Gold price pops over 1% on Monday with last-minute flight to safety ahead of Trump’s tariff deadline.

Traders brace for reciprocal tariffs after Trump committed implementation for all countries.

Gold traders above $3,120, far ahead of several analysts’ calls.

Gold price (XAU/USD) shots higher at the start of the trading week and hovers around $3,120 at the time of writing on Monday. The move comes as a last-minute flight to safety after the United States (US) President Donald Trump confirmed that Tuesday's reciprocal tariffs will apply to all countries. It seems that any hopes for some last-minute easing or paring back are off the table ahead of the deadline on Wednesday.

Meanwhile, analysts from several major banks have raised their price targets for the precious metal, with Goldman Sachs Group Inc. ramping up its forecast to $3,300 by year-end. The lender cited higher-than-expected central bank demand and strong inflows into bullion-backed Exchange Traded Funds (ETFs). In the meantime, US yields gapped lower on Monday and are flirting with a break below the low of March at 4.172%.

Daily digest market movers: Point of no return

Option pricing in Gold is not becoming more expensive, and it is even becoming cheaper. This comes as markets see the Gold price higher for longer. This is not like Coffee futures earlier this year, where a supply shock sent Option prices spiralling higher. Seeing the drop in Option prices for Gold contracts could mean more upside is available with current levels becoming the new normal, Bloomberg reports.

The CME FedWatch tool sees a tilt in the chances of an interest rate cut by the Federal Reserve (Fed) as US yields are dropping lower this Monday. The tilt goes in favor of cutting rates, with chances for a rate cut in May increasing to 18.6% compared to near 11% one week ago. However, a rate cut in June looks almost inevitable, with only a 16.5% chance for rates to remain at current levels.

This Monday, there is a very clear pattern ahead of reciprocal tariffs, with Gold rising, Bond prices shooting higher, and the US Dollar (USD) softening in this domino chain, while Equities sell off.

Gold Price Technical Analysis: Already there

Thus far, most of the analysts’ calls issued in recent weeks have already been reached, leaving analysts now to re-issue higher levels ahead. However, traders and market participants should not forget that this will not be a straight line higher, and profit-taking will occur along the way.

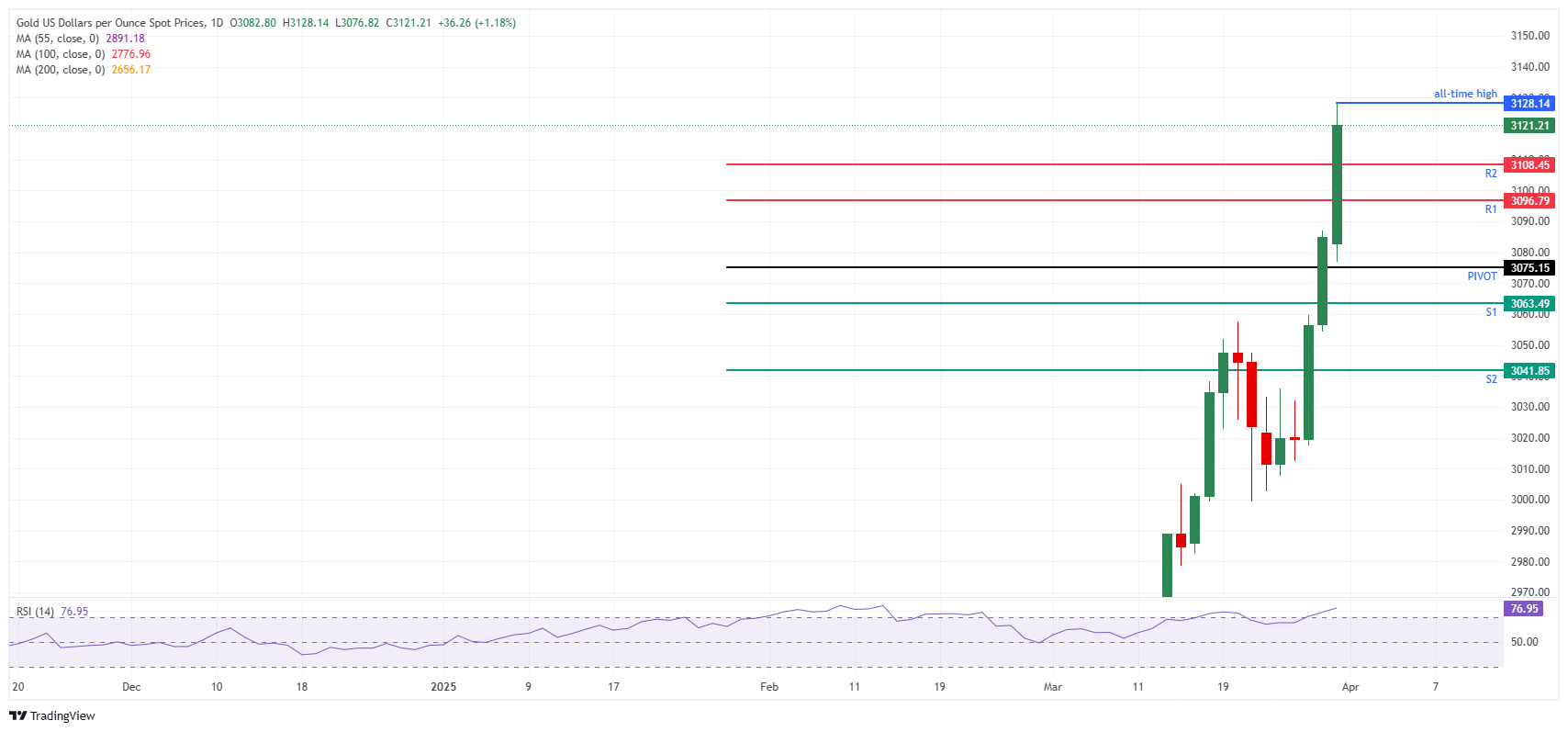

On the upside, the daily R1 resistance at $3,096 and the R2 resistance at $3,108 have already been broken in the steep rally earlier on Monday. From here, the big psychological figures are coming into play, with $3,130 and $3,150 as the next upside targets.

On the downside, R1 and R2 resistances should now support Gold’s price, followed by the daily Pivot Point at $3,075. Further down, the S1 support at $3,063 is quite far, though it could be tested if a headline comes out that pares back the earlier move.

XAU/USD: Daily Chart

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.