Crypto market sees $330 billion added in 4 hours after Trump’s announcement

- Bitcoin Drops to $70,000. U.S. Government Refuses to Bail Out Market, End of Bull Market or Golden Pit?

- Gold rallies further beyond $5,050 amid flight to safety, dovish Fed expectations

- Bitcoin Bottom Debate: $70,000 or $50,000?

- A Crash After a Surge: Why Silver Lost 40% in a Week?

- Bitcoin Slips Below 75,000 Mark. Will Strategy Change Its Mind and Sell?

- Bitcoin Rout. Bridgewater Founder Dalio Publicly Backs Gold.

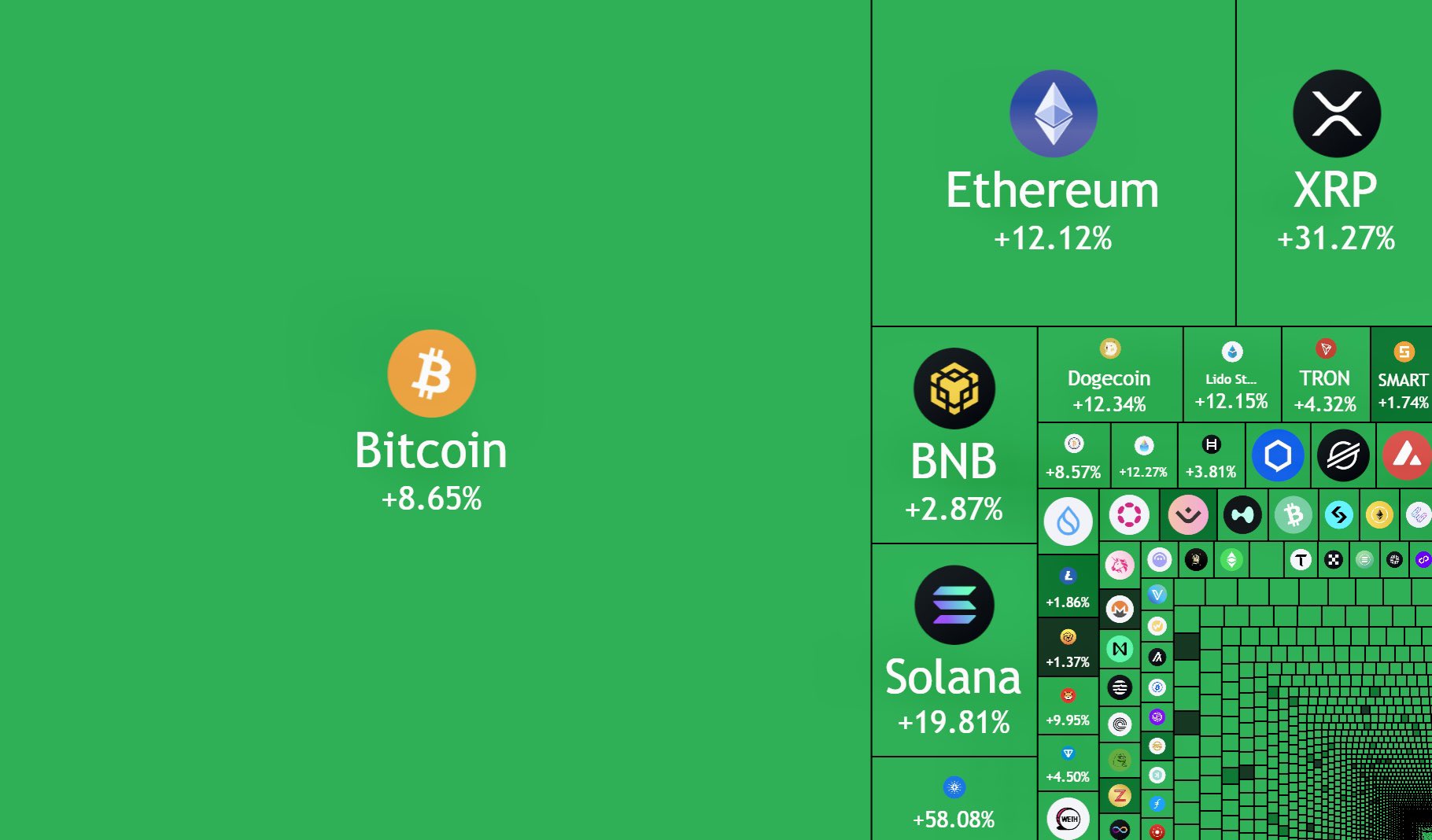

The crypto market’s total market cap saw a massive $330 billion surge in just four hours after president Donald Trump announced plans for a US Crypto Reserve that would include Bitcoin, Ethereum, Solana, XRP, and Cardano on Sunday.

The news sent the bears packing, liquidating $160 million in Bitcoin shorts in the process, per data from Coinglass. In his announcement, which was made via Truth Social as usual, president Trump said:

“My Executive Order on Digital Assets directed the Presidential Working Group to move forward on a Crypto Strategic Reserve that includes XRP, SOL, and ADA. I will make sure the US is the Crypto Capital of the World. We are MAKING AMERICA GREAT AGAIN! And, obviously, BTC and ETH, as other valuable Cryptocurrencies, will be the heart of the Reserve. I also love Bitcoin and Ethereum!”

Trump first shared the idea for a Bitcoin national reserve at the Nashville Bitcoin Conference in July 2024, though at the time, he only mentioned Bitcoin. It was also during this conference that he started calling himself the ‘crypto president.’

Bitcoin hits $94K, and altcoins get a bump too

After the announcement, Bitcoin’s price surged by over 10% in 24 hours, reclaiming $94,000. Ethereum followed with an 11% spike, reaching $2,500. Solana saw an increase of 20% to $169, while XRP surged by 30% to $2.80. Cardano saw the biggest increase, rallying 60% to $1.02, per data from CoinGecko.

This rally comes after weeks of losses. Bitcoin, which started the year at $109,000, had dropped below $80,000 last week after a wave of risk asset selloffs and a security breach at Bybit that saw nearly $1.5 billion stolen.

Meanwhile, Trump has announced that he is gonna host the first-ever White House Crypto Summit on Friday, with a mission to bring together top executives, investors, and blockchain founders like Gemini’s Winklevoss twins, Coinbase’s Brian Armstrong, Ripple’s Brad Garlinghouse, and Cardano’s Charlie Hoskinson.

The event comes as investors and analysts speculate how the US Crypto Reserve will be funded. One option is using the government’s massive Bitcoin stash—more than 180,000 BTC worth $18 billion—seized from cybercriminals and darknet markets. Historically, these assets have been auctioned off, with proceeds going to victims and government expenses. It remains unclear if the administration will hold onto these coins or accumulate more.

After the Sunday announcement, White House Crypto Czar David Sacks (who has been investing in Bitcoin since 2011), shared that:

“President Trump has announced a Crypto Strategic Reserve consisting of Bitcoin and other top cryptocurrencies. This is consistent with his week-one E.O. 14178. President Trump is keeping his promise to make the U.S. the “Crypto Capital of the World.” More to come at the Summit.”

Arthur Hyayes, BitMEX’s infamous founder (who has been trading crypto since 2009), commented on David’s statement to say:

“Nothing new here. Just words. Lmk when they get congressional approval to borrow money and or revalue the gold price higher. Without that they have no money to buy Bitcoin and shitcoins.”

Peter Schiff, a longtime Bitcoin critic, questioned why altcoins are even included at all. “I get the rationale for a Bitcoin reserve,” Peter wrote. “I don’t agree with it, but I get it. We have a gold reserve. Bitcoin is digital gold. So let’s create a Bitcoin reserve too. But what’s the rationale for an XRP reserve? Why the hell would we need that?”

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.