Bitcoin price could reach $285K by 2030 as Citigroup forecasts $1.6 trillion stablecoin inflows

- Citigroup projects the stablecoin market could reach $1.6 trillion by 2030 from $240 billion today.

- Bitcoin price could surge past $285,000 if stablecoin capital rotation follows historical patterns.

- Regulatory clarity and political tailwinds may accelerate institutional adoption of blockchain-based payments

Bitcoin price outlook strengthens as Citigroup projects $1.6 trillion stablecoin growth, calling them critical bridges between banks and blockchain.

Citigroup predicts stablecoin market cap will hit $1.6 trillion by 2030

Global investment bank Citigroup has forecasted a dramatic rise in stablecoin adoption, projecting the market could expand to $1.6 trillion by the end of 2030. In a recent report, the bank emphasized the growing utility of fiat-backed digital assets in remittances, cross-border settlements, and tokenized financial instruments.

The report described a “multi-rail” financial future, where stablecoins operate alongside traditional banking infrastructure to enable near-instantaneous, 24/7 global transactions. Institutional appetite and regulatory clarity — particularly from US authorities — were identified as pivotal catalysts.

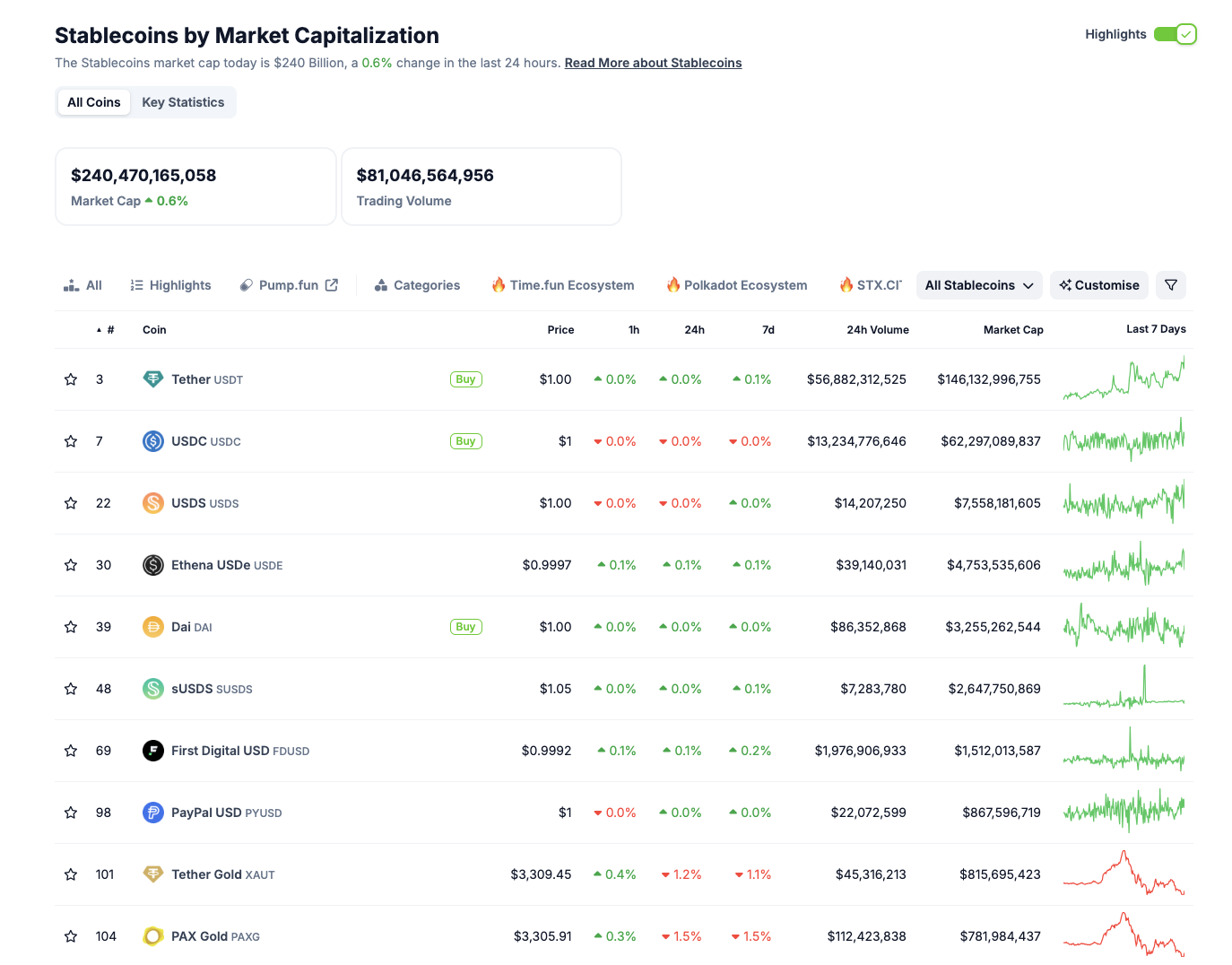

Top 10 Stablecoins as of April 25, 2025 | Source: Coingecko

The current data in the Coingecko chart above places the total stablecoin market capitalization at approximately $240 billion as of Friday. This includes dominant players like Tether (USDT), Circle’s USDC, and PayPal USD. Their increasing use in payment platforms and treasury operations has signaled a maturing market.

In terms of institutional impact, Visa and Mastercard have already begun integrating stablecoin settlements into select cross-border rails, hinting at gradual adoption into global payments systems.

This trend, Citigroup suggests, may accelerate under a US administration more favorable to crypto innovation — raising the probability of regulatory guardrails rather than outright restrictions.

Stablecoin market trends in 2025

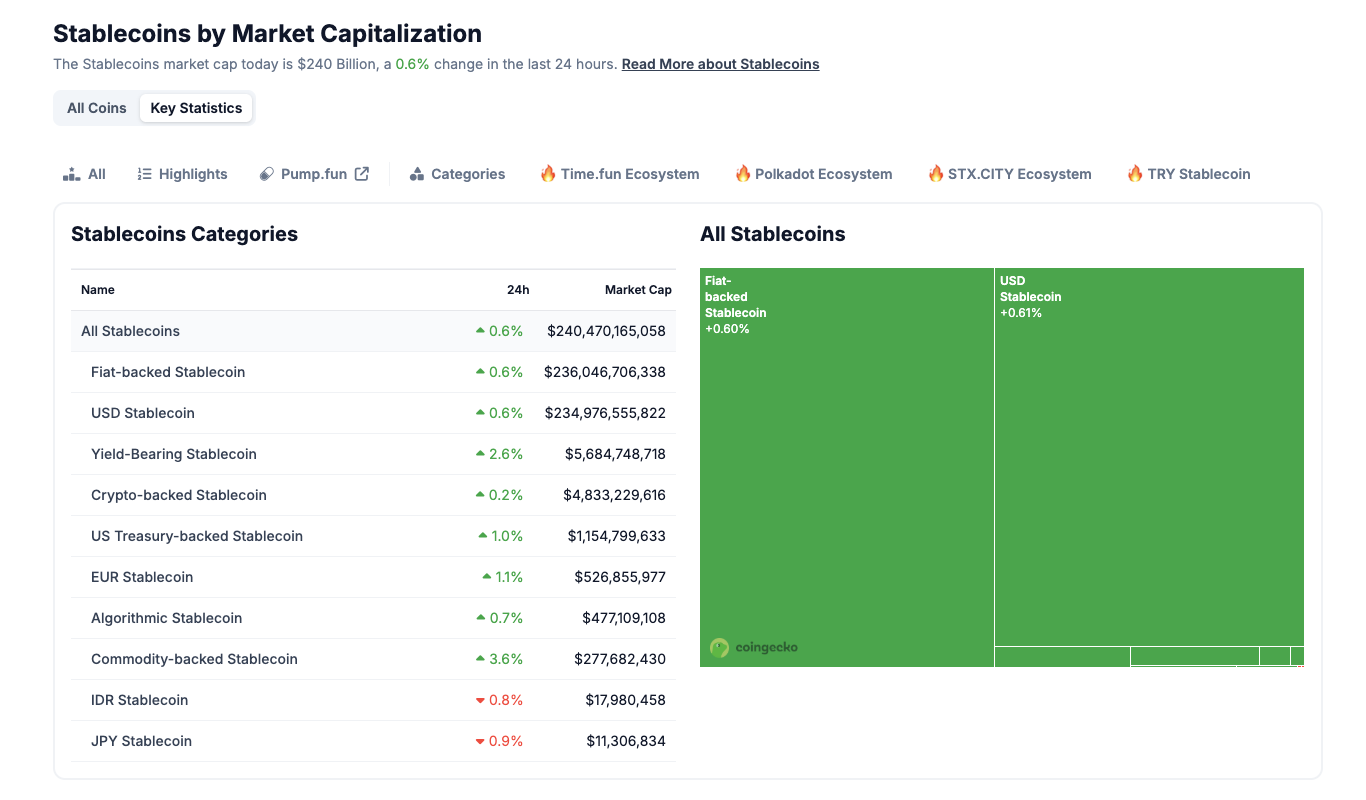

The composition of the stablecoin sector also points to increasing institutional participation. USD-backed stablecoins dominate with nearly 98% market share, while US Treasury-backed and yield-bearing stablecoins are gaining traction. The latter saw gains of 1.2% and 1.0%, respectively, in the last 24 hours, indicating demand for tokenized low-risk yield instruments.

Commodity-backed stablecoins rose 2.6% as investors seek hedges against inflation and geopolitical volatility. Meanwhile, algorithmic and exotic fiat-backed stablecoins showed divergent performance — suggesting that institutional capital is gravitating toward fully collateralized, regulated products.

Stablecoin market categories, April 2025 | Source: Coingecko

Notably, stablecoins also serve as on-ramps for new crypto users, allowing easy access to decentralized apps, exchanges and custody solutions without exposure to volatility.

This suggests that imminent stablecoin inflows could eventually funnel capital into Bitcoin and other cryptocurrencies.

Bipartisan US stablecoin bill could unlock billions in sidelined institutional capital

Since Trump’s inauguration in January, US regulators have softened their stance on cryptocurrencies. In recent regulatory updates, the US Senate Banking Committee has advanced the Guarding US National Interests in Essential Unified Stablecoins (GENIUS) act.

According to official filings, the legislative bill aims to establish a clear federal framework for issuing, auditing and redeeming fiat-backed stablecoins.

The Genius Act would permit qualified non-bank entities to issue stablecoins under rigorous reserve requirements, while ensuring oversight from the Federal Reserve (Fed) and the Office of the Comptroller of the Currency (OCC).

The bill also includes provisions to block algorithmic stablecoins not backed 1:1 by cash or Treasuries, addressing systemic risks without stifling innovation.

If enacted, the Genius Act could unlock billions in sidelined capital, as regulated stablecoin issuers gain access to traditional banking rails and offer stable, yield-bearing products that meet compliance standards.

Bitcoin price prediction if stablecoin market hits $1.6 trillion by 2030

If Citigroup’s $1.6 trillion market cap prediction materializes, the knock-on effect for Bitcoin price could be significant. Notably, historical data shows stablecoin market inflows have often preceded major BTC rallies.

During the 2020–2021 bull market, stablecoin supply ballooned from $20 billion to $140 billion, coinciding with Bitcoin’s rise from $10,000 to nearly $64,000. The correlation stemmed from market participants parking capital in USD-denominated stablecoins before rotating into risk-on assets like BTC.

If a similar pattern unfolds, Citigroup’s projected 670% growth in the stablecoin market cap, from $240 billion at press time to $1.6 trillion, could potentially propel Bitcoin into new global peaks in the higher six-figure territories.

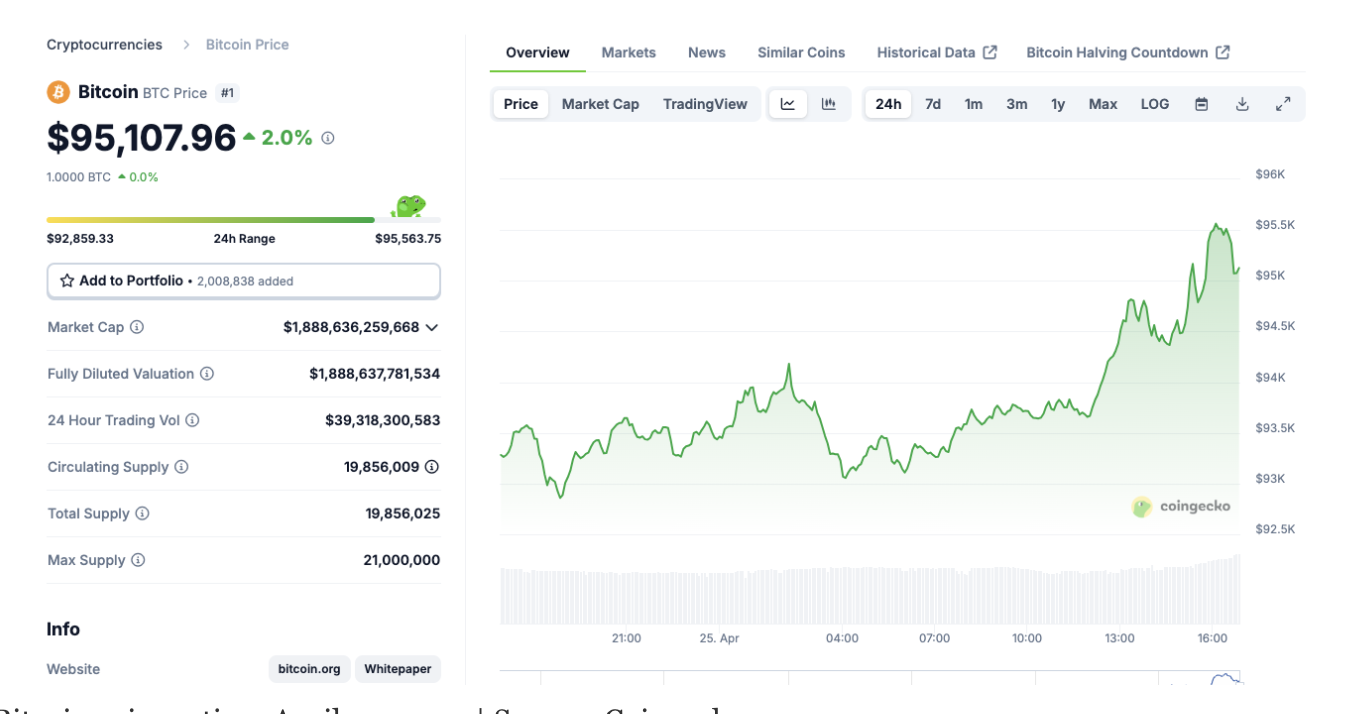

Bitcoin price action, April 25 | 2025 | Source: Coingecko

At the time of publication, Bitcoin price is trading just above the $95,000 mark, its highest in 60 days of trading.

If historical correlations between stablecoin supply growth and Bitcoin price persist, a 6.7x expansion in the stablecoin market could correspond to a 3x to 5x increase in Bitcoin’s price — placing BTC in the $285,000 to $475,000 range.

Even under more conservative assumptions — where just 25% of stablecoin inflows rotate into BTC — Bitcoin could still see gains of 200% to 250% from current levels. This conservative scenario implies a projected price range of $190,000 to $237,500 by 2030, assuming continued alignment between regulatory clarity and capital allocation trends.