Selecting a trading platform is one of the most critical decisions for any trader. But how do you ensure you're choosing one that's regulated, cost-effective, and easy to use? Understanding the key criteria can set you up for success.

In this article, we’ll break down the essential factors to consider when evaluating trading platforms and illustrate them with a real-world example: Mitrade.

1. Supervision

This is always a top requirement for trading platforms if they want to gain attention and support from investors, as no one wants to entrust their assets to a platform lacking credibility.

Currently, checking whether a trading platform meets this criterion often relies on leading regulatory organizations in major countries around the world, such as:

Country | Regulatory Organization |

USA | National Futures Association (NFA) |

UK | Financial Conduct Authority (FCA) |

Australia | Australian Securities and Investments Commission (ASIC) |

Cyprus | Cyprus Securities and Exchange Commission (CySEC) |

Switzerland | Swiss Federal Banking Commission (SFBC) |

Germany | Federal Financial Supervisory Authority (BaFin) |

France | Financial Markets Authority (AMF) |

A trading platform that is one of the organizations listed in the table above provides greater credibility and security for investors.

One of the key indicators of a forex platform's credibility is its operating license. Typically, reputable international platforms are licensed by major financial organizations such as ASIC, CySEC, and FCA, which are considered among the top regulatory bodies worldwide for overseeing securities and investment markets.

There are several offshore licenses available, including the Financial Services Authority (FSA) of Seychelles, the International Financial Services Commission (IFSC) of Belize, the Cayman Islands Monetary Authority (CIMA), and the Financial Services Commission (FSC) of Mauritius.

An offshore forex license allows a company to legally operate a forex brokerage business outside its home country. These licenses are issued by regulatory authorities in various jurisdictions, which often feature favorable regulatory environments, lower taxation, and streamlined processes for obtaining licenses.

While offshore licenses can be beneficial for certain business models, they may be perceived as less reputable compared to onshore licenses, such as those from ASIC and FCA, as we mentioned.

The choice between offshore and onshore licensing often depends on the broker's target market, business strategy, and the importance of regulatory reputation to their clients.

For example, to cater to users in different jurisdictions, Mitrade holds both onshore and offshore licenses from ASIC, CySEC, CIMA, and FSC.

The regulated brokers always clearly state their regulated status on their websites. However, whether the information is accurate or not, you need to check it yourself on the official websites of the regulatory bodies or by other methods, as follows:

2.Trading Costs

Almost all trading platforms charge a small commission fee for each transaction made by investors. However, not all platforms with low commissions are good; investors need to consider the balance between commission fees, other costs, and the platform's security.

Balancing these two factors is not straightforward, and a platform with high security and low trading costs will be an optimal choice for investors.

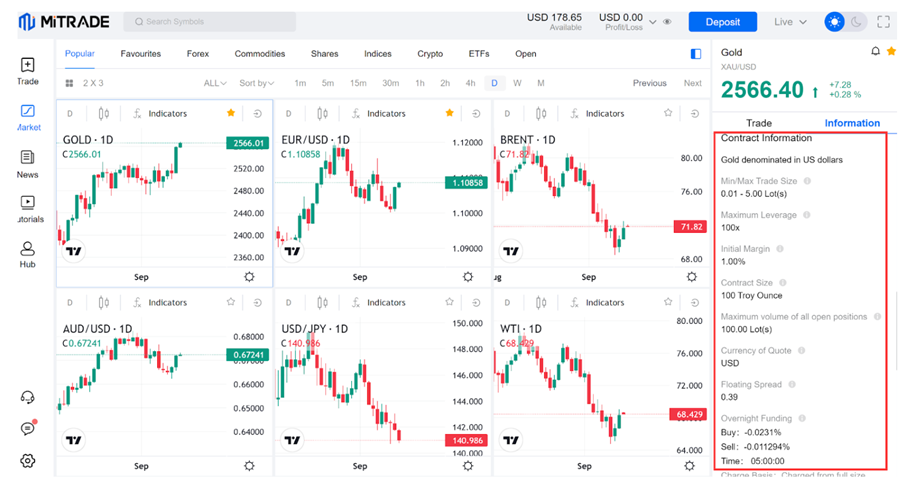

When you log in to the trading platform, you can find extremely detailed information about position size, margin requirements, and related fees. While you don't need to calculate these, you should understand how they affect your trading experience and profits. If you're unfamiliar with the trading terms in the following Mitrade platform screenshot, you can start with the Trading Fundamental Courses.

3.Order Execution Speed

Under normal market conditions (normal liquidity, no significant news, or unexpected events), executing a buy/sell order at the displayed price at the moment of selection should pose no issues, and your investment will match the value shown or have a very small spread.

However, during periods of strong market volatility, even a few pips of price difference can complicate trading, especially for speculators. Therefore, platforms with fast order processing speeds are often preferred by investors.

4. User-Friendly for New Traders

The trading platform must be friendly and understand its customers. You should choose platforms that offer demo accounts and have simple account opening procedures.

Demo accounts are very important; they are risk-free trading accounts that help you familiarize yourself with the platform before trading with real money. They will help you understand the platform, products, and tools offered.

For example, Mitrade provides a demo trading account with virtual capital up to $50,000.

A simple registration process also reflects the platform's friendliness. At Mitrade, you only need a few simple steps to register and verify before you can trade immediately. You can even start demo trading without identity verification.

Trading platforms provide the essential functions and tools to support users' trading. However, more features do not necessarily mean better usability, especially when a simple operating interface may be easier for new traders. A humanized design and convenience are also required.

Issuer | Mitrade |

Year of release | 2011 |

Trading instruments | Forex, Commodities, Stocks, Indices, Cryptocurrencies |

Market data | Yes |

Pending orders | 4 pending orders (Take Profit, Stop Loss, Trailing Stop Loss, Buy Limit) With negative balance protection tool |

Time frame | 11 (You can choose your own time frame) |

Technical indicators | 86 (Including MACD, KDJ, RSI, TRIX, DMA, CCI, and more) |

Multilingual | English, Traditional Chinese, Thai, Vietnamese, Simplified Chinese, Spanish, Portuguese, German, Korean |

Economic calendar | Yes |

Suitability | User-friendly, easy to use |

5. Products and Leverage

You should choose trading platforms that offer a variety of products and flexible leverage.

For instance, at Mitrade, the financial products offered are very diverse, covering various financial sectors such as Forex, commodities, indices, stocks, and cryptocurrencies. Leverage at Mitrade is also highly flexible, depending on the investment product and juristic.

Another noteworthy feature is that Mitrade allows you to adjust the leverage ratio. You can speculate on gold with a leverage of 1:10 and on cryptocurrencies with a leverage of 1:5.

6. Customer Service

Customer service is one of the most important requirements for any trading platform to ensure user experience. A good trading platform is one with excellent service quality and a dedicated customer support team always ready to address customer inquiries.

Thus, to evaluate whether a trading platform is good, we will rely on the nine criteria mentioned above.

7. Summary

In conclusion, choosing the right trading platform is a crucial decision that can significantly impact your trading experience and success. By considering key factors such as regulatory supervision, trading costs, order execution speed, and customer service, you can ensure that the platform you select meets your needs and provides a secure, efficient trading environment.

Platforms like Mitrade, with a balance of onshore and offshore licenses, competitive fees, fast execution, and user-friendly features, serve as strong examples of what to look for. Ultimately, a well-rounded platform that offers diverse products, flexible leverage, and excellent customer support will be best suited to enhance your trading journey.

References:

Before making any trading decisions, it is important to equip yourself with sufficient fundamental knowledge, have a comprehensive understanding of market trends, be aware of risks and hidden costs, carefully consider investment targets, level of experience, risk appetite, and seek professional advice if necessary.

Furthermore, the content of this article is solely the author's personal opinion and does not necessarily constitute investment advice. The content of this article is for reference purposes only, and readers should not use this article as a basis for any investment decisions.

Investors should not rely on this information as a substitute for independent judgment or make decisions solely based on this information. It does not constitute any trading activity and does not guarantee any profits in trading.

If you have any inquiries regarding the data, information, or content related to Mitrade in this article, please contact us via email: insights@mitrade.com. The Mitrade team will carefully review the content to continue improving the quality of the article.