Dogecoin Price Forecast: DOGE outperforms SHIB and PEPE as traders bet on Trump

- Bitcoin Drops to $70,000. U.S. Government Refuses to Bail Out Market, End of Bull Market or Golden Pit?

- Gold rallies further beyond $5,050 amid flight to safety, dovish Fed expectations

- Bitcoin Bottom Debate: $70,000 or $50,000?

- A Crash After a Surge: Why Silver Lost 40% in a Week?

- Bitcoin Slips Below 75,000 Mark. Will Strategy Change Its Mind and Sell?

- Bitcoin Rout. Bridgewater Founder Dalio Publicly Backs Gold.

Dogecoin price crossed $0.36 on Tuesday, outperforming rivals SHIB and PEPE with 13% gains over the past X days.

Dogecoin open interest crossed $3.8 billion as traders piled on $570 million new long positions in the last three days.

With Trump’s inauguration 1 week away, DOGE appears poised for more upside as bullish speculators hold sway.

Dogecoin price crossed $0.36 on Tuesday, outperforming rivals SHIB and PEPE with 13% daily timeframe gains. With Trump’s inauguration 1 week away, DOGE appears poised for more upside as bullish speculators holdsway.

Dogecoin price breaches $0.35 resistance as Trump bets swings market traders

Dogecoin (DOGE) surged past the $0.36 resistance level on Tuesday, posting a 13% gain within 24 hours and outpacing rival memecoins like Shiba Inu (SHIB) and PEPE. The price rally comes as speculative fervor builds ahead of former President Donald Trump’s upcoming inauguration, which has captivated a segment of crypto traders betting on market volatility.

Dogecoin Price Action | DOGEUSDT

Dogecoin Price Action | DOGEUSDT

The rally reflects a shift in sentiment, with bullish traders seizing control following DOGE’s earlier consolidation near $0.33.

Renewed retail interest and social media-driven enthusiasm could propel the meme coin further, especially as sentiment around major macroeconomic risks eases.

At press time, Dogecoin is trading at $0.36, holding firmly above key support levels.

Should momentum persist, the cryptocurrency could target the $0.40 mark in the coming sessions, marking a significant recovery from earlier lows this month.

Dogecoin Open Interest Surges $570M in 3-days

Despite a period of price consolidation last week, traders continued to place speculative bets on Dogecoin. This suggests that strategic Dogecoin traders are preparing for potential bullish triggers linked to upcoming events.

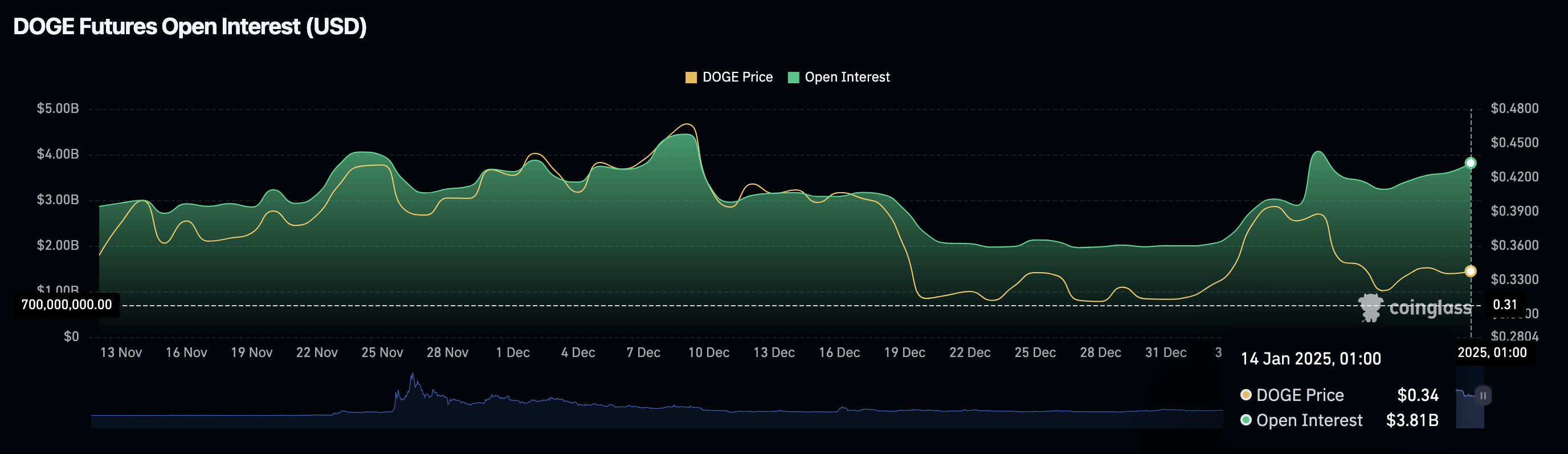

Affirming this stance, Coinglass open interest chart below tracks the capital flows towards DOGE perpetual futures contracts.

Dogecoin Open Interest vs. DOGE Price | Source: Coinglass

Dogecoin Open Interest vs. DOGE Price | Source: Coinglass

As depicted above, Dogecoin has witnessed a remarkable surge in open interest, with $570 million in new positions added over the past three days.

This brings the total open interest in DOGE futures contracts to $3.81 billion as of January 14, according to data from Coinglass.

The 15% increase in open interest, outpaces the 10% gains seen in DOGE's spot prices, indicating that leveraged traders are betting on further upside.

Historically, when open interest grows faster than price during a rally, it reflects traders’ willingness to hold positions rather than take profits, suggesting confidence in additional upward momentum.

This dynamic could propel DOGE toward the $0.40 resistance level in the coming days.

Dogecoin Price Forecast: $0.40 breakout could trigger further gains

Dogecoin's current price action displays notable bullish momentum, with the token trading at $0.3568, breaking above the Volume-Weighted Average Price (VWAP) level of $0.3516.

This technical signal highlights increased buying support as the market regains confidence following the recent $570 million surge in open interest.

The Keltner Channel's upper band at $0.4007 represents a critical resistance level, and a successful breakout could propel DOGE toward a sustained rally.

Dogecoin Price Forecast (DOGEUSD) | TradingView

Dogecoin Price Forecast (DOGEUSD) | TradingView

From a bullish perspective, the recent climb above the VWAP indicates institutional buying pressure, supported by strong open interest growth.

Should DOGE breach the $0.4007 resistance, traders could see further gains toward the $0.45 level, driven by a compounding effect of leveraged long positions.

Additionally, the Accumulation/Distribution Line (ADL) at 1,573 suggests steady capital inflows, underpinning the likelihood of sustained upward momentum.

Conversely, bearish risks remain if DOGE fails to hold above $0.35, potentially triggering profit-taking or liquidation of leveraged positions.

A reversal toward the Keltner Channel midline at $0.3469 could signal weakening demand, pushing prices into a consolidation phase.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.