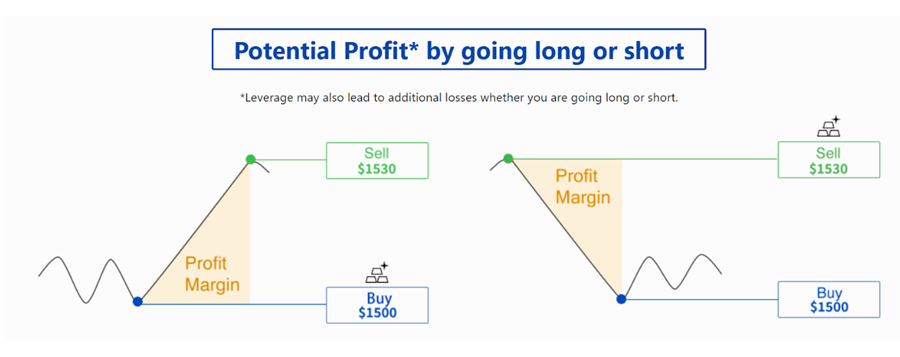

In the world of trading, understanding the concepts of long and short positions is crucial for making informed decisions. A long position involves buying an asset with the expectation that its value will rise, while a short position entails selling an asset you don't own, betting that its price will fall.

Today's article will introduce in detail the two most popular terms used daily by all traders: "Long" and "Short" – long position and short position.

1. What is Position?

A position in trading refers to the amount of a particular asset or financial instrument that a trader holds at any given time. It can be categorized into two main types:

Long Position: When a trader buys an asset with the expectation that its price will rise. The trader profits if the asset increases in value.

Short Position: When a trader sells an asset they do not own, anticipating that its price will fall. The trader profits if they can buy back the asset at a lower price.

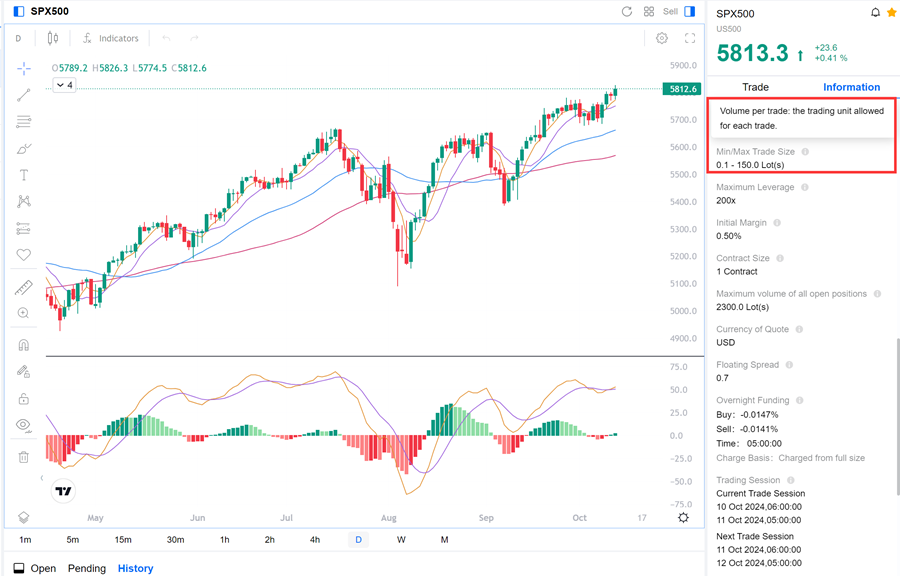

Traders can pursue profits by establishing long or short positions simultaneously, but the size of these positions is not limitless. A position limit refers to the maximum number of contracts or shares that a trader is allowed to hold for a specific asset or market at any given time.

Each product or brokerage firm has specific regulations regarding the number of positions a trader can maintain. These regulations are designed to ensure market transparency, promote fairness, and prevent the manipulation of product prices by individual investors or large organizations, ultimately protecting investor interests.

Traders need to understand this position limit to ensure effective trading and avoid missing out on buying and selling opportunities when exceeding the limit.

For example:

Minimum and maximum trade sizes (Position limits) for each trade for S&P 500 index trading at Mitrade.

The specific concept and how to use buying and selling positions will be further detailed in the next part of the article.

2. What is a Long Position?

A long position (buy) refers to the concept of an investor buying one or more financial products.

When a trader takes a long position, they are essentially betting on the asset’s appreciation, aiming to sell it later at a higher price for a profit.

The key characteristics of a long position include:

Profit Potential: The potential for unlimited gains as the asset's price can rise indefinitely.

Risk: The maximum loss is limited to the initial investment, as the asset can only lose value down to zero.

Market Sentiment: Long positions are often favored in bullish market conditions, where optimism prevails, and prices are expected to rise.

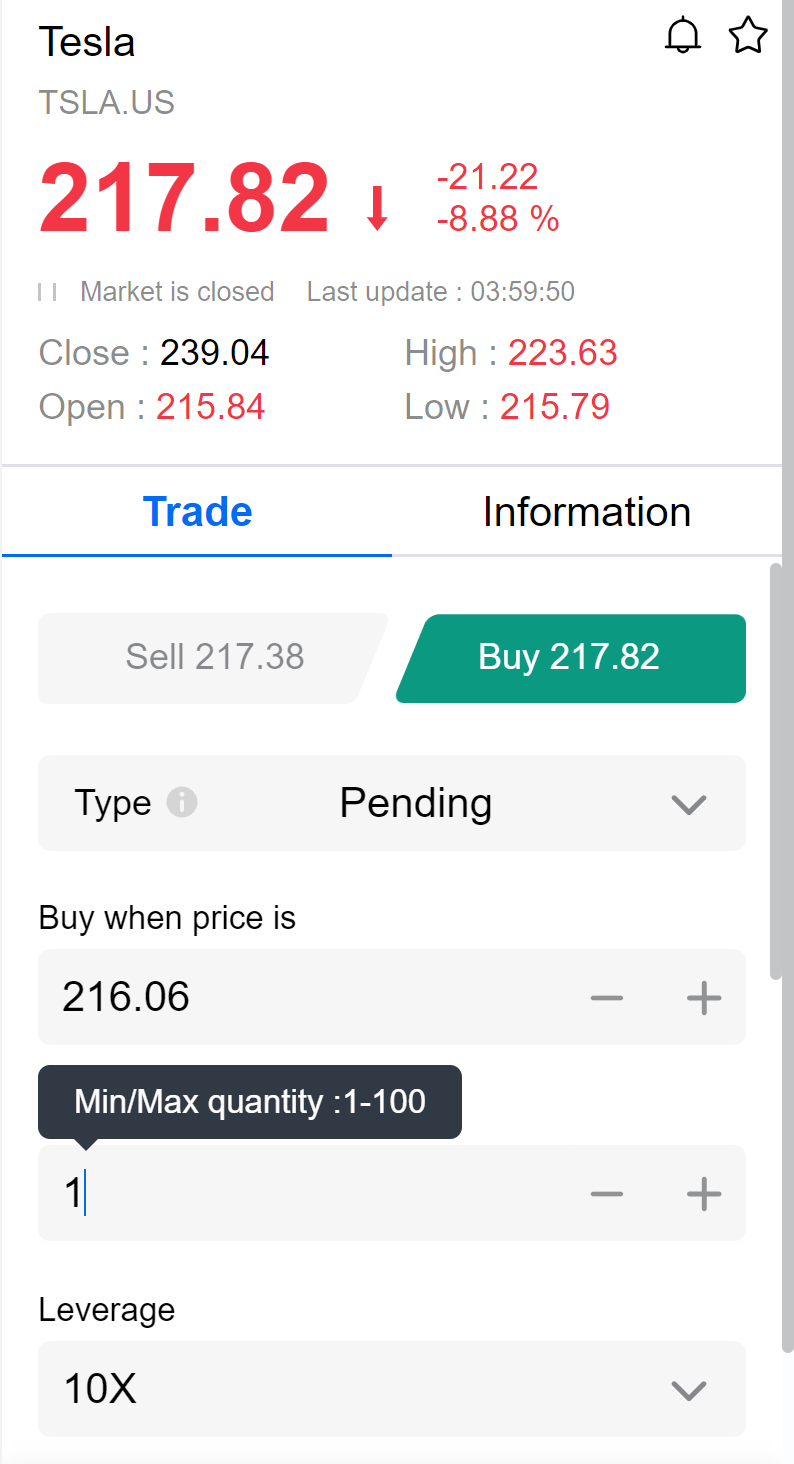

Example:

In the example with Tesla stock, a trader places a long order (buy) at a price of $216.06 per share for 1 lot, using a leverage of 1:10, anticipating the price to increase. The trader can also set automatic take-profit and stop-loss orders at levels corresponding to their expected profit and acceptable risk.

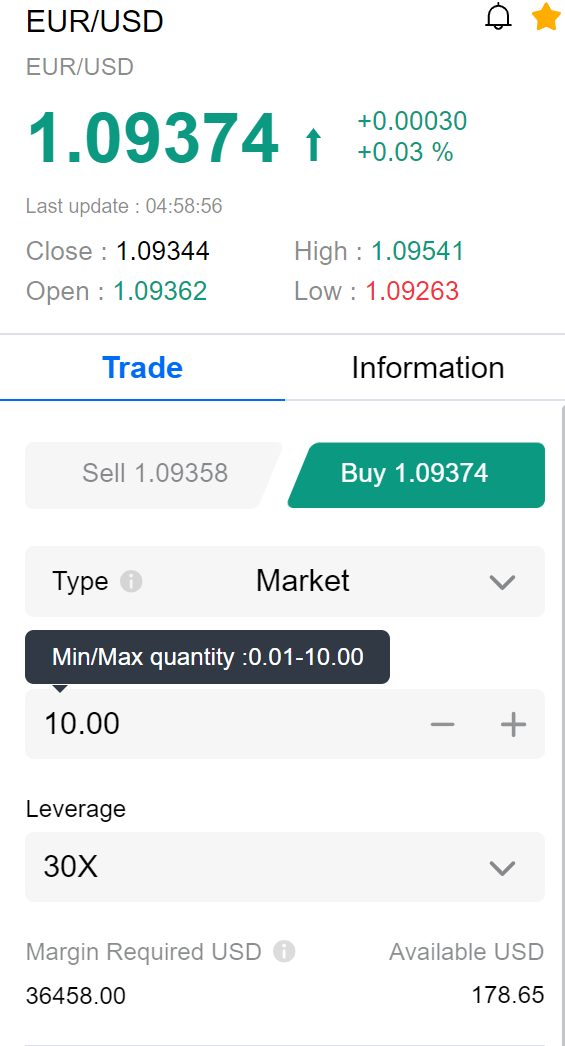

Similarly, in the Forex market, a trader places a long order for the EUR/USD currency pair at a price of $1.09374, with 10 lots and a leverage of 1:30.

When to use a long order to place a long position?

Traders typically use long orders when an asset shows signs of a potential price increase. They rely on fundamental and technical analysis to predict price trends and identify optimal entry points. Positive news about the overall market often fosters a buying sentiment among investors, which can drive prices upward. This is an ideal time to place a long order.

For example, in the stock market, key macroeconomic indicators reported monthly or quarterly—such as low inflation rates, GDP growth, and high employment figures—can create a favorable environment for long positions. These indicators often support an upward market trend, making it a strategic moment to invest.

Strategies for Managing Long Positions:

Stop-Loss Orders: Setting a stop-loss order helps limit potential losses by automatically selling the asset if it drops to a specified price.

Take-Profit Orders: Similar to stop-loss orders, take-profit orders automatically sell the asset when it reaches a predetermined profit level, securing gains.

Diversification: Spreading investments across various assets can reduce risk. This way, poor performance in one position may be offset by gains in another.

Rebalancing: Regularly reviewing and adjusting the portfolio ensures that the long positions align with market conditions and investment goals.

Trailing Stops: A trailing stop order adjusts the stop-loss price as the asset price increases, locking in profits while allowing for further gains.

By utilizing these strategies, traders can effectively manage their long positions to minimise risk, which sets the stage for understanding the opposite approach: a short position.

3. What is a Short Position?

A short position (sell) refers to the concept of an investor selling one or more financial products.

Traders take short positions to profit from falling prices, essentially betting that they can buy back the asset later at a lower price. This strategy is commonly used in various markets, including stocks, commodities, and cryptocurrencies.

Key characteristics of a short position include:

Profit Potential: The potential profit is limited to the initial sale price, as the asset can only drop to zero.

Risk: The maximum loss is theoretically unlimited because there is no cap on how high the asset price can rise, which can lead to significant financial exposure.

Market Sentiment: Short positions are typically favored in bearish market conditions, where negative sentiment prevails, and prices are expected to fall.

Example:

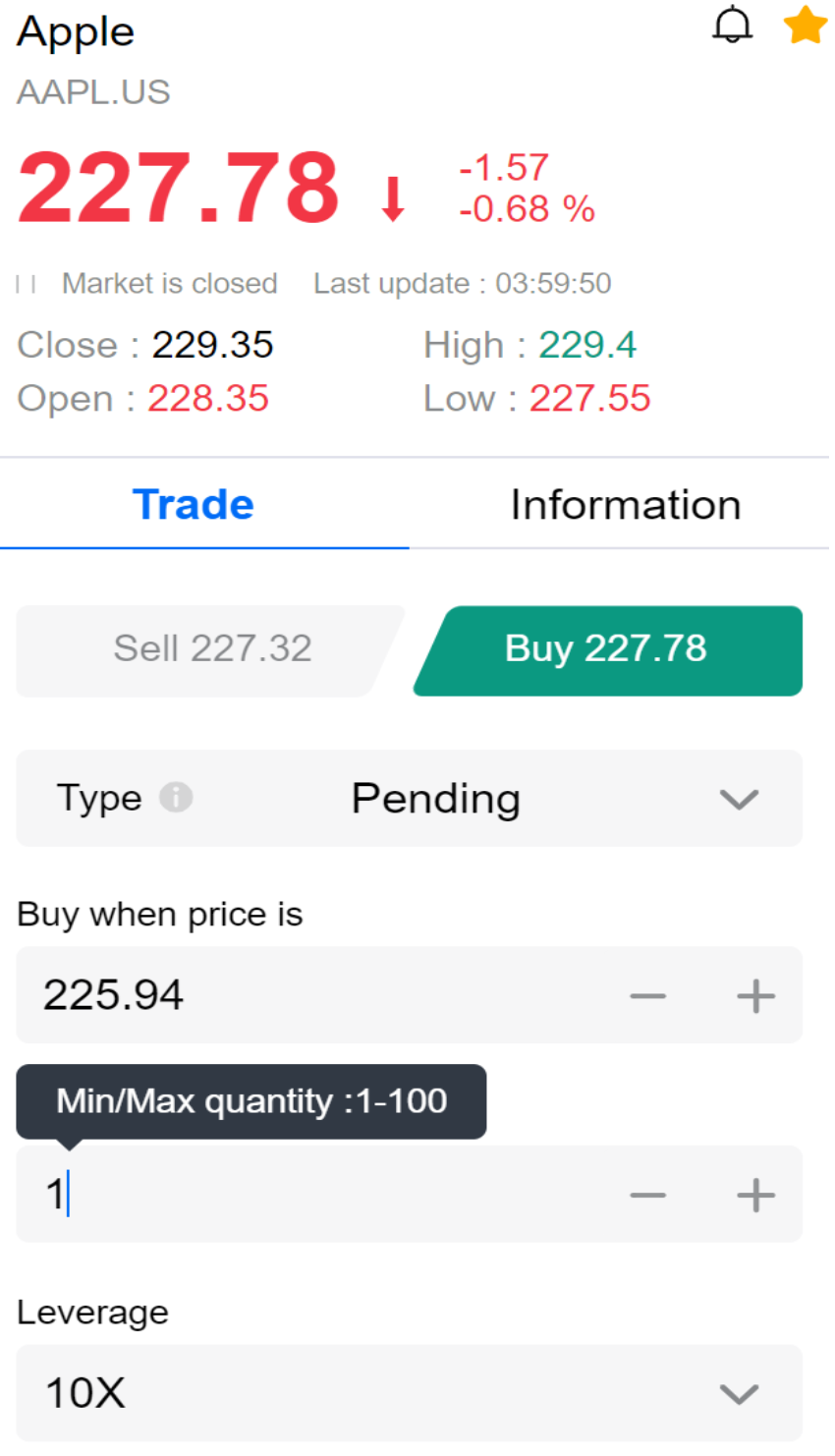

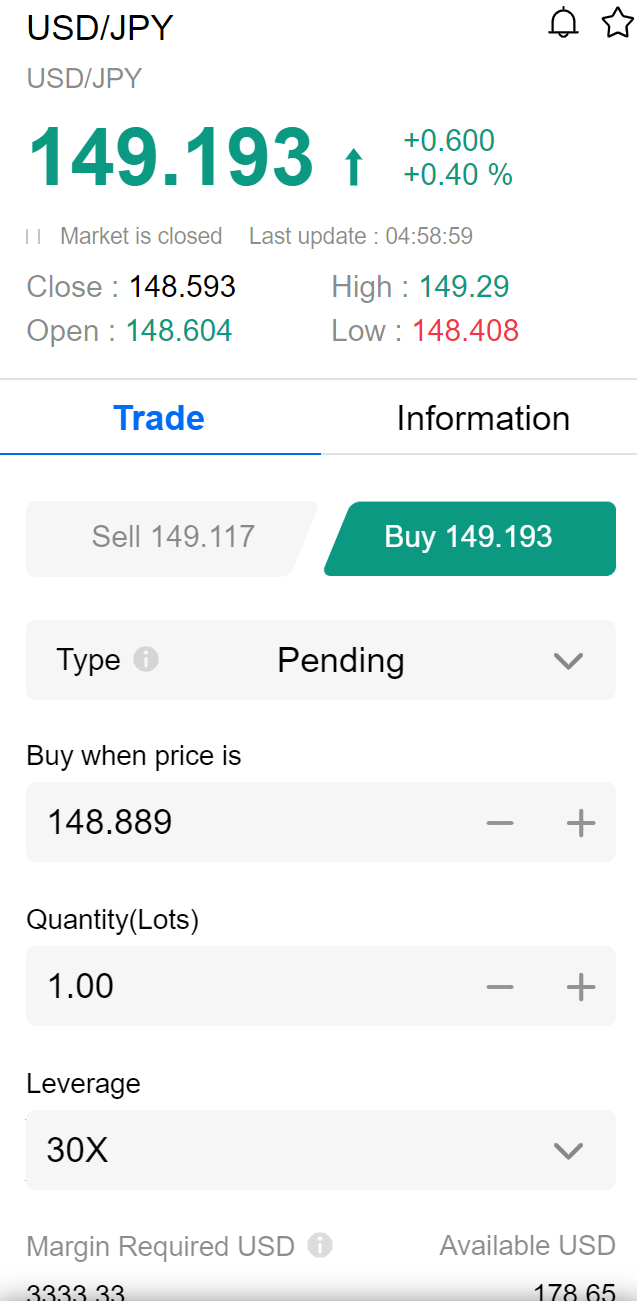

Placing a Short Order with Apple Stock (Source: Mitrade)

In the example with Apple stock, a trader places a short order (sell) at a price of $277.78 per share for 1 lot, using a leverage of 1:10, anticipating that the price will decrease. The trader can also set automatic take-profit and stop-loss orders at levels corresponding to their expected profit and acceptable risk.

Similarly, in the Forex market, a trader places a short order for the USD/JPY currency pair at a price of $149.193, with 1 lot and a leverage of 1:30.

When to use a short order to place a short position

Traders use short orders when an asset shows signs of price decline, employing both fundamental and technical analysis to predict price trends. Negative news about the overall market can often lead investors to adopt a selling sentiment, resulting in downward pressure on prices. This creates an opportune moment for traders to take advantage of short orders.

For example, in the Forex market, a volatile economic environment characterized by rising inflation and central banks tightening monetary policy can lead to significant currency fluctuations. Countries with increasing interest rates may strengthen their currencies, pushing exchange rates up against those with lower rate increases. A notable instance occurred in the second half of 2022 when the USD rose sharply, allowing many investors to profit from short orders on the EUR/USD pair.

Strategies for Managing Short Positions

Stop-Loss Orders: Similar to long positions, stop-loss orders are crucial for short positions, limiting potential losses if the asset price unexpectedly rises.

Position Sizing: Carefully calculating the size of a short position relative to the overall portfolio helps manage risk and avoid overexposure.

Hedging: Utilizing options or other derivatives can provide a safety net for short positions, protecting against adverse price movements.

Monitoring Market Sentiment: Keeping an eye on news, market trends, and investor sentiment can help anticipate price movements and allow for timely adjustments to short positions.

Covering Shorts: Being prepared to close short positions when the market shows signs of reversal can prevent significant losses. Establishing specific criteria for covering can aid in decision-making.

Having covered the basics of long and short positions along with essential strategies, it's important to clarify their differences.

4. Long Position vs. Short Position: What’s the Difference?

Long (buy) and short (sell) positions each have their own advantages and disadvantages:

Aspect | Long (Buy) | Short (Sell) |

Definition | Buying an asset with the expectation that its price will rise. | Selling an asset that you do not own, expecting to buy it back at a lower price. |

Market Sentiment | Bullish sentiment; optimism about price increases. | Bearish sentiment; pessimism about price declines. |

Profit Mechanism | - Profit when prices rise. - Potential dividends from owning assets. | - Profit when prices fall. - Capitalize on downward trends. |

Risk | - Risk of loss if prices fall. - Limited loss potential (maximum loss is the initial investment). | - Risk of loss if prices rise. - Unlimited loss potential (price can theoretically rise indefinitely). |

Market Conditions | - Beneficial in a rising market. - Can hold long-term for growth. | - Beneficial in a declining market. - Requires careful timing and market analysis. |

Emotional Impact | - Positive emotions when prices rise; confidence in investment. | - Negative emotions when prices rise; stress and pressure to act quickly. |

Typical Use Cases | - Long-term investing (stocks, real estate). - Retirement accounts. | - Hedging against market downturns. - Speculative trading. |

Advantages | - Profit when prices rise. - Can own the product when trading in the spot market. Shareholders may receive dividends. | - Profit when prices fall. - When fundamental factors from the market or company (for stocks) are unfavorable. The downtrend may persist, giving traders an advantage to execute short orders. |

Disadvantages | - Loss when prices fall. - When the market is highly volatile, panic selling can lead to losses for traders due to falling prices. | - Loss when prices rise. - Do not own the product when trading in the spot market. - In cases of sudden market price increases, traders are forced to buy and may incur significant losses if risk management is not well executed. |

5. summary

Both long and short positions offer unique advantages and risks, making them suitable for different market environments and trader preferences. Long positions are generally safer and better suited for bullish markets, while short positions can offer significant profits in bear markets but come with higher risks.

Deciding which is better depends on your market outlook, risk tolerance, and trading objectives. By understanding when and how to use these strategies, you can enhance your trading performance and make informed decisions in any market condition.

6. FAQs About Long and Short Positions

# Can long orders be used in all markets?

Yes. Long orders are common and applicable in all markets, including spot and derivative markets.

# Can I short-sell any asset?

Not all assets can be short-sold. While stocks are commonly shorted, certain mutual funds, options, and illiquid securities may have restrictions on short-selling. Additionally, engaging in short-selling often requires a margin account and is subject to various regulations.

The rules around short-selling can vary by market. For instance, short-selling is not permitted in the Chinese stock market, unlike in markets such as the U.S. and Australia.

# Which is easier to use: long or short orders?

The application of long or short orders depends on price trend analysis. Use a long order when predicting price increases and a short order when predicting price decreases.

# Should traders use long and short positions simultaneously?

Traders should not use long and short orders for the same product at the same time as a strategy to offset losses and profits when prices move contrary to their predictions. This can lead to a lack of profits and incur transaction costs.

However, traders can simultaneously use long and short positions in different markets after analyzing the downward trend of a product to seize opportunities.

For example, if the USD strengthens, a trader might use a short order for the EUR/USD pair while applying a long order for the USD/JPY pair.

Before making any trading decisions, it is important to equip yourself with sufficient fundamental knowledge, have a comprehensive understanding of market trends, be aware of risks and hidden costs, carefully consider investment targets, level of experience, risk appetite, and seek professional advice if necessary.

Furthermore, the content of this article is solely the author's personal opinion and does not necessarily constitute investment advice. The content of this article is for reference purposes only, and readers should not use this article as a basis for any investment decisions.

Investors should not rely on this information as a substitute for independent judgment or make decisions solely based on this information. It does not constitute any trading activity and does not guarantee any profits in trading.

If you have any inquiries regarding the data, information, or content related to Mitrade in this article, please contact us via email: insights@mitrade.com. The Mitrade team will carefully review the content to continue improving the quality of the article.