Monitoring and understanding macroeconomic indicators play a crucial role for traders in the financial investment process. One of the most discussed indicators in financial magazines is GDP.

So, what is GDP? What impact does it have on the financial market? In today's article, we will discuss GDP, examine its recent changes, and explore how to use GDP for market trend analysis.

1. What is GDP?

GDP (Gross Domestic Product) is the total domestic product or the total value of all goods and services produced within a country's territory over a specific period (usually quarterly or annually). GDP is one of the most important economic indicators for assessing the health and growth of an economy.

Specific significance of GDP:

Measuring economic health: GDP is one of the most fundamental indicators for assessing the economic health of a country. It allows governments, managers, and investors to understand the level of economic growth within the country and its various sectors.

Measuring growth and progress: By comparing production values across different years or quarters, if GDP increases over a certain period (quarters or years), it indicates that the economy of that country is developing and progressing.

Forecasting economic trends: GDP can help forecast economic trends within a country, such as labor market conditions, export status, and consumer spending.

Determining economic policy: GDP is a key factor in shaping a country’s economic policies. Policymakers can use GDP to assess economic conditions and make decisions regarding fiscal policy, monetary policy, investment strategy, and education policy.

Guiding investment: GDP can help direct the investments of businesses and investors. If a country’s GDP is rising, businesses and investors may be inclined to invest there due to its potential for development and economic growth.

Understanding economic structure: By analyzing the components of GDP—such as consumption, investment, government spending, and net exports—one can identify which sectors contribute more or less to GDP, as well as the balance between various sources of income and expenditure in the economy.

Comparing economic development across countries: GDP serves as a basis for comparing the levels of economic development among countries by converting GDP into a common currency, such as USD. This allows for ranking countries by economic size or calculating GDP per capita to compare living standards.

2. World Economic Outlook for 2024 and 2025

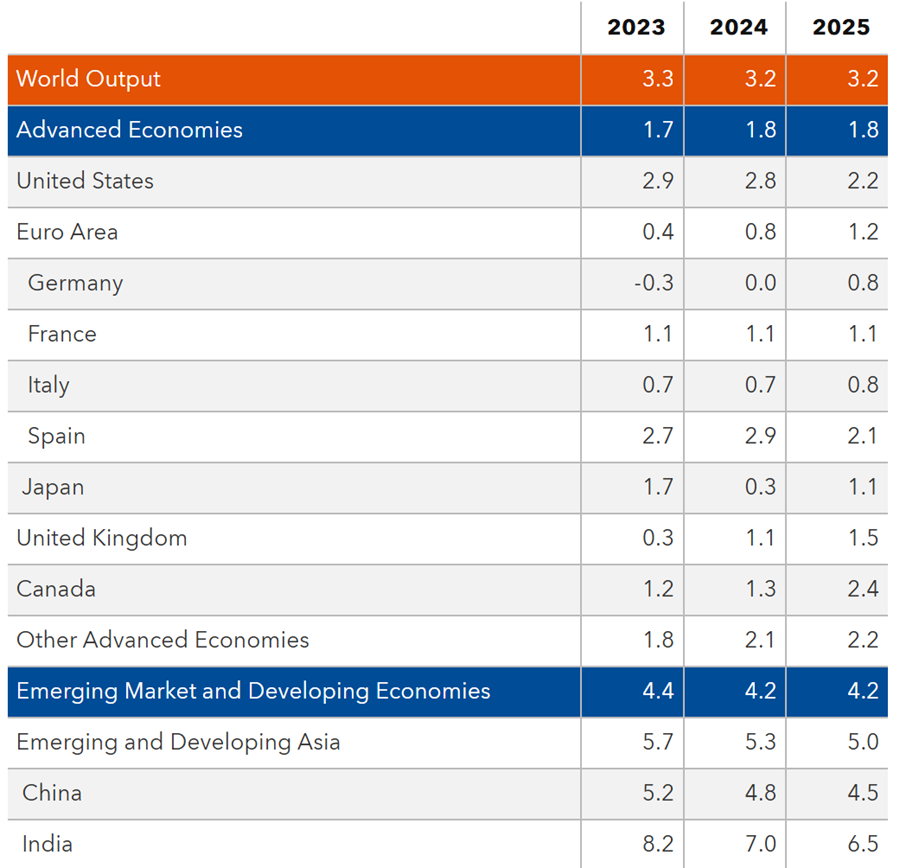

The IMF has increased the growth forecasts for the country to 2.8% for 2024 and 2.2% for 2025, marking it as the only developed economy to receive upgrades for both years. Global growth is anticipated to remain at 3.2% in 2024, a slight decrease from the prediction made in July, and is expected to decline to 3.1% over the next five years.

The following is the IMF's outlook for major economies, including the U.S., China, the Eurozone, Japan, and others, for 2024, and 2025.

The World Economic Outlook for 2024 and 2025 indicates a stable yet underwhelming global economic growth trajectory:

Regional disparities: While the United States has seen positive forecast revisions, other advanced economies, particularly in Europe, face downward adjustments. Emerging markets, especially in regions like the Middle East and Central Asia, are challenged by conflicts and climate-related disruptions, although parts of Asia benefit from strong demand driven by technological investments.

Monetary and fiscal policy: The report stresses the need for a policy pivot. As monetary policies ease, there is an emphasis on recalibrating fiscal strategies to ensure sustainable debt management and to support economic resilience.

Inflation dynamics: Global disinflation is ongoing, but elevated services inflation illustrates the complexities in addressing price stability. Understanding sectoral dynamics will be crucial for effective monetary policy.

Structural reforms: The necessity for structural reforms is underscored to enhance long-term growth potential. These reforms must be socially acceptable to ensure public support and successful implementation.

While the outlook shows some resilience, it is tempered by geopolitical tensions, financial market volatility, and the need for careful management of economic policies to navigate the complexities of the current global environment.

3. How GDP Data Affects Financial Markets?

Given the importance of GDP, it has significant impacts on all financial markets, including:

Bond and deposit markets: When GDP rises, banks may increase interest rates due to higher demand for capital to expand business operations. Higher interest rates make borrowing and investing more expensive for organizations and investors. This can affect the value of assets and financial markets such as the bond and deposit markets.

Stock market: If GDP increases, the revenues and profits of companies typically rise, leading to an increase in stock values. Additionally, rising GDP can boost investor sentiment, creating positive momentum for the stock market.

Forex market: When a country's GDP grows, its currency tends to strengthen. This can increase the currency's value and decrease the value of exported goods, affecting the foreign exchange market.

Commodity market: Generally, when GDP rises, the demand for goods and services increases, which can lead to higher values for commodity assets such as oil or agricultural products.

However, this is also influenced by other factors such as interest rates, trade relations, and political conditions between countries. For example, gold prices often tend to rise during economic downturns or when GDP declines.

Cryptocurrency market: The cryptocurrency market is relatively new compared to other financial markets, so there is no clear correlation between GDP data and the value of cryptocurrencies. However, due to the impact of GDP on the economy and the stock market, and because the cryptocurrency market often follows stock market trends, one can assess the influence of GDP on the cryptocurrency market through other markets.

Inflation issues: Higher-than-expected GDP data can exert upward pressure on inflation, prompting central banks to raise interest rates to control it. This may increase the value of the national currency but also reduce borrowing and spending capacity for businesses and consumers.

Conversely, lower-than-expected GDP data can put downward pressure on inflation, leading central banks to lower interest rates to stimulate the economy. This can decrease the value of the national currency but increase borrowing and spending capacity for businesses and consumers.

In summary, GDP has a significant impact on various financial markets, and investors often use it to make investment decisions.

4. How to Use the GDP Indicator in Financial Trading?

GDP is a critical economic indicator that traders use to assess the health of an economy, which can influence their trading decisions in various markets. Here's how traders typically leverage GDP data:

Understanding economic health: A rising GDP signals a growing economy, likely leading to increased corporate profits and higher stock prices. Conversely, a declining GDP can indicate economic trouble, prompting traders to adjust their positions.

Market sentiment and expectations: Traders often speculate on GDP data before its release. High expectations followed by disappointing data can lead to market volatility, while exceeding expectations may boost market confidence.

Interest rates and monetary policy: GDP figures significantly influence central bank policies. A strong economy may lead to interest rate increases to control inflation, while a weak economy might prompt rate cuts, which traders closely monitor.

Sector-specific impacts: Different sectors respond uniquely to GDP changes. For example, consumer discretionary stocks may thrive during GDP growth, while utilities may perform better in downturns. Traders adjust sector allocations based on these trends.

Investment strategies: Long-term investors can use GDP growth trends to identify promising markets, while short-term traders might capitalize on immediate reactions to GDP data. Many also integrate GDP data with technical analysis to refine their strategies.

Global comparisons: Investors compare GDP growth rates across countries to assess relative economic performance, guiding foreign investment and currency trading decisions.

Using GDP as an economic indicator in trading requires a nuanced understanding of how it affects market sentiment, interest rates, and sector performance. By integrating GDP data with other economic indicators such as unemployment rates and inflation, traders can make more informed decisions that align with broader economic trends.

5. Summary

GDP is a vital economic indicator that traders can use to gauge market conditions and inform their trading strategies across various financial sectors.

Traders can analyze GDP reports to predict market trends and make informed decisions. Understanding GDP growth rates, forecasts, and revisions helps in anticipating shifts in market sentiment and potential asset movements.

Before making any trading decisions, it is important to equip yourself with sufficient fundamental knowledge, have a comprehensive understanding of market trends, be aware of risks and hidden costs, carefully consider investment targets, level of experience, risk appetite, and seek professional advice if necessary.

Furthermore, the content of this article is solely the author's personal opinion and does not necessarily constitute investment advice. The content of this article is for reference purposes only, and readers should not use this article as a basis for any investment decisions.

Investors should not rely on this information as a substitute for independent judgment or make decisions solely based on this information. It does not constitute any trading activity and does not guarantee any profits in trading.

If you have any inquiries regarding the data, information, or content related to Mitrade in this article, please contact us via email: insights@mitrade.com. The Mitrade team will carefully review the content to continue improving the quality of the article.