Fantom price extends its rally by 8% until Thursday, after gaining 43% in the previous week.

FTM’s daily trading volume reaches 1.34 billion on Tuesday, the highest level since April 2022.

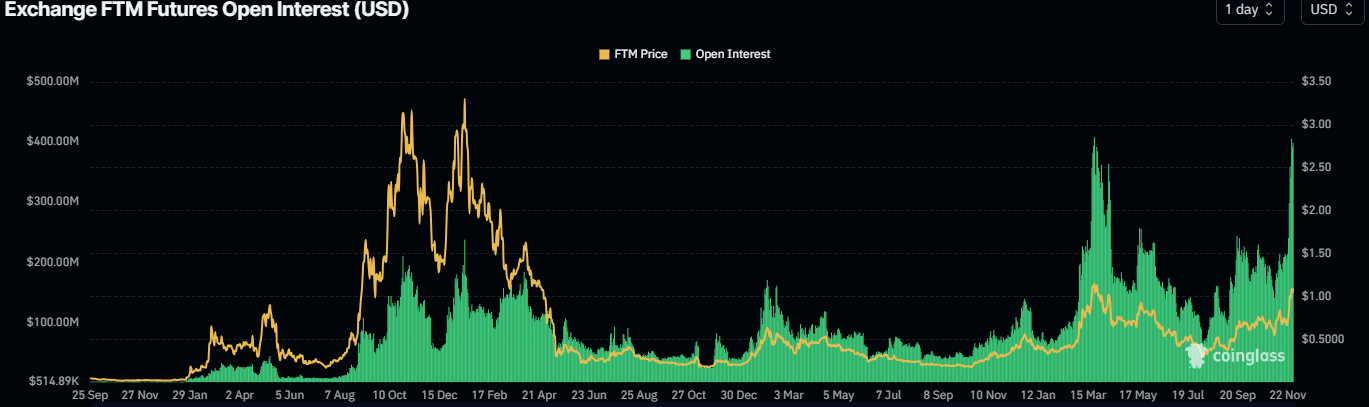

Fantom’s Open Interest is also rising, suggesting new money is entering the market.

Fantom (FTM) continued its rally and rallied 8% until Thursday, trading above $1.09 after 43% gains in the previous week. Like FTM, most altcoins have continued the rally as Bitcoin (BTC) recovers from its recent pullback this week.

On-chain data further support the bullish outlook as FTM’s daily trading volume and Open Interest (OI) reach record levels, indicating the continuation of the rally.

Fantom price is poised for a rally, targeting the yearly high of $1.22

Fantom price continues its rally this week, gaining over 8% until Thursday. If the upward momentum continues, FTM could extend the rally to retest its yearly high of $1.22, set in March.

A successful close above the yearly high could extend additional gains toward the $1.45 weekly resistance level.

The Relative Strength Index (RSI) on the weekly chart reads 67, well above its neutral value of 50 and points upwards, suggesting bullish momentum is gaining traction.

FTM/USDT weekly chart

Another aspect bolstering the platform’s bullish outlook is a recent surge in traders’ interest and liquidity in the Fantom chain. Santiment’s data shows that FTM Chain’s daily trading volume rose from $387.6 million on November 22 to $1.34 billion on Tuesday, the highest since April 2022.

[09.43.52, 28 Nov, 2024]-638683686463787614.png)

FTM daily trading volume chart. Source: Santiment

Fantom’s Open Interest (OI) is also supporting the bullish outlook. Coinglass’s data shows that the futures’ OI in FTM at exchanges almost doubled from $213.51 million on November 22 to $405.14 million on Wednesday, the highest level since mid-March. An increasing OI represents new or additional money entering the market and new buying, which suggests a rally ahead in the Fantom price.

FTM Open Interest chart. Source: Coinglass

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.