing more innovation to the market.

Potential Risks

1. Technical Challenges: AI applications in cryptocurrencies are still in early stages and may face algorithm instability or market adaptability issues.

2. Over-speculation: Some projects may lack real value, relying heavily on market hype; investors should evaluate cautiously.

3. Regulatory Uncertainty: Rapid developments in AI and cryptocurrency may prompt stricter regulations, affecting market stability.

4. Security Risks: While AI can enhance security, it may also become a target for attacks, such as adversarial machine learning or data breaches.

5. Business Model Risks: Many projects rely on token incentives without stable cash flow. Competition from established cloud services like AWS and Google Cloud may also threaten decentralized projects.

Conclusion

AI cryptocurrencies hold vast growth potential, particularly in areas such as the data economy, smart contracts, and cross-industry integration. However, investors must remain mindful of market volatility, technical challenges, regulatory risks, and fierce competition. Thorough analysis and prudent risk management are essential before considering any allocation to AI cryptocurrencies.

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.