Why Does the Fed Raise Interest Rates? The Impact of the Fed's Interest Rate Hikes

The financial markets are always dynamic and constantly changing, and one of the key factors impacting these markets is the Federal Reserve's (Fed) interest rate policy. The Fed's continuous interest rate hikes from March 2022 up to the present have drawn the attention of all financial and economic experts, as well as investors.

Specifically, how will the Fed's interest rate hikes impact various financial markets such as stocks, gold, or Bitcoin? To hedge against inflation, investors should invest in which markets? The following article aims to help investors understand this issue better.

1. Historical cycles of the Federal Reserve raising interest rates

The Fed has raised interest rates in several cycles over the past few decades:

1980s Cycle:

Under Chair Paul Volcker's leadership, the Fed aggressively raised rates in the early 1980s to combat high inflation, reaching a peak of around 20% in 1981.

This sharp tightening helped bring down inflation from double-digit levels, but also contributed to a severe recession in 1981-1982.

1990s Cycle:

The Fed gradually raised rates from 1994 to 2000 as the economy expanded, raising the federal funds rate from 3% to 6.5%.

This was done to slow down an overheating economy and keep inflation in check.

2000s Cycle:

In response to the 2001 recession, the Fed cut rates sharply in the early 2000s, bringing the federal funds rate to 1%.

It then raised rates from 2004 to 2006, taking the benchmark rate from 1% to 5.25%, as the economy recovered.

2010s Cycle:

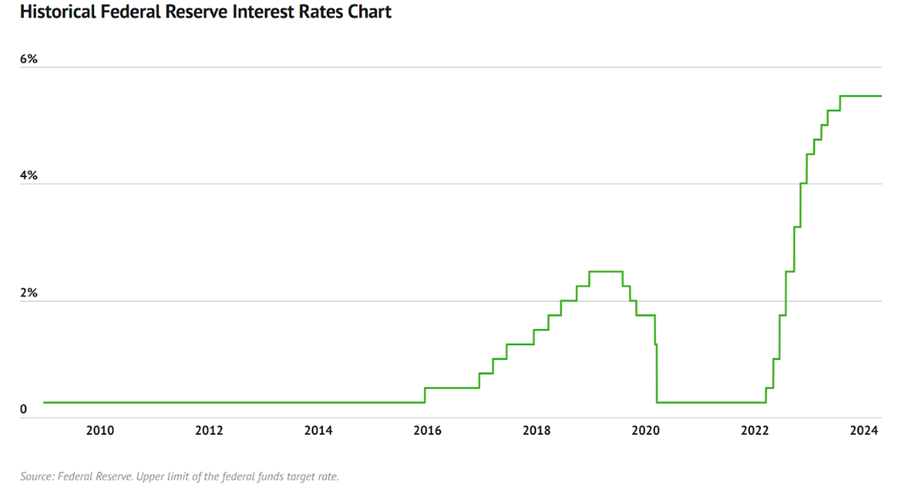

After cutting rates to near-zero during the Great Recession, the Fed began a slow and steady rate hike cycle in 2015.

It raised rates a total of nine times, taking the federal funds rate from 0.25% to 2.25-2.50% by the end of 2018.

2020s Cycle:

The Fed aggressively cut rates to near-zero in March 2020 in response to the COVID-19 pandemic.

It then began raising rates in March 2022 to combat the highest inflation in 40 years, taking the federal funds rate from near-zero to 4.25-4.50% by the end of 2022.

Each rate hike cycle has played out differently based on the economic conditions at the time. Investors need to closely monitor the Fed's policy actions and adjust their strategies accordingly.

2. Why did the Fed raise interest rates in 2022?

Inflationary pressure was the catalyst for the Fed to raise interest rates

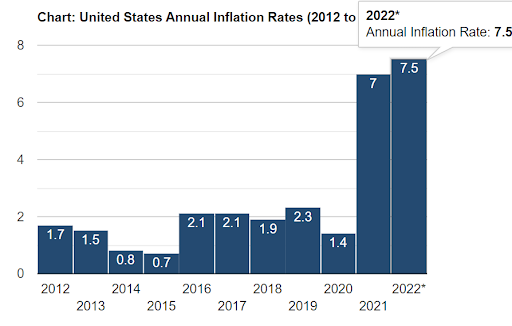

Since November 2021, the US Consumer Price Index (CPI) has risen to 6.8% year-over-year, becoming the highest increase in the US in 39 years.

At this time, inflation had been above the Fed's 2% target for 10 consecutive months. All costs in the US were rising rapidly, such as food prices up 6.4% year-over-year and energy prices (gas and electricity) up over 33% from a year earlier...

Faced with this situation, the Fed needed to act quickly to raise interest rates to reduce damage to consumers and the economy, and bring the targeted inflation back to 2%.

The labor market has stabilized compared to before the pandemic

In March 2020, in order to alleviate the recession that occurred when the economy began to shut down due to the initial impacts of Covid-19, the Fed quickly cut interest rates to 0. At that time, more than 40 million workers - equivalent to a quarter of the US labor force - fell into unemployment, an unprecedented number.

Even though the US recession only lasted two months before the economy started to recover, the Fed continued to support many workers and businesses by maintaining the zero interest rate.

At the present time, the US labor market has started to grow again. In November 2021, the number of unemployed Americans fell to 3.9 million, with a national labor force participation rate of 61.8%, only 1.5% lower than in February 2020.

As the labor market has begun to stabilize again, the need for the Fed to maintain a 0% interest rate is no longer necessary. At this point, the Fed is likely to focus more on actions to stabilize prices.

Latest 12-month average US inflation data (Source: usinflationcalculator.com)

3. The Fed has raised interest rates between 2022 and 2024

After about 2 years of lowering interest rates to 0 - 0.25% (March 2020 - February 2022) to support the economy during the Covid-19 pandemic, the Fed began raising interest rates again starting in March 2022 due to persistently high inflation.

The timeline of the Fed's interest rate hikes from 2022 to present

2022

June 16, 2022: The Fed raised interest rates to a range of 1.50% to 1.75%.

July 28, 2022: The Fed raised interest rates to a range of 2.25% to 2.50%.

September 22, 2022: The Fed raised interest rates to a range of 3.00% to 3.25%.

November 2, 2022: The Fed raised interest rates to a range of 3.75% to 4.00%.

December 14, 2022: The Fed raised interest rates to a range of 4.25% to 4.50%.

2023

January 31, 2023: The Fed raised interest rates to a range of 4.50% to 4.75%.

March 22, 2023: The Fed raised interest rates to a range of 4.75% to 5.00%.

May 3, 2023: The Fed raised interest rates to a range of 5.00% to 5.25%.

June 14, 2023: The Fed raised interest rates to a range of 5.00% to 5.25%.

July 26, 2023: The Fed raised interest rates to a range of 5.25% to 5.50%.

2024

June 12, 2024: The Fed is expected to maintain interest rates at their current level of 5.3%.

4. How will the FED's interest rate hike impact the markets?

Aside from the notable events surrounding the Ukraine-Russia conflict, the Fed's interest rate hikes in 2022/2023 have had impacts on major financial markets such as cryptocurrency, stocks, gold, and forex. What will happen to these markets?

+Cryptocurrency

In the past, cryptocurrency was often seen as a "cure-all" for everything investors faced: inflation, low interest rates, a weakening dollar, recessions, etc. Many investors expected that in subsequent developments at the Fed, cryptocurrency would also play a key role and become a viable investment channel.

From the opposite perspective, some analysts argue that recently, cryptocurrency has been operating in a similar mechanism to other risky assets. For example, in December 2021, when the Fed announced it would begin tapering bond purchases and signal an upcoming interest rate hike program, cryptocurrency reacted quickly by dropping more than 30% in value.

In 2022, the cryptocurrency market also fell into a downward trend, with market capitalization dropping to around $757 billion by the end of 2022, a loss of nearly 73% compared to the peak reached in November 2021 ($2.847 trillion).

From the beginning of 2023 to the present, the cryptocurrency market has shown a resurgence, with Bitcoin increasing by ~78%, Ethereum increasing by ~60%, and the total market capitalization returning to over $1 trillion. In addition to the impact of the Federal Reserve slowing the pace of interest rate hikes, the recovery of the cryptocurrency market may also be related to the current instability in the banking system.

+Gold

In 2022, the geopolitical tensions due to the escalation of the Russia-Ukraine war were expected to be a factor driving a significant increase in gold prices. However, gold prices actually fell sharply in 2022 as the Federal Reserve continued to raise interest rates.

Gold Prices and U.S. Dollar Correlation - 05 Year Chart (Source: macrotrends.net)

Directly, when interest rates rise, other investments such as bonds or bank deposits become more attractive to investors. This may cause investors to sell gold to switch to other investments, leading to a decrease in gold prices.

Indirectly, as interest rates rise, the US dollar becomes stronger (increasing by 18% in the first 10 months of 2022), causing gold prices to fall. Gold trades in US dollars, and an increase in the dollar's value forces foreign buyers to pay more for the same amount of gold, thereby decreasing the demand for gold.

Although interest rates remain at high levels, the instability in the financial system has increased the risk of a prolonged recession and the possibility of the Federal Reserve pausing interest rate hikes earlier, causing the US dollar to decline. Since the beginning of 2023, gold prices have risen sharply, sometimes regaining the $2,000 mark.

+Forex

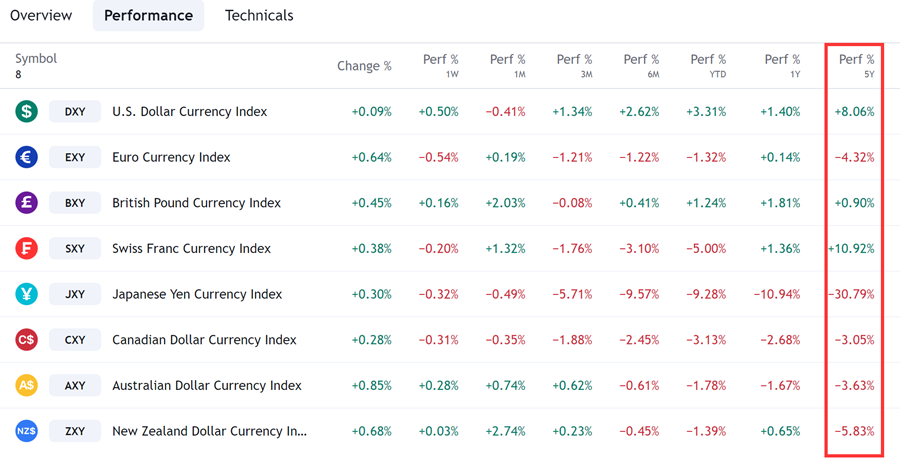

Indices of major currencies (Source: Tradingview)

According to financial analysts, the Federal Reserve's interest rate hikes and the start of reducing its bond holdings will give the US dollar an advantage compared to other major currencies.

In a recent survey conducted by Reuters with 49 foreign exchange strategists, nearly two-thirds of the analysts said that interest rate differentials will determine sentiments in major foreign exchange markets in the coming period, and the majority expect the foreign exchange market to rise in the next three months.

When the Fed raises interest rates, the value of the US dollar consistently rises, making it more attractive to investors due to higher yields. However, as the US dollar appreciates, other currencies will depreciate against the dollar, affecting the exchange rates and values of various currency pairs in the forex market.

In 2022, Japan's continued low-interest rate policy to support its economy led to a sharp rise in the USD/JPY exchange rate, while the EUR/USD rate fell significantly. However, with interest rate adjustments by central banks and Japan's interventions in the foreign exchange market, the exchange rates of various currency pairs have stabilized since the beginning of 2023.

+Stocks/Indexes

In theory, when the US interbank interest rate rises, investors tend to shift to other investment channels such as bank savings, bonds, and certificates of deposit. Businesses also suspend their growth plans. Both of these can cause the stock market to turn and decline.

However, in reality, analysts argue that there is quite little correlation between rising interest rates and a declining stock market in the history of the US stock market. For example, during a series of interest rate hikes from June 29, 2004 to September 17, 2007, the federal funds rate rose from 1.0% to 5.25%, but the Dow Jones Industrial Average (DJIA) increased by 28.7%. Even in 2017, the Fed raised interest rates three times and the S&P 500 also rose by more than 18%.

Typically, the Fed's interest rate hikes will cause immediate psychological reactions a few sessions before or after the rate hike.

In 2022 specifically, the stock market declined sharply as interest rates rose, which also came from investors' concerns about an economic recession, making investment cautious and reducing liquidity. In 2023, the market has rebounded as interest rates tend to slow down.

All of this suggests that the overnight lending rate is not the only factor with a significant impact on the profitability of the stock market. The Fed's rate hikes will make the economy continuously volatile for a year, but it is not certain to affect the already strong US economy, and of course it is not certain to have a major impact on the stock market.

In summary, if you are still worried about the impact of the Fed raising interest rates, investors should have a diversified investment portfolio strategy to withstand short-term volatility.

5. How Should Investors Respond to Fed’s Interest Rate Hikes?

How should ordinary investors respond to the Federal Reserve's interest rate hikes?Here are a few suggestions:

Suggestion 1: Invest in the US Dollar

When the Federal Reserve raises interest rates, the US dollar will appreciate. Therefore, investing in the US dollar is the best choice. There are many ways to invest in the US dollar, such as bank currency exchange, futures, contracts for difference (CFDs), etc.

0 commission, low spreads

0 commission, low spreads Diverse risk management tools

Diverse risk management tools Flexible leverages and instant analysis

Flexible leverages and instant analysis Practice with $50,000 risk-free virtual money

Practice with $50,000 risk-free virtual money

Suggestion 2: Adjust Your Stock Portfolio

Interest rate hikes will impact the stock market, especially high-valuation stocks (like tech stocks). Therefore, it's best to reduce positions in high-valuation stocks and increase positions in high-dividend stocks, such as financial stocks.

Suggestion 3: Implement Hedging

In addition to reducing stock positions, we can also hedge by shorting indices.

The S&P 500 Index and the Nasdaq 100 Index are highly positively correlated with global markets. Shorting the S&P 500 or Nasdaq 100 Index can help you offset losses from a drop in your domestic stock market.

The Correlation between the S&P 500 Index, Dow Jones Index and the Nasdaq 100 Index (Source: Tradingview)

Suggestion 4: Capitalize on Policy Rate Changes

When interest rates rise, the stock market often tends to decline, which could be a good time for investors to short sell or accumulate stocks for the long-term. Conversely, when interest rates fall, the stock market will become more positive, and participating then can bring significant profits to investors.

However, traders need to carefully evaluate the price trends of individual stocks and manage risk in the buying and selling process.

Suggestion 5: Allocate Capital Appropriately

Financial markets such as stocks, forex, gold, and cryptocurrencies may react differently to the Fed's interest rate hikes and cuts, and they may not always repeat historical price patterns.Therefore, traders need to evaluate the actual context and allocate capital appropriately, adjusting their portfolios to minimize the risk of losses.

Suggestion 6: Short-term Investment Can Be a Good Option for Some Traders

Some investors place great importance on the future investment value and have a relatively strong risk tolerance. These people will choose short-term investment strategies.

In contrast, individual traders without large investment capital will always engage in short-term trading like day trading. This approach can capture opportunities from market fluctuations.

6. Conclusion

The U.S. Federal Reserve's interest rate hikes are having a significant impact globally, including on markets and currencies outside of the United States. Countries like Japan have seen their currencies depreciate and stock markets decline as a result of these rate increases.

However, the changing monetary policy environment also creates opportunities for investors, both domestic and international. Strategies such as investing in the U.S. dollar, financial sector stocks, or taking short positions on stock indexes can allow investors to benefit from the rising rate environment.

It's important for all investors to closely monitor the Fed's actions and be prepared to adjust their portfolios accordingly. The end of an interest rate hike cycle often brings a reversal, so investors need to time their moves carefully to maximize gains and minimize losses.

Overall, while the Fed's rate increases present challenges, proactive and nimble investors can identify and capitalize on the opportunities that arise amidst the shifting market dynamics. Prudent portfolio management will be key to navigating this environment successfully.

Before making any trading decisions, it is important to equip yourself with sufficient fundamental knowledge, have a comprehensive understanding of market trends, be aware of risks and hidden costs, carefully consider investment targets, level of experience, risk appetite, and seek professional advice if necessary.

Furthermore, the content of this article is solely the author's personal opinion and does not necessarily constitute investment advice. The content of this article is for reference purposes only, and readers should not use this article as a basis for any investment decisions.

Investors should not rely on this information as a substitute for independent judgment or make decisions solely based on this information. It does not constitute any trading activity and does not guarantee any profits in trading.

If you have any inquiries regarding the data, information, or content related to Mitrade in this article, please contact us via email: insights@mitrade.com. The Mitrade team will carefully review the content to continue improving the quality of the article.