Gold edges lower as Trump’s administration plans to toughen chip controls over China

Gold price edges lower on Tuesday along with yields and equities.

The Trump administration seeks to toughen its semiconductor restrictions on China.

Gold heads back to $2,930 and looks heavy with an overall market rout.

Gold’s price (XAU/USD) hit a new all-time high on Monday at $2,956, though traders were unable to enjoy it for long. The precious metal trades at around $2,940 at the time of writing on Tuesday, while US President Donald Trump’s administration plans to impose more limitations on China’s technological developments. A tougher stance on semiconductor restrictions and pressuring other allies to corner China is part of that strategy.

The news creates a negative tone in markets this Tuesday. Traders are fleeing into bonds as a safe haven, which is pressuring yields for more downside (inverse correlation bond price to yield). Equities are also being slaughtered, with red numbers across the board from Asia to Europe, including US equity futures. Except for three Federal Reserve (Fed) members who are set to speak, not much is expected on Tuesday ahead of the Personal Consumption Expenditures (PCE) due on Friday.

Daily digest market movers: On the table

The Trump administration plans to expand its limitations on China's technological developments, including tougher semiconductor curbs and pressuring allies to install restrictions on China's chip industry. Trump’s goal is to prevent China from developing a domestic semiconductor industry that could boost its AI and military capabilities, Bloomberg reports.

The CME FedWatch tool shows an uptick in chances for an interest rate cut by the Federal Reserve (Fed) in June by 25 basis points (bps), growing to 50.0%, while odds for a rate pause have diminished to only 32.6%, backed by the drop in US yields this Tuesday.

Investors are looking ahead to January’s Personal Consumption Expenditures Price Index, the Fed preferred inflation gauge, set to release on Friday, for clues on monetary policy, with the indicator expected to cool to its slowest since June, Reuters reports.

Fed Vice Chair for Supervision Michael Barr will give a speech on financial stability and answer questions at an event hosted by Yale School of Management at 16:45 GMT.

Richmond Fed President Tom Barkin will give a speech called "Inflation Then and Now", followed by a Q&A at an event hosted by the Rotary Club of Richmond, expected around 18:00 GMT.

At 21:15 GMT, President of the Federal Reserve Bank of Dallas Lorie Logan will speak on the future of the central bank balance sheet at the Bank of England's annual BEAR research conference in London, United Kingdom.

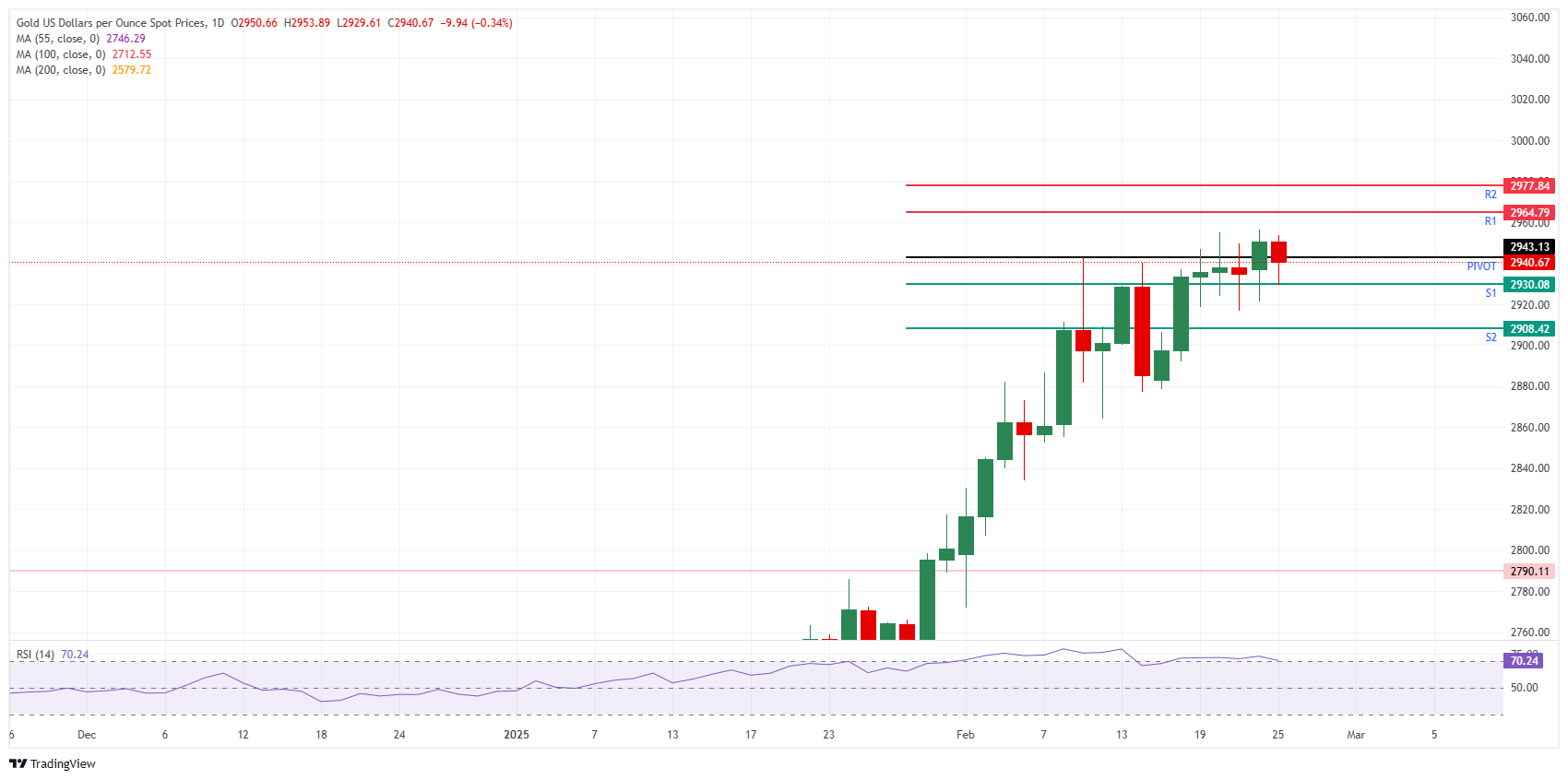

Technical Analysis: Technical below pivot

A quick drop below the daily Pivot Point near $2,943 is signalling a bit of an issue for Gold on Tuesday. Selling pressure is present, and it looks like buyers already tried to get Gold back above the daily Pivot in early Asian trading but failed. The S1 support at $2,930 has held for now, though once that level breaks, the S2 support only comes in at $2,908.

On the upside, the all-time high at $2,956 remains the main level to watch. On the way up, the daily R1 resistance at $2,964 comes in after that. Further up, the R2 resistance stands at $2,977 before considering the $3,000 mark.

On the downside, the S1 support comes in at $2,930, which roughly coincides with Monday’s low in the US session. In case that level does not hold, the $2,900 big figure comes into play with the S2 support at $2,908.

XAU/USD: Daily Chart

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.