Bitcoin has overtaken gold as the leading financial asset in the ETF market, marking a historic shift in investor demand.

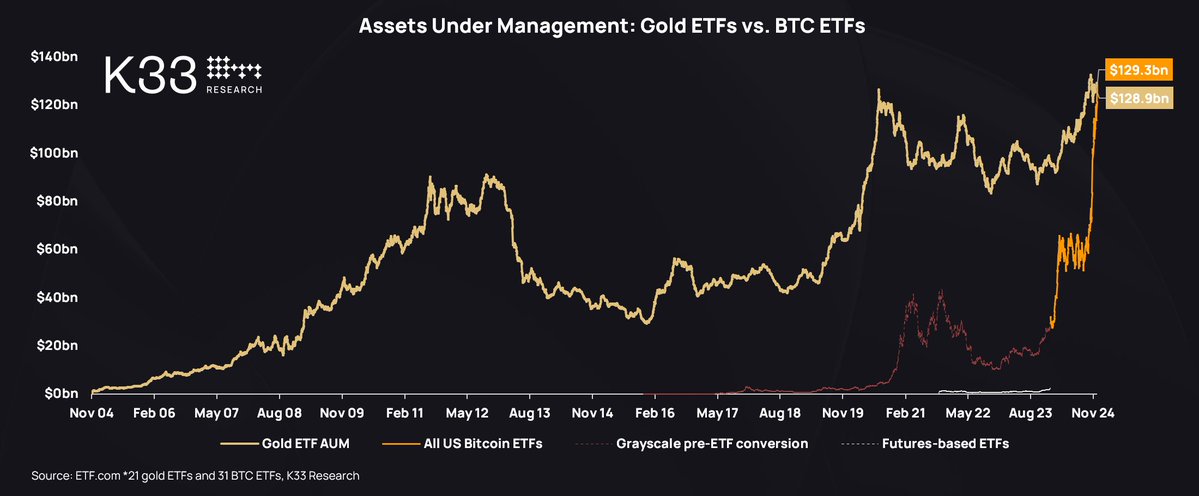

According to Vetle Lunde, an analyst at crypto market research firm K33 Research, the assets under management (AUM) of Bitcoin spot exchange-traded funds (ETFs) listed in the United States have officially surpassed those of gold ETFs. Lunde shared the milestone on December 17 via X, highlighting the unprecedented moment.

The Surge of Bitcoin Spot ETFs

Gold ETFs were first introduced in 2003, giving the precious metal a significant head start. By comparison, Bitcoin spot ETFs in the US were only launched in January 2024 after years of regulatory delays. Despite this gap, Bitcoin ETFs have managed to outpace gold ETFs in AUM, signaling growing institutional and retail confidence in the digital asset.

“In the United States, Bitcoin ETF AUM has surpassed gold ETF AUM. Gold, with a 20-year head start, has been flipped,” Lunde wrote.

AUM, Gold vs BTC ETFs, December 17. Source: K33 Research.

AUM, Gold vs BTC ETFs, December 17. Source: K33 Research.

The approval of Bitcoin spot ETFs marked a turning point for cryptocurrency adoption within traditional financial markets. These products allow investors to gain direct exposure to Bitcoin without holding the asset itself, bridging the gap between digital assets and traditional finance.

The milestone reflects surging investor demand for regulated and accessible Bitcoin investment vehicles, particularly given Bitcoin’s strong price performance throughout 2024.

The rapid growth of Bitcoin ETFs mirrors increasing institutional interest. Financial giants like BlackRock, Fidelity, and Ark Invest have launched Bitcoin ETFs, providing credibility and exposure to a wider investor base. Their involvement has fueled competition, driving significant inflows into these products.

Gold has long been regarded as a hedge against economic instability and inflation. For decades, investors turned to gold ETFs as a safe store of value. However, Bitcoin is increasingly seen as “digital gold,” offering a more modern, decentralized alternative with similar store-of-value properties. Bitcoin’s limited supply—capped at 21 million coins—has made it particularly attractive in inflationary environments.

What This Means for Investors

Bitcoin surpassing gold in ETF AUM represents more than a milestone; it reflects a generational shift in investor sentiment. Younger investors, more familiar with digital assets, are embracing Bitcoin as a technological and financial innovation. At the same time, traditional investors seeking higher returns are increasingly looking to Bitcoin as part of a diversified strategy.

The demand for Bitcoin ETFs also signals growing regulatory acceptance of the cryptocurrency market. After years of resistance, US regulators approved Bitcoin spot ETFs in early 2024, setting a precedent for other jurisdictions and paving the way for future crypto investment products.

The surpassing of gold ETFs raises questions about Bitcoin’s trajectory and its place in the broader financial system. While Bitcoin’s volatility remains a concern, its institutional adoption and regulatory clarity could drive continued growth. Analysts suggest that as Bitcoin matures, it may attract even greater inflows from traditional markets, potentially expanding its lead over gold in AUM.

As Bitcoin ETFs set new records, this moment highlights a major evolution in how investors view digital assets. Bitcoin is no longer the fringe investment it once was—it has officially entered the mainstream, challenging gold’s long-standing dominance as the ultimate store of value.

For now, Bitcoin’s rise signals a changing tide in financial markets, where innovation and decentralization are reshaping investor preferences in real-time.

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.