[IN-DEPTH ANALYSIS] Coinbase: The Next Chapter of Crypto from Trading to Consumer Apps

Key Takeaways

- From Trading to Ecosystem: Coinbase has evolved beyond trading into a multi-product ecosystem, diversifying revenue and reduce reliance on volatile trading fees.

- Global Expansion: Coinbase is scaling globally and integrating crypto into everyday finance through partnerships.

- Undervalued Potential: Coinbase’s $50B market cap undervalues its $75-$87B potential, fueled by institutional trading and global expansion.

As the cryptocurrency market matures, Coinbase is transforming from a trading-focused exchange into a multi-dimensional financial ecosystem. By diversifying its revenue streams and expanding globally, Coinbase is positioning itself for long-term growth in the evolving crypto economy.

How Coinbase Started

Founded in 2012, Coinbase pioneered retail cryptocurrency trading, offering a beginner-friendly platform when crypto was still a niche asset class. Its early success was fueled by Bitcoin’s meteoric rise, attracting retail investors and cementing Coinbase’s reputation as a trusted gateway to crypto.

The company’s 2021 IPO marked a major milestone, but its reliance on trading fees tied its performance to market volatility. During the 2022 bear market, this dependence exposed vulnerabilities, prompting Coinbase to pivot strategically. Today, Coinbase is a diversified enterprise, serving retail traders, institutions, and developers with an expanding product portfolio.

Coinbase and BTC Correlation

Source: Tradingview

Coinbase’s stock price frequently mirrors the movements of Bitcoin (BTC), reflecting the company’s historical dependence on trading volume. As a crypto exchange, Coinbase generates transaction fees proportional to activity on its platform.

In bull markets, Bitcoin price rallies, such as in Q4 2024, spur both retail and institutional participation, attracting new users and reactivating dormant ones. Conversely, during bear markets, like the crypto winter of 2022, trading activity declines as fear dominates, users hold rather than trade, and overall volumes contract—leading to revenue declines.

This dynamic creates an asymmetry: strong upside during market rallies and muted downside during slumps, driven by user behavior. In bull markets, euphoria drives engagement as new users flock to buy BTC or trending tokens, while long-dormant holders reengage to check balances or trade. In contrast, bear markets see activity stall, as users adopt a wait-and-see approach, reducing trading fees and platform activity.

Coinbase’s higher fees, compared to competitors like Binance, have long been a point of contention. However, this premium reflects Coinbase’s focus on regulatory compliance, user experience, and security, qualities that appeal to both beginners and institutions.

Source: Tradingkey.com

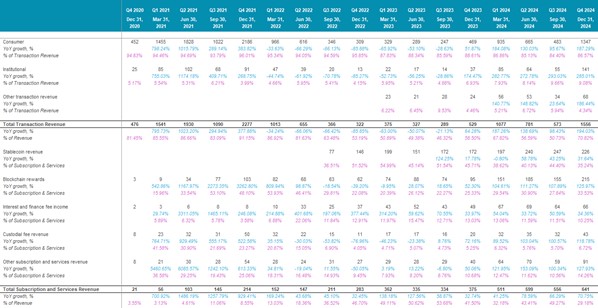

To address fee concerns, Coinbase launched Coinbase One, a $29.99/month subscription that offers zero-fee trading for high-frequency users. However, Coinbase is not just a commission-taker. Its multi-product model mitigates reliance on trading, unlike pure-play exchanges. Risks remain, if crypto prices crash or stagnate, volumes could dry up, but diversification and utility focus buffer this exposure. The table below shows Coinbase’s revenue breakdown and 70% of revenue is generated from transactions.

Source:Company Financials, Tradingkey.com

Future Growth: From Trading to Ecosystem

Coinbase has strategically evolved into a multi-product ecosystem with the following standout growth engines:

Base: The Leading Layer 2 Blockchain

Base, Coinbase’s Layer 2 blockchain, has rapidly established itself as a key Web3 infrastructure. It was developed by Coinbase to address the scalability issues of the Ethereum network. This approach significantly increases transaction speed and lowers gas fees, making it more accessible for decentralized applications (dApps), DeFi platforms, NFT marketplaces, and gaming. Key highlights include:

- Base Smart Wallet: Simplifies access to on-chain applications.

- Coinbase Wrapped Bitcoin (cbBTC): An ERC20 token supported by Coinbase, cbBTC is specifically designed to expand Bitcoin's use cases. The mechanism behind cbBTC works as follows: users deposit their Bitcoin into Coinbase's custody account and, in return, receive an equivalent amount of cbBTC (1:1 backing). Each cbBTC is directly backed by real Bitcoin, meaning users can exchange their cbBTC back to Bitcoin at any time. The key advantage of cbBTC is that it allows users to leverage the value of Bitcoin on other blockchains such as Ethereum, Solana, and Base. These blockchains support a wide range of decentralized applications (dApps), including DeFi lending, staking, liquidity mining, NFT trading, and blockchain gaming — functionalities that Bitcoin's native network cannot directly facilitate.

- Developer-Friendly: Base is fully compatible with the Ethereum Virtual Machine (EVM), allowing developers to deploy their applications with minimal adjustments.

Coinbase One: Subscription Surge

Coinbase One has attracted over 600,000 subscribers, generating $216 million in annualized revenue. This subscription model not only reduces trading costs for active users but also drives cross-selling of other products like staking and payments. With global crypto adoption on the rise, Coinbase One has significant expansion potential.

USDC: Stablecoin Powerhouse

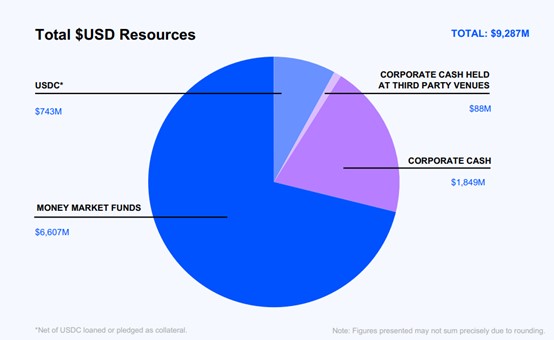

USDC, a stablecoin closely tied to Coinbase through its partnership with Circle which issues USDC, is a cornerstone of Coinbase’s ecosystem. Key metrics for 2024 include:

- Circulation Increase: USDC experienced a 79% year-over-year increase in circulation, outpacing other major stablecoins. USDC's total all-time transaction volume surpassed $20 trillion, with significant monthly transaction volumes.

- Revenue Growth: Coinbase's stablecoin revenue (including USDC) grew by 31% year-over-year, reaching $910 million for the full year. The core source of this revenue is the interest income generated from USDC reserves.

- USDC Reserve Mechanism: When a user purchases 1 USDC with $1, that $1 is deposited into the USDC reserve account. Circle and Coinbase manage these reserves, ensuring all circulating USDC is backed 1:1 by dollar-equivalent reserves. At any time, users can redeem USDC at a 1:1 ratio with USD. To avoid leaving the reserves idle and to generate returns, Circle and Coinbase invest these funds in low-risk, highly liquid financial instruments, such as short-term U.S. Treasury bills or interest-bearing bank accounts. According to the partnership agreement between Coinbase and Circle, Coinbase receives 50% of the interest income generated from USDC reserves. As USDC’s circulation increases, the reserve size grows, leading to larger investment amounts. Combined with rising market interest rates, these factors have significantly driven the growth of Coinbase's stablecoin revenue.

Source: Coinbase

USDC provides a stable revenue stream, even during market downturns, and highlights Coinbase’s ability to capitalize on the growing role of stablecoins in global finance.

International Expansion

Coinbase’s international revenue reached 18% of its total earnings in Q4 2024, reflecting successful global expansion efforts. The company has entered four new markets over the past two years, all of which are now profitable due to localized payments and compliance strategies.

India stands out as a key market:

- Ranked #1 in grassroots crypto adoption by Chainalysis in 2024.

- Home to 12% of global on-chain developers, signaling untapped potential.

- Regulatory approval from India’s Financial Intelligence Unit (FIU) paves the way for Coinbase’s 2025 relaunch after an earlier exit due to regulatory challenges.

By leveraging its expertise in compliance and infrastructure, Coinbase is well-positioned to capitalize on India’s rapid crypto adoption.

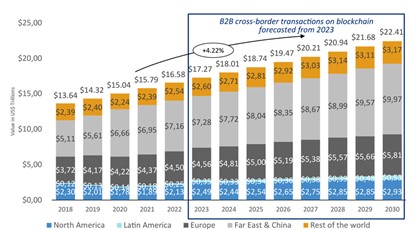

Payments: The Next Frontier

Currently, crypto accounts for just 0.5%-1% of global GDP, but this could grow to 5%-10% by 2030, signaling a shift from trading-focused origins to mainstream financial utility. Coinbase aims to revolutionize cryptocurrency as a payment, which is swift, seamless, and universally accessible, redefining how value moves globally.

Source: Agile Dynamics Tech Research and Analysis

In 2024, Coinbase made significant strides in this vision. The launch of its smart wallet streamlined user onboarding, achieving notable growth in active users. Additionally, cbBTC, a Base-native token for DeFi payments, secured substantial traction, expanding beyond stablecoin reliance. These innovations position Coinbase to capture direct, peer-to-peer transactions, bypassing traditional intermediaries.

Strategic partnerships further accelerate this transformation:

- Visa enables instant fiat conversions from or to cryptos, improving liquidity for both institutional and retail users.

- Stripe leverages USDC for $100 billion in projected cross-border flows, expanding Coinbase’s role in remittance and merchant payments.

- The Coinbase Card, with 200,000 monthly active users, outpaces competitors by 30% and integrates crypto seamlessly into everyday spending.

By leveraging blockchain’s efficiency, these efforts reduce reliance on market volatility and establish Coinbase as a cornerstone of the emerging $5 trillion payment ecosystem.

Real-World Asset (RWA) Tokenization: Redefining Ownership

Beyond payments, Coinbase is driving the tokenization of real-world assets (RWAs), merging traditional finance with crypto and positioning itself as the primary financial hub for the crypto economy. Coinbase is now targeting U.S. equities through its investment in BackedFi, a Swiss RWA issuer that raised $9.5 million from Coinbase Ventures in 2024. Coinbase’s ambitions extend far beyond payments, or its own stock ($COIN) and it envisions bringing stocks like Apple and Tesla on-chain.

Tokenization on Base enables 24/7 global trading, bypassing Nasdaq’s limited trading hours and offering near-instant settlement compared to the traditional T+2 system. Base, which processed $25 billion in Q4 2024 payment volume, has proven its capacity to scale. Additionally, smart contracts unlock new possibilities, such as derivatives, indices, fractional shares, and margin products, capabilities that far exceed those of traditional platforms. With on-chain securitization reducing intermediaries, lowering costs, and democratizing access, investors worldwide, from New York to Nigeria, can trade $COIN anytime. Why stick with Nasdaq when Coinbase offers this superior alternative?

This strategy aligns with Coinbase’s long-term vision of transcending trading to encompass asset ownership. Tokenizing stocks, real estate, and debt could revolutionize capital markets, with $13.5 billion in RWAs already tokenized by December 2024. While regulatory hurdles, such as unclear Security Token Offering (STO) frameworks, remain, a pro-crypto regulatory shift in the U.S. could pave the way. Coinbase isn’t just bridging traditional and decentralized finance—it’s redefining it.

Metrics for Valuation

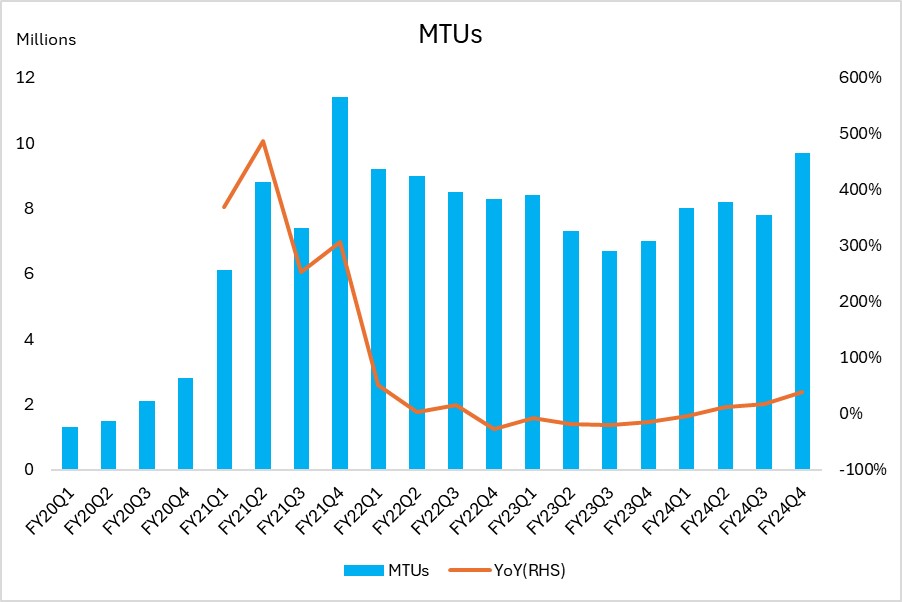

Acquisition and Retention: Coinbase’s marketing strategy excels through a two-pronged approach that capitalizes on crypto market volatility, driving 9.7 million monthly transacting users (MTUs) in Q4 2024—a 24% QoQ increase:

- New Users: Coinbase attracts first-time users through new coin listings, generating hype, while BTC and ETH serve as stable entry points due to their brand trust and large market caps.

- Resurrected Users: Dormant holders—long-term holders inactive during bear markets—re-engage during price spikes or news cycles. These users, already onboarded, return to check balances, trade, or explore new offerings like the Coinbase Card or loans, with zero reacquisition costs.

This dual strategy maximizes lifetime value, transforming one-time traders into loyal ecosystem participants. The global rollout of Coinbase One further improves retention, reinforcing Coinbase's competitive edge.

Source: Company Financials, Tradingkey.com

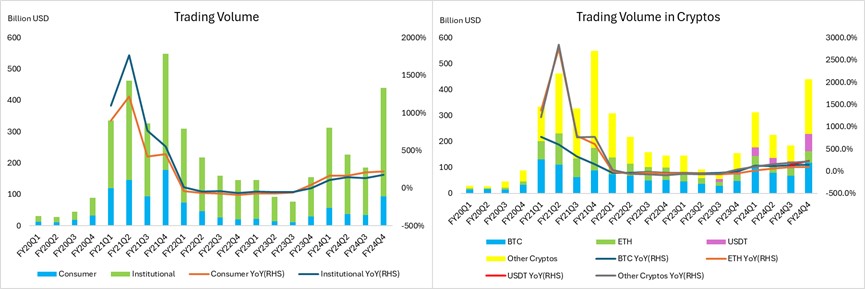

Trading Volume: Coinbase’s Q4 2024 trading volume reached $439 billion, showcasing its ability to meet diverse crypto demand. With $404 billion in platform assets, approximately 12% of the total crypto market—Bitcoin (BTC) and Ethereum (ETH) remain the primary drivers of activity, while newer listings like PEPE spiked retail engagement.

- Retail: Retail trading volume surged to $94 billion, a 176% QoQ increase. Coinbase’s appeal to individual investors seeking both stability and emerging opportunities.

- Institutions: The institutions generate almost 80% of trading volume. Institutional trading volume climbed to $345 billion, a 128% QoQ increase, fueled by Coinbase Prime and custody services. With $220 billion in assets under custody, Coinbase Prime achieved record financing loan volumes, catering to hedge funds and ETF issuers. The approval of Bitcoin ETFs in 2024, coupled with the addition of 92 new derivative assets, further solidified Coinbase’s position as a leading institutional platform.

Source: Company Financials, Tradingkey.com

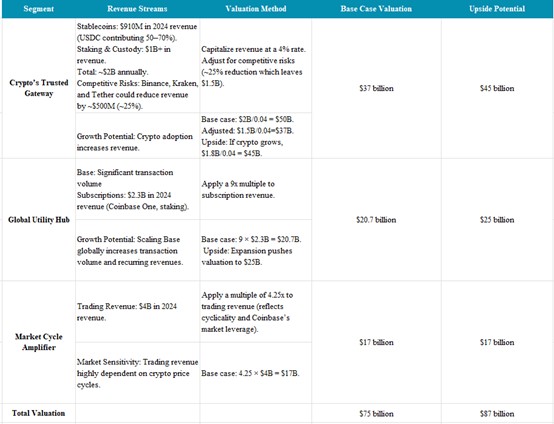

Valuation: Undervalued Potential

Coinbase's $50 billion market cap underestimates its potential as a diversified financial platform. By dissecting its revenue streams and growth engines, we estimate its intrinsic value at $75-$87 billion, reflecting a blend of stable revenue, emerging opportunities, and market-sensitive earnings.

Source: Tradingkey.com

Conclusion

Coinbase has evolved beyond being just a crypto exchange—it is now a cornerstone of the broader crypto economy. With its strategic pivot toward payments, subscriptions, and infrastructure, combined with a focus on international scalability, Coinbase is well-positioned for significant long-term growth.

Our valuation estimates its intrinsic worth at $75–$87 billion, suggesting meaningful upside potential from its current market cap of $50 billion. While risks such as regulatory uncertainty and crypto market volatility remain, Coinbase’s diversified revenue streams and strong execution capabilities make it a compelling investment for the next chapter of the crypto economy.