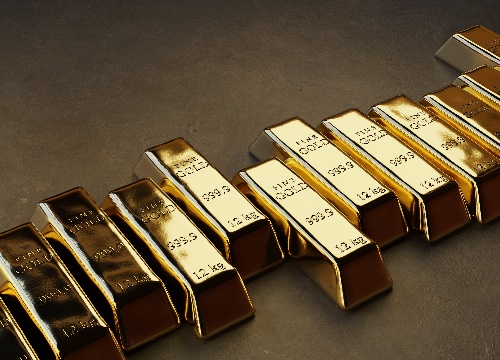

Gold price trades in negative territory near $2,645 in Monday’s early Asian session.

Trump trades and the Fed’s cautious stance undermine the yellow metal price.

The geopolitical risks might help limit Gold’s losses.

Gold price (XAU/USD) edges lower to around $2,645 during the early Asian session on Monday. A recovery in the US Dollar broadly weighs on the precious metal. However, persistent geopolitical tensions could cap the downside for XAU/USD.

The yellow metal declined 3% in November, its worst monthly loss since September 2023. A victory of Donald Trump in the US Presidential election in November fuelled expectations that the Federal Reserve (Fed) would adopt a cautious approach to further rate cuts, which boost the Greenback and drag the USD-denominated Gold lower.

Nonetheless, the escalating geopolitical tensions could boost the Gold price, a traditional safe-haven asset. Russian and Syrian jets have carried out air strikes on Syrian rebels who are advancing through the country after seizing its second-largest city, per Reuters. "Persistent global uncertainties continue to drive demand for gold as a safe-haven asset," Ole Hansen, head of commodity strategy at Saxo Bank, said in a note.

Traders brace for the US ISM Manufacturing Purchasing Managers' Index (PMI) on Monday for fresh impetus. The Manufacturing PMI is projected to rise to 47.5 in November from 46.5 in the previous reading. On Friday, the attention will shift to the US Nonfarm Payrolls (NFP) for November.

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.