- Bitcoin Drops to $70,000. U.S. Government Refuses to Bail Out Market, End of Bull Market or Golden Pit?

- Gold rallies further beyond $5,050 amid flight to safety, dovish Fed expectations

- Bitcoin Bottom Debate: $70,000 or $50,000?

- A Crash After a Surge: Why Silver Lost 40% in a Week?

- Bitcoin Slips Below 75,000 Mark. Will Strategy Change Its Mind and Sell?

- Bitcoin Rout. Bridgewater Founder Dalio Publicly Backs Gold.

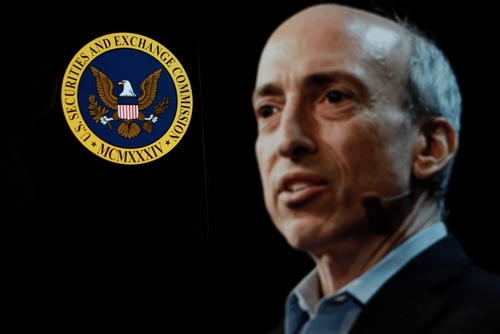

The U.S. Securities and Exchange Commission (SEC) has once again delayed its decision on listing options tied to spot Ethereum exchange-traded funds (ETFs), as per an Oct. 11 announcement. The deadline for a ruling has been extended from the initial date of Oct. 19 to Dec. 3.

The SEC delays multiple requests for ETF options

The SEC’s delay comes after Cboe Exchange submitted a request in August to list options on nine ETFs, including BlackRock’s iShares Ethereum Trust, Fidelity Ethereum Fund, Grayscale Ethereum Trust, and others. The SEC also delayed a similar request from Nasdaq’s electronic exchange in September.

In contrast, the SEC approved Bitcoin options for listing on BlackRock’s spot Bitcoin ETF in September. The final approval from the Commodity Futures Trading Commission (CFTC) and the Options Clearing Corporation (OCC) is still pending. According to Bloomberg analyst James Seyffart, options on Bitcoin ETFs are expected to launch by Q1 2025.

On Oct. 9th Seyffart said:

I think before the end of the year is possible for options, but more likely in Q1 2025.

~ Seyffart

Investors and financial advisers use options to navigate risks in the evolving crypto market

Options are contracts that provide the right to buy or sell an underlying asset at a specified price, commonly referred to as “call” or “put” options in trading terminology. In the U.S., if one party does not fulfill the terms of the agreement, the Options Clearing Corporation (OCC) steps in to settle the trade.

The introduction of spot crypto options on regulated U.S. exchangesᅳwhere the OCC protects traders from counterparty riskᅳrepresents a “monumental advancement” in the crypto market, creating “extremely compelling opportunities” for investors, according to Jeff Park, head of alpha strategies at Bitwise Invest, in a post on X dated Sept. 20.

Financial advisers, who manage up to half of the investment flows in the $9 trillion ETF market, use options to mitigate the risks of sharp market fluctuations. A 2023 survey by The Journal of Financial Planning found that over 10% of advisers actively utilized options to manage client portfolios.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.