Crypto AI altcoin market rallies fueled by NVIDIA's Q4 earnings: KAITO, GRASS, Berachain price analysis

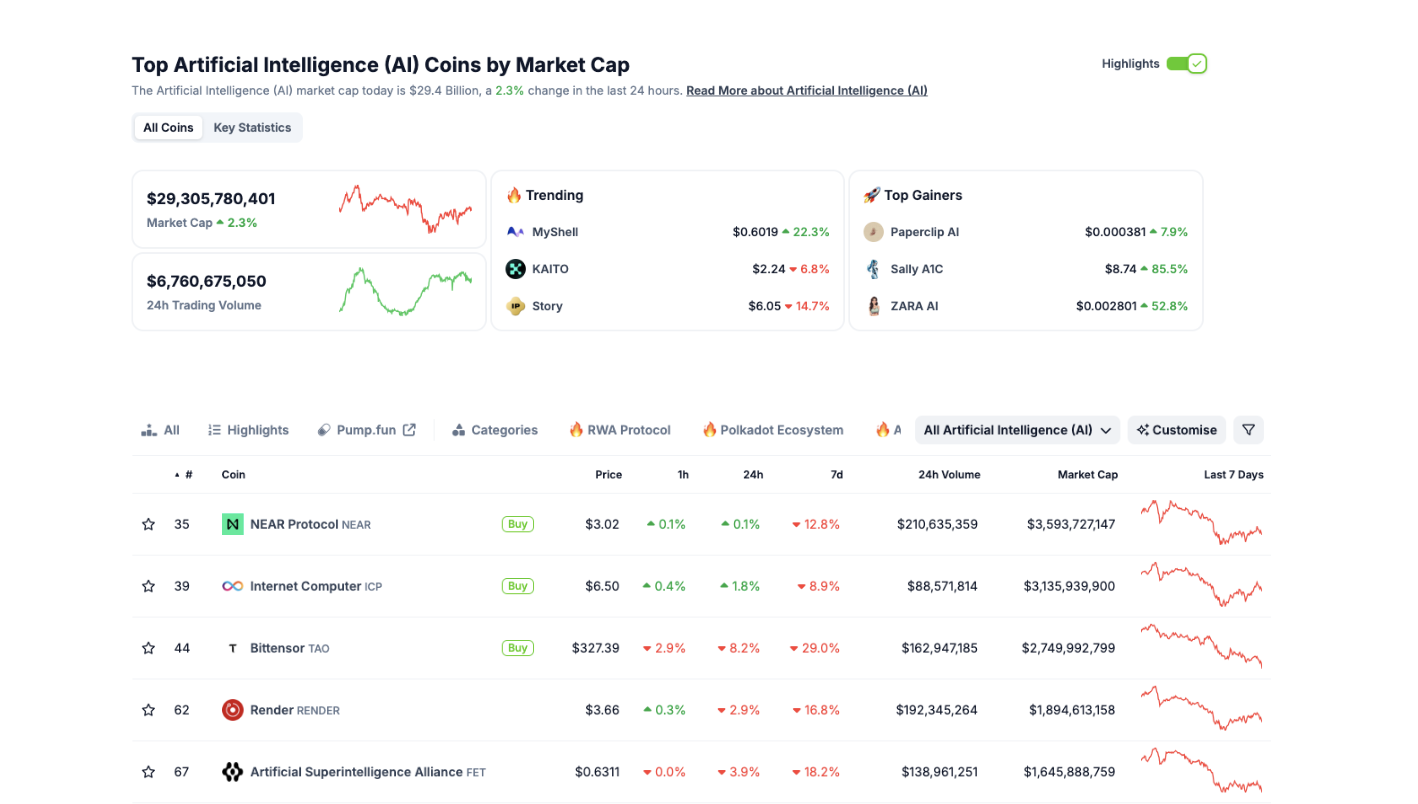

The crypto AI sector rose 2.3% to reach a $29 billion market cap on Thursday as traders reacted to NVIDIA’s Q4 earnings report.

NVIDIA reported $39.3 billion in Q4 revenue, up 12% from the previous quarter and 78% YoY.

KAITO, GRASS and Berachain gained over 20% in the last 24 hours while BTC price plunged to multi-month lows.

Crypto AI tokens’ aggregate valuation rose $660 million on Thursday as investors reacted to NVIDIA’s Q4 earnings report. Market data show investors prioritized three low-cap tokens during the rally, while large-cap AI projects like ICP, Near Protocol and Render moved sideways.

Why NVIDIA’s record-breaking Q4 earnings sparked $600M in AI crypto gains

The global crypto market faced significant turbulence this week. United States (US) President Donald Trump’s tariff announcements triggered $200 billion in outflows on Monday, sending many digital assets into retreat. However, NVIDIA’s Q4 report injected a rare dose of optimism.

The semiconductor titan reported $39.3 billion in revenue, propelled by surging demand for AI-focused hardware.

GAAP earnings per share reached $4.93, a 33% jump from the previous quarter. Non-GAAP EPS climbed 28% to $5.16.

The earnings beat catapulted NVIDIA’s stock price 4% higher, adding $125 billion to its market cap in a single trading session.

NVIDIA (NVDA) Stock Price Performance after Feb 26 Earnings call

NVIDIA (NVDA) Stock Price Performance after Feb 26 Earnings call

Despite Bitcoin’s slip toward the $80,000 mark, capital swiftly rotated into AI-centric crypto projects.

The AI sector’s total valuation climbed to $29.4 billion, underlining the market’s hunger for cutting-edge machine learning applications in blockchain environments.

Investors saw an opportunity to hedge against macroeconomic risk by pivoting to assets benefiting from AI’s growth narrative.

Geopolitics also influenced sentiment. Renewed diplomatic talks between Russia and the United States raised hopes of de-escalation in Ukraine.

Observers speculated that reintegrating Russian energy exports into global supply chains could slash costs for power-intensive AI operations.

Such an outcome would help large-scale AI developers, including NVIDIA, further bolster profits. In turn, smaller crypto AI networks stood to benefit from improved access to cheaper computing resources.

AI crypto cally: Capital flows favor low-cap tokens over market leaders

The artificial intelligence (AI) crypto sector jumped 2.1% on Thursday, adding $660 million to its market capitalization.

Traders took cues from NVIDIA’s record-breaking Q4 results, which showcased $39.3 billion in revenue—a 12% quarter-over-quarter increase and a remarkable 78% leap year-over-year.

Crypto AI Sector Performance, Feb 27 2025 | Source: Coingecko

Crypto AI Sector Performance, Feb 27 2025 | Source: Coingecko

A closer analysis of AI crypto market movements reveals that inflows predominantly targeted emerging low-cap assets like KAITO, GRASS and Berachain rather than established names.

Coingecko data shows that while the sector added $660 million in 24 hours, the largest beneficiaries were newer projects rather than larger cap AI tokens like Render (RNDR) and Fetch.ai (FET).

KAITO AI price analysis

KAITO is an AI-driven research aggregator that aims to transform how traders and analysts discover market intelligence. Its platform leverages machine learning to scrape on-chain data, social media and financial reports, then presents consolidated insights in an easy-to-navigate interface.

KAITO AI Price Analysis

KAITO AI Price Analysis

Recent price action shows KAITO’s token surging nearly 40% in 24 hours. Investors piled in when NVIDIA’s earnings reignited enthusiasm for AI-related ventures.

KAITO’s low market cap attracted speculators seeking higher returns compared to more established AI tokens.

Trading volumes spiked as short-term traders chased momentum, while long-term believers cited KAITO’s unique value proposition.

One key growth driver is the project’s planned integration with institutional trading desks. By offering robust data analysis in real-time,

KAITO could bridge the gap between traditional finance and blockchain analytics.

The team’s upcoming partnerships with known research firms have fueled speculation of deeper adoption. If KAITO maintains its focus on user-friendly tools and enterprise-grade solutions, it could capture a sizable share of the AI-powered crypto intelligence niche.

2. GRASS price analysis

GRASS stands for “Global Resource and AI Shared System.” This decentralized platform democratizes data and computational resources for AI development. By linking nodes around the world, GRASS enables machine learning engineers to access scalable computing power without relying on centralized providers.

GRASS Price Analysis

In the last 24 hours, GRASS soared over 20%, buoyed by NVIDIA’s robust earnings report. The strong results suggested continued demand for AI hardware, hinting at a favorable environment for AI-focused crypto projects. GRASS’s modest market cap and innovative model made it an appealing target for traders chasing outsized returns.

A notable development within the GRASS ecosystem involves recent grants for AI research in autonomous vehicles and natural language processing. These collaborations could draw institutional funding and drive further token utility.

The team’s emphasis on frictionless access to high-performance computing has sparked interest among smaller AI startups.

They see GRASS as a cost-effective alternative to big cloud providers. If these partnerships bear fruit, GRASS could evolve into a cornerstone for decentralized AI infrastructure, sustaining its price momentum even if broader crypto markets falter.

3. Berachain (BERA) price analysis

Berachain is a DeFi-oriented AI platform focused on liquidity optimization and cross-chain asset management.

Its protocol employs machine learning algorithms to identify yield opportunities across various blockchain networks, aiming to maximize returns for liquidity providers.

Berachain (BERA) Price Analysis

Berachain (BERA) Price Analysis

Berachain’s token price climbed over 20% within a day, diverging from Bitcoin’s downward trajectory. Speculative capital flowed in as investors saw parallels between NVIDIA’s AI success and Berachain’s ambition to revolutionize liquidity provisioning.

The project’s current market cap remains relatively small, amplifying price swings when new buyers rush in.

More so, recent upgrades to Berachain’s mainnet introduced advanced analytics modules that factor in real-time volatility data. This improvement aligns with the growing demand for smart DeFi protocols that mitigate risk while pursuing yield.

The development team’s strategic alliances with major decentralized exchanges have also piqued market interest. Berachain’s capacity to integrate with diverse blockchain ecosystems strengthens its appeal, especially if cross-chain interoperability becomes more mainstream.

If Berachain sustains this innovation pace, it may attract further liquidity from both retail and institutional players. Continued upgrades and successful partnerships could fortify its market standing, ensuring that it remains a fixture in the AI-powered DeFi landscape.

Summary

Following NVIDIA’s earnings report on Wednesday, crypto traders seemingly sought low-cap AI tokens with higher upside potential, sidestepping larger tokens.

Leading this charge were KAITO, GRASS and Berachain, each notching more than 20% gains in the last 24 hours.

KAITO drew institutional buzz as a blockchain-based AI search protocol, while GRASS rode the wave of NVIDIA’s bullish momentum to bolster its decentralized data network. Berachain’s surging liquidity caught investors’ attention, signaling heightened confidence in the protocol’s roadmap.

Meanwhile, mid-cap tokens posted mixed results. Internet Computer (ICP) inched 1.8% higher, and Near Protocol (NEAR) stayed flat, lagging the behind broader AI sector rally. BitTensor (TAO) and Render (RNDR) saw minor dips, suggesting capital shifted from more prominent AI projects to newly emerging alternatives.

If geopolitical tensions ease up between Russia and Ukraine, and US negative sentiment around US tariffs, these crypto AI tokens may sustain their upward trajectory, especially with NVIDIA’s positive earning reports acting as a growth anchor for AI-centric projects globally.

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.