Inflation Cools Down and Strong Economy in the US - Will Gold Extend Its Decline?

Gold may continue to fluctuate downwards in the short term, with resistance levels at 1976 and 1944, and support levels at 1913 and 1809. The positive performance of the US economy is negative for gold. Furthermore, based on CFTC positioning data and technical analysis, the medium to long-term upward trend in gold faces reversal risks, and it may continue to consolidate with downward fluctuations in the short term.

Market Review

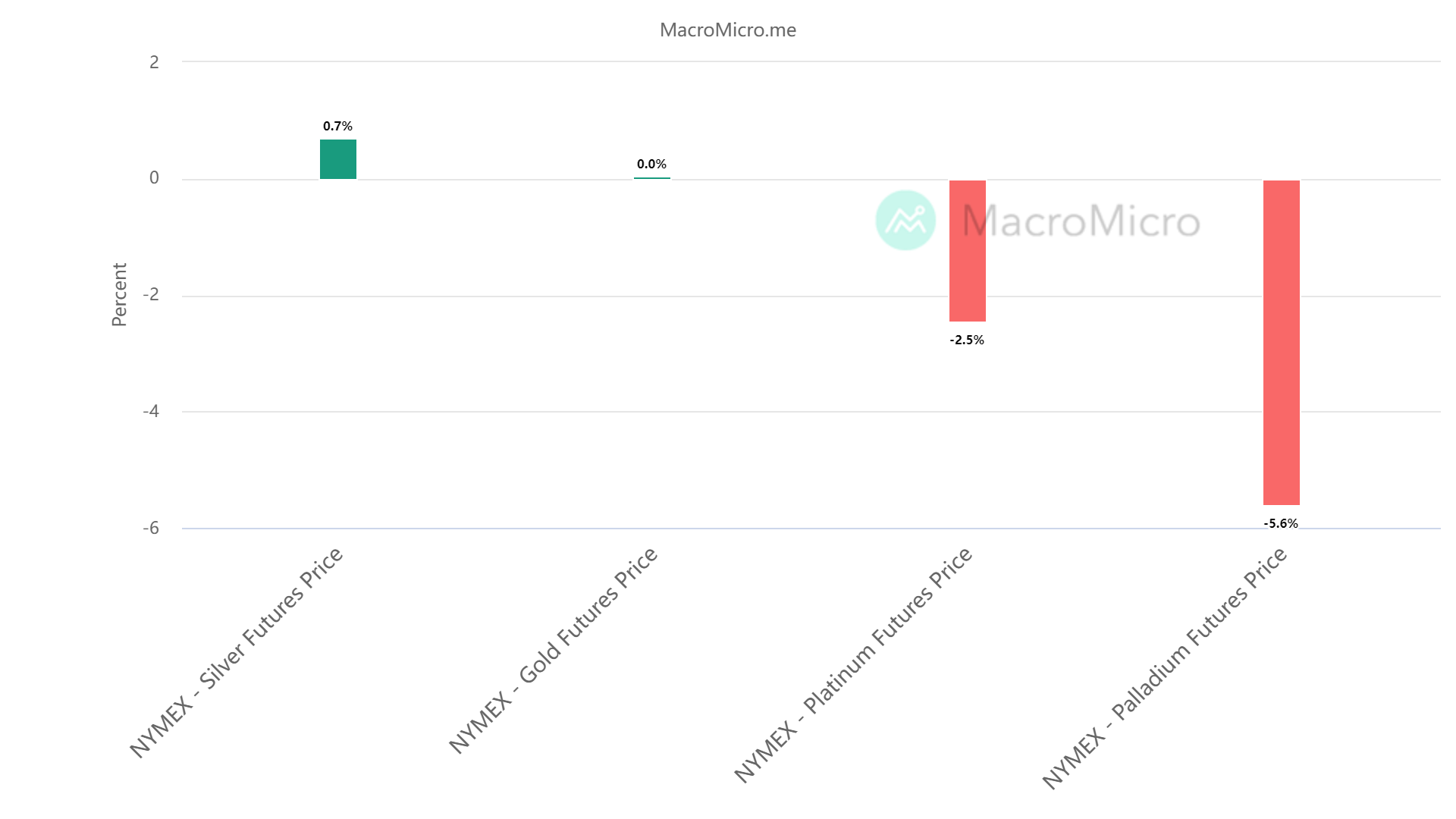

Last week (June 26 - July 2), precious metals had mixed movements, and gold's weekly change was similar to the previous week. Silver saw a slight increase of 0.7% for the week. Due to the impact of rising US Treasury yields, the price of gold continued to be suppressed. Overall, gold had relatively small fluctuations during the week, gradually recovering from a sharp drop after Powell's hawkish speech to stabilize at levels similar to the previous week.

Source: MacroMicro - Percentage Change of Major Precious Metals in the 4th Week of June 2023

Strong US Economic Performance May Restrict Gold Price Increases

On June 28-29th, Powell made hawkish comments regarding rate hikes. He stated that considering most officials predicted two rate hikes this year on the dot plot, the Fed does not rule out the possibility of raising rates at the July and September rate decision meetings, nor the possibility of consecutive rate hikes. He also explained that the pause in rate hikes in June was to evaluate the lagged effects of past rate increases on the economy. This hawkish stance may have a suppressing effect on gold prices while supporting a stronger US dollar.

Furthermore, on June 29th, the United States released the final reading of the first-quarter GDP, which stood at 2%, surpassing market expectations of 1.4%. As a result, US Treasury yields rose, putting downward pressure on gold prices.

In addition, on June 30th, the US Department of Commerce released data showing that the Personal Consumption Expenditures (PCE) price index for May increased by 3.8% compared to the previous year, which is in line with market expectations but lower than the revised previous value of 4.3%. After excluding food and energy prices, the core PCE increased by 4.6% compared to the previous year, slightly below market expectations and the previous value of 4.7%.

Mitrade Analyst

Gold has continued to experience downward fluctuations after the Fed's announcement of rate hikes, primarily due to unexpectedly cooled inflation, Powell's hawkish rate hike comments, and stronger-than-expected economic data for the first quarter. The market generally expects a higher probability of a rate hike in July by the Fed.

The aforementioned news and data indicate that the US economy is performing strongly, to some extent alleviating previous concerns about a US economic downturn. This has diminished demand for safe-haven assets like gold, while rate hike expectations further support the US dollar. Additionally, the recent rapid rise in US Treasury yields due to cooled inflation further suppresses gold's upward momentum. Therefore, gold may face short-term consolidation with downward fluctuations.

This week, the minutes of the Federal Reserve meeting, the US June unemployment rate, and non-farm payroll figures are important factors that could temporarily impact gold prices.

The possibility of a July interest rate hike and the magnitude of the hike may be captured in the Fed meeting minutes. Considering that the Fed has slowed down its rate hikes to 25 basis points in the first three meetings of this year, it is expected that the July rate hike will not be too aggressive, with a higher likelihood of a 25 basis point increase.

Looking back at the US May non-farm payroll data, employment figures recorded 339,000, but the market generally predicts that the June non-farm payroll figures will be lower than the previous value, around 224,000. If this meets market expectations, it may briefly boost gold prices, whereas if it falls below expectations, it will further drag down gold.

Bullish sentiment continues to exit, bearish on gold

Speculative positions in gold have significantly reduced recently. According to CFTC position updates, from June 21st- 27th, speculative long positions in gold decreased by 11,065 from the previous period. During the same period, speculative long positions in gold futures open contracts also decreased by 8,427, while short positions increased by 2,638 from the previous period. This information indicates that short-term market investors are bearish on the future of gold.

Mitrade Analyst

In summary, with continued exit of bullish speculators and a few aggressive short positions covering their positions, the short-term outlook for gold remains bearish. Gold prices may experience volatility this week along with market news.

Technical Analysis

Gold fell below 1900 level last week and oscillated between 1891 and 1930.

From a technical indicator perspective, the MA (60-day) long-term trend has shown a turning point and is currently exhibiting a slight downward trend. The 14-day RSI value of 39 is significantly lower than 60 and also trending downwards. At the same time, the daily MACD shows no clear trend as the short-term and long-term lines are close together. The histogram remains low and below the zero line, while the MACD, DIFF, and DEA are all negative, indicating that gold is likely to continue its downward consolidation in the short term.

Resistance levels: 1944, 1976

Support levels: 1913, 1809

Source: Investing.com- July 3 Gold Daily Chart

Mitrade Analyst

Based on the analysis of various indicators mentioned above, there is a risk of a reversal in the medium to long-term upward trend of gold, and it may continue to oscillate downwards this week.

Important factors that could cause significant fluctuations in gold this week include the release of the Fed meeting minutes, US unemployment rate for June, and non-farm payrolls data.

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.