Gold orbits around $2,900 as tariff tensions start to ease a bit.

The delay of automaker US tariffs on Mexico and Canada has led to a shift in Treasury yields.

Traders are betting on multiple Fed rate cuts while US economic data is deteriorating.

Gold’s price (XAU/USD) is consolidating for a second day in a row around $2,900 on Thursday while keeping an eye on the all-time high at $2,956. Although there might be some easing for Canada and Mexico with a delay on car import tariffs into the United States (US), the reciprocal tariffs are still due to kick in as of April. This still supports safe haven inflow which is beneficial for the precious metal.

Meanwhile, the focus shifts this Thursday to Europe, where the European Central Bank (ECB) will deliver its interest rate decision, with market expectations for a 25 basis points (bps) rate cut. A high-stakes European meeting is set to take place as well, where EU leaders will decide on the defense spending package and the possibility of providing more aid to Ukraine.

Another seismic shift can be seen this week in bonds, where traders are now pricing in multiple interest rate cuts by the Federal Reserve (Fed) for 2025. The reason is the deteriorating US economic data, which looks to confirm the idea that exceptionalism has come to an end and sparks recession fears.

Daily digest market movers: A delay is not indefinite

The delay of automaker US tariffs on Mexico and Canada has led to a shift in Treasury yields, with investors expecting the Fed to cut interest rates multiple times this year, which could benefit Gold, Bloomberg reports.

Another precious metal, Copper, jumped by more than 5% in Wednesday’s New York session. Prices are leaping further above other global benchmarks, as US President Donald Trump suggested imports of this commodity could be subject to a 25% tariff, Reuters reports.

Mali has stopped issuing permits for small-scale Gold mining to foreign nationals after several deadly incidents. Interim President Assimi Goita has “instructed the government to strengthen measures to avoid human and environmental tragedies,” Minister of Security and Civil Protection General Daoud Aly Mohamedinne said on Wednesday, Bloomberg reports.

Technical Analysis: Tailwind to be priced in

More bets on interest rate cuts by the Federal Reserve are another tailwind for Gold while markets undergo seismic shifts. When all analysts and economists were predicting just one or no rate cut from the Fed, in just three trading days that narrative has now shifted to possibly more than at least two rate cuts this year.

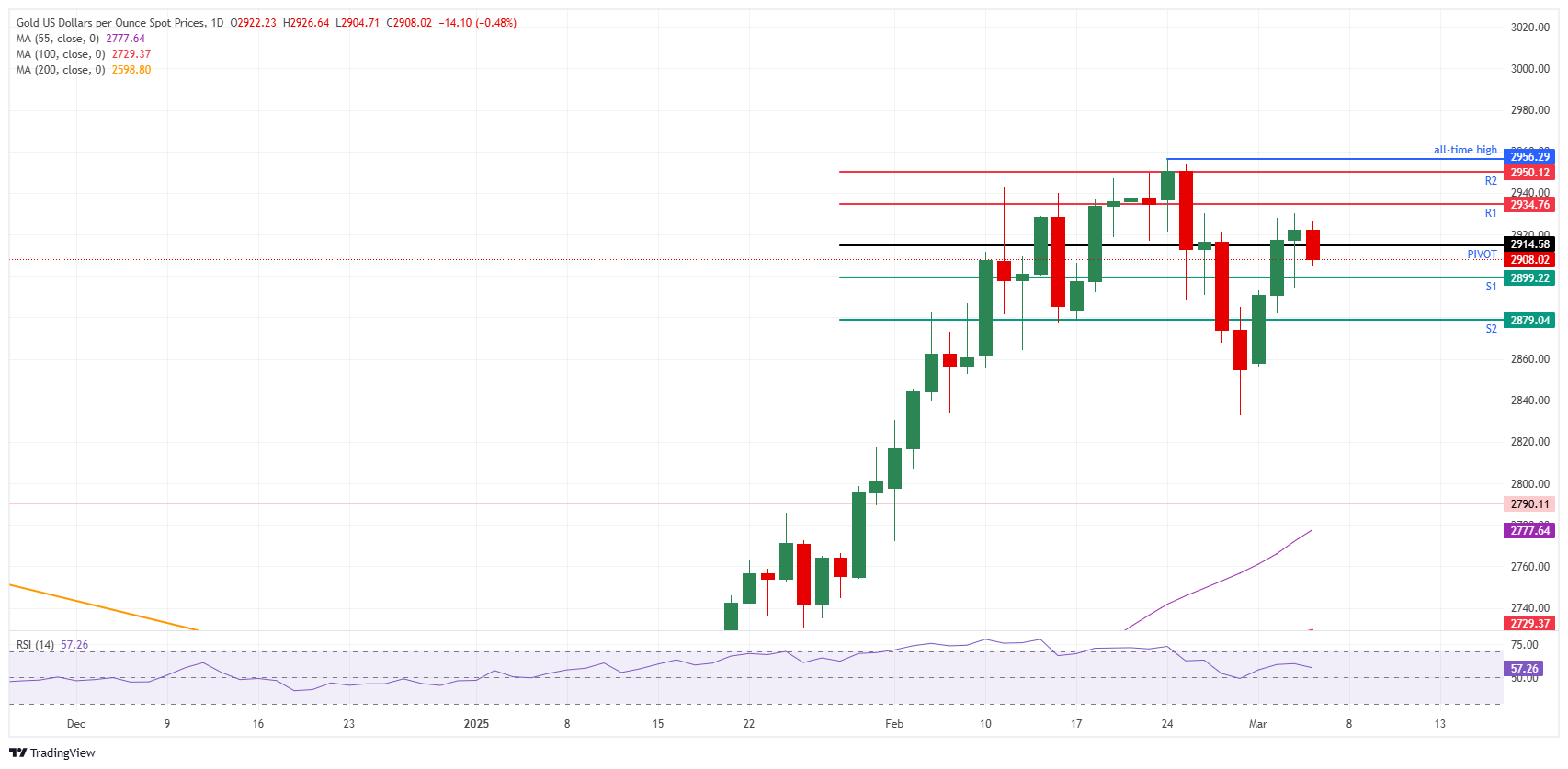

While Gold trades near $2,905 at the time of writing, the daily Pivot Point at $2,914 and the daily R1 resistance at $2,934 are the key levels to watch for on Thursday. In case Gold sees more inflows, the daily R2 resistance at $2,950 will possibly be the final cap ahead of the all-time high of $2,956 reached on February 24.

On the downside, the S1 support at $2,899 acts as a double support with the $2,900 psychological big figure. That will be the vital support for this Thursday. If Bullion bulls want to avoid another leg lower, that level must hold. Further down, the daily S2 support at $2,879 should be able to catch any additional downside pressure.

XAU/USD: Daily Chart

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.