Vitalik Buterin Suggests New Ethereum Upgrades to Safeguard Decentralization

- Bitcoin Drops to $70,000. U.S. Government Refuses to Bail Out Market, End of Bull Market or Golden Pit?

- Gold rallies further beyond $5,050 amid flight to safety, dovish Fed expectations

- Bitcoin Bottom Debate: $70,000 or $50,000?

- A Crash After a Surge: Why Silver Lost 40% in a Week?

- Bitcoin Slips Below 75,000 Mark. Will Strategy Change Its Mind and Sell?

- Bitcoin Rout. Bridgewater Founder Dalio Publicly Backs Gold.

Ethereum co-founder Vitalik Buterin has continued his weeklong intervention on how the blockchain network’s Proof-of-Stake (PoS) mechanism can be further improved with a new essay titled “Possible Futures of the Ethereum Protocol, Part 3: The Scourge.”

In this post, Buterin discussed how Ethereum must evolve to maintain decentralization while addressing security threats.

Tackling Ethereum Staking Centralization Risks

Buterin pointed out that the Scourge is a proposed upgrade aimed at reducing the risk of centralization within Ethereum’s staking process. He explained that factors such as block construction centralization, economic incentives, and the 32 ETH staking minimum contribute to these risks. Additionally, hardware requirements for participation further intensify the problem.

“One of the biggest risks to the Ethereum L1 is proof-of-stake centralizing due to economic pressures. If there are economies-of-scale in participating in core proof of stake mechanisms, this would naturally lead to large stakers dominating, and small stakers dropping out to join large pools,” Buterin wrote.

Buterin’s proposed solution within the Scourge phase is to break up the block production process. This would shift the responsibility of transaction selection from builders to stakers, leaving builders only with the task of organizing transactions and including some of their own.

Read more: A Deeper Look into the Ethereum Network

“The leading solution is to break down the block production task further: we give the task of choosing transactions back to the proposer (ie. a staker), and the builder can only choose the ordering and insert some transactions of their own. This is what inclusion lists seek to do,” the Ethereum co-founder stated.

Buterin also discussed alternative solutions like the Multiple Concurrent Proposers (MCP), which introduce systems like BRAID. According to him, the MCP schemes distribute the block production process across multiple entities. This lowers the barrier to participation and makes it harder for any single entity to dominate staking.

Addressing Over-Staking Concerns

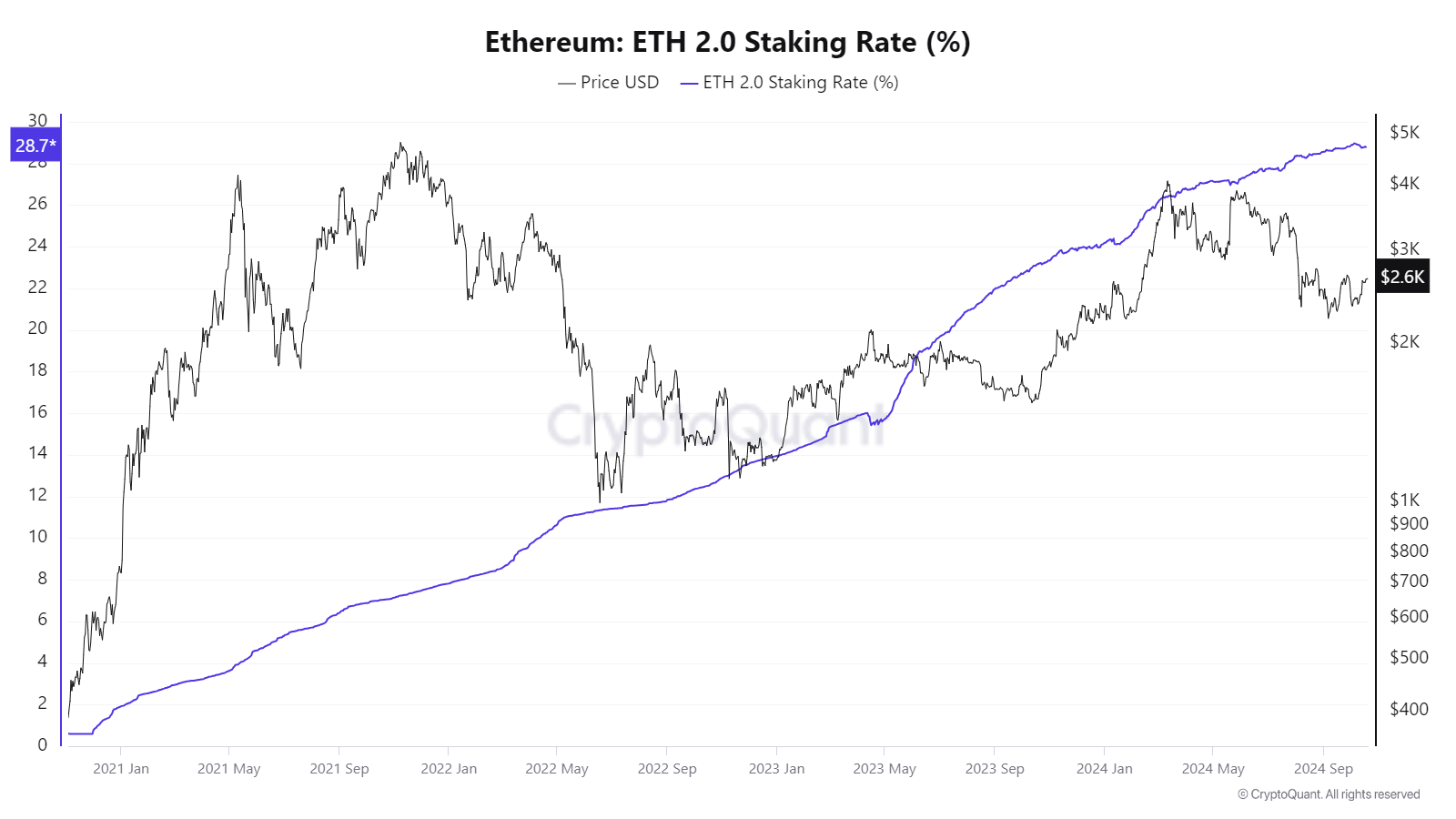

Buterin also raised concerns about potential “over-staking” in the Ethereum network. Currently, around 30% of the total ETH supply is staked. Buterin cautioned that if this figure rises too high, ETH staking could become a near-mandatory obligation for ETH holders, driving more stakers to centralized platforms.

Total Ethereum Staked. Source: CryptoQuant

Total Ethereum Staked. Source: CryptoQuant

To counter this, Buterin suggested adjusting Ethereum’s issuance curve. This way, staking returns diminish if the total amount of staked ETH exceeds a certain threshold. This adjustment would prevent a small group of large stakers from gaining excessive influence over the network.

Read more: Staking Crypto: How to Stake Coins and Grow Your Income

In conclusion, Buterin’s proposals in the Scourge phase reflect his focus on maintaining Ethereum’s decentralization as it scales. By addressing the centralization risks of both staking and block production, he aims to safeguard the long-term security and openness of the Ethereum blockchain.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.