Major political events in large countries, especially the US, always have a certain impact on the economic market. The US presidential election is a prime example of this, as it will have significant implications for the country's policies and international diplomatic relations.

The US presidential election is held every four years, with the current one scheduled for 2024. The outcome of this election can greatly influence a variety of economic and financial factors, including the stock market and other investment markets.

This article will examine the relevant details about what impacts the US presidential election may have on the markets. Understanding these dynamics is crucial for investors who want to make informed decisions and navigate the potential market volatility surrounding the US presidential election.

1. Important Components of the US Election

The US presidential election is held every 4 years, typically in November of an even-numbered year (2016, 2020, 2024, etc.), and the next one is coming up in 2028.

This also means that a president will serve a 4-year term. The US vice president is also selected as part of this election. Rather than a direct popular vote by US citizens, the US presidential election is conducted through members of the Electoral College.

The key components of the US election include:

The presidential election is held every 4 years

The president and vice president are elected together

The election is decided by the Electoral College, not just the popular vote

No. | Ingredient | Describe |

1 | President | + Conditions: - Be an American citizen born in the United States. - From 35 years old or older. - Permanent residence in the US for at least 14 years. + Term: 04 years + Responsibility & power: Domestic, foreign, legislative & executive affairs.

|

2 | Vice president | + Conditions: - Be an American citizen born in the United States. - From 35 years old or older. - Permanent residence in the US for at least 14 years. + Term: 04 years + Responsibilities & powers: President of the US Senate & assumes the position of temporary President in case the US president is unable to perform the position.

|

3 | Electoral College | + Number: 538 belonging to the 50 US states and the District of Columbia (the number of electors depends on the number of people divided in the US Congress in that state). + Time: only created during the election period (every 4 years) + Function: vote for US president & vice president. |

4 | The Senate | + The Senate consists of about 100 senators in 50 states. + Term: 6 years + Mission in the election: When no candidate gets more than ½ of the votes to become vice president, the Senate will make the choice. |

5 | House of Commons | + The House of Representatives includes about 435 members of the House of Representatives with voting rights. + Term: 2 years + Mission in the election: When no candidate gets more than ½ of the votes to become president, the House of Representatives will make the choice. |

6 | Citizens have the right to vote | + Conditions: - Over 18 years old before election day - Be a citizen of the US. - Meet state residency requirements. + Responsibilities and functions: citizens have the right to vote universally to elect electors in their state. And usually the electors will also vote for the candidate who wins the majority of the popular vote in their state. |

2. The U.S. Election Process

The election process:

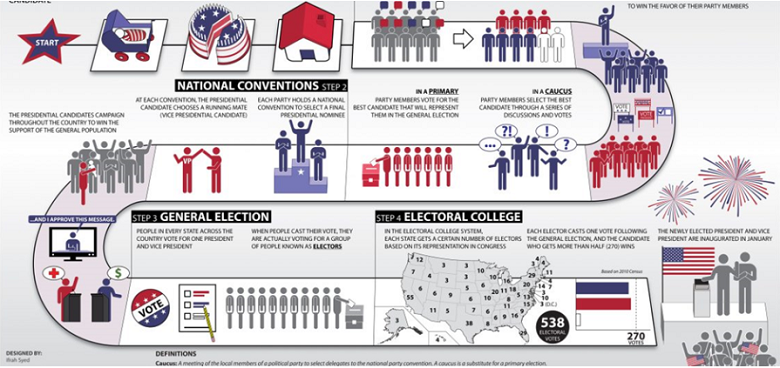

Illustration of the U.S. presidential election process (Source: kids.usa.gov)

Stage 1: Presidential Candidacy (about a year before election day)

Eligible candidates who want to become president (usually from the two major parties - the Republican Party and the Democratic Party) will set up a Committee.

This Committee will travel across the United States to gather support and raise funds for their campaign.

Stage 2: Campaign Efforts

Candidates from both parties will participate in televised debates. Each candidate will answer policy questions and defend their policy positions against the other candidates.

Stage 3: Primary Elections and Caucuses

Starting around February of the election year, primary election events - party members will elect the representative candidate for the general election, and caucuses (discussions and voting to select delegates) will be held.

Stage 4: National Conventions

Each party will hold a national convention to select the final presidential candidate.

Stage 5: General Election

Citizens in each state will vote for a president and vice president. Essentially, they are choosing a group of electors to directly vote in the election.

Stage 6: Electoral College

The Electoral College will vote and decide who becomes president. Currently there are 538 electors, and the candidate who receives over half the votes or at least 270 votes will win.

In addition to the presidential election held every 4 years, the U.S. also holds midterm elections 2 years after each presidential election.

This is also an important event with significant political and economic impacts in the U.S. The next part of the article will explore this event in more detail.

3. Understanding the U.S. Midterm Elections

The U.S. midterm elections are general elections held midway through the president's 4-year term.

In the midterm elections, 453 seats in the House of Representatives and 35/100 seats in the Senate will be selected. Additionally, the governors of 39 states and territories, as well as other state and local races, will also take place at the same time. The results will determine the makeup of the 118th U.S. Congress.

The Functions of the U.S. Congress:

The two chambers of the U.S. Congress, the Senate and the House of Representatives, have equal legislative and judicial powers; declaring war; regulating commerce; monetary policy (taxes, printing money, borrowing money, etc.).

However, there are some differences:

House of Commons | The Senate |

In the House of Representatives, the majority party will hold the main power in the house to draft laws, plan for discussion and vote. In most cases, House rules will limit debate so that important legislation/laws can be passed on legislative day. | In the Senate, the majority holds planning power when bills come to Congress for a vote, but a Senator can delay the time it takes a piece of legislation to Congress for a vote. Because debate in the Senate cannot end until 60 Senators vote to pass it. |

Midterm election process:

Phase 1: Election Campaign

In this phase, the Parties can carry out campaigns to support their own candidates in order to gain an advantage in the official election or for other political purposes.

Phase 2: Federal Election

Elections for members of the Senate and House of Representatives will be held, alongside special elections, which include two special Senate races and eight special House races to fill vacancies created by recalls or resignations.

Additionally, states and localities will conduct their own elections to select candidates for various offices, including gubernatorial, secretary of state, and attorney general elections at the state level, as well as mayoral elections at the local level.

The results will be determined in the next session of the United States Congress. These election outcomes will influence whether the Democratic Party or the Republican Party dominates in enacting and implementing policies moving forward.

4. Some Important Events That Happened During the U.S. General Elections 2024

The 2024 U.S. General Elections have been marked by several significant events that shaped the political landscape leading up to Election Day on November 5, 2024.

Biden Withdraws: In March 2024, President Joe Biden announced his withdrawal from the race, prompting an emergency transition for the Democratic nomination. Vice President Kamala Harris quickly stepped in, securing her position as the Democratic candidate with overwhelming support from party delegates.

Republican National Convention: The Republican National Convention took place in July 2024 in Milwaukee, where former President Donald Trump was officially nominated as the Republican candidate, alongside Ohio Senator J.D. Vance as his running mate.

Key Supreme Court Rulings: Throughout the election cycle, pivotal Supreme Court decisions influenced campaign issues. Notably, the court ruled against efforts to remove Trump from ballots based on the Fourteenth Amendment, further entrenching his position within the Republican Party.

Abortion and Economic Issues: Abortion rights emerged as a central topic following the Supreme Court's Dobbs v. Jackson Women's Health Organization decision in 2022, which overturned Roe v. Wade. This issue resonated strongly with voters, especially in swing states where referenda on abortion rights were set to appear on ballots. Economic concerns also dominated discussions, particularly inflation and healthcare costs, with both candidates proposing extensive federal interventions.

Debates and Campaign Dynamics: The campaign featured several high-stakes debates, including a vice-presidential debate between Kamala Harris and J.D. Vance. These debates were crucial for shaping public perception and voter sentiment as both parties sought to rally their bases ahead of Election Day.

These events collectively illustrate a highly dynamic and contentious election cycle, underscoring the critical issues at stake and the intense competition between the major parties.

5. How will the US elections affect the stock markets in 2024 and 2025?

The US presidential election has various impacts on the stock market. The quadrennial presidential election will have a significant impact on US policies, laws, and foreign relations. Analysts at US banks have analyzed market data since 1930 and found a relatively regular cyclical pattern of the presidential election's impact on the stock market.

Historical data on the S&P 500 index shows that on average, the performance of the stock and bond markets is weaker in the year before a presidential election compared to other times. During the election period, the stock market's performance was also slightly worse. After the election, there are different variables that impact the stock market, and stock market returns often decline slightly in the following year, while bond performance is slightly better than during the election.

The stock market's volatility is not significantly impacted by the elected president. Analysts found that when a new party takes office, the stock market rises an average of 5%. When the same president is re-elected, stock returns rise slightly, reaching 6.5%. Political issues are usually not the key factors considered by the market. Regardless of which party's candidate is elected, there is usually not a significant overall impact on the stock and bond markets, because "the market does not like uncertainty".

However, key policy adjustments with significant impact can influence the market's direction. Policies in the four key areas of fiscal, monetary, market, and trade can have a greater impact on the real economy and the stock market. These policies may lead to changes in market valuations.

As for how to reasonably avoid the risks that the US presidential election may bring to the stock market, it is wise to closely monitor which industries are most likely to be affected by the presidential election. But there is no need to panic about market volatility during the election season or its aftermath. Even without the impact of the election, increased volatility may not necessarily mean bad news, especially when the economic situation is good.

For investors, the focus should be on relevant policies with significant impact, rather than the competition between candidates and parties. Investors should pay more attention to their own investment portfolios and ensure rebalancing when necessary. For the presidential election, it is suggested that investors ensure they have a diversified investment portfolio and develop a medium to long-term investment plan to cope with the variable factors that may impact the capital market during the election.

Regardless of the election result, for investors, it is still important to understand the situation and changes in macro policies. While understanding the volatility and performance patterns in election years may generate some investment opportunities, the key is to have a long-term investment strategy and risk control measures to cope with the uncertainties in the market.

The 2024 U.S. elections are poised to significantly impact the stock markets in both 2024 and 2025, depending on the outcome between Vice President Kamala Harris and former President Donald Trump. According to analysis from The Hill, a Trump victory could lead to a boost in sectors like energy and defense, benefiting companies such as Exxon Mobil and Lockheed Martin due to expected deregulation and increased government spending. Conversely, a Harris presidency is likely to stimulate growth in renewable energy stocks and healthcare sectors, as her administration may prioritize clean energy initiatives and healthcare reforms.

Market reactions are anticipated to be volatile leading up to and immediately following the election, as investors adjust their portfolios based on the expected policies of the winning candidate. Historically, election years see heightened trading volumes in sector-specific ETFs, reflecting investor sentiment about potential policy shifts. For instance, sectors sensitive to regulatory changes, like financials, could see significant movements; banks may benefit from deregulation under Trump, while tighter regulations could impact tech stocks under Harris. Moreover, economic forecasts suggest that uncertainty surrounding the elections could create a risk premium in the markets.

Analysts from Capital Economics warn that Trump's policies might lead to slower growth and higher inflation, which could negatively affect overall market performance. In contrast, if Harris wins, a continuation of current fiscal policies might support market stability and growth. Overall, the stock market's trajectory will largely depend on the election outcome and subsequent policy implementations, making it crucial for investors to stay informed about electoral developments as they prepare for potential market shifts in 2024 and beyond.

6. Conclusion

Political events are an inseparable factor in analyzing market trends, especially in powerful economies like the US.

The impacts can vary by time and scale of the event, but traders should not overlook them. Through this article, we hope readers have gained a basic understanding of elections in the US and their effects on the market.

7. FAQs

# Who won the U.S. election in 2024?

As of now, Donald Trump has won the U.S. election in 2024, securing 312 of 538 electoral votes, including all seven battleground states.

# When is the next US election?

The 2028 United States presidential election will mark the 61st quadrennial presidential election, set to take place on Tuesday, November 7, 2028.

# Do stock markets prefer a particular political party?

While market reactions often vary, historically, the stock market does not consistently favor one political party over another. Instead, markets react more to stability, clear policies, and investor confidence in the government’s economic direction. However, certain sectors may perform better under specific administrations based on their policies, such as healthcare or energy.

# How does uncertainty around election results affect the stock market?

Prolonged uncertainty, such as delayed election results or disputes over the outcome, can increase volatility and negatively impact investor sentiment. Uncertainty creates risks, as investors become cautious about the future direction of the economy and policy changes, which may lead to temporary sell-offs.

# What role do interest rates play in election-related market reactions?

The Federal Reserve's monetary policy, including interest rates, plays a critical role in how markets react during election periods. If markets expect higher government spending or inflationary policies, interest rates may rise, impacting borrowing costs and economic growth. Investors often closely watch the Fed's actions during an election year to gauge potential market impacts.

# Does election year volatility always negatively impact the stock market?

Election-year volatility can create both risks and opportunities for investors. While some sectors may experience temporary declines due to uncertainty, others might benefit from anticipated policy changes. The market’s reaction to elections is complex and does not always result in a negative impact. In fact, many investors use volatility to find attractive entry points for long-term investments.

# How long will the elected officials serve?

Elected Senators will serve a six-year term, from January 3, 2029, to January 3, 2035. The President and Vice President will serve a four-year term.

Before making any trading decisions, it is important to equip yourself with sufficient fundamental knowledge, have a comprehensive understanding of market trends, be aware of risks and hidden costs, carefully consider investment targets, level of experience, risk appetite, and seek professional advice if necessary.

Furthermore, the content of this article is solely the author's personal opinion and does not necessarily constitute investment advice. The content of this article is for reference purposes only, and readers should not use this article as a basis for any investment decisions.

Investors should not rely on this information as a substitute for independent judgment or make decisions solely based on this information. It does not constitute any trading activity and does not guarantee any profits in trading.

If you have any inquiries regarding the data, information, or content related to Mitrade in this article, please contact us via email: insights@mitrade.com. The Mitrade team will carefully review the content to continue improving the quality of the article.