The Non-Farm Payrolls (NFP) report is a crucial economic indicator that provides insights into employment trends in the U.S. economy, excluding sectors like agriculture, government, and non-profit organizations.

NFP data significantly influences various financial markets, including stocks, foreign exchange, cryptocurrencies, and indices. Understanding its impact is essential for investors and analysts alike.

1. What are non-farm payrolls?

Non-farm payrolls (non-farms or NFP) is one of the most important economic indicators in the U.S. economy. The U.S. Non-Farm Payrolls (NFP) index is a monthly data report on employment conditions published by the U.S. Bureau of Labor Statistics. This index provides information on changes in employment within the U.S. economy, covering all sectors except for non-profit organizations, private household employees, government employees, and those working in agriculture.

NFP data is also closely related to the unemployment rate, working conditions across industries, and average hourly wages. This index is often used to reflect the employment situation and fluctuations in business production across various economic sectors. NFP is one of the most important indicators of the U.S. economy and has a significant impact on fluctuations in the value of the U.S. dollar, U.S. Treasury bonds, U.S. stocks, gold, and other financial markets.

In news reports, we often hear terms like "NFP" and "ADP." So, what do these terms actually mean?

The U.S. Bureau of Labor Statistics publishes non-farm payroll (NFP) data, which highlights the growth and development of the manufacturing and service sectors. Each month, approximately 131,000 businesses and government agencies, representing around 670,000 worksites, are surveyed.

The ADP National Employment Report, produced by the ADP Research Institute, offers forecasts on the non-farm employment landscape in the U.S., although it is not publicly disclosed. This report compiles data from over 500,000 anonymous companies nationwide.

2. When will Non-farm payrolls (NFP) be released?

The NFP is a monthly report released on the first Friday of each month. For the exact release date, you can check the official calendar or website of the Bureau of Labor Statistics.

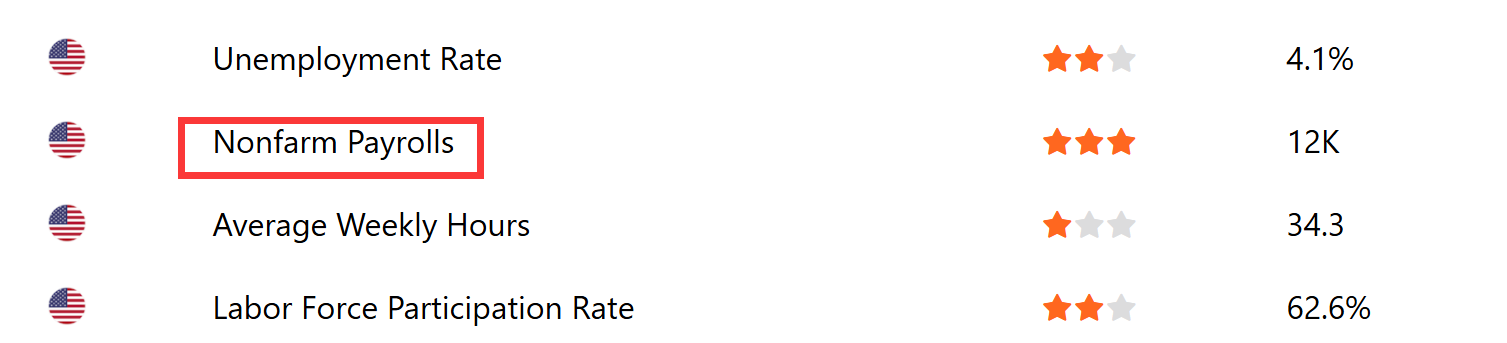

Alternatively, you can use our economic calendar tool to access the latest Non-farm Payrolls data.

3. What are the Details and Statistical Scope for Non-Farm Payroll (NFP) Data?

The establishment survey portion of the employment situation report provides details on nonfarm payroll additions, commonly referred to as the nonfarm payrolls report. Key components of the establishment survey include:

The total number of nonfarm payrolls added for the reporting month

Nonfarm payroll additions by industry category, such as durable goods, non-durable goods, services, and government

Details on hours worked

Information on average hourly earnings

The statistical scope of Non-Farm Payroll (NFP) data includes information related to workers engaged in non-agricultural sectors in the United States. This encompasses the number of people employed in manufacturing, construction, and the service industry.

However, certain groups are not included in the NFP index, such as:

Farmers

Private household employees (e.g., domestic workers)

Government employees, including military personnel and officials

Freelancers

Employees of non-profit organizations

Self-employed individuals not affiliated with non-agricultural companies

These groups are excluded from NFP data because they are not employed in non-agricultural sectors but instead work in fields such as agriculture, family businesses, government, or self-employment.

4. Impact of Non-Farm Payroll Data on Financial Markets

Stock Market

When non-farm payroll data exceeds expectations and shows steady growth, investors often believe the economy is performing well. This typically generates optimism in the stock market, creating a positive sentiment that drives stock prices higher.

Investors recognize a positive correlation between job growth, corporate profits, and consumer spending. As a result, they tend to increase their exposure and invest in stocks. Conversely, when non-farm payroll data falls short of expectations or is weak, investors may become concerned about slowing economic growth, which can lead to a decline in stock prices.

Foreign Exchange Market

Non-farm payroll data also significantly affects the value of the U.S. dollar. When the non-farm payroll index exceeds projections, the U.S. economy is perceived to be growing well. This increases demand for the U.S. dollar, raising its value against other currencies.

On the other hand, when non-farm payroll data does not meet expectations or is weak, the market may become skeptical about growth prospects, leading to decreased demand for the dollar. Investors might shift to other currencies to diversify their investments or seek higher returns.

Cryptocurrency Market

Although non-farm payroll data has little direct impact on the cryptocurrency market, it can create indirect effects. When the non-farm index is stronger than expected, investors often feel more stable and confident in traditional financial markets, reducing demand for high-risk assets like cryptocurrencies and decreasing trading volume in the crypto market.

Conversely, if non-farm payroll data is lower than expected, it may raise concerns about economic growth prospects, leading some investors to turn to alternative investments like cryptocurrencies to preserve value or seek higher returns.

Index Market

Non-farm payroll data also significantly affects the index market. When NFP figures are stronger than expected, expectations for economic growth rise. Investors often view job growth as a crucial indicator of economic health, leading them to increase their exposure to the index market, which can trigger upward momentum.

In contrast, when non-farm employment figures do not meet expectations, it may raise concerns about global economic growth prospects. Investors might perceive signs of a slowing or contracting economy, resulting in a decline in the index market. They may reduce investments in the index market and shift to safer or more stable assets.

It is important to note that these impacts primarily depend on how much non-farm payroll data deviates from market expectations and the interaction of various other factors. We recommend that investors assess these different factors and make investment decisions wisely and carefully.

5. Summary

Positive NFP results typically boost investor confidence, leading to higher stock prices, increased demand for the U.S. dollar, and a shift away from high-risk assets like cryptocurrencies.

Conversely, disappointing NFP figures can raise concerns about economic growth, resulting in declines in stock and index markets and potential shifts toward safer investments.

The article emphasizes the importance of considering NFP data in the broader context of market expectations and other influencing factors for informed investment decisions.

Before making any trading decisions, it is important to equip yourself with sufficient fundamental knowledge, have a comprehensive understanding of market trends, be aware of risks and hidden costs, carefully consider investment targets, level of experience, risk appetite, and seek professional advice if necessary.

Furthermore, the content of this article is solely the author's personal opinion and does not necessarily constitute investment advice. The content of this article is for reference purposes only, and readers should not use this article as a basis for any investment decisions.

Investors should not rely on this information as a substitute for independent judgment or make decisions solely based on this information. It does not constitute any trading activity and does not guarantee any profits in trading.

If you have any inquiries regarding the data, information, or content related to Mitrade in this article, please contact us via email: insights@mitrade.com. The Mitrade team will carefully review the content to continue improving the quality of the article.