Bitcoin price bottoms out as MicroStrategy raises $100 million more than initially announced

●Bitcoin price remains above the $65,000 threshold as MicroStrategy makes headlines for the second time this week.

●BTC could have another shot at $69,000 threshold as buyer momentum continues to rise.

●The voluminous acquisition could inspire FOMO in the market ahead of the halving.

Bitcoin (BTC) price remains a key headline in the cryptocurrency community amid a budding bull market. Ahead of the April halving, BTC enthusiasts remain committed to growing their portfolio with business intelligence firm MicroStrategy doubling down on its efforts.

MicroStrategy raises $100 million more than initially announced for Bitcoin purchase

In a March 5 announcement, MicroStrategy, one of the largest BTC holders in the world, revealed plans to absorb more Bitcoin (BTC). The firm’s CEO, Michael Saylor, cited a proposed private offering of $600 million in convertible senior notes.

Barely 48 hours later, Saylor announced having advanced with the plans, detailing the pricing of the offering.

Highlights of the report include:

●The offering was upsized from the previously announced offering of $600 million to $700 million.

●The notes will be sold in a private offering to persons reasonably believed to be qualified institutional buyers.

●Initial purchasers have access within a 13-day period beginning on, and including, the date on which the notes are first issued.

●The offering is expected to close on March 8, 2024, subject to satisfaction of customary closing conditions.

●The notes will be unsecured, senior obligations of MicroStrategy, bearing an interest rate of 0.625% per annum, payable semi-annually.

●The notes will be convertible into cash, shares of MicroStrategy’s class A common stock (initially be 0.6677 shares per $1,000 principal amount of notes), or a combination of cash and shares of MicroStrategy’s class A common stock, at MicroStrategy’s election.

●Estimated net proceeds from the sale of the notes will be approximately $684.3 million. This will be used to acquire additional BTC and for general corporate purposes.

The highlight of the announcement was that the firm added a stark $100 million to the aggregate principal amount. While this was unexpected, it is not really a surprise considering the firm’s strong liking and bullishness toward BTC.

In January, Saylor sold $216 million worth of the company’s stock, MSTR, to buy more Bitcoin. With this manner of BTC bullishness, the firm is steadily edging toward meriting S&P 500 inclusion.

Bitcoin price could retest $69,000

As optimism continues to abound in the cryptocurrency market, Bitcoin price could retake the $69,000 threshold. One analyst on X, @Coinmamba, says, “The probability of Bitcoin topping at $69k twice is very low,” adding that the next retest could see the pioneer cryptocurrency shatter this blockade.

The likely move would be to clear the $69,325 all-time high, recorded on March 5, with the potential to tag the $70,000 psychological level. Such a move would denote an approximate 5% move above current levels.

BTC/USDT 1-day chart

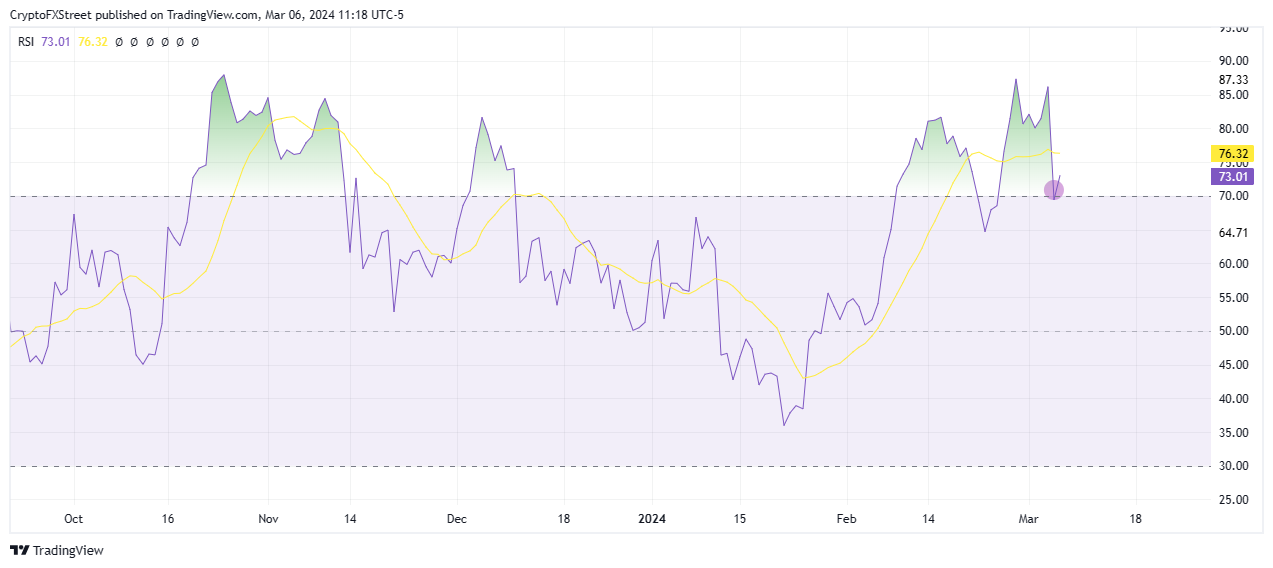

A close look at the Relative Strength Index (RSI) shows that buying momentum is rising after the indicator bounced around the 70 threshold. If this trajectory sustains, the RSI could soon cross above the yellow band of the signal line. Such a crossover would revitalize the uptrend since it is interpreted as a buy signal.

BTC RSI 1-day chart

On the flip side, however, if traders start cashing in on the gains, Bitcoin price could drop to retest the $65,000 threshold. In a dire case, BTC could nosedive to the $60,000 psychological level before another possible leg north.

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.