Crypto market shaves off $230 billion as Trump's tariff on Mexico, Canada weighs on Bitcoin and altcoins

The crypto market dipped by 8% as President Trump announced that Mexico and Canada tariffs would kick off in March.

Bitcoin dropped below $92,000 following a $1 billion wipeout across the crypto futures market.

Solana slumped by 15% below $150 following a connection of Lazarus Group to Pumpfun meme coins.

Bitcoin (BTC) fell below $92,000 on Monday, stretching the crypto market's decline by 8% following US President Donald Trump's expectations for US tariffs on Mexico and Canada to begin on March 4.

Meanwhile, Solana (SOL) saw double-digit losses, causing its price to slump below $150 as Lazarus Group's Bybit hack has also been linked to Pumpfun meme coins.

Trump tariffs stirs crypto market downtrend

President Donald Trump stated in a press conference at the White House that he expects tariffs for Mexico and Canada to kick off in March, per Bloomberg.

He stated that the tariffs are moving forward on time and schedule.

The tariffs include a 25% levy on goods from both countries, with a lower 10% tariff on Canadian energy resources like oil, natural gas, and electricity.

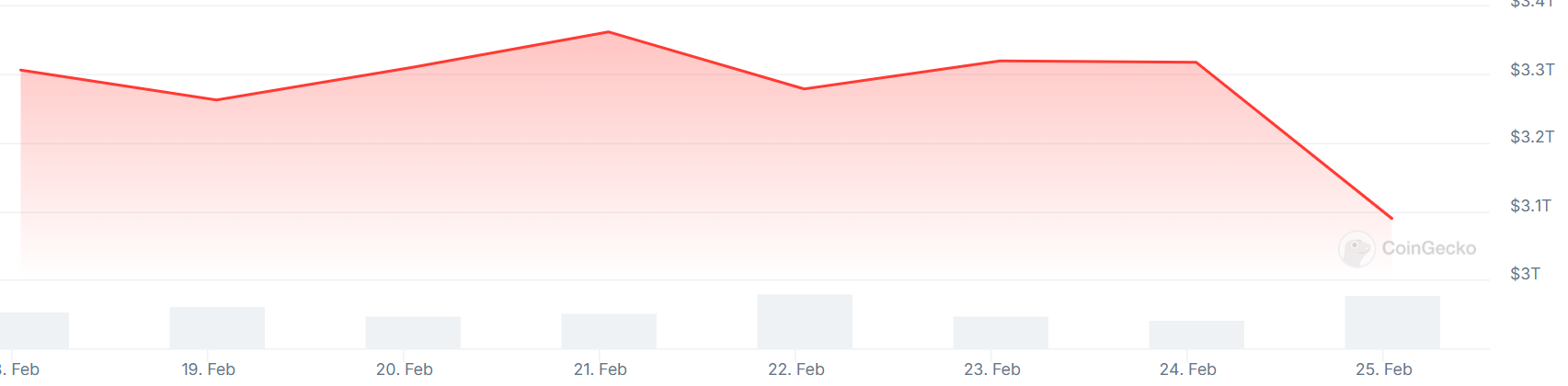

The uncertainty surrounding the tariff's impact on global trade resulted in several investors de-risking as the crypto market plunged by about 8%, with Bitcoin breaching the $92,000 level. The decline has shaved off nearly $230 billion from the crypto market capitalization.

Crypto market capitalization. Source: CoinGecko

On the futures side, traders are on track to mark about $1 billion in liquidations spearheaded by Bitcoin, Ethereum (ETH) and Solana (SOL), per Coinglass data.

Likewise, Bitcoin investment products also witnessed significant outflows last week, according to CoinShares weekly ETF flows data.

Bitcoin exchange-traded funds (ETF) shed $571 million last week, marking a second week of straight outflows since the year began.

CoinShares noted that new tariffs and expectations surrouding macroeconomic data could be among the reasons investors pulled out capital.

Bitcoin and Solana demand slides as investors show signs of weakened demand

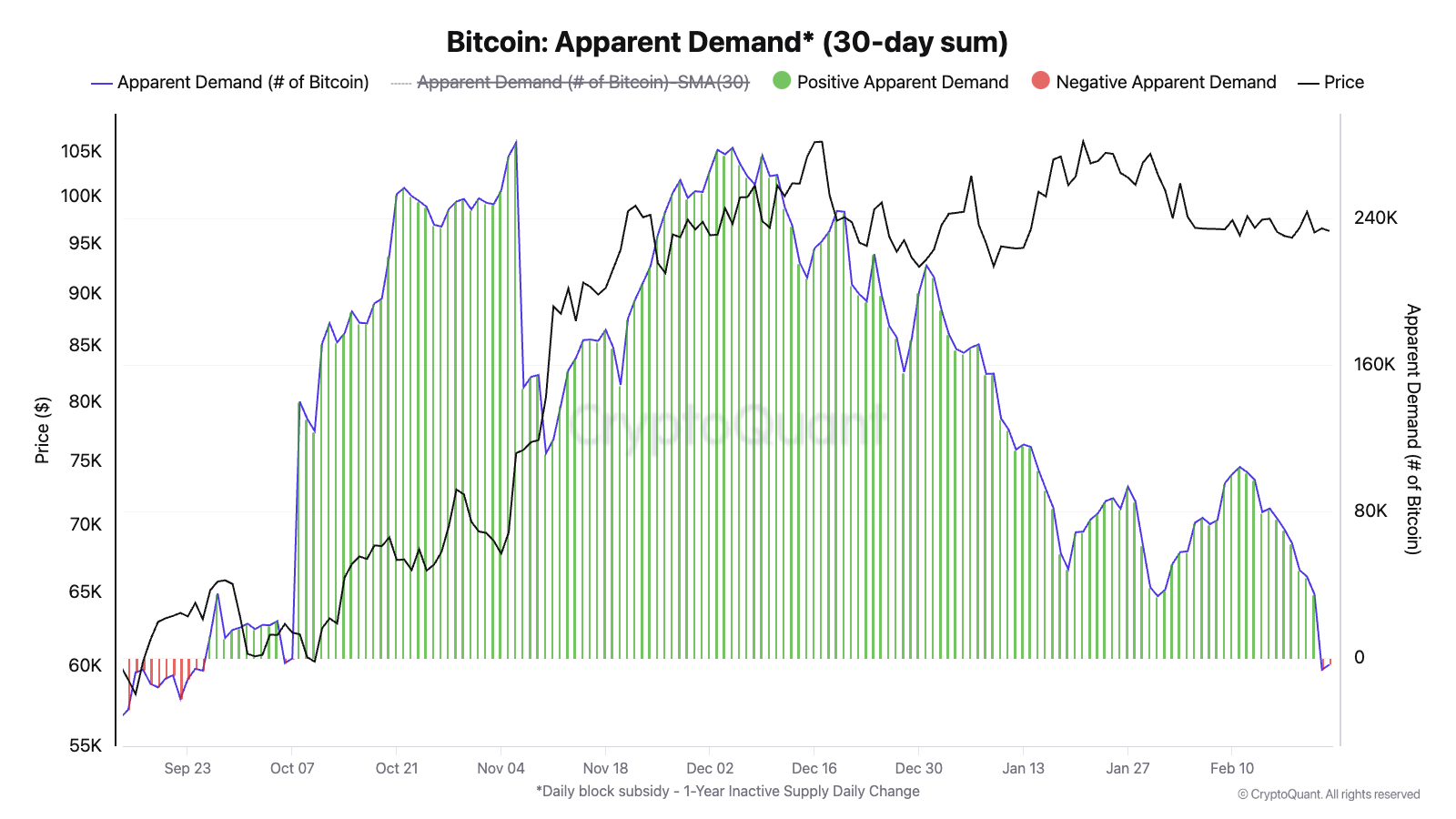

Bitcoin's investor demand has declined over the past month, reaching negative values for the first time since September 2023. The reduced demand follows a decrease in the number of active wallets and transactions, according to CryptoQuant.

This signals declining investor sentiment since the presidential elections, which boosted its price above $100,000.

Bitcoin Apparent Demand. Source: CryptoQuant

However, Bitcoin still maintains a long-term bullish structure, which suggests that further downward pressure could result in an extended consolidation phase.

"If uncertainty persists, we must consider the possibility of another prolonged consolidation phase, similar to what began in March 2024," CryptoQuant analyst stated in a blog post on Monday.

Furthermore, the market appeared to be subdued by the North Korean Lazarus Group's recent hack on crypto exchange Bybit.

Top altcoins Ethereum, XRP and Solana have all plunged below 10%, with bearish sentiment dominating them — especially Solana, whose price dropped over 15% in the past 24 hours.

SOL's downward movement largely stems from the recent deadline in meme coin activity on its blockchain.

Likewise, crypto investigator ZachXBT discovered that some entities laundering the Bybit stolen funds for Lazarus Group are connected to the launch of several meme coins on Solana's Pumpfun.

This has further dampened investor interest in the Solana ecosystem and, by extension, the SOL token.

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.