Concept

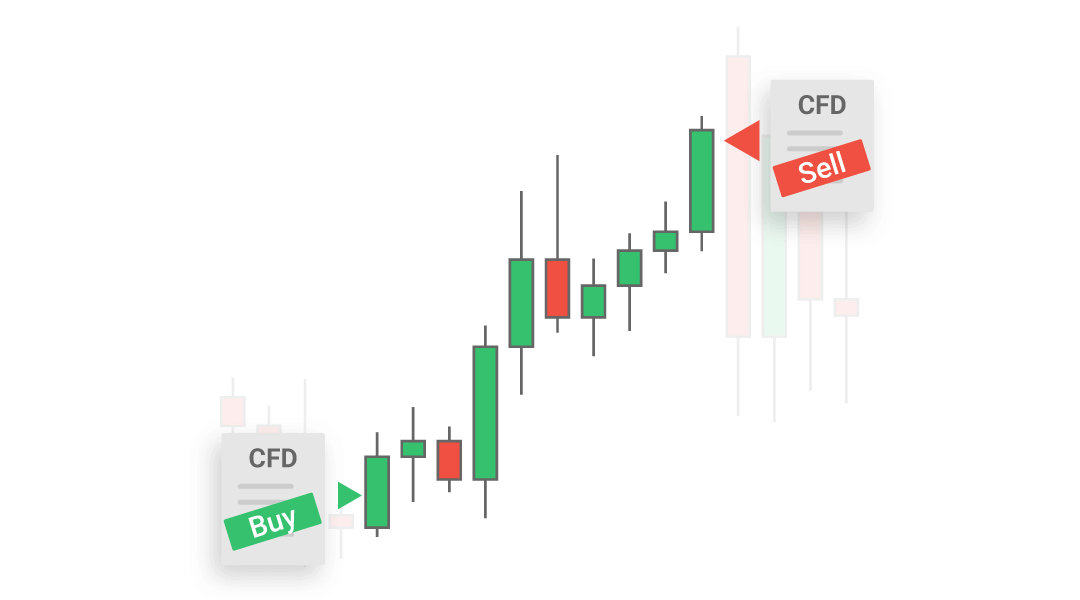

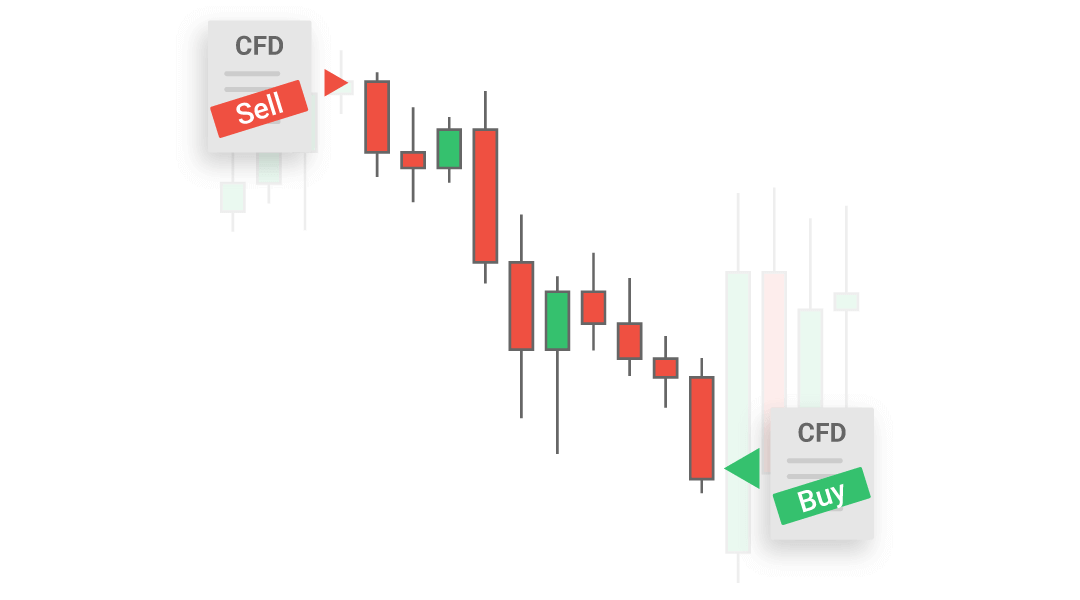

Contract for difference (CFD) refers to a contract between two parties in a trade. This contract is derived from an underlying asset, and traders do not own the said asset.

-

Forex

-

Indices

-

Commodities

-

Shares

Advantage

Compared with traditional finance markets, CFD trading has many advantages. Traders can trade anytime, anywhere they want.

-

24-Hour Trading

-

Global Markets

-

Low Initial Capital Requirement High Leverage

-

T+0 Settlement