In the current market uncertainty, cryptocurrencies like Bitcoin have received much more attention as the US Dollar weakens and investors look to assets that can’t be controlled by any government.

In crypto, Bitcoin exchange-traded funds (ETFs) have transformed cryptocurrency investing by providing a regulated, accessible way to gain exposure to Bitcoin’s price movements.

Investing into them also has the added benefits of not having to deal with the complexities of direct ownership, such as managing digital wallets or private keys.

For investors seeking a long-term "buy and hold" strategy, selecting ETFs with substantial assets under management (AUM), competitive expense ratios, and reputable management is critical. Below, we highlight the top three Bitcoin ETFs by AUM.

These ETFs are spot Bitcoin ETFs, meaning they hold actual Bitcoin to track its spot price, offering direct exposure to the cryptocurrency’s market performance.

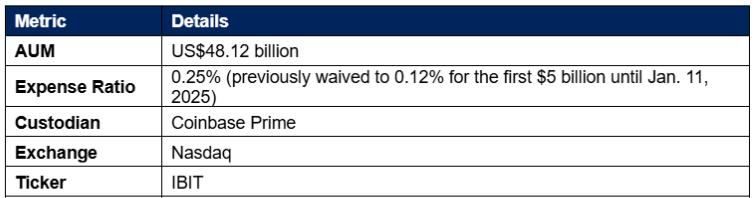

1.iShares Bitcoin Trust ETF (NASDAQ: IBIT)

Source: Yahoo Finance

Why it’s a top pick?

The iShares Bitcoin Trust ETF (NASDAQ: IBIT) is managed by BlackRock, the world’s largest asset manager that manages over $10.5 trillion in AUM as of March 2024.

Since its launch in January 2024, IBIT has amassed US$48.12 billion in AUM, reflecting strong investor confidence and making it the largest spot Bitcoin ETF. Its expense ratio of 0.25% is highly competitive, especially after the fee waiver period ended in January 2025, as the AUM far exceeds the $5 billion threshold for the promotional rate.

IBIT tracks the CME CF Bitcoin Reference Rate – New York Variant, ensuring close alignment with Bitcoin’s spot price. The use of Coinbase Prime, a leading institutional-grade custodian, provides robust security for the underlying Bitcoin assets.

With high liquidity—evidenced by significant trading volumes—and BlackRock’s reputation, IBIT is a compelling choice for investors seeking a cost-effective, secure, and liquid vehicle for long-term Bitcoin exposure.

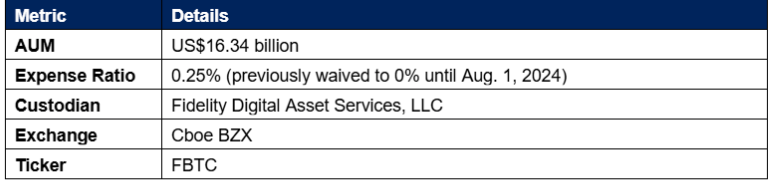

2.Fidelity Wise Origin Bitcoin Fund (NYSE: FBTC)

Source: Yahoo Finance

Why it’s a top pick?

The Fidelity Wise Origin Bitcoin Fund (BZX: FBTC), launched in January 2024, is backed by Fidelity, a global investment leader with decades of experience. With US$16.34 billion in AUM, FBTC offers substantial liquidity, making it a reliable option for long-term investors.

Its expense ratio of 0.25%, effective after the fee waiver expired in August 2024, remains competitive, minimising costs over time. FBTC tracks the Fidelity Bitcoin Reference Rate, ensuring accurate price alignment with Bitcoin’s spot market.

Fidelity’s in-house custody solution, Fidelity Digital Asset Services, enhances security and trust, leveraging the firm’s early involvement in cryptocurrencies, including its 2023 crypto exchange launch.

FBTC’s combination of low fees, significant AUM, and Fidelity’s institutional backing makes it an attractive choice for those prioritising affordability and reliability in a long-term Bitcoin investment.

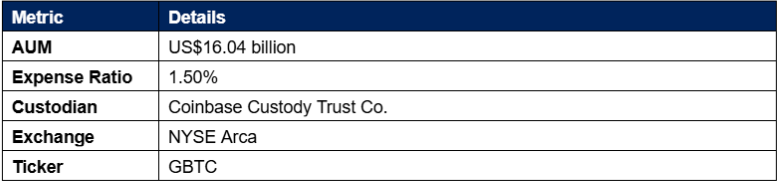

3.Grayscale Bitcoin Trust ETF (GBTC)

Source: Yahoo Finance

Why it’s a top pick?

The Grayscale Bitcoin Trust ETF (NYSE: GBTC), originally launched in 2013 as a private trust and converted to an ETF in January 2024, is a pioneer in Bitcoin investing. Despite its higher expense ratio of 1.50%, GBTC’s AUM of US$16.04 billion underscores its enduring market presence and investor trust.

The ETF uses Coinbase Custody for secure cold storage of Bitcoin, mitigating risks associated with direct ownership. GBTC tracks the Bitcoin spot price, providing straightforward exposure.

While its fees are notably higher than those of IBIT and FBTC, Grayscale’s long history and established brand in the cryptocurrency space appeal to investors who value experience and reputation.

GBTC’s significant AUM ensures liquidity, though investors should weigh the impact of its fees on long-term returns.

Why These ETFs for Long-Term Investment?

These ETFs stand out for several reasons that align with a "buy and hold forever" strategy:

High Liquidity: The substantial AUM figures of IBIT, FBTC, and GBTC indicate strong market participation, reducing bid-ask spreads and facilitating efficient trading. High liquidity is crucial for long-term investors to enter or exit positions without significant price impact.

Robust Security: All three ETFs use reputable custodians—Coinbase Prime for IBIT, Fidelity Digital Asset Services for FBTC, and Coinbase Custody for GBTC—ensuring the underlying Bitcoin is stored securely, often in cold storage, minimising risks like hacking or loss.

Cost Considerations: IBIT and FBTC offer low expense ratios of 0.25%, making them cost-effective for long-term holding, as lower fees compound favourably over time. GBTC’s 1.50% expense ratio is a drawback, but its historical performance and brand may justify the cost for some investors.

Regulatory Oversight: As SEC-approved spot Bitcoin ETFs, these funds adhere to strict regulatory standards, providing a layer of safety compared to unregulated crypto exchanges or direct Bitcoin ownership.

Direct Exposure: Unlike futures-based ETFs, these spot ETFs hold actual Bitcoin, ensuring their performance closely tracks Bitcoin’s spot price, which is ideal for capturing the cryptocurrency’s long-term growth potential.

Volatility remains key risk

One of the key risks to watch out for when investing in Bitcoin ETFS is the cryptocurrency volatility. Price fluctuations can be substantial, driven by factors such as regulatory changes, market speculation, or technological developments.

While these ETFs mitigate some risks of direct Bitcoin ownership, such as digital wallet security, they do not eliminate market risk.

Investors should also note that AUM figures can change rapidly due to inflows, outflows, or Bitcoin price movements, and expense ratios may be subject to future adjustments.

Prepare for volatility with Bitcoin ETFs

The iShares Bitcoin Trust ETF (IBIT), Fidelity Wise Origin Bitcoin Fund (FBTC), and Grayscale Bitcoin Trust ETF (GBTC) offer compelling options for long-term investors seeking Bitcoin exposure. IBIT and FBTC stand out for their low fees and substantial AUM, supported by BlackRock and Fidelity’s institutional credibility.

GBTC, despite higher costs, benefits from its pioneering role and brand recognition. These ETFs provide liquidity, security, and regulatory compliance, making them suitable for a "buy and hold forever" strategy.

However, Bitcoin’s volatility necessitates a high-risk tolerance, and investors should consult a financial advisor to ensure these investments align with their financial goals and risk profile.

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.