Bitcoin In ‘Euphoria Wave’ – How Long Until The Bull Run Ends?

- Bitcoin Drops to $70,000. U.S. Government Refuses to Bail Out Market, End of Bull Market or Golden Pit?

- Gold rallies further beyond $5,050 amid flight to safety, dovish Fed expectations

- Bitcoin Bottom Debate: $70,000 or $50,000?

- Bitcoin Slips Below 75,000 Mark. Will Strategy Change Its Mind and Sell?

- Bitcoin Rout. Bridgewater Founder Dalio Publicly Backs Gold.

- Ethereum Price Forecast: ETH faces heavy distribution as price slips below average cost basis of investors

The price of Bitcoin appears to have returned to a choppy market condition, quashing any hopes of a breakout to new highs soon. However, the good news is that the current bull cycle may still not be over, even though it is taking a while for the premier cryptocurrency to resume its upward momentum.

Specifically, the latest on-chain observation shows that Bitcoin has been going through a “euphoria wave” over the past few months. Here’s the implication of this phase on the current bull run.

How Old Is The Current Bitcoin ‘Euphoria Wave’?

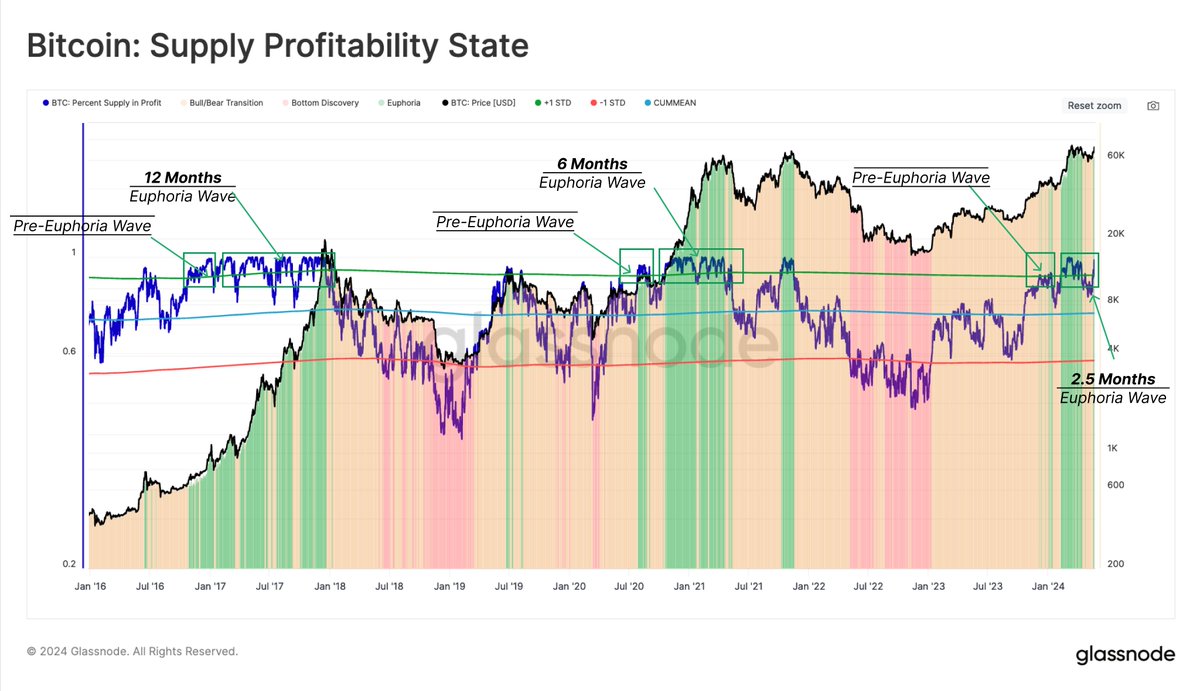

Blockchain intelligence firm Glassnode revealed via a post on the X platform that Bitcoin has entered the euphoria phase of the market cycle. This on-chain observation is based on the “Percent Supply in Profit” metric, which measures the percentage of the total circulating Bitcoin supply that is currently in profit.

According to Glassnode, the “Euphoria Wave” is identified as a period during which the supply in profit usually fluctuates around the 90% level. This phase typically lasts between 6 to 12 months and is characterized by increased investor sentiment and heightened market speculation.

Glassnode’s data shows that 93.4% of the circulating Bitcoin supply is currently in the green and that the Euphoria Wave is “relatively young”. The on-chain analytics platform noted that the euphoria phase has only been active for about two and a half months.

As with every phase in the market cycle, the Euphoria Wave will eventually come to an end at some point. Historically, the euphoria phase can signal tops and is usually followed by a cooling-off period, which is marked by a downturn in the price of Bitcoin.

If the last cycle – with a 6-month Euphoria Wave – is anything to go by, then there might still be about three to four months in the current bull run. Ultimately, the current profitability of the premier cryptocurrency may prove pivotal in the duration of its bull cycle and overall future trajectory.

Rise Of BTC Accumulation Addresses Continued In May: Analyst

One of the tell-tale signs of the bullish sentiment around Bitcoin is the continuous rise in accumulation addresses. According to an on-chain analyst on CryptoQuant’s platform, there has been a notable increase in the number of new BTC accumulation addresses.

The analyst pointed out the continuity of this positive trend despite BTC’s relatively slow price action in May. Meanwhile, the large Bitcoin holders have also continued to load their bags, with significant purchases recorded over the past month.

As of this writing, Bitcoin is valued at $67,744, reflecting a mere 0.4% increase in the last 24 hours. According to data from CoinGecko, the pioneer cryptocurrency is up by about 15% in the past month.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.