Research: $10 Trillion AUM BlackRock Could Launch Its Own Blockchain

- Bitcoin Drops to $70,000. U.S. Government Refuses to Bail Out Market, End of Bull Market or Golden Pit?

- Gold rallies further beyond $5,050 amid flight to safety, dovish Fed expectations

- Bitcoin Bottom Debate: $70,000 or $50,000?

- A Crash After a Surge: Why Silver Lost 40% in a Week?

- Bitcoin Slips Below 75,000 Mark. Will Strategy Change Its Mind and Sell?

- Bitcoin Rout. Bridgewater Founder Dalio Publicly Backs Gold.

The on-chain data platform Token Terminal says BlackRock could launch its own blockchain, similar to Coinbase’s Layer-2 (L2) network, Base.

The assumption follows a peek into the asset manager’s holdings across asset classes.

Token Terminal: Why BlackRock Blockchain Is a Possibility

BlackRock categorizes its crypto holdings into three groups: crypto assets like Bitcoin (BTC), stablecoins like USDC, and tokenized assets like BUIDL. This information comes from the on-chain data platform Token Terminal, which analyzed the asset manager’s crypto strategy.

BlackRock reportedly identifies three distinct advantages of Bitcoin as an asset. First, it is internet-native, making it globally accessible. Second, Bitcoin’s efficiency in cross-border transactions is highlighted. Lastly, its fixed supply cap positions it as a hedge against inflation.

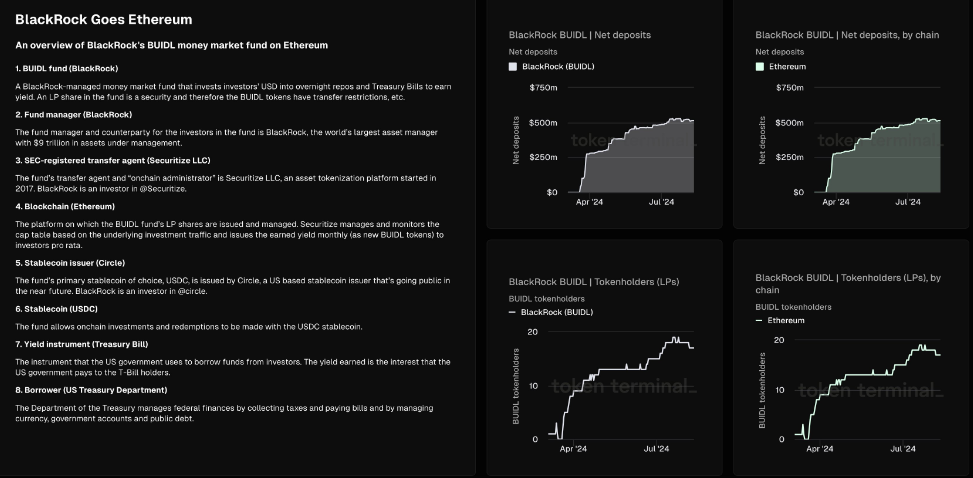

BlackRock BUIDL. Source: Token Terminal

Highlighting the role of BlackRock’s iShares Bitcoin ETF (exchange-traded fund), IBIT, Token Terminal anticipates the firm will similarly productize all major crypto assets. Notably, while BlackRock has already done this with Ethereum, prospects of a Solana ETF remain slim for now.

Nevertheless, the on-chain data platform attests to BlackRock’s belief in the potential of blockchain technology to improve capital markets. It cites round-the-clock operational capital markets, improved transparency and investor access, lower fees, and faster settlement. This investigation led Token Terminal to conclude that the firm could launch its own blockchain, as Coinbase did with Base L2.

“We believe that BlackRock will eventually launch its own blockchain, and follow a similar playbook that Coinbase has used with Base. This would allow BlackRock to concentrate the recordkeeping of its holdings across asset classes ($10T AUM) to a single, global, interoperable, and transparent ledger,” Token Terminal concludes.

Possible Implications of BlackRock Blockchain For TradFi

BlackRock’s launch of a blockchain would mark a major shift in the traditional finance (TradFi) sector, signaling a move towards decentralized solutions. Similar to how Coinbase transformed into a Web3 gateway with Base, BlackRock’s blockchain initiative could elevate the company from a traditional asset manager to a leader in the digital asset space.

Whether BlackRock will launch its own blockchain remains unknown, as the firm did not immediately respond to BeInCrypto’s request for comment. Nevertheless, such a move would warrant clear regulations.

“As much as we would absolutely love to see this, unless regulations and compliance around this are clear, it won’t be happening in the short term at all. This is given the need for compliance. There is one thing: an entire blockchain ecosystem would be incredible, but how would they solve for compliance?” one X user commented.

Leveraging blockchain technology, BlackRock could streamline its operations, reduce costs, increase transparency, and enhance security across its extensive financial products and services. This approach has the potential to revolutionize transactions and create a more efficient and secure financial ecosystem.

Furthermore, such a venture would open up new opportunities for its clients and investors to access a wide range of digital assets. They would also be exposed to more seamless and user-friendly investment opportunities. This would democratize access to financial products and strengthen BlackRock’s position as a leader in the digital asset management space.

The firm has already set a new standard in tokenizing real-world assets (RWAs) with the success of BUIDL, BlackRock’s USD Institutional Digital Liquidity Fund. BUIDL recently became the largest tokenized fund, showcasing the growth and increasing integration of blockchain technology in traditional finance (TradFi).

While the general demand for such tokenized products remains in its nascent stages, specific segments continue to show promising interest. BlackRock’s BUIDL and Franklin Templeton’s BENJI point to this effect.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.