Gold price hits new all-time high ahead of Trump’s reciprocal tariffs

- Bitcoin Drops to $70,000. U.S. Government Refuses to Bail Out Market, End of Bull Market or Golden Pit?

- Gold rallies further beyond $5,050 amid flight to safety, dovish Fed expectations

- Bitcoin Bottom Debate: $70,000 or $50,000?

- Bitcoin Slips Below 75,000 Mark. Will Strategy Change Its Mind and Sell?

- Bitcoin Rout. Bridgewater Founder Dalio Publicly Backs Gold.

- Ethereum Price Forecast: ETH faces heavy distribution as price slips below average cost basis of investors

Gold price pops over 1.5% this week ahead of Trump’s tariff deadline.

Traders brace for reciprocal tariffs with Trump committed to implement them on all countries.

Gold traders are looking for upside levels with $3,200 as the next nearby target.

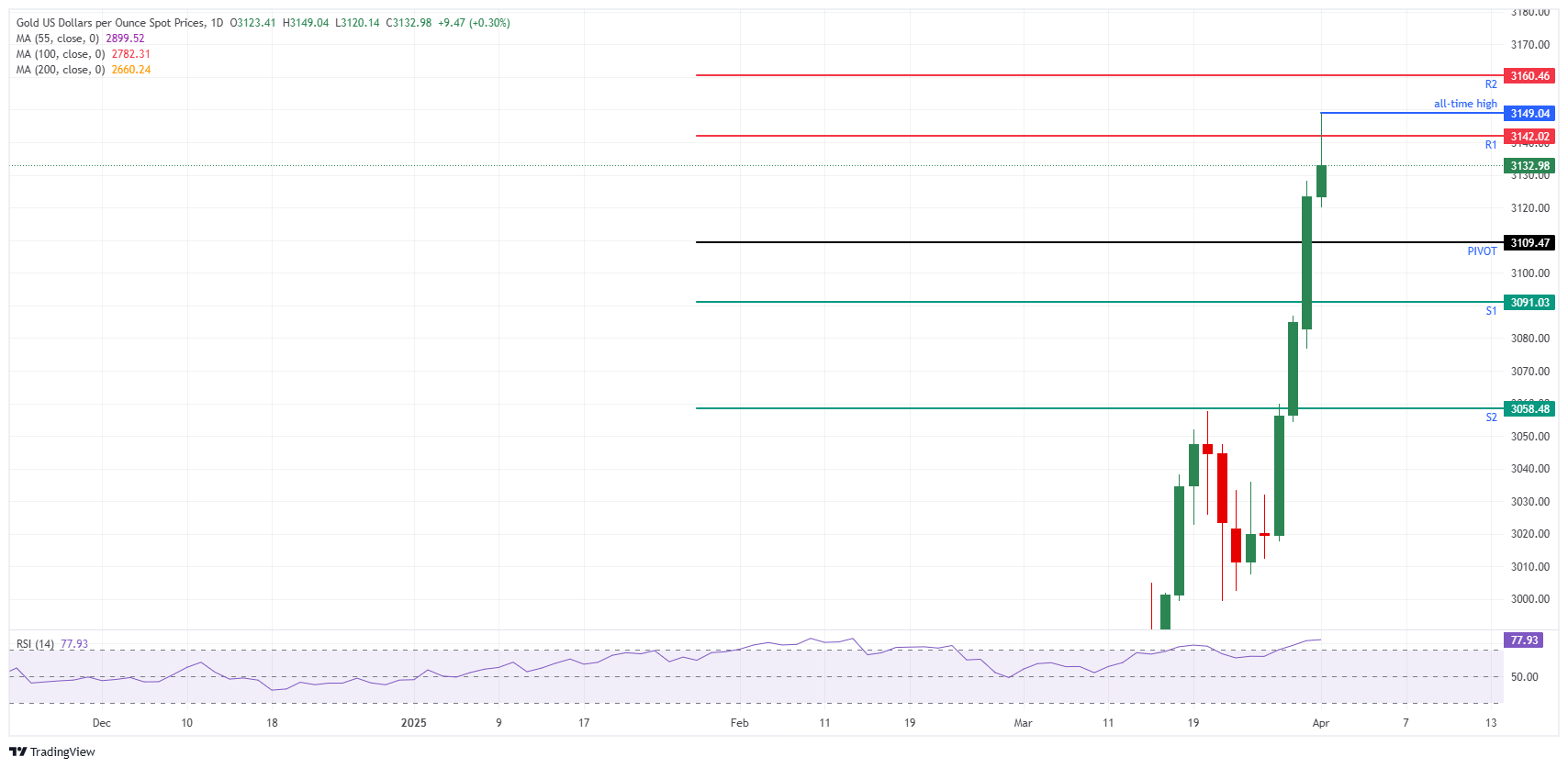

Gold price (XAU/USD) edges higher again for a second day this week and for the first day of the second quarter of 2025. The precious metal trades slightly above $3,130 at the time of writing and the new all-time high was eked out at $3,149 this Tuesday. Investors are still seeking refuge in Gold’s market with United States (US) President Donald Trump set to announce reciprocal tariffs on Wednesday around 19:00 GMT.

Meanwhile, traders brace for a heavy trading week in terms of US economic data. In the runup towards the Nonfarm Payrolls release due on Friday, markets will wait for several data to be published. Overnight, during a CNBC interview, Richmond Federal Reserve (Fed) Bank President Thomas Barkin said the economic reading is wrapped in a thick fog and is unclear for policymakers to read where rates should go, while recession fears are still on the table, CNBC reports.

Daily digest market movers: The event just around the corner

The surging Gold price has propelled South African mining Stocks to their best monthly performance on record, shielding the country’s benchmark index from the mayhem in global markets, Reuters reports. The South African mining Equities had their best monthly performance on record in March, with a 33% jump, driven by increasing Gold prices.

The CME FedWatch tool sees chances for a rate cut in May decrease to 13.1% compared to near 18.1% on Monday. A rate cut in June is still the most plausible outcome, with only a 23.1% chance for rates to remain at current levels.

Physical demand and a favorable macro backdrop are helping drive the Gold rally, according to Amy Gower, a commodity strategist at Morgan Stanley, which predicts prices may rise to $3,300 or $3,400 this year. That outlook coincides with forecasts from other major banks, with Goldman Sachs Group Inc. now looking for $3,300 by year-end, Bloomberg reports.

Gold Price Technical Analysis: Once the event is there

A small ‘parental advisory’ on the longevity of the Gold rally makes sense around now. With the main tailwind for the Goldrush set to be officially announced, the ‘buy the rumour, sell the fact’ rule of thumb should be considered. The risk could be that once the reciprocal tariffs take effect on Wednesday, only easing due to profit-taking in Gold could occur once separate trade agreements and partial unwinds take place.

On the upside, the daily R1 resistance at $3,142 has already been tested in Tuesday’s steep rally. The R2 resistance at $3,160 could still be targeted later in the US trading session as the European session sees Gold price action settle a touch. Further up, the broader upside target stands at $3,200.

On the downside, the daily Pivot Point at $3,109 should be strong enough to support any selling pressure. Further down, the S1 support at $3,091 is quite far, though it could still be tested without completely erasing the prior’s day move. Finally, the S2 support at $3,058 should ensure that Gold does not fall back below $3,000.

XAU/USD: Daily Chart

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.