When calculating profits before entering the real markets, you need to consider all types of fees. While you may easily mind well-known fees like commissions and spreads, you may often overlook less well-known fees like overnight funding, also known as swap fees.

This article will explain overnight funding and how to calculate it. We will examine the factors that influence overnight funding fees and provide examples to help you understand how they can affect your trading profits.

1. What is overnight funding (swap fee)?

Financing charges such as overnight funding or sometimes also referred to as swap fees.

Overnight funding and swap fees share similarities in that they both involve costs related to financial transactions, but they serve different purposes and are calculated differently. Overnight funding is a direct cost incurred for holding positions overnight, while swap fees are part of a broader financial strategy involving the exchange of interest payments. The table below show a comparison between two types of fee:

Aspect | Overnight Funding | Swap Fees |

Definition | A daily interest charge applied to positions held overnight in leveraged trading. | Fees associated with interest rate swaps, where two parties exchange interest payments. |

Purpose | Compensates for the cost of holding a leveraged position overnight. | Allows parties to manage interest rate exposure by swapping fixed and floating rates. |

Calculation Method | Based on the value of the position, interest rates, and administrative fees. | Determined by the difference between fixed and floating rates, based on a notional amount. |

Frequency of Charges | Charged daily for positions held past a specific cutoff time. | Payments can be made at specified intervals (monthly, quarterly, etc.) depending on the swap agreement. |

Impact on Trading | Affects the overall cost of maintaining a position in the market. | Influences cash flows and risk management strategies for interest rate exposure. |

Types of Instruments | Commonly applied to CFDs, forex, and other leveraged products. | Used in interest rate swaps, currency swaps, and other derivative contracts. |

Risk Management | Primarily addresses the cost of overnight financing in trading. | Helps in hedging against interest rate fluctuations and managing debt obligations. |

Market Participants | Traders and investors in leveraged markets. | Corporations, financial institutions, and investors engaged in interest rate management. |

It refers to the fees that you pay to hold the trade position overnight. This fee is essentially an interest payment to cover the cost of borrowed capital that you’re using.

For the currency you buy, you may receive interest, and for the currency you sell, you need to pay interest. You will either charge or receive overnight interest corresponding to the product, depending on the difference in interest on the currency pair.

2. How is overnight funding calculated?

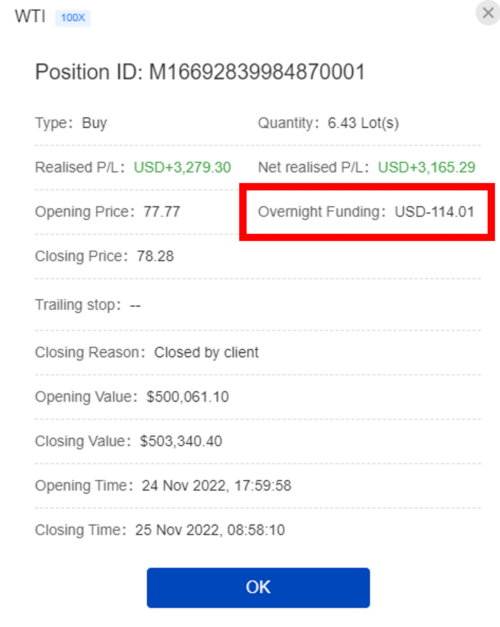

The formula for calculating the daily overnight funding of the daily position

= trading lot * contract size * opening price * daily overnight funding rate (%).

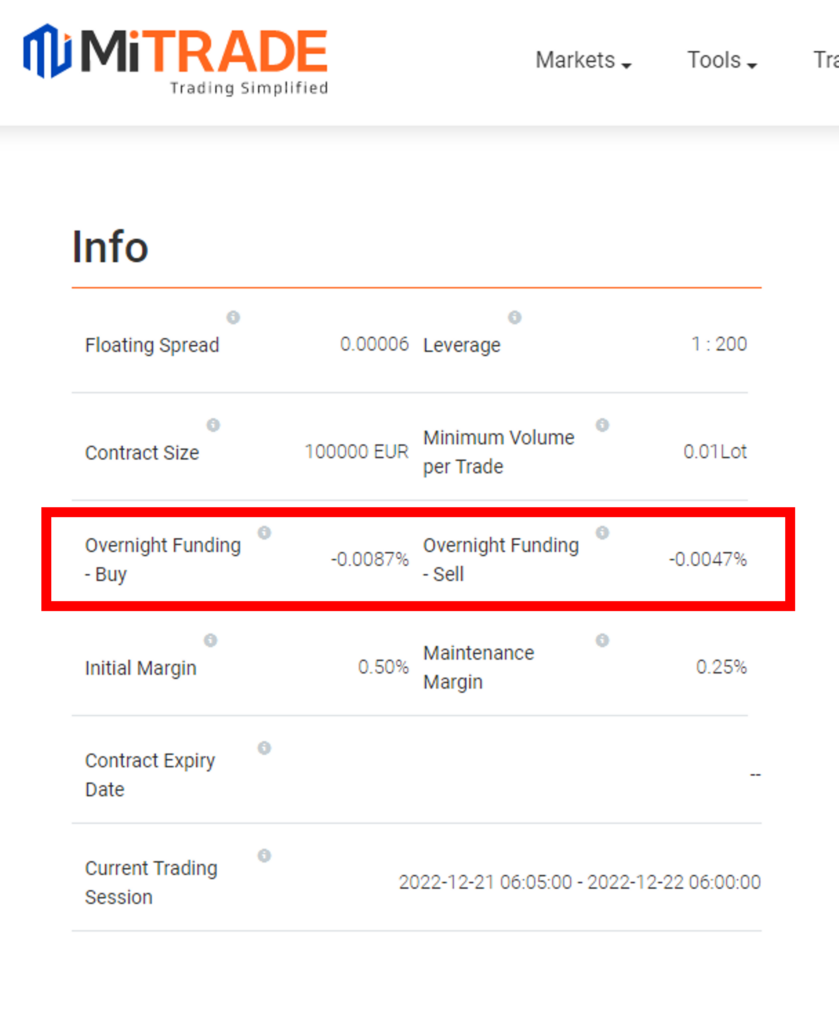

Overnight Funding fee percentage rate is derived from several factors including amongst others, whether the Transaction is a buy or a sell, interest rates, instrument differentials, daily price fluctuations, and other economic and market-related factors.

You can check on the daily overnight funding rate here at Mitrade Market Data.

3. When is the overnight funding charged?

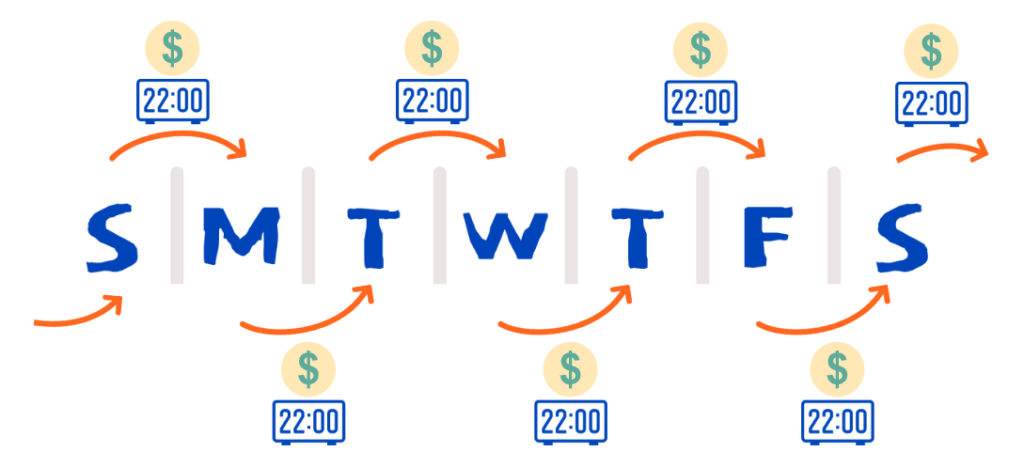

Overnight funding will be charged daily on GMT 2200hrs

First of all, as the name suggests, the fee is charged on a daily basis.

When you hold positions through the settlement time (GMT 2200hrs), an overnight funding adjustment will be incurred on your account.

This means that the moment the clock strikes 10 pm (2200hrs). A charge will be applied to all open trades that you have at the moment.

4. How can I see what I’ve been charged?

The trading platform will update and reflect this charge every day.

Example;

Each day, Mitrade charges or deposits overnight funding to any client who holds a currency pair position during the settlement time. The settlement time is GMT 22:00. Generally, overnight funding applies if you hold a position until this time. Please note that the time zone varies depending on your settings.

5. Summary

Overnight funding, also known as swap fees, refers to the interest rate or fee charged by brokers and exchanges for holding open positions in financial instruments like forex, stocks, or cryptocurrencies overnight.

Overnight funding can be a significant factor in the profitability of short-term trading strategies, so traders need to account for these fees when calculating their potential gains or losses. The fee is typically charged daily on open positions carried over to the next trading session.

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.