Crude oil's financial significance is profound, as it influences global markets, economies, and investment strategies. The dynamics of its pricing can have far-reaching implications across various sectors and economies worldwide. This creates opportunities for profit, attracting a large number of traders. However, it’s important to recognize that trading in crude oil also carries inherent risks, making it essential for investors to navigate this complex landscape carefully.

In this article, we will explore the fundamentals of crude oil, outlining the essential concepts, key steps in the trading process, and effective strategies for navigating this dynamic market.

1. What Is Crude Oil?

Crude oil is a natural, unrefined petroleum product composed of hydrocarbon deposits and other organic materials. It is extracted from the earth and refined into various products, such as gasoline, diesel, and other petrochemicals. Crude oil can be categorized by its density and sulfur content, typically classified as light or heavy, and sweet or sour. Among these, West Texas Intermediate (WTI) and Brent are the primary benchmarks used in the global oil market.

Brent crude, which is sourced from the North Sea, accounts for approximately 80% of all crude oil contracts traded worldwide. It is favored for its light and sweet characteristics, making it ideal for refining into diesel and gasoline.

West Texas Intermediate (WTI), extracted mainly from the U.S., is also light and sweet but is primarily used as a benchmark for oil consumed in the United States. WTI is traded at a premium in the U.S. market, but its land-locked nature can increase transportation costs compared to Brent.

To clarify the differences between the two types of crude oil, please refer to the following table:

Brent vs. WTI

Feature | Brent Crude | WTI Crude |

Origin | North Sea | United States |

Density | Light | Light |

Sulfur Content | 0.37% | 0.24% |

API gravity | 38 | 39.6 |

Benchmark | Global benchmark | U.S. benchmark |

Transportation Cost | Lower for international shipping | Higher due to transport needs |

Market Influence | Affected by geopolitical factors | More influenced by U.S. supply |

Trading Platform | ICE (Intercontinental Exchange) | NYMEX (New York Mercantile Exchange) |

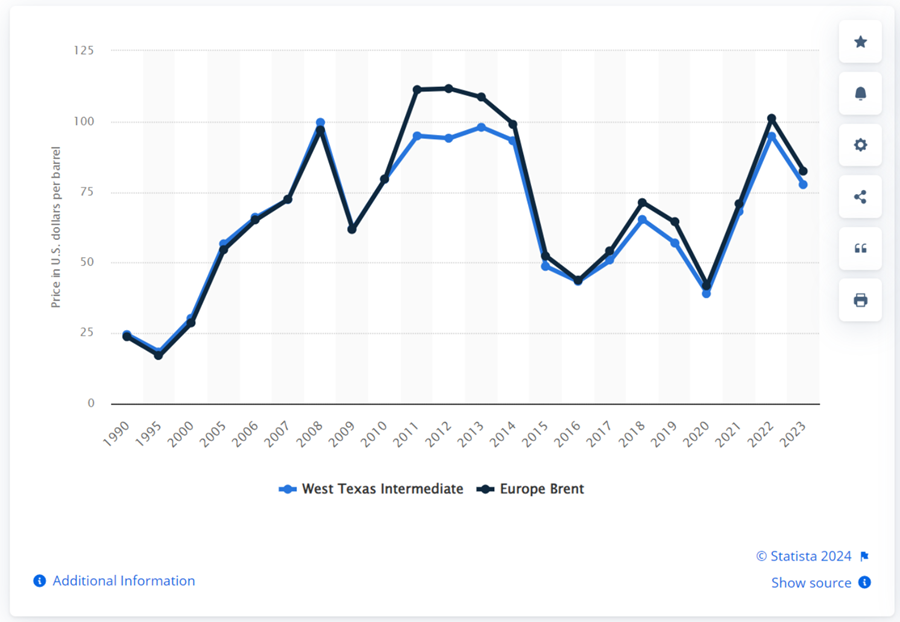

Brent and WTI prices typically exhibit a narrow spread and move closely together, as illustrated by the chart "Annual Average WTI and Brent Crude Oil Spot Prices from 1990 to 2023 (in U.S. dollars per barrel)" on Statista.com.

Brent Crude is generally priced higher than WTI due to its superior quality and strong global demand, serving as a benchmark for oil prices in Europe, Africa, and the Middle East.

Brent prices are significantly influenced by geopolitical events, particularly conflicts in oil-producing regions. For instance, during the Arab Spring in 2011, Brent prices surged amid concerns about potential supply disruptions.

Source: tradingeconomics.com

In contrast, WTI prices are more sensitive to domestic factors, such as inventory levels and refinery capacity in the United States. The 2020 oil price war between Russia and Saudi Arabia highlighted WTI's volatility, as prices plummeted sharply due to oversupply.

Source: tradingeconomics.com

Both benchmarks are essential for understanding price movements in the oil market and are utilized in various financial instruments, including futures contracts, to hedge against price fluctuations.

2. What Is Crude Oil Trading?

Crude oil trading refers to the process of buying and selling crude oil and its derivatives, such as futures contracts, as mentioned in Section 1. Traders can participate in this market through various instruments, including spot contracts, futures, and options. The price of crude oil is influenced by multiple factors, such as geopolitical events, supply and demand dynamics, and economic indicators.

The crude oil market is among the largest and most liquid markets globally, attracting participants from diverse sectors such as finance, energy, and commodities trading. It is estimated that thousands of active traders participate in the global crude oil market, operating through exchanges like the New York Mercantile Exchange (NYMEX), the Intercontinental Exchange (ICE), and regulated online brokers.

These traders may pursue the following objectives:

Global Demand: Crude oil is a vital energy source used for transportation, heating, and electricity generation. Its consistent demand makes it an attractive commodity for traders.

Price Volatility: Crude oil prices can be highly volatile due to geopolitical events, natural disasters, and changes in supply and demand. This volatility creates opportunities for traders to profit from price fluctuations.

Diversification: Trading crude oil allows investors to diversify their portfolios, as it often behaves differently from stocks or bonds, providing a hedge against economic downturns.

Leverage: Many markets offer leveraged trading options, allowing traders to control larger positions with a smaller amount of capital, potentially increasing returns.

Hedging: Companies involved in the oil industry can hedge against price fluctuations by trading crude oil futures, thereby protecting their profit margins.

If you aspire to be a trader with one of these objectives, you can explore some of the most popular crude oil investments to identify one that best suits your needs in the next section.

3. Six Common Crude Oil Investments

Investing in crude oil can be a lucrative option for those looking to diversify their portfolio. It can take various forms, each with distinct characteristics, advantages, and risks. Here’s a look at some common methods of crude oil investment, along with their pros and cons.

Investment Type | Risk Level | Capital Requirement | Leverage Available | Short Sell Potential |

Futures Contracts | High | Moderate to High | Yes | Yes |

Options Contracts | Moderate to High | Moderate | Yes | Yes |

Exchange-Traded Funds (ETFs) | Low to Moderate | Low to Moderate | No | Yes |

Stocks of Oil Companies | Moderate | Moderate | No | Yes |

Contracts for Difference (CFDs) | High | Low to Moderate | Yes | Yes |

Physical Oil Purchases | Very High | Very High | No | No |

Futures Contracts: Agreements to buy or sell a specific amount of crude oil at a predetermined price on a future date.

Pros:

Leverage: Potential for significant returns with a smaller initial investment.

Liquidity: Highly liquid, allowing for quick entry and exit from positions.

Cons:

High Risk: Prices can be extremely volatile, leading to substantial losses.

Margin Calls: Investors may face additional funding requirements if prices move unfavorably.

Options Contracts: Contracts that give the buyer the right, but not the obligation, to buy/sell oil at a specified price before a certain date.

Pros:

Flexibility: Provides the option to buy or sell without obligation.

Limited Risk: Maximum loss is limited to the premium paid for the option.

Cons:

Complexity: Requires a good understanding of options trading strategies.

Cost: Premiums can be high, particularly for options with favorable strike prices.

Exchange-Traded Funds (ETFs): Funds that track the price of crude oil or oil companies and trade on stock exchanges.

Pros:

Diversification: Allows investors to gain exposure to a basket of oil-related assets.

Liquidity: Can be bought and sold like stocks on the exchange.

Cons:

Management Fees: ETFs may have associated fees that can eat into profits.

Market Risk: Subject to overall market fluctuations, not just oil prices.

Stocks of Oil Companies: Investing in shares of companies involved in the extraction, refining, and distribution of oil.

Pros:

Potential for Dividends: Many oil companies pay dividends, providing income.

Long-Term Growth: Opportunity for capital appreciation if the company performs well.

Cons:

Market Dependency: Stock prices can be influenced by broader market trends.

Company-Specific Risks: Performance can be affected by management decisions and operational issues.

Contracts for Difference (CFDs): Allow investors to speculate on the price movements of crude oil without owning the underlying asset.

Pros:

Leverage: Enables traders to control larger positions with a smaller investment.

Flexibility: Can profit from both rising and falling markets.

Cons:

High Risk: Potential for significant losses, especially with high leverage.

Fees: May incur overnight financing fees or spreads.

Physical Oil Purchases: Buying physical barrels of crude oil, though this is typically limited to large corporations due to logistical challenges.

Pros:

Direct Ownership: Provides tangible asset ownership.

Hedging Against Inflation: Physical assets can be a hedge in inflationary environments.

Cons:

High Capital Requirement: Significant upfront investment needed.

Logistical Challenges: Storage and transportation can be complex and costly.

Understanding these investment types, along with their pros and cons, can help investors make informed decisions in the crude oil market.

4. Six Steps To Start Crude Oil Investing

Investing in crude oil can be a strategic way to diversify your portfolio and capitalize on market opportunities. Here are six essential steps to help you get started.

Step 1: Educate Yourself

Before diving into crude oil investing, it’s crucial to understand the fundamentals of the oil market, including how prices are determined, the different types of crude oil, and the factors influencing supply and demand.

Read books and articles on crude oil investing.

Follow market news and analysis from reputable sources.

Familiarize yourself with key terms and concepts related to oil trading.

Step 2: Determine Your Investment Strategy

Identify how you want to invest in crude oil—whether through futures contracts, stocks, ETFs, or other methods. Each approach has its own risk profile and capital requirements.

Assess your risk tolerance and investment goals.

Decide whether you prefer short-term trading or long-term holding.

Choose a method that aligns with your financial situation.

Step 3: Choose a Brokerage

Select a reputable brokerage that offers access to oil investments. Ensure they provide the tools and resources you need.

Look for brokerages that specialize in commodities trading.

Compare fees, margin requirements, and available trading platforms.

Verify that the brokerage is regulated and trustworthy.

Step 4: Develop a Trading Plan

Create a comprehensive trading plan outlining your investment goals, entry and exit strategies, and risk management techniques.

Setspecific targets for profits and losses.

Determine the types of analysis you’ll use (technical or fundamental).

Include guidelines for diversifying your investments.

Step 5: Start Small and Monitor the Market

Begin your investment journey with a smaller amount to minimize risk. As you gain experience and confidence, you can gradually increase your investments.

Use demo accounts to practice trading without real money.

Monitor market trends and price movements regularly.

Stay updated on geopolitical events and economic indicators that may impact oil prices.

Step 6: Review and Adjust Your Strategy

Periodically assess your investment performance and make necessary adjustments to your strategy based on market conditions and your financial goals.

Analyze your trades to identify what worked and what didn’t.

Be flexible and willing to adapt your approach as the market evolves.

Consider seeking advice from financial experts if needed.

Starting to invest in crude oil requires careful planning and continuous learning. By following these six steps, you can establish a solid foundation for your investment journey and navigate the complexities of the oil market with greater confidence.

5. Effective Crude Oil Trading Strategies

Trading crude oil can be rewarding, but it requires a solid strategy to navigate its inherent volatility and complexity. Here are some effective strategies that traders can use to maximize their potential in the crude oil market.

# Fundamental Analysis Strategies

Fundamental analysis involves evaluating economic, geopolitical, and supply-demand factors to predict oil price movements. This strategy is essential for understanding the broader market context.

Economic Indicators: Monitor key reports such as U.S. inventory levels, production data from OPEC, and global demand forecasts.

Geopolitical Events: Keep an eye on tensions in oil-producing regions, sanctions, and natural disasters that could impact supply.

Market Sentiment: Analyze how news and reports affect trader sentiment and overall market movement.

Implementation:

Create a calendar of important economic releases and geopolitical events.

Use reports from the EIA and IEA to assess supply-demand dynamics.

Adjust your trading positions based on the outcomes of these analyses.

# Technical Analysis Strategies

]

Technical analysis focuses on price charts and indicators to forecast future price movements based on historical data.

Chart Patterns: Recognize formations like head and shoulders, flags, and triangles that signal potential price movements.

Indicators: Utilize moving averages, Relative Strength Index (RSI), and Bollinger Bands to identify trends and reversals.

Implementation:

Use daily and weekly charts to identify long-term trends.

Apply technical indicators to confirm entry and exit points.

Set stop-loss orders based on technical levels to manage risk.

# Seasonality Strategies

Seasonality strategies involve recognizing patterns in price movements during specific times of the year. Certain factors, such as weather and seasonal demand, can influence oil prices.

Weather Patterns: Understand how seasonal changes (e.g., winter heating oil demand) affect consumption.

Historical Trends: Analyze historical price data to identify recurring patterns tied to specific months or seasons.

Implementation

Review historical price charts to identify seasonal trends.

Adjust trading strategies based on anticipated seasonal changes in demand.

#Swing Trading Strategy

Swing trading aims to capture short- to medium-term price movements by holding positions for several days to weeks.

Price Swings: Focus on identifying potential price reversals or continuations.

Technical Indicators: Use RSI or MACD to find overbought or oversold conditions.

Implementation

Identify support and resistance levels to establish entry and exit points.

Monitor price movements closely to capitalize on short-term changes.

Set stop-loss orders to protect against adverse swings.

# Trend Trading Strategies

Trend trading focuses on identifying and following established market trends, whether upward or downward.

Moving Averages: Use simple or exponential moving averages to determine the direction of the trend.

Breakouts: Look for price breakouts above resistance or below support levels to signal entry points.

Implementation

Establish criteria for entering and exiting trades based on trend indicators.

Stay in the trade as long as the trend remains intact, using trailing stop-loss orders to lock in profits.

Regularly reassess market conditions to ensure alignment with the prevailing trend.

Employing a combination of fundamental analysis, technical analysis, seasonal patterns, swing trading, and trend trading strategies can enhance your effectiveness in crude oil trading. Understanding each strategy's nuances and adapting them to current market conditions will help you make informed trading decisions and capitalize on opportunities in the dynamic oil market.

6. Summary

Crude oil trading can be a lucrative investment opportunity, but it requires knowledge, careful planning, and risk management. By understanding the market and following a structured approach, investors can navigate the complexities of crude oil investing.

7. FAQs

What influences crude oil prices?

Supply and demand, geopolitical events, economic data, and market sentiment are key factors.

Is crude oil trading risky?

Yes, due to the high volatility of oil prices and market dynamics.

Can I invest in crude oil without trading futures?

Yes, through ETFs or stocks of oil companies.

What is the best way to start?

Educate yourself, choose a reputable broker, and start with a small investment.

How often should I monitor my investments?

Regularly, especially during significant market events or changes in economic indicators.

Before making any trading decisions, it is important to equip yourself with sufficient fundamental knowledge, have a comprehensive understanding of market trends, be aware of risks and hidden costs, carefully consider investment targets, level of experience, risk appetite, and seek professional advice if necessary.

Furthermore, the content of this article is solely the author's personal opinion and does not necessarily constitute investment advice. The content of this article is for reference purposes only, and readers should not use this article as a basis for any investment decisions.

Investors should not rely on this information as a substitute for independent judgment or make decisions solely based on this information. It does not constitute any trading activity and does not guarantee any profits in trading.

If you have any inquiries regarding the data, information, or content related to Mitrade in this article, please contact us via email: insights@mitrade.com. The Mitrade team will carefully review the content to continue improving the quality of the article.