Why Rigetti Is Positioning Itself for the Next Compute Revolution

- Ankaa-2 offers >99% two-qubit fidelity and 2.5x performance over Aspen-M, narrowing the gap toward commercial-grade fault-tolerant systems.

- Rigetti trades at ~$140M market cap (42x revenue), vs IonQ's ~$1.5B (68x), despite similar long-term architecture optionality and R&D intensity.

- FY2024 revenue reached $3.3M (+90% YoY in Q4), while net loss narrowed to $52.7M from $71M, with positive gross margins at 26%.

- $8.5M Air Force and $1.6M DOE contracts in Q4 point to momentum in milestone-based, multi-year defense and research partnerships.

- With $82M cash and $11–13M burn per quarter, Rigetti has >5 quarters of runway to prove Ankaa-2’s scalability and commercial relevance.

TradingKey - Being a full-stack innovator in the race to achieve quantum advantage, Rigetti Computing (RGTI) has developed a vertically integrated superconducting quantum computing platform just when the industry is still in its early stage and undergoing tremendous growth. Despite being unconvinced by the market, due primarily to ongoing operating losses and nascent end-use case immaturity, the firm's recent technical achievements, strategic positioning with Quanta Computer, and strong cash runway may be a turning point. Rigetti is not on the hunt for scale; it is designing quantum system architecture that could be invaluable when narrow quantum advantage becomes an achievable reality.

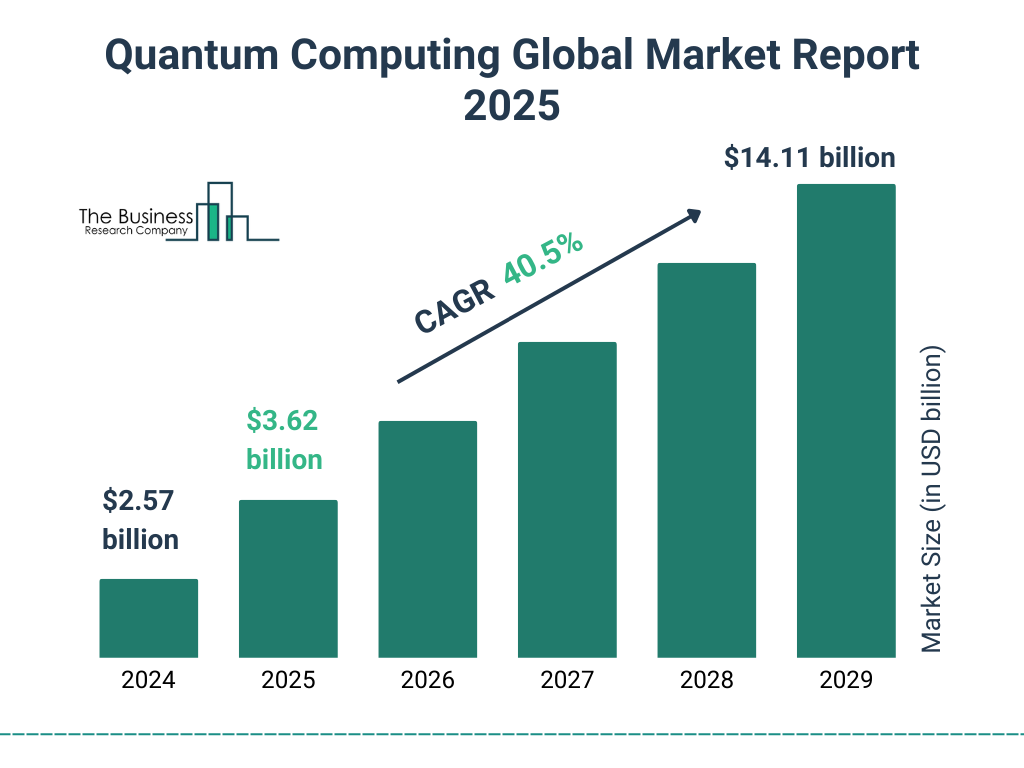

With quantum computing being estimated to provide hundreds of billions in value over the decades to come, Rigetti's multi-chip architecture, AI-assisted calibration tools, and government-validated deployments could provide asymmetric upside if execution pans out. But dilution risk exposure, ambiguous short-term monetization, and shifting standards are significant headwinds. This article assesses Rigetti's business model, competitive advantage, financials, value estimate, and risks with institutional rigor.

Source: the business research company

Quantum-classical synergy: The Rigetti Stack and scalable modularity

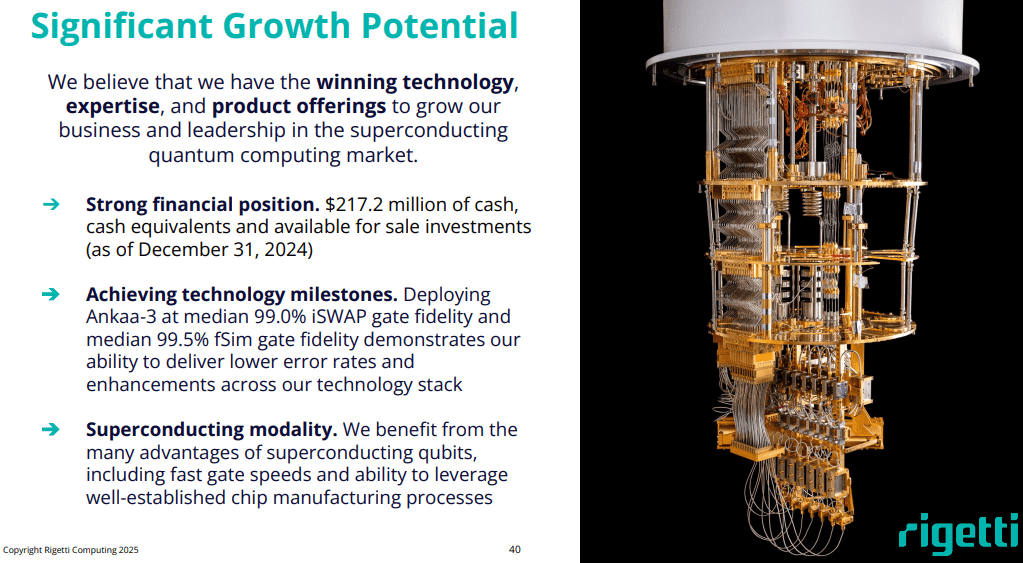

The strategic foundation of Rigetti is its vertically integrated model. From its own Fab-1 quantum foundry to its cloud-delivered QCS platform, the company develops its own superconducting quantum processors and makes and runs them itself. The integration enables quick iteration on top of this stack, evidenced by the quick release of its Ankaa-3 system with 84 qubits with 99.5% two-qubit fidelity for the fSim gate and 72ns gate speeds.

The critical innovation behind this evolution is Rigetti’s patented multi-chip module (MCM) architecture that allows quantum chips to be tiled like traditional processors without loss of performance. Modularity is not merely an engineering breakthrough, it’s a requirement for scaling toward commercially significant 300–3,000 qubit systems that form the foundation of narrow and general quantum advantage.

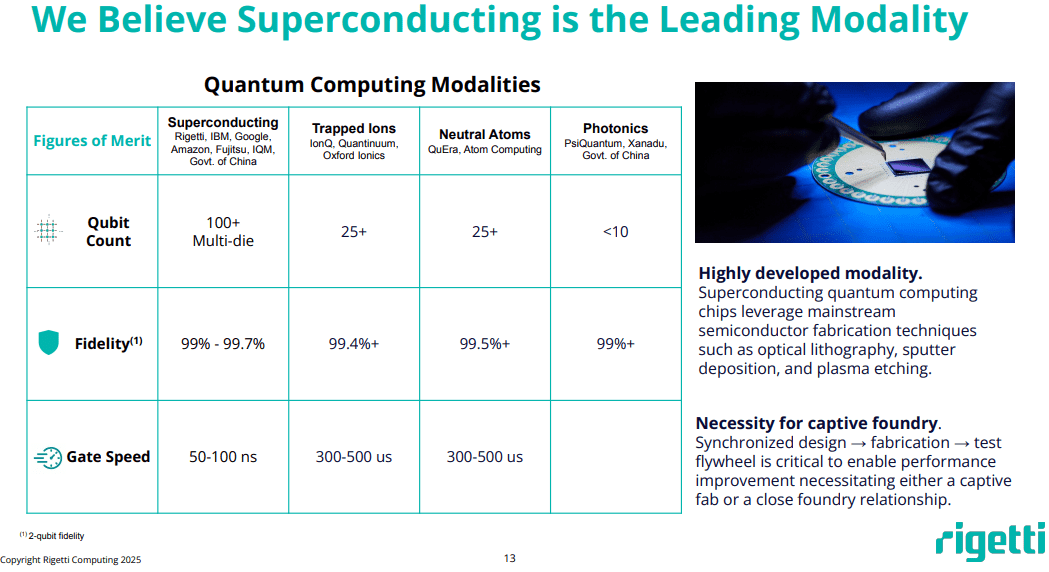

Compared to trapped ion and photonic modalities, which are plagued by issues with scalability and control fidelity, superconducting technologies like those used by Rigetti make use of traditional lithography and packaging methods. The payoff: A scalable path to industrial-scale systems. The company plans to produce by mid-year and by the end of the year 36Q and 108Q systems with 2x lower error rates vis-à-vis current standards.

Aside from its hardware, Rigetti's QCS software stack enables classical co-processing through hybrid workloads using public clouds like Azure and AWS. Hybridization is necessary because most quantum workloads demand strong classical-quantum looping. Its dynamic reprogrammability leadership and compiler-level optimization distinguishing factor make it an all-stack player.

Source: March 2025 Investor Deck

Positioning among an increasingly fractured yet evolving competitive landscape

The quantum computing market is splitting into two leading modalities: superconducting and trapped ion. Of these two, only one is the publicly listed pure-play superconducting company with both integrated manufacturing capabilities and full-stack delivery: Rigetti. It thus takes on a distinct persona among platform players that specialize in annealing, photonics, or aggregation in the cloud.

Although its public valuation and revenue foundation are still modest, its modularity could provide greater scalability compared with monolithic chip designs or with ion-based architectures that are constrained by qubit density. Rival platforms with greater qubit capacities could lack the gate fidelity or architectural modularity that Rigetti is currently attaining.

Additionally, its on-prem QPU deployments in the U.K. and U.S.-based academic labs demonstrate its differentiated value in controllability and system access against competitors who are cloud-only focused. Engagements with government labs, financial institutions, and semiconductor manufacturers confirm its cross-sector significance in government, finance, and hardware ecosystems.

A significant marker is the strategic partnership with Quanta Computer, one of the world's biggest server manufacturers. Apart from an equity deal valued at $35 million, Quanta will make an initial $250 million in co-investments with Rigetti over five years to drive the development of superconducting systems. If well implemented, this would revolutionize both the demand scenario and the supply chain advantage of Rigetti at once.

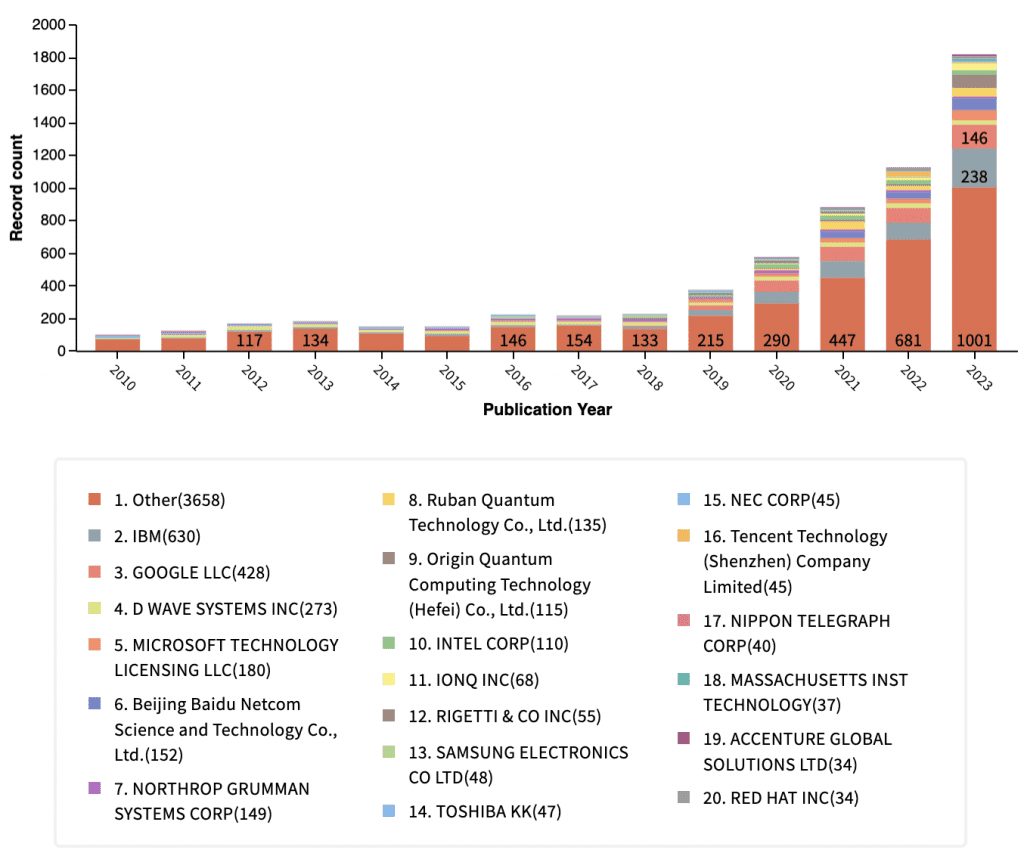

Source: quantumconsortium.org Patent Trends

Strategic and Financial Levers to Drive Long-term Value Creation

Rigetti's growth strategy is founded on four pillars: modularity QPU scalability, increased deep integration with the cloud, R&D on domain-specific application software, and a solid balance sheet to support financing through inflections in commercialization.

Financially, it closed out the year with $217 million in cash, supported by raises in capital during 2024. It enhances its capability to support chip development, cloud growth, and international partnerships. It eliminated all debt as well, enhancing its agility going into the subsequent hardware cycle. Operating costs for the period were $74 million, with almost $50 million spent on R&D, a demonstration of the capital-intensive nature of leading edge technology. Gross margin was 53%, and revenue is still largely dependent on government grants and R&D contracts with commercial momentum still in its early stages. More than 89% of 2024 revenue was from public-sector customers.

Although net losses increased through non-cash warrant and equity issuance related items, operation cash burn is under control considering the liquidity position of Rigetti. Achieving operating leverage will require successful utilization and deployment of the forthcoming 100+ qubit systems and evident ROI demonstration through initial application in optimization, chemistry and quantum ML use cases.

The first hints at commercial-readiness are being announced. AI-optimized calibration systems are reaching internal-tuning levels of precision and partnerships with benchmarking and QEC software companies are evidence that integration is already on the cards. Two 2025 systems are forecasted in the roadmap to push the limits on multi-chip scalability and gate fidelity in a commercial environment.

Source: March 2025 Investor Deck

Valuation and Scenario Analysis: Option Value with a Long Fuse

Rigetti Computing's $2.7 billion market cap marks its dramatic re-rating from previous levels and now reflects a significant level of future execution expectations. Investors' faith in Rigetti's module quantum architecture, tech momentum, and strategic fit with deep-pocketed partners are valued by this price level.

Having more than $217 million in cash on hand with no debt and an increasingly believable roadmap to 100+ qubit deployments by years' end, the current price level infers that Rigetti's full-stack infrastructure will be an architecting anchor to commercial quantum systems beyond narrow quantum advantage. Given its vertically integrated model with its Fab-1 quantum chip foundry and deep patent moat, the company today trades more on par with high-growth deep-tech comps rather than early-stage moonshots.

At a $2.7 billion valuation, however, there is little room for error. The market is valuing forward not only on Rigetti’s technical achievements, but on its ability to translate those breakthroughs into significant QCaaS revenue streams. The transition has not happened to this point. FY2024 revenue came in just above $10 million, with greater than 85% from U.S. government deals. Commercial momentum on enterprise use cases, portfolio optimization, simulation, and machine learning, has yet to materialize. Without repeatable, scalable revenue in 2025–2026 on the cloud, Rigetti’s valuation could come under pressure.

Additionally, capital intensity persists at high levels. Although the firm has strengthened its balance sheet with strategic equity offerings and partnerships, burn continues to be around $50–60 million annually. Ongoing investment in R&D in chips, software integration, and in the cloud will be required to sustain leadership positions, elevating the risk of future dilution or the need to raise non-dilutive funds.

Competition is an issue as well. IBM, Google, and Microsoft and others continue to make progress on competing modalities. If one achieves usable quantum advantage sooner, or particularly in an everyday, benchmarked application, investor opinion will begin to turn against Rigetti's methodology. Furthermore, the company's collaboration with Quanta Computer, although promising itself, poses regulatory and geopolitical risk with increasing scrutiny of cross-border partnerships in critical technologies.

Rigetti's current valuation embodies a market leader story. To sustain and expand it, the company needs to demonstrate it can move from technical validation to commercial significance. The ensuing 12–18 months will be decisive. Success would unleash category-defining quantum infrastructure franchise. Failure could reveal the vulnerability of a value predicated on assumptions about the future state.

.png)

Source: March 2025 Investor Deck

Conclusion: Long Term Call Option on Scalable Quantum Infrastructure

Rigetti is an early-stage high-conviction bet on the scalable superconducting quantum computing future. Despite its unproven financials and commercial inflection point being elusive, its full-stack differentiation, technological roadmap, and modularity in chip architecture provide a compelling strategic advantage in the quantum race. Given adequate capital resources, ecosystems partnerships, and architectural direction, Rigetti could develop into a leading supplier of narrow quantum advantage systems over the next three years. Investors hoping to see near-term profitability will be disappointed. Yet, for those who prize long-term option value in frontier infrastructure, Rigetti could be one breakthrough away from being globally relevant.