Bitcoin exchange-traded funds (ETFs) recorded a modest net inflow of $15 million last week, marking a significant turnaround from the previous week’s sharp outflows exceeding $713 million.

However, despite the positive shift in capital flow, last week’s figure represents the lowest weekly net inflow recorded since the beginning of 2025.

Bitcoin ETF Inflows Drop to 2025 Low

Last week, between April 14 and April 17, institutional investors added capital to BTC spot ETFs, bringing net inflows into these products to $15.85 million.

Bitcoin Spot ETF Net Inflow. Source: SosoValue

Despite the positive movement, this latest fund influx represents the smallest net inflow for BTC ETFs since the beginning of the year, further confirming the slowdown in bullish sentiment.

The slowdown comes amid escalating global trade tensions, which have introduced fresh uncertainty into financial markets. As major economies tighten trade policies and retaliatory measures mount, institutional investor sentiment has become more cautious, prompting them to adopt a wait-and-see approach, while they reallocate their capital.

BTC Pushes Higher, But Traders Exit Positions

BTC trades at $87,64 at press time, having gained 3% in value over the past 24 hours. However, the coin’s futures open interest has fallen by 2%.

BTC Futures Open Interest. Source: Coinglass

An asset’s open interest refers to the total number of outstanding futures or options contracts that have not been settled or closed. When it falls during a price rally, it suggests that traders are closing out their positions rather than opening new ones, indicating a lack of strong conviction for a sustained price rally.

This sentiment extends to the coin’s options market, as reflected by today’s high demand for put contracts.

BTC Options Open Interest. Source: Deribit

When there are more puts than calls like this, it indicates a bearish market sentiment, as traders are positioning for potential downside or seeking protection against price declines.

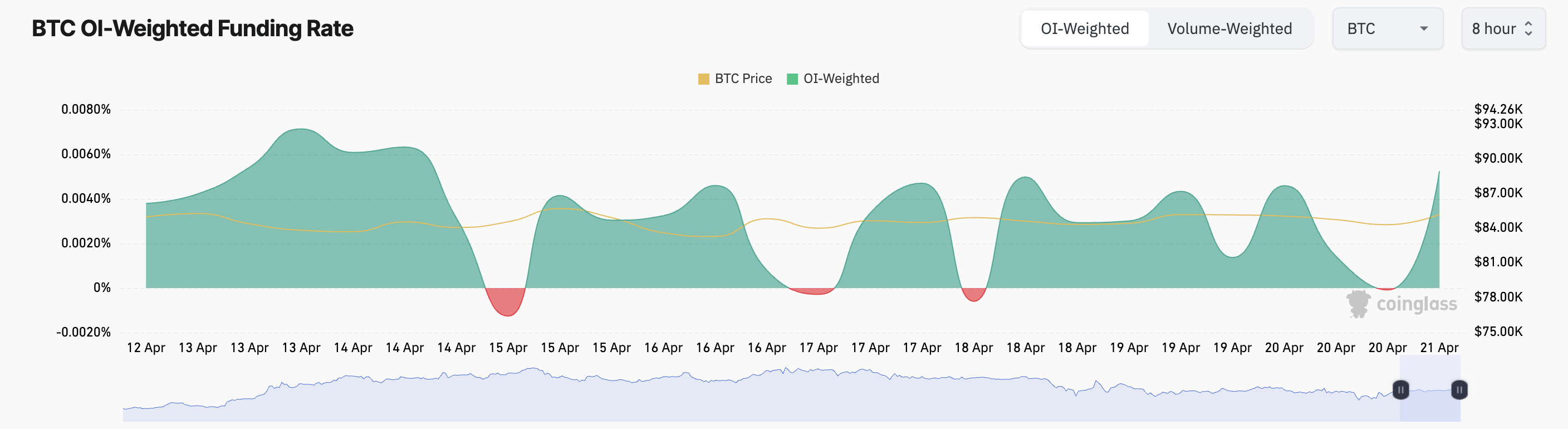

While this, combined with BTC’s falling open interest, points to a market that is still treading carefully amid broader uncertainty, the coin’s positive funding rate offers respite. At press time, according to Coinglass, this stands at 0.0052%.

BTC Funding Rate. Source: Coinglass

When the funding rate is positive like this, long traders are paying shorts, indicating that bullish sentiment dominates and demand for long positions is higher.

These suggest that, despite the cautious tone in derivatives and ETF flows, some traders remain confident and anticipate further upside.

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.