Bitcoin Google Search Volume Drops to Low Point: Does This Signal an Imminent Price Crash?

- Bitcoin Drops to $70,000. U.S. Government Refuses to Bail Out Market, End of Bull Market or Golden Pit?

- Gold rallies further beyond $5,050 amid flight to safety, dovish Fed expectations

- Bitcoin Bottom Debate: $70,000 or $50,000?

- A Crash After a Surge: Why Silver Lost 40% in a Week?

- Bitcoin Slips Below 75,000 Mark. Will Strategy Change Its Mind and Sell?

- Bitcoin Rout. Bridgewater Founder Dalio Publicly Backs Gold.

A drop in Bitcoin's Google search volume doesn't directly indicate a price decline. However, it does show bearish signals.

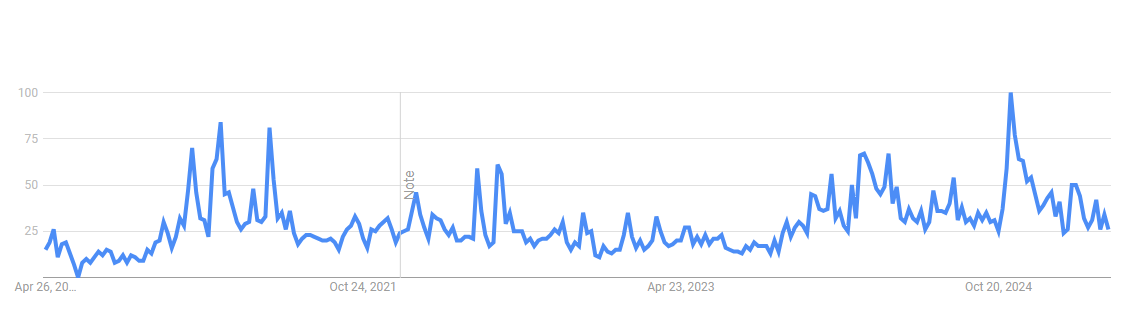

Recently, Bitcoin (BTC) reached $95,000. Yet, Google searches didn't rise. Instead, they fell below 30, a long-term low. Does this unusual trend mean a price drop is imminent?

Bitcoin search volume on Google. Source: Google Trends.

Hunter Horsley, CEO of Bitwise, links this anomaly to buyer dynamics. He notes, "The price rise isn't driven by retail investors. Institutional buyers, advisors, corporations, and countries are entering the market."

While Google search volume reflects market interest, it doesn't directly show bullish or bearish forces. However, the average Bitcoin futures funding rate does. According to Glassnode, this rate dropped to about -0.023%. This indicates a dominant short position, with contract prices below spot prices. It signals a weakening demand for bulls.

Additionally, Bitcoin's price chart shows strong bearish signals. Since April 25, Bitcoin surged past $95,000 but couldn't hold that level. Prices continued to decline, hitting new lows. This indicates persistent bearish momentum, while bulls struggle to keep up.

Bitcoin price trend chart. Source: TradingView.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.