Gold steadies and trades within a very tight range on Monday.

US yields are off their year-to-date low after President Trump addressed the US economy.

Traders are gearing up for the upcoming Fed meeting on March 19.

Gold’s price (XAU/USD) stabilizes and consolidates within a tight range near the $2,900 level at the start of the week. Traders are mulling over comments from United States (US) President Donald Trump after an interview on Fox News over the weekend. When asked about the US economy, President Trump said that the economy is in a ‘transition’ phase, while markets have already floated the idea that the US economy is in a recession scenario.

Meanwhile, Federal Reserve (Fed) Chairman Jerome Powell issued some remarks on Friday before the Fed’s blackout period started. That blackout period precedes the actual policy rate decision on March 19, where expectations are for keeping the policy rate steady. Powell said that the central bank does not need to do anything at this point and that the price for keeping its policy rate steady comes with a very small price against the chances of a policy mistake by changing interest rates preemptively.

Daily digest market movers: Fed’s on board

US President Donald Trump said the economy faced “a period of transition” as he pressed on with his focus on tariffs and federal job cuts, Bloomberg reports.

Fed Chair Jerome Powell acknowledged on Friday the rising economic uncertainties in the US but said the central bank does not need to rush to adjust policy. Among recent data points, the Atlanta Fed’s Gross Domestic Product (GDP) gauge signaled the US economy may shrink this quarter. Lower borrowing costs tend to be beneficial for Gold, Reuters reports.

The CME Fedwatch Tool sees a 97.0% chance for no rate changes in the upcoming Fed policy meeting on March 19. The odds for an interest rate cut by the June 18 meeting have grown now to 81.8% on Monday.

Technical Analysis: Time to come off the boil

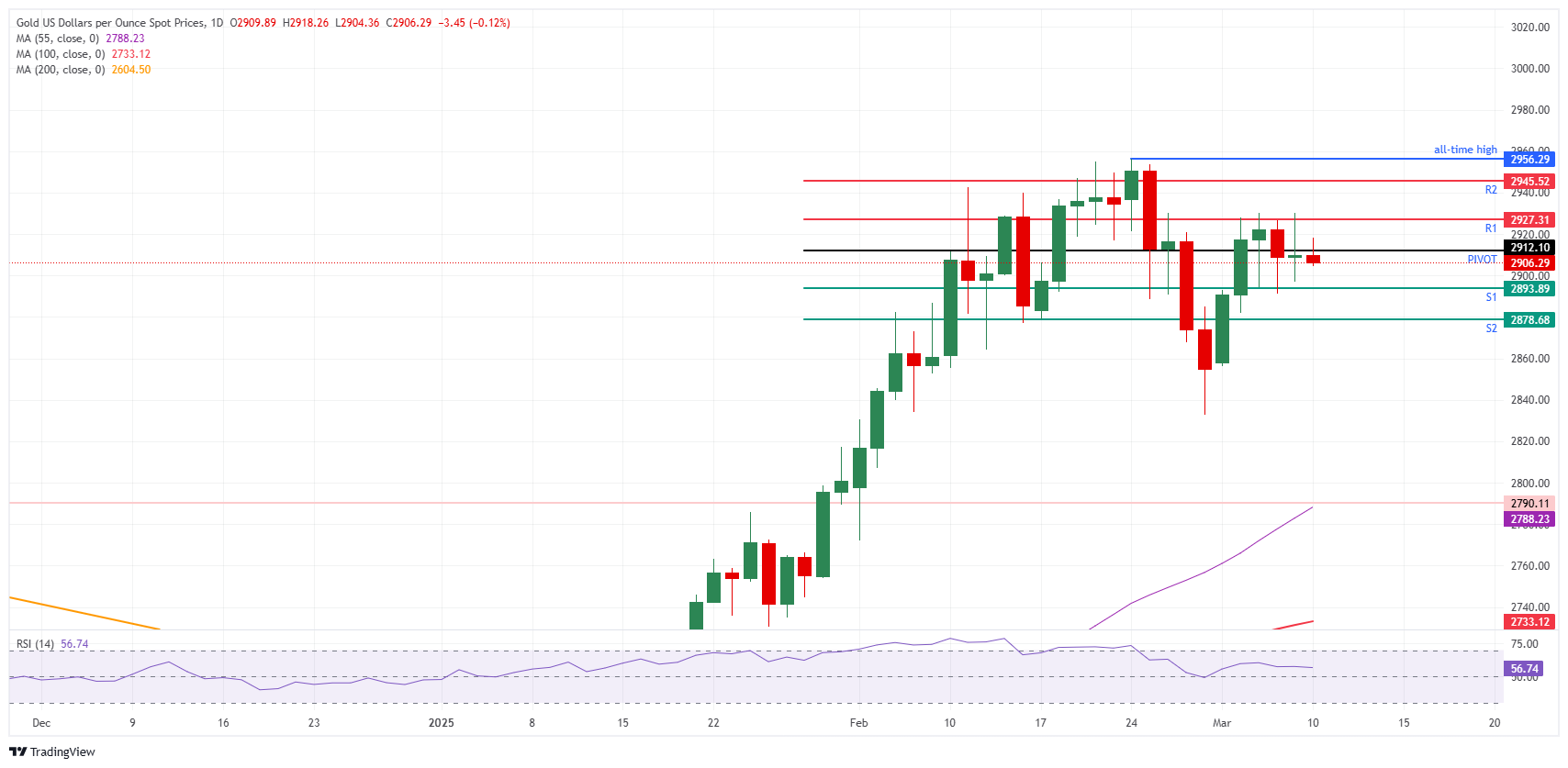

It is time for markets to settle down and see a pullback after stretched positions and moves on the charts. The same goes for Bullion, where the precious metal would benefit from a pullback. Should President Trump remain relatively quiet on any additional tariffs, the nervousness would start to settle and would see Gold dipping towards the S2 support of the daily Pivot Point near $2,878 or even lower, ideal for bulls to get back in before reciprocal tariffs are set to hit by next month.

While Gold trades near $2,905 at the time of writing on Monday, the daily Pivot Point at $2,912 and the daily R1 resistance at $2,927 are the key levels to watch for. In case Gold sees more inflows, the daily R2 resistance at $2,945 will possibly be the final cap ahead of the all-time high of $2,956 reached on February 24.

On the downside, the $2,900 psychological big figure and the S1 support at $2,893 acts as a double support barrier. If Bullion bulls want to avoid another leg lower, that zone must hold. Further down, the daily S2 support at $2,878 should be able to catch any additional downside pressure.

XAU/USD: Daily Chart

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.