Gold price bulls pause for a breather after the recent run up to a fresh record high

Gold price enters a bullish consolidation phase after hitting a fresh all-time peak on Thursday.

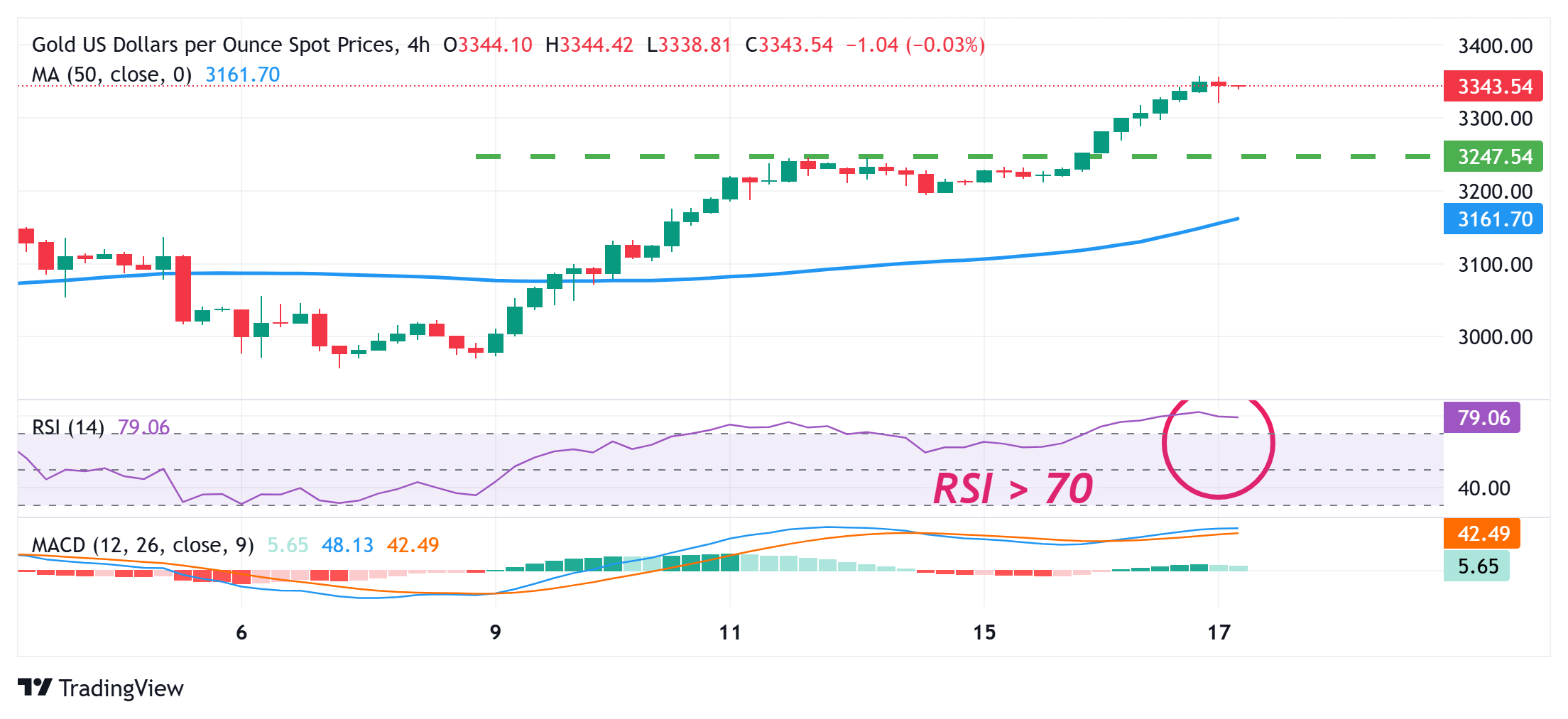

A modest USD bounce and a positive risk tone cap the commodity amid overbought conditions.

US-China trade war concerns, recession fears, and Fed rate cut bets support the XAU/USD pair.

Gold price (XAU/USD) consolidates the previous day's blowout rally and oscillates in a range near the all-time high touched during the Asian session on Thursday amid mixed fundamental cues. The upbeat US Retail Sales data and Federal Reserve (Fed) Chair Jerome Powell's hawkish comments on Wednesday assist the US Dollar (USD) to gain some positive traction. This, along with a generally positive tone around the equity markets, holds back traders from placing fresh bullish bets around the commodity amid slightly overbought conditions on short-term charts.

Meanwhile, traders are still pricing in the possibility that the US central bank will lower borrowing costs at least three times by the end of this year, which might cap any meaningful USD appreciation amid the weakening confidence in the US economy. Adding to this, the escalating US-China trade war should act as a tailwind for safe-haven assets and contribute to limiting losses for the Gold price. Hence, it will be prudent to wait for strong follow-through selling before confirming a near-term top for the bullion and positioning for a deeper corrective decline.

Daily Digest Market Movers: Gold price continues to draw support from rising trade tensions

The US Census Bureau reported on Wednesday that Retail Sales climbed 1.4% in March, the most in over two years. The reading followed a revised 0.2% increase in the previous month and was better than the market expectation for a 1.3% rise.

Adding to this Federal Reserve Chair Jerome Powell said the US central bank was not inclined to cut interest rates in the near future, citing the potential inflationary pressure stemming from US President Donald Trump's aggressive tariffs policies.

Meanwhile, the equity market in Asia-Pacific largely advanced on Thursday, which, along with the emergence of some US Dollar (USD) buying, holds back traders from placing fresh bullish bets and caps the upside for the Gold price.

US President Donald Trump kickstarted a bitter trade war with China earlier this month and raised tariffs to an unprecedented 145%. China retaliated with 125% duties on US goods and imposed new export licensing restrictions on seven rare earths.

The US government also imposed new licensing requirements and limited exports of H20 artificial intelligence chips to China. Meanwhile, China’s Foreign Ministry said that Beijing will pay no attention if the US continues to play the tariff game.

Investors remain worried that tit-for-tat tariffs the world's two countries are imposing on one another will hinder global economic growth. This keeps a lid on any optimism in the market and continues to support the safe-haven commodity.

Moreover, traders are still pricing in the possibility that the US central bank will resume its rate-cutting cycle in June. This holds back the USD bulls from placing aggressive bets and further acts as a tailwind for the non-yielding yellow metal.

Traders now look forward to the US economic docket – featuring the release of the usual Weekly Initial Jobless Claims, the Philly Fed Manufacturing Index, and housing market data – and Fed-speak to grab short-term opportunities.

Gold price might consolidate its recent strong gains amid a slightly overbought daily RSI

From a technical perspective, the daily Relative Strength Index (RSI) is holding above the 70 mark and flashing overbought conditions. This makes it prudent to wait for some near-term consolidation or a modest pullback before positioning for an extension of a well-established uptrend witnessed over the past four months or so. In the meantime, any corrective pullback could be seen as an opportunity to initial fresh bullish positions and is more likely to remain cushioned near the $3,300 mark. The latter should act as a key pivotal point, which if broken decisively could pave the way for deeper losses.

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.