Ethereum (ETH) Price Closes Above $3,900 — Is a New All-Time High Possible Before 2024 Ends?

- Bitcoin Drops to $70,000. U.S. Government Refuses to Bail Out Market, End of Bull Market or Golden Pit?

- Gold rallies further beyond $5,050 amid flight to safety, dovish Fed expectations

- Bitcoin Bottom Debate: $70,000 or $50,000?

- A Crash After a Surge: Why Silver Lost 40% in a Week?

- Bitcoin Rout. Bridgewater Founder Dalio Publicly Backs Gold.

- WTI declines below $63.00 as US-Iran talks loom

Once again, the price of Ethereum (ETH) has risen above $3,900. This bounce has hinted at a further price increase for the altcoin before the end of the year.

But does this mean the cryptocurrency can surpass its previous all-time high within this short period? This on-chain analysis reveals whether that is possible.

Ethereum Loses Bullish Dominance in Two Major Zones

Ethereum currently trades around $3,939, which means that the altcoin’s price has increased by 67.30% in 2024. One indicator that played a key role in ETH’s rally during the year is its Open Interest (OI).

The OI refers to the value of the sum of all open contracts in the market. When it increases, it means that more liquidity has flowed into contracts related to a cryptocurrency. In the derivatives market, this indicates rising buying pressure, which could lead to higher prices.

On the flip side, a decrease in the OI indicates selling pressure. The decline suggests that traders are increasingly closing their positions and withdrawing liquidity from the market.

According to Santiment, Ethereum’s OI climbed to $14.50 billion yesterday, December 15. However, as of this writing, it has decreased to $13.94 billion, indicating that exposure to ETH has reduced. Given the conditions above, this decline suggests that Ethereum Price risks another decline if the OI sustains this position.

Ethereum Open Interest. Source: Santiment

Ethereum Open Interest. Source: Santiment

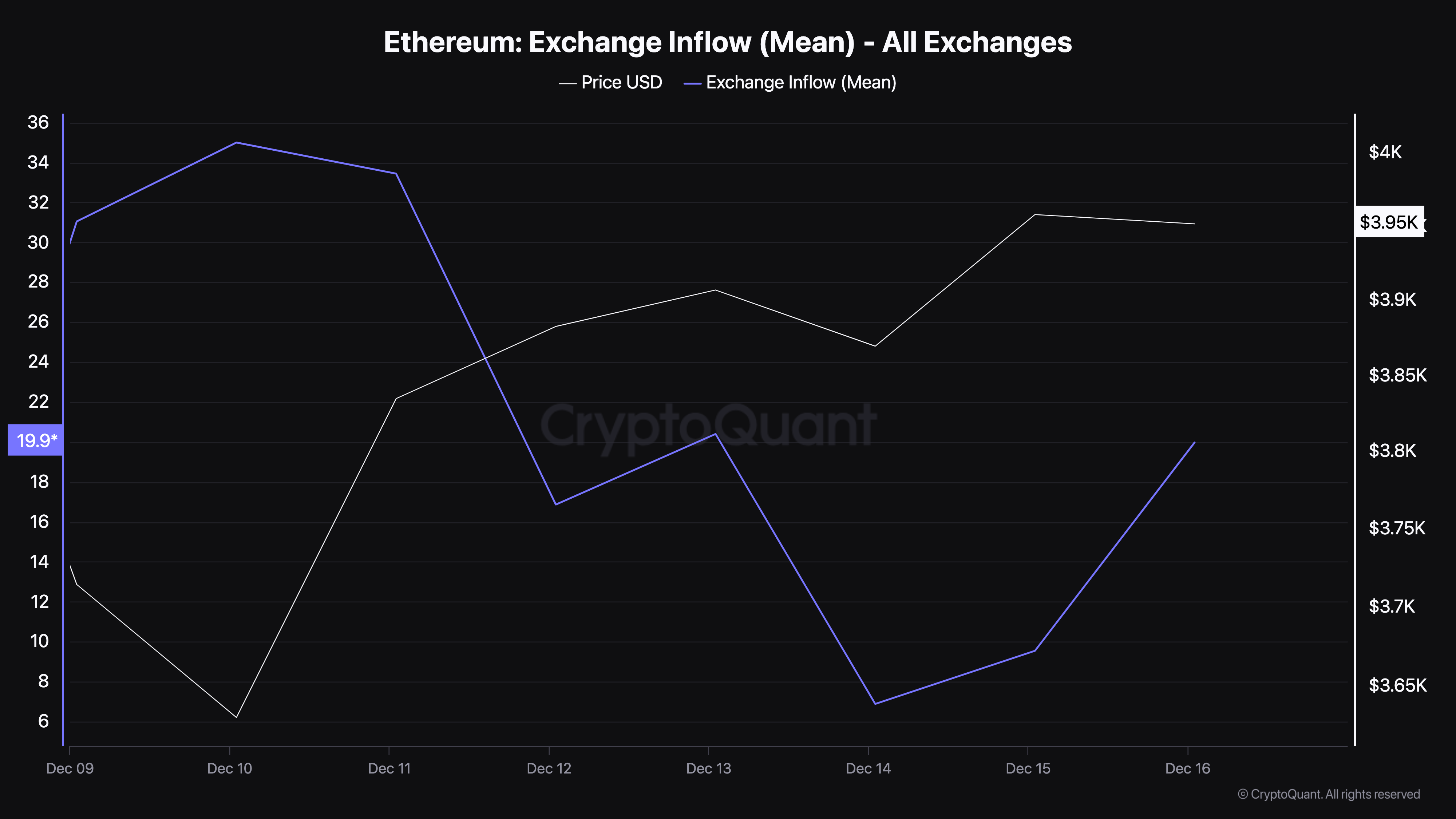

Another indicator that supports this bias is the Ethereum exchange inflow. Exchange inflow is the mean amount of coins per transaction sent to exchanges. A high value suggests that investors are transferring larger amounts, signaling increased selling pressure, which could potentially drive prices lower.

A low exchange inflow in the metric, however, suggests a decline in selling pressure. According to CryptoQuant, the exchange inflow has climbed from what it was on December 14, indicating that selling pressure around ETH has increased.

If sustained, this could hinder the cryptocurrency from rising toward $4,500 or hitting a new all-time high before 2024 closes.

Ethereum Exchange Inflow. Source: CryptoQuant

Ethereum Exchange Inflow. Source: CryptoQuant

ETH Price Prediction: Now $4,500 Yet

According to the daily chart, the Parabolic Stop-and-Reverse (SAR) indicator has risen above ETH’s price. The SAR is a technical indicator that shows whether a cryptocurrency has encountered resistance or solid support.

When the dotted lines are below the price, it indicates significant support that could drive prices higher. However, currently, the dotted lines are above Ethereum’s price. Therefore, the cryptocurrency is facing resistance.

As long as ETH trades below the indicator, the price is likely to fall, with possible targets around $3,315. If that is the case, then Ethereum’s price might not hit a new all-time high before the year ends.

Ethereum Daily Analysis. Source: TradingView

Ethereum Daily Analysis. Source: TradingView

However, if Open Interest increases and exchange inflow drops to an extremely low point, the forecast might be invalidated.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.