MicroStrategy Announces $1.75 Billion Private Note Sale to Buy More Bitcoin

MicroStrategy Founder Michael Saylor announced the firm would offer $1.75 billion in zero-coupon convertible notes to purchase more Bitcoin. Earlier today, MicroStrategy bought over $4.6 billion in BTC.

The post-Trump bull market has turbocharged MicroStrategy’s Bitcoin-first policy, as the company makes record investments in BTC.

MicroStrategy to Buy Even More Bitcoin

According to the latest announcement, the convertible senior notes will be offered as zero-coupon convertibles, meaning they will pay no interest. In 2029, these notes will mature into MicroStrategy stock and are therefore offered at a discount.

“MicroStrategy intends to use the net proceeds from this offering to acquire additional bitcoin and for general corporate purposes,” the company stated in its press release.

This $1.75 billion fundraiser for further Bitcoin purchases has been announced on the same day MicroStrategy bought $4.6 billion in BTC. One week prior to this, it also put slightly over $2 billion into Bitcoin purchases.

This unequivocally makes MicroStrategy the world’s largest Bitcoin holder, continuing its staunch Bitcoin-first policy.

MicroStrategy: A Major Bitcoin Holder. Source: Shaun Edmondson

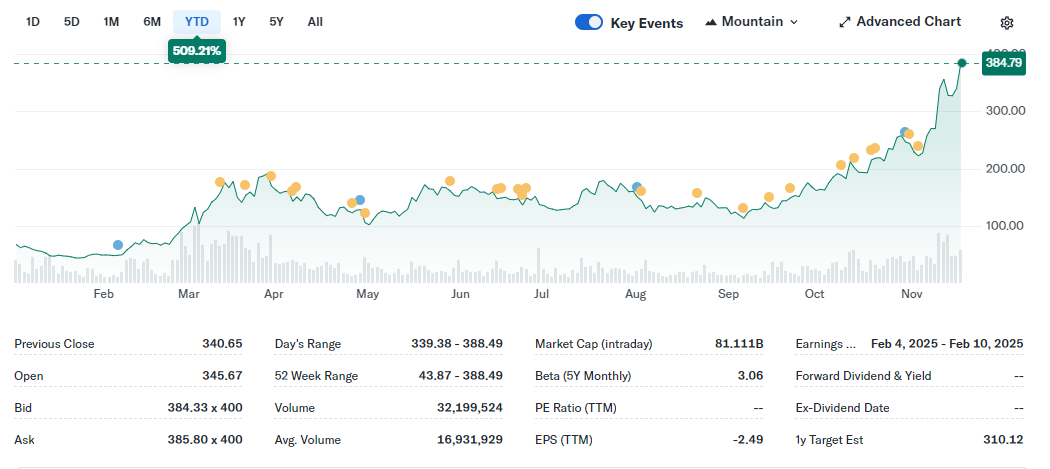

MicroStrategy’s stock price has ballooned since adopting this policy, outperforming Bitcoin with a 24-year high in October. Its stock prices have increased by over 460% in a year and nearly 75% this month alone.

The company’s value is inexorably tied to the performance of Bitcoin, but they do not always align directly. In any event, MicroStrategy hit these highs before Trump’s re-election, and the subsequent bull market has sent them soaring.

MicroStrategy year-to-date stock performance. Source: Yahoo Finance

Some of the exact details around this private offering were not explicitly stated in the press release; for example, the exact terms of asset maturation and MicroStrategy’s right to redeem the notes for cash.

To that end, Saylor also announced a Webinar to discuss the offering on Tuesday, November 19. It’s open to Qualified Institutional Buyers, the same group that can buy the notes.

As long as the bull market continues, there’s no clear limit to MicroStrategy’s Bitcoin appetite. However, there is a limited supply of bitcoins, and ETF issuers have already outpaced miners’ production levels. These massive purchases are not sustainable forever, especially with such a buyer’s market, but Saylor will likely continue as long as possible.

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.