Bitcoin rises 4% amid long liquidations, and short-term holders realized share

Bitcoin rose above $63K following a bounce off the $59K level.

The recent decline in Bitcoin between Wednesday and Thursday led to long liquidations of $290 million.

Short-term holders realized share have declined over the last three months.

Bitcoin (BTC) climbed above $63,000 on Friday after Mt Gox pushed its repayment plans to 2025, easing tension among investors. Meanwhile, CryptoQuant data reveals that Bitcoin long liquidations hit $290 million on Thursday, the highest level since 2022.

Top Bitcoin moves ahead of weekend

Bitcoin declined early on Friday following speculations that a second rate cut may be unnecessary. As fears stormed the market, prices fell below $60K. Prices only began to recover after Mt Gox postponed its repayment plans to 2025.

Bitcoin experienced an 11% drop between October 1 and October 11, resulting in heavy liquidations among long position holders. CryptoQuant data indicates that the long liquidations between Wednesday and Thursday stood at $290 million. This also represents the highest amount of BTC long liquidations since June 2022.

Bitcoin has traded sideways for nearly 200 days since the halving event in April. Ki Young Ju, CEO of CryptoQuant, suggests that if Bitcoin fails to trigger a bull market within 14 days, it will be the longest sideways post-halving in BTC's history.

Likewise, according to long-term trader Peter Brandt, Bitcoin has traded below its all-time high of $72K for 30 weeks. Brandt suggests top cryptocurrency could see a decline as it usually dives over 75% when it fails to establish a decisive new all-time high within this period.

Hey Bitcoiners

— Peter Brandt (@PeterLBrandt) October 11, 2024

Are you familiar with the concept of "market analogs?"

Here is something to think about

It has been 30 weeks since $BTC made an ATH

Whenever has not made a decisive new ATH within this time length a 75%+ decline has occurred pic.twitter.com/CUyK4C2W93

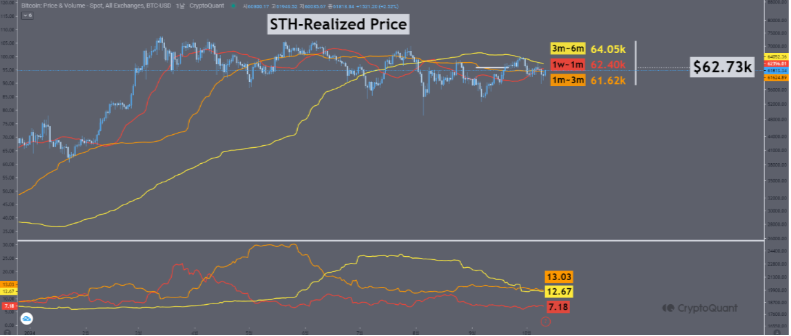

The critical Bitcoin short-term holder (STH) level also hovers around $62K, which remains consistent with the past three months. However, CryptoQuant data revealed that Bitcoin's persistent sideways movement led to a decline in STH realized share within this period. This drop from 55% three months ago to 40% now indicates that short-term holders are more likely to react to price fluctuations in the future.

BTC Short-Term Holders Realized Price

However, CryptoQuant analysts still suggest that the bull cycle is still in progress. The current market movement mirrors the 2013 and 2020 cycles, during which long-term investors realized profits twice while prices hit new highs.

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.