TSMC 2025 Q1 Outlook: AI-Driven Growth and Supply Chain Breakthrough Amid Tariff Pressures

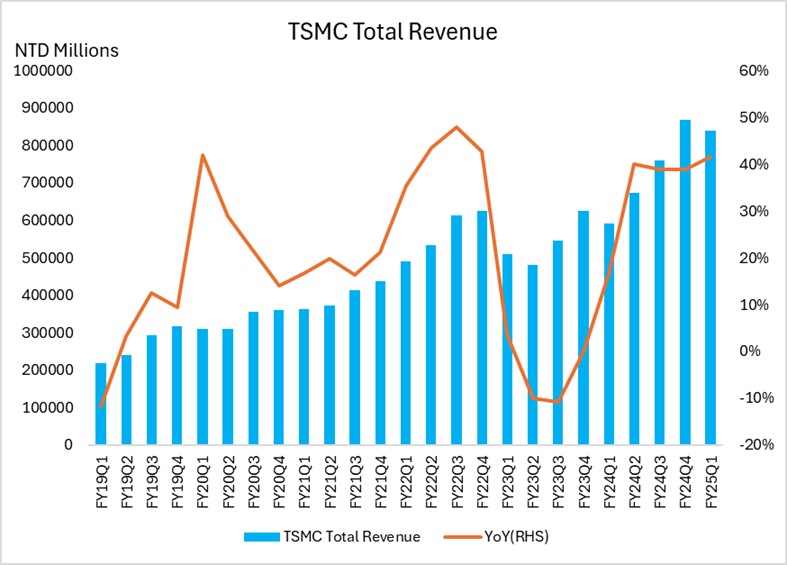

As the world's leading semiconductor foundry, TSMC's Q1 2025 revenue reached NT$839.254 billion, a year-on-year increase of 41.6%, exceeding market expectations and in line with the company's guidance of NT$820 billion to NT$846.24 billion. Gross margin and operating margin are expected to decline from Q4. The company previously guided the Q1 gross margin to be between 57% and 59%, and the operating margin between 46.5% and 48.5%. The main reason for the decline is that the new 2nm process capacity has just started mass production, the manufacturing cost is high, and the yield is still improving; at the same time, TSMC has built new wafer fabs overseas, and the operating costs of these factories are higher than those in Taiwan, resulting in an increase in overall costs and insufficient allocation of fixed costs.

Source: TSMC, TradingKey

The explosion of AI chips demand, the recovery of the smartphone market, and the inventory stockpiling boom before the adjustment of the US tariff policy have provided solid support for TSMC's performance in the first half of the year. However, with the uncertainty of tariff policies and the intensification of global economic fluctuations, the growth outlook in the second half of the year has been overshadowed.

Strong Q1 Growth Momentum

TSMC's revenue growth in Q1 2025 was mainly driven by three major factors. First, the demand for AI server chips continued to grow, becoming a shot in the arm to resist the weakness of the traditional consumer electronics market. Gartner predicts that global overall spending on generative artificial intelligence (GenAI) is expected to grow by 76.4% in 2025, of which 80% will be used for hardware (including AI chips), with particularly strong demand in data centers and high-performance computing. TSMC has successfully captured the benefits of this high-gross-margin market with its technological leadership in 3nm and the upcoming mass production of 2nm processes. Meanwhile, the smartphone industry has gradually recovered, especially the demand for high-performance chips for high-end models has increased significantly. Counterpoint Research data shows that global smartphone shipments in the first quarter of 2025 increased by 3% year-on-year, among which Apple's iPhone 17 series chip orders have entered mass production preparations, providing stable support for TSMC's Q1 and Q2 revenue.

The 90-day grace period of the US tariff policy further amplifies short-term demand. In order to avoid potential cost increases, electronic product manufacturers have accelerated inventory hoarding, pushing up TSMC's orders. In March 2025, Taiwan's manufacturing PMI new orders index climbed to 56.8, while the customer inventory index remained at a low 45.2, indicating that downstream companies are actively replenishing inventory to cope with potential tariff increases. This rush to grab orders has enabled TSMC's revenue to achieve a premium growth that exceeds the industry average.

Source: MacroMicro

2nm Process Ready to Mass Produce

TSMC's advanced process technology is a reflection of its core competitiveness, and the progress of mass production of the 2nm process is particularly eye-catching. The company plans to officially launch large-scale production of the 2nm (N2) process in the second half of 2025, with an initial monthly production capacity target of 50,000 wafers, which is expected to increase to 80,000 wafers by the end of the year. The latest data shows that the yield of 2nm trial production has exceeded 70%, a significant increase from three months ago, clearing technical barriers for mass production and attracting customers such as Apple, Qualcomm, MediaTek and AMD.

Apple is expected to be one of the first users of the 2nm process. In the second half of 2025, Apple plans to use the 2nm process to produce the A20 chip for the high-end Pro models of the iPhone 18 series. Compared with the previous generation A19 chip, the performance of the A20 is expected to increase by 15% and the energy efficiency by 30%, which will further consolidate Apple's leading position in the high-end smartphone market. It is worth noting that the standard version of the iPhone 18 may continue to use the enhanced 3nm process (N3P), highlighting the scarcity and high-end positioning of the 2nm process. At the same time, TSMC's 3nm (N3P) will continue to support the A19 chip of the iPhone 17 series in 2025.

TSMC's new factory in Arizona, the United States, has also added weight to the global layout of advanced processes. The factory has begun to produce 4nm and more advanced process chips for Apple and is expected to expand production further in 2025. This localized production capacity not only enhances TSMC's supply chain security for Apple but also avoids potential tariff barriers to a certain extent.

Double-Edged Sword of Tariffs

The adjustment of US tariff policy has brought short-term benefits to TSMC, but it has also laid long-term hidden dangers. During the 90-day tariff grace period, customers in the electronics industry accelerated their purchases to lock in low-cost inventory, driving a wave of orders for TSMC in Q1 and Q2. As TSMC's core customer, Apple's supply chain adjustment is particularly critical. Recently, the US market has set off a rush to buy Apple products such as iPhones as consumers worry about price increases due to tariffs. This surge in demand has, to a certain extent, driven Apple's demand for chip purchases, which in turn promoted the growth of TSMC's chip orders.

However, after the grace period ends, the full implementation of tariffs may have an impact on the consumer electronics market, especially the price-sensitive high-end smartphone sector. According to the US Conference Board data, the US Consumer Confidence Index fell from about 98.3 in February to 92.9 in March 2025, falling for four consecutive months, and the consumer expectations index fell to the lowest level in 12 years, showing an increase in concerns about economic prospects and price increases. Although the decline in consumer confidence is affected by multiple factors, the rise in terminal product prices caused by tariffs is one of the important reasons. This market sentiment may cause customers to gradually slow down their pace of replenishing inventory at the end of the second quarter, which will in turn put some pressure on TSMC's order growth in the second half of the year.

Geopolitical factors have added complexity to the global semiconductor supply chain. In April 2025, China issued the rules for the identification of semiconductor origin, using wafer location (the location of the wafer fab where the chip is manufactured) as the origin standard. This rule has limited impact on TSMC, and the wafer location of its Taiwan factory meets China's transparency standards and will not face additional tariffs or market access restrictions. On the contrary, if American chip companies such as Intel are taped out in the United States or Europe, their chips entering China may be regarded as non-Chinese origin and face higher tariffs or trade barriers, increasing export costs. TSMC's Taiwan factory may therefore attract more orders from Chinese customers and enhance its market competitiveness.

At the same time, TSMC has invested $165 billion in the United States to build three chip factories, two advanced packaging factories and R&D centers, taking a two-pronged approach to US tariffs and geopolitical risks. Localized production at the Arizona factory reduces dependence on exports from Taiwan, avoids potential high tariffs in the United States, and serves core customers such as Apple. The global layout covers the United States, Japan, and Europe, effectively dispersing the risks arising from US-China technology competition and tensions in the Taiwan Strait, and enhancing supply chain resilience and customer trust.

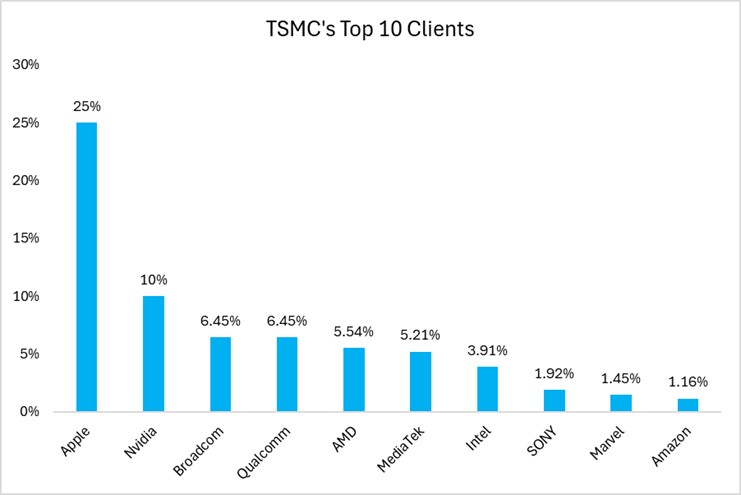

Customer Dependence and Diversification Strategy

Source: moomoo, TradingKey

Apple is TSMC's largest customer, contributing more than 20% of revenue. In 2025, the A19 chip for the iPhone 17 series and the A20 chip orders for the iPhone 18 series in 2026 will provide TSMC with a reliable source of revenue. In addition, Apple's self-developed baseband modem and other chips are also manufactured by TSMC, further deepening the partnership between the two parties. However, the high dependence on a single customer also brings potential risks. To this end, TSMC actively expands its customer diversification strategy. Qualcomm, MediaTek and AMD continue to grow in demand for orders for 2nm process, while the rapid expansion of AI chip customers such as Nvidia has opened up a new growth track for TSMC. In 2024, AI business accounts for about 15% of TSMC's revenue, and it is expected to rise to 20% in 2025, effectively balancing the risk of a single customer and becoming an important driving force for the company's continued growth.

Long-Term Competitive Advantages & Potential Challenges

With its technological advantages and strategic flexibility, TSMC is expected to continue to lead the global semiconductor industry. TSMC's long-term competitive advantages stem from its technological barriers, customer ecosystem and global layout. First, in the field of advanced processes, TSMC's yield, and cost control capabilities far exceed its competitors. In contrast, Intel and Samsung are still at least one year behind in their progress in 2nm processes. Second, TSMC's long-term partnerships with customers such as Apple and Qualcomm have formed a strong ecological barrier. In addition, TSMC's leading position in advanced packaging technologies such as CoWoS further consolidates its core role in the AI chip supply chain.

However, TSMC also faces several challenges. Geopolitical tensions may disrupt the global semiconductor supply chain. Although its factory layout in the United States, Japan and Europe reduces some risks, the long-term impact of the US-China technology competition still needs to be vigilant. In addition, the global economic slowdown may weaken demand for consumer electronics, especially in the high-end market. TSMC needs to cope with these uncertainties through continuous technological innovation and customer diversification. Looking ahead to 2025, Q1 and Q2 will achieve strong growth thanks to AI demand, smartphone recovery and tariff rush, but we still need to be vigilant about the impact of full implementation of tariffs and economic fluctuations in the second half of the year.