Will Bitcoin price reach $200K after Trump’s inauguration? BitDCA CTO weighs MicroStrategy, El-Salvador impact

Bitcoin price hit a new all-time high $109,000 after Trump’s inauguration on Monday.

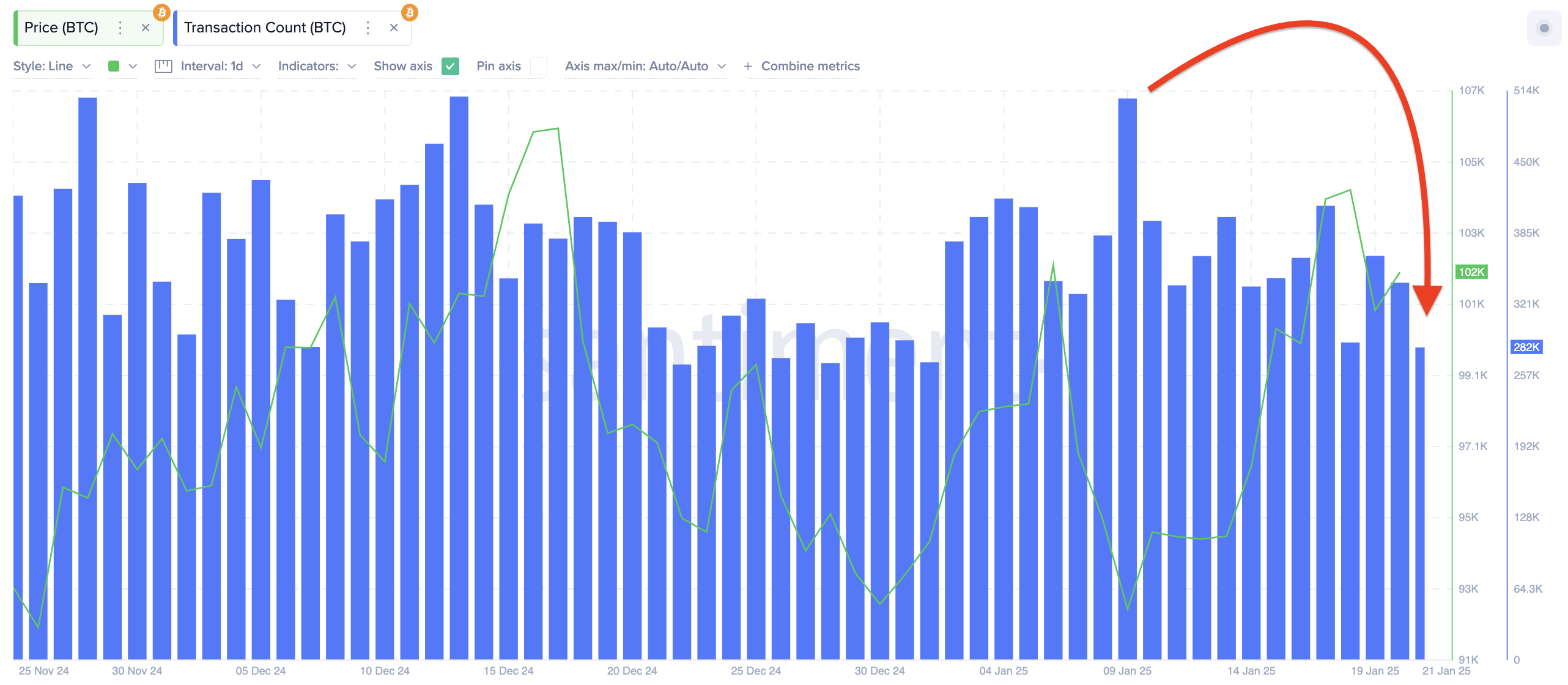

BTC on-chain transaction volumes dropped by 37% in the last two weeks, signaling that institutional investors are leading the current rally.

In an exclusive interview, Ondřej Kavka, CTO and Co-founder at BitDCA hinted that retail traders could mirror MicroStrategy and El Salvador’s periodic purchase strategy in 2025.

Bitcoin price hit a new all-time high of above $109,000 amid Trump’s inauguration on Monday. With on-chain data trends showing that institutional players have been dominant during the latest BTC rally, Ondřej Kavka, CTO and Co-founder at BitDCA has hinted how recent accumulation wave from whale entities like MicroStrategy and El-Salvador could influence retail traders in 2025.

Bitcoin price rises 19% as Trump memes and tariff fears spark demand

Bitcoin surged to an all-time high of $109,241 on Monday, reflecting heightened investor interest amid President Donald Trump's inauguration and the launch of meme coins representing the US President and First Lady.

The introduction of $TRUMP and $MELANIA tokens was a big hit, with both assets reaching peak market capitalizations of $9.6 billion and $750 million, respectively within 48 hours post-launch.

Bitcoin price action | BTCUSDT

Bitcoin price action | BTCUSDT

Despite initial enthusiasm, these meme coins experienced substantial volatility, with $TRUMP and $MELANIA tokens declining by 50% and 74% from their peaks, respectively.

During that period, Bitcoin price also rose 19% from the lows recorded on January 9, to hit $109,241 on Monday before retracing to find support above the $100,000 territory.

As depicted above, BTC attempted another breakout on Tuesday, rising 3.87% before hitting a major sell-wall at the $107,200 area.

Bear traders anticipated a massive sell-the-news cycle after the inauguration. However, President Trump's proposal of 25% tariffs on imports from Mexico and Canada by February 1st has introduced potential economic uncertainties.

However, recent Bitcoin price action shows fresh geopolitical risk factors surrounding tariffs on China, and controversy surrounding a potential TikTok ban further drove up demand for BTC after the inauguration.

BitDCA CTO weighs large investors’ impact as BTC transactions decline amid rally

Bitcoin price hit 25% year-to-date gains when it crossed $109,000 on Monday, driven by positive speculations around ETF approvals and crypto friendly policies, heating ahead of Trump’s inauguration. However, there has been a considerable decline in BTC on-chain transaction count since June 9.

Bitcoin Transaction Count | Source: Santiment

Bitcoin Transaction Count | Source: Santiment

Bitcoin price rising despite fewer network transactions, signals that the latest rally is being largely driven by whales, while retail traders exitted to the sidelines. This was further emphasized, with prominent institutional investors like Microstrategy, Metaplanet and Blackrock-led ETF making record BTC purchases after Trump’s re-election in November.

In an in-depth interview with FXStreet, BitDCA CTO discussed Bitcoin’s growth prospect for 2025, hinting how retail traders adopting the Dollar-Cost Averaging (DCA) currently deployed by MicroStrategy, Metaplanet and El-Salvador El-Salvador could potentially impact the market, as traders place optimistic bets on a potential $200,000 breakout.

Question 1: Bitcoin's transaction volumes have dropped by 37%, hinting that Institutional investors appear to dominate the current rally. How sustainable is this trend without retail participation, and what risks does it pose ?

Ondřej Kavka: Institutional investors tend to be less driven by emotions compared to retail investors, allowing them to adopt long-term strategies for holding Bitcoin (BTC).

This suggests that a steady and sustainable price increase might be achievable.

On the other hand, when retail investors start buying and speculating in large numbers, it may signal that we are nearing the potential peak of the current market cycle.

Question 2: Bitcoin price crossed the $100,000 mark in the final weeks of 2024, marking a significant milestone. What would you say to retail traders, and new entrants who think it's too late to buy Bitcoin in 2025?

Ondřej Kavka: Bitcoin’s value is likely to be significantly higher in the future, so short-term volatility shouldn’t be a concern.

Instead, the focus should be on adopting the best long-term strategy, such as Dollar-Cost Averaging (DCA).

Many believed it was “too late” to invest when BTC reached $1000, then $10,0000, and now some feel the same at $100,000. Will they one day say the same when Bitcoin hits $1,000,000?

Question 3: High-profile firms like MicroStrategy, Metaplanet, Blackrock and Countries like El-Salvador have entered a race of periodic BTC purchases in 2025. How can retail traders and private individuals adopt and execute this strategy ? Any key factors that could deepen retail adoption in 2025?

Ondřej Kavka: Bitcoin is steadily becoming more integrated into the banking world, supported by regulatory advancements like the upcoming MiCA regulation in Europe and policy shifts in the United States under Trump’s new administration.

This integration is expected to significantly increase retail participation in Bitcoin.

Retail investors now have access to an expanding range of user-friendly tools for Dollar-Cost Averaging (DCA), even through micro-transactions. Apps like Littlebit, are designed to simplify Bitcoin investing and make it more accessible to everyone, regardless of their experience level.

Question 4: BitDCA is dedicated towards enhancing retail participation in Bitcoin, what are some risk factors that traders must avoid?

Ondřej Kavka: As a retail investor, I would strongly advise against attempting to time the market or engaging in short-term trading.

For most people, trading is not only unprofitable but also mentally draining.

Those who have consistently practiced long-term Dollar-Cost Averaging (DCA) into Bitcoin are likely already seeing substantial gains at current prices—achieved without the stress and volatility that comes with active trading.

Question 5: Crypto traders on Polymarket voted https://polymarket.com/a 1% chance of BTC reaching $200,000 after Trump's inauguration on January 20. Do you think increased retail participation could improve those odds ?

Ondřej Kavka: Predicting outcomes in a market as volatile as crypto is incredibly challenging.

However, as more people enter the crypto space, the increased buying pressure could improve the likelihood of upward price movement.

That said, major events, such as the inauguration, might trigger a short-term sell-off, similar to what occurred following last year’s ETF approval—since significant events often lead to market corrections.

In the long term, however, by 2025, the possibilities remain wide open— even reaching $200,000 for Bitcoin is within the realm of possibilities.

Bitcoin price forecast: Falling wedge pattern signals $110K breakout before reversal

Bitcoin price action is currently flashing textbook bullish patterns on the daily chart, signaling a potential move above $110,000.

As seen below, the formation of a falling wedge, a bullish continuation pattern, aligns with the broader market sentiment after Trump’s inauguration.

Historically, this setup forecasts a breakout to the upside, confirmed by a decisive close above $106,500.

Considering that BTC has now breached this level twice within the past 24 hours, bulls could garner momentum to aim for the next key resistance level at $110,000, aligned with the falling wedge’s higher breakout projection.

Bitcoin Price Forecast | BTCUSDT

The double bottom structure near $95,000, labeled as "Bottom 2," adds credibility to the bullish case.

This pattern suggests that Bitcoin price has established strong demand at these levels, evidenced by the increasing volume during recent upswings.

Additionally, the long lower shadow on recent candles highlights buyer interest at intraday lows, reinforcing $102,500 as a key support level.

On the MACD, the bullish crossover, coupled with rising histogram bars, indicates strengthening momentum.

The breakout above the wedge’s resistance could propel Bitcoin to test immediate targets at $110,000, with an extended rally toward $115,000 if bullish momentum sustains.

Yet, bearish risks remain active. Failure to maintain support above $106,000 may expose BTC price to a retest of the $102,500 level.

A breakdown below this threshold could invalidate the near-term bullish structure, opening doors for a deeper retracement toward $95,000.

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.