CrowdStrike: Repricing the Architecture of Cybersecurity

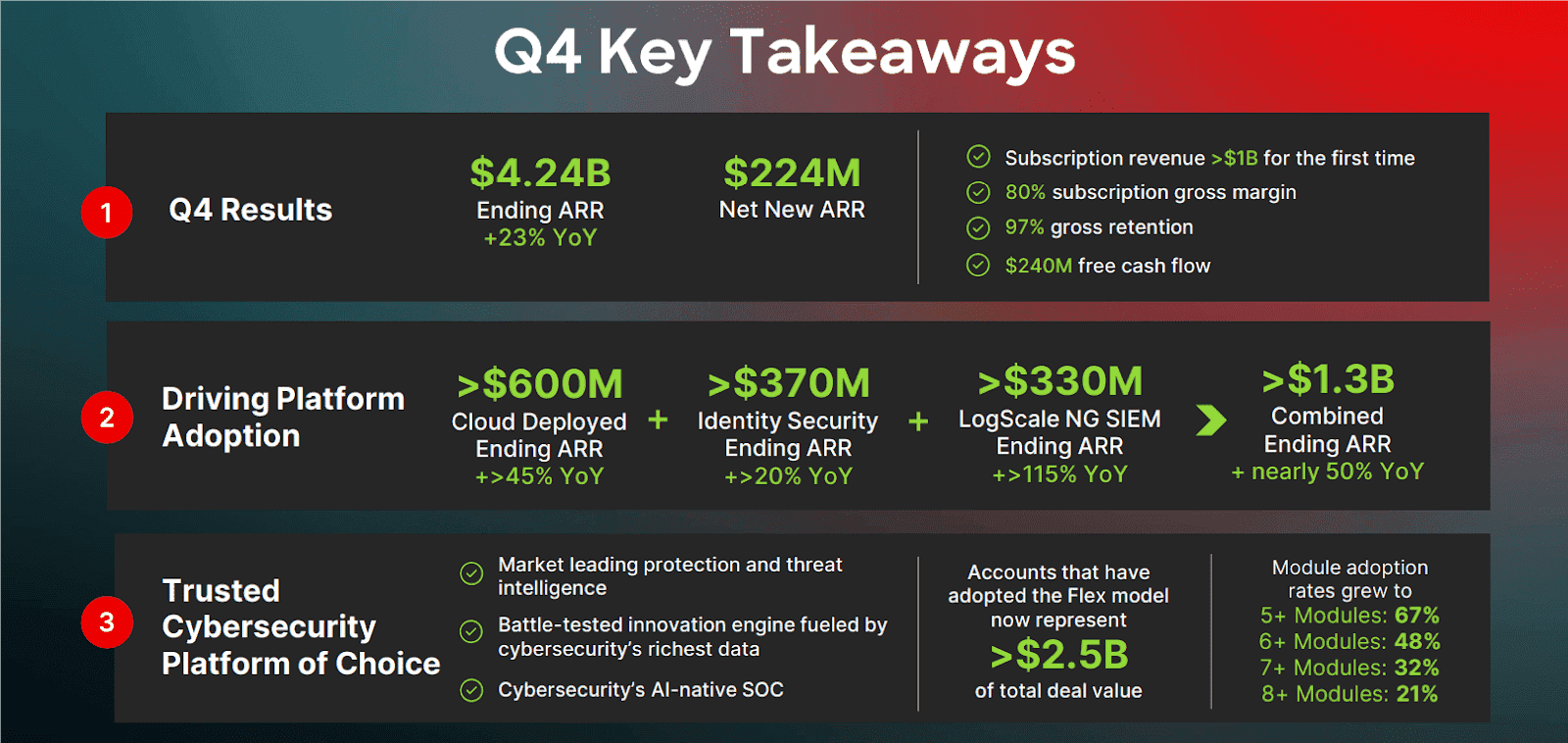

- CrowdStrike reached $4.24 billion in ARR with 67% of customers using five or more modules; 48% use six or more, and 21% use eight or more modules.

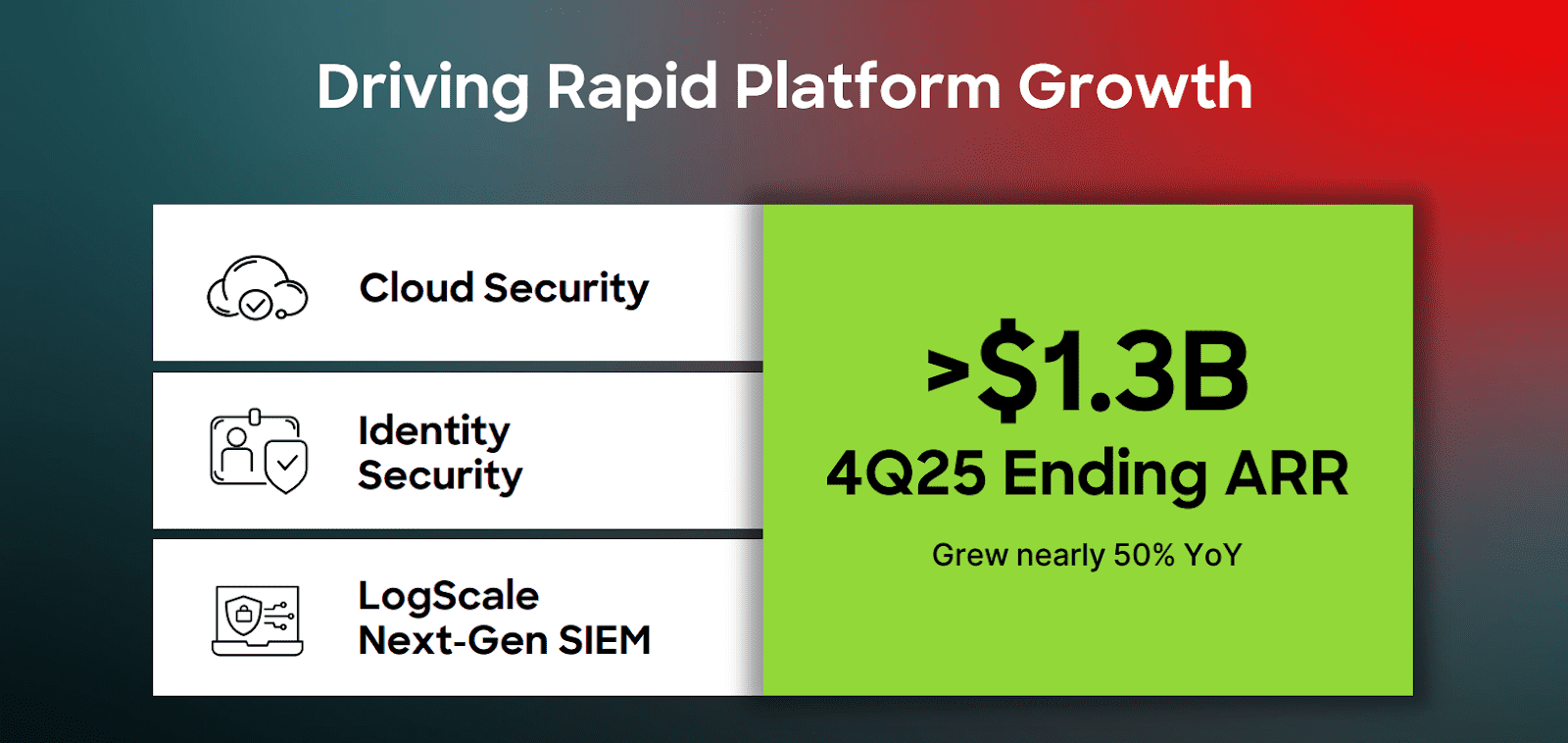

- Core platform segments are growing rapidly—Cloud Security hit $600M ARR (+45% YoY), Identity Protection $370M (+20% YoY), and LogScale SIEM $330M (+115% YoY), totaling $1.3B ARR at ~50% blended growth.

- FY25 free cash flow totaled $1.07 billion with a 27% margin (up from 22% in FY24), driven by 80% subscription margins and efficient CapEx, highlighting scalable SaaS economics.

- Management projects FY26 revenue between $4.74–$4.80 billion, non-GAAP net income of $851M–$883M, and aims for 27%+ FCF margin with long-term targets of 34–38% FCF margins by FY29.

TradingKey - In an AI-native world where security is ever-more defined by identity-driven and AI-native threats, most investors continue to look at cybersecurity through an historic lens, judging endpoint providers as point products, not full-spectrum operating systems for business risk. CrowdStrike (CRWD), with its AI-native Falcon platform, is shattering this model. No longer merely an endpoint protection leader, CrowdStrike is becoming an AI-native, multi-domain security platform that unites endpoint, identity, cloud, and observability into one data-driven control plane.

While the stock price has appreciated sizably, crowding out late entrants' easy alpha, still, the market underrates its long-run monetization quality inherent in its design. With $4.24 billion of ARR, 67% adoption of five or more modules, and free cash margins moving into 30%, CrowdStrike's structural leverage is only just beginning to show its full earnings potential. Here, this article deconstructs CrowdStrike's flywheel economics, competitive insulation, and valuation through an institutional framework, triangulating between its FY2025 financials, Q4 performance, and market share momentum.

Source: Q4 Deck

Security Cloud Flywheel: A Platform Designed for AI’s War Room

CrowdStrike's differentiator isn't only technological, it's architectural. Natively designed for the cloud, Falcon uses a single lightweight agent and horizontally scaled cloud backbone to collect and correlate endpoint, identity, container, and cloud workload data in real time. The Security Cloud is at the center of three proprietary data fabrics: Threat Graph, Asset Graph, and Intel Graph. Combined, these provide a holistically converged context for billions of security events daily.

Such a “collect-once, analyze-everywhere” architecture powers CrowdStrike's high rate of module adoption. With no requirement for incremental agents or for data pipes, each new product can be shipped friction-free, driving cumulative customer lifetime value. As of Q4 FY25, 48% of customers had six or more modules, and 21% had eight or more. Such module density creates high retention and expansion: gross retention is 97%, and net retention is 112%, one of SaaS's highest.

Three segments lead CrowdStrike's platform growth at this point: Cloud Security ($600M ARR, +45% YoY), Identity Protection ($370M ARR, +20% YoY), and LogScale SIEM ($330M ARR, +115% YoY). These aren’t additive feature sets, these are platform moves into $20B+ TAMs by IDC's estimate. Combined, these already represent more than $1.3 billion of ARR, growing at a nearly-50% blended growth rate.

Charlotte AI, CrowdStrike’s autonomous cybersecurity assistant, is an added capability. Unlike shallow LLM integrations, Charlotte is deeply integrated into detection triage, threat hunting, and response processes. Based on live telemetry of more than 20 trillion security signals weekly, Charlotte operates as a virtual Tier-1 analyst, lowering time-to-resolution and increasing SOC effectiveness. In a world of AI-first security, data quantity, quality, and latency become more important than models, and CrowdStrike controls all the stack.

Source: Q4 Deck

Running Ahead of the Pack: Benchmarking Competitors

Cybersecurity is a fragmented market between legacy incumbents (McAfee, Symantec), vertical experts (Zscaler, Okta), and platform contenders (Palo Alto, SentinelOne). CrowdStrike alone bridges endpoint, identity, cloud, and observability without trading off platform coherence. Its marketplace advantage lies not just with tech effectiveness, but with GTM execution, data gravity, and product breadth.

SentinelOne provides richly automated EDR but not first-party identity and SIEM functionality, with third-party integrations being used as an alternative. Palo Alto's Cortex is developing a similar platform but with heavy dependence upon M&A, which creates integration complexity and reduced organic module adoption. Microsoft Defender takes advantage of bundling strength, but lags with cross-domain correlation and suffers with increasing customer concerns regarding telemetry silos and report fatigue.

CrowdStrike’s module adoption and revenue diversification tell the story best. Deals over $1M grew to 350+ in Q4, and over 20 deals exceeded $10M in TCV, reflecting success in large enterprise and federal markets. Moreover, the Falcon Flex model, an innovation in procurement flexibility, now covers over $2.5B in cumulative deal value, offering long-term upsell paths with predictable revenue layering.

Operationally, CrowdStrike performs better than peers on profitability. It generated $1.07B of free cash flow during FY25 with a 27% margin, versus 22% last year. SentinelOne's still FCF-negative, and Zscaler's FCF margin (~22%) is below despite revenue scale similarity. With 80% subscription margins, minimal CapEx needs, and modest overhead of infrastructure, CrowdStrike attains SaaS scalability that is uncommon.

Valuation: Premium Multiple, Premium Fundamentals

At a valuation of ~$82 billion and trailing ARR of $4.24 billion, CrowdStrike is trading at a ~19x EV/ARR and ~58x forward free cash flow, based on achieving FY26 guidance. Premium to software peers, these multiples are warranted as a result of CrowdStrike’s singular combination of scale, scope, retention, and growth efficiency.

Subscription revenue grew 31% annually to $3.76 billion for FY25, and total revenue increased to $3.95 billion. Free cash flow for the year totaled $1.07 billion, and $240 million for Q4 alone. The company ended FY25 with a Rule of 40 score of 56, well into the top decile of all public SaaS companies.

Most significantly, monetization width is expanding. The company's future-looking pillars, Cloud Security, Identity, and LogScale SIEM, are generating over $1.3B of ARR and at a rate of growth higher than the core endpoint business. It lowers dependence upon a single use and raises customer lock-in through module growth.

Prospects for FY26 are for total revenue of $4.74–$4.80 billion and non-GAAP net income of $851M–$883M. Management anticipates finishing FY26 with a 27% or higher FCF margin and GAAP profitability by Q4. Long-term targets include operating margins of 28–32% and 34–38% FCF margins, which CrowdStrike believes it will achieve by FY29.

Relative to peer SaaS leaders, CRWD's valuation looks even reasonable. It's higher than Palo Alto Networks' 14x EV/ARR, Zscaler's 11x, and SentinelOne's 6x for good reason: it monetizes better, retains stronger, and compounds more reliably.

Source: Q4 Deck

Risk Assessment: Managing Execution, Competitiveness, and Trust

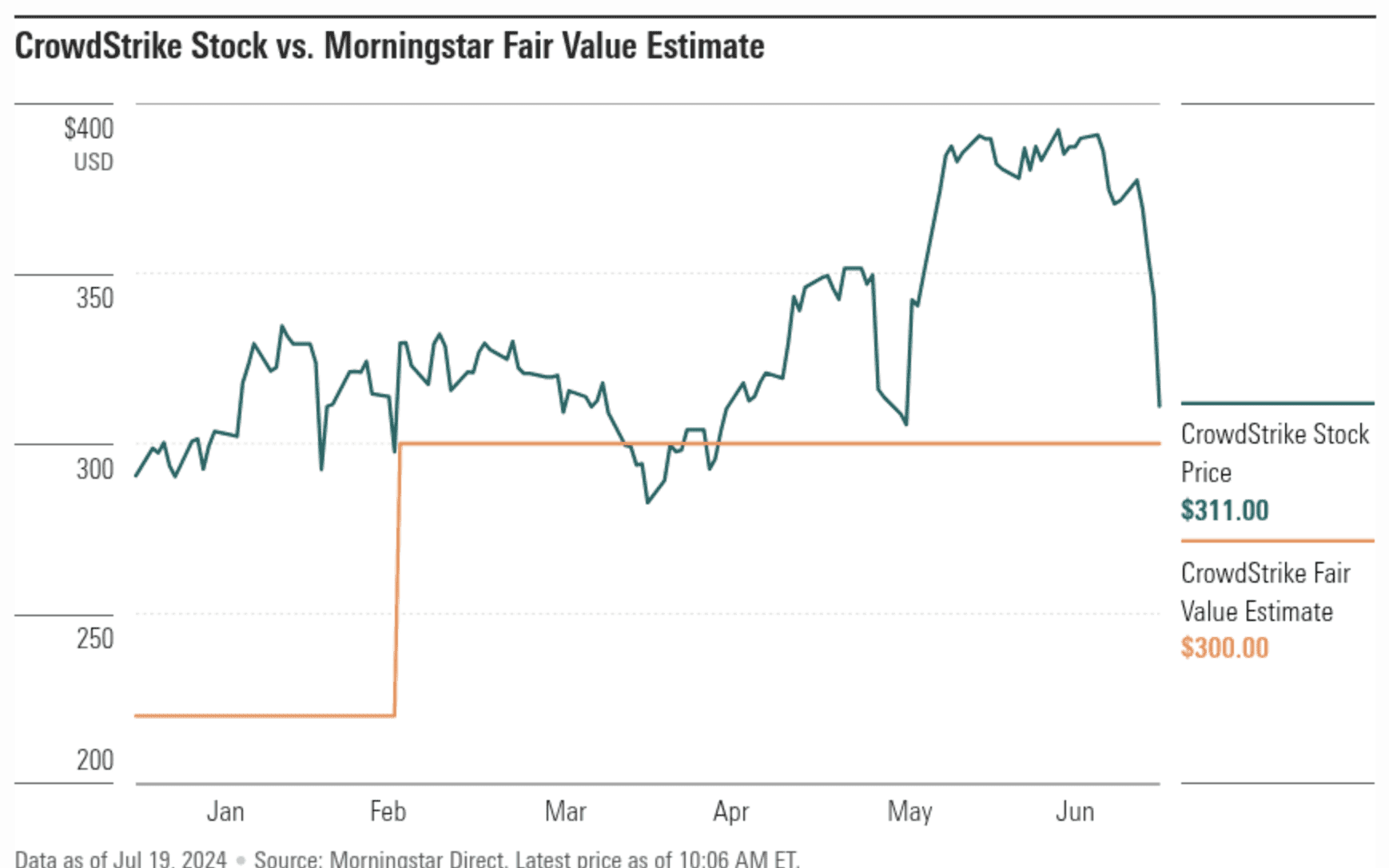

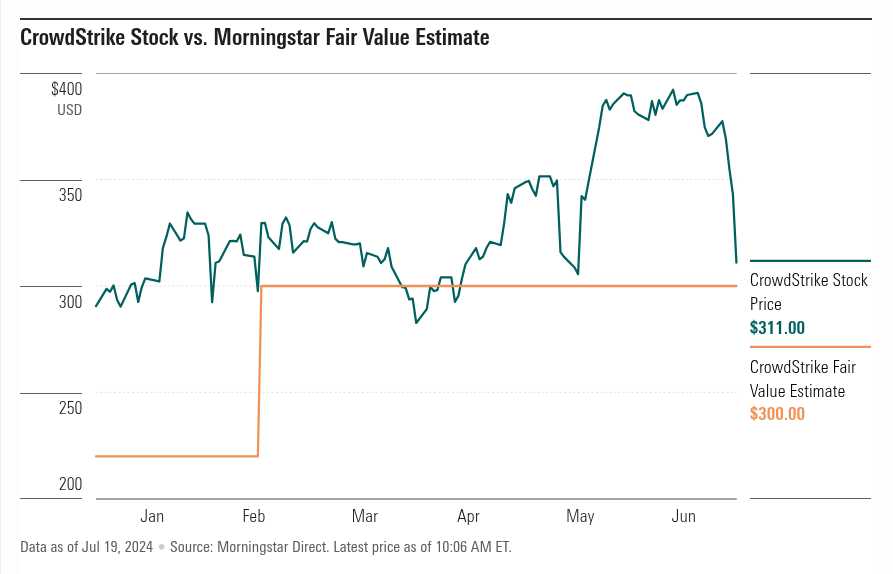

The most critical threat to CrowdStrike is still the enduring legacy of the July 19 Incident, which triggered a universal service outage linked to a problematic Falcon update. While quickly responding with support packages and taking ~$73 million of associated costs, reputational harm may not be fully reflected. Large commercial and governmental customers, especially, have long purchasing cycles where continuity of operations and trust are a priority. While CrowdStrike preserved robust gross retention (97%) and kept its net new ARR trend line intact during Q4, longer term, there is only the threat of renewal headwinds or elevated vendor scrutiny to potentially dampen module growth, most critically in regulated industries.

Secondly, there is structural pressure coming from platform bundlers such as Palo Alto Networks and Microsoft. Microsoft's Defender collection is building momentum with deep bundlings with Microsoft 365 at zero marginal cost to users. This threatens to price CrowdStrike out, especially in mid-sized and cost-sensitive corporations. Sure, Palo Alto's Cortex platform, which is not necessarily cloud-native, boasts deep-selling penetration and cross-products integration between firewalls, SASE, and SIEM. If CrowdStrike fails to be able to continue to demonstrate superior performance, integration, and ROI through its modularity, it could be at risk of price compression or expanded head-to-head platform evaluations.

Finally, its accelerating expansion into new adjacencies brings with it execution complexity. With 29 modules across endpoint, cloud, identity, observability, and managed detection, CrowdStrike must be careful not to fragment its product vision. With growing numbers of teams responsible for building and selling differentiated features, misalignment around GTM and customer confusion become risks. Any slowdown at new module adoption or trouble incorporating new capability into the Falcon platform could be an indication of organizational growing pains, potentially slowing ARR growth or flattening operating leverage. Sustaining coherence as it scales horizontally will be a critical factor in CrowdStrike's ability to realize its platform potential.

Source: Morningstar (CrowdStrike July 19 Sell-Off)

Conclusion

A Structural Compounder in the Making CrowdStrike is not just safeguarding endpoints, it's reshaping security architecture for an AI-first world. Its platform leverage, financial resilience, and growing surface area of products make it one of the most comprehensive, capital-effective plays available across cybersecurity. While risks relate to competition, complexity, and dilution, long-term upside to becoming the digital risk control plane for the enterprise is both sustainable and undervalued. For investors looking for multiyear compounders with infrastructure-level stickiness and platform optionality, CrowdStrike is still a core holding, deservedly not by hype, but by operating excellence and monetization depth.