LTC, BCH, DOGE Price Analysis: Nine proof-of-work coins rally on Nvidia’s $5.5 billion charge

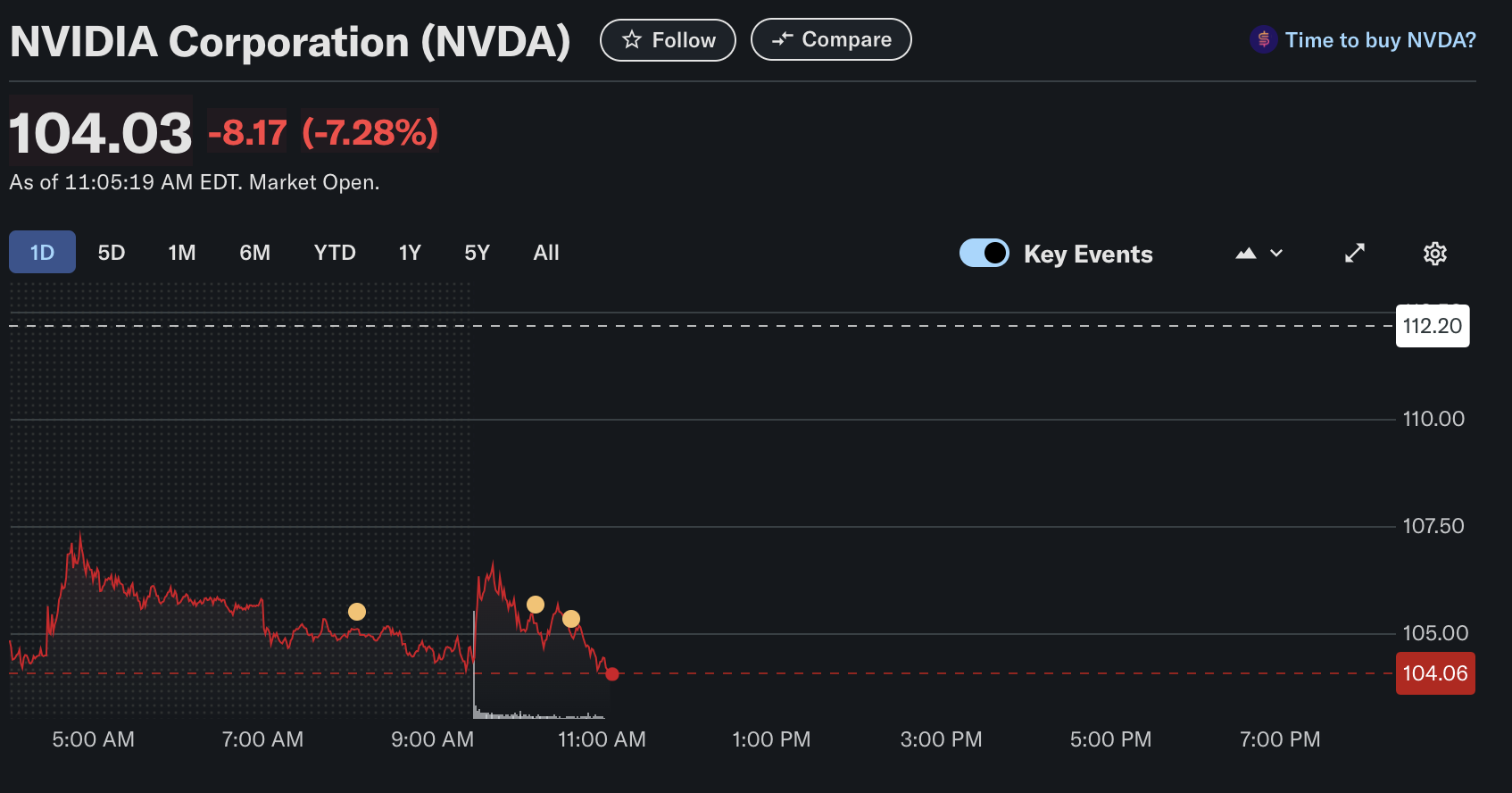

- Nvidia stock plunged 7% on Wednesday, wiping out over $200 billion in market valuation as markets react to a new twist in the US-China trade war.

- As Bitcoin price advances above $85,000, the broader proof-of-work sector flashes buy signals on Wednesday.

- As investors rotated out of NVDA and other US tech names, nine of the top ten PoW assets—including Litecoin, Bitcoin Cash, and Dogecoin—posted gains.

Litecoin (LTC), Bitcoin Cash (BCH), and Dogecoin (DOGE) experienced significant rallies today, as nine proof-of-work cryptocurrencies surged following Nvidia's announcement of a $5.5 billion charge due to U.S. restrictions on its AI chip sales to China .

US trade war wipes $180 billion off Nvidia market cap within hours

Nvidia (NVDA) is currently facing significant challenges due to new United States (US) government restrictions on exporting its H20 AI chips to China, a key market. This led to a $5.5 billion charge for inventory, purchase commitments and related reserves, causing the stock to drop as much as 7.5% on Monday, and erasing over $180 billion in market value.

The restrictions, part of US efforts to limit China's access to advanced semiconductors, were unexpected, and Nvidia reportedly did not inform some major Chinese customers in advance. At the time of publication, NVDA price has dropped to $103.63, down 5.72% from the previous close, and is about 25% off its 52-week high.

Proof-of-work coins see gains as traders place early bets on Nvidia’s $500M local production plans

Traders exiting Nvidia and adjacent US tech stocks on Wednesday appear to be rotating capital towards the crypto market. Zooming in, initial market movements show that nine of the top ten roof-of-work coins have benefited the most from the latest swing in market dynamics.

On the positive side, Nvidia had recently announced plans to invest up to $500 billion in the US AI infrastructure over the next four years, including supercomputer manufacturing in Texas with partners like TSMC, Foxconn, and Wistron. This aligns with the Trump administration’s push for domestic manufacturing amid tariff concerns.

Expectations of an increased local supply of mining equipment within the US appear to have boosted investors' sentiment around proof-of-work coins.

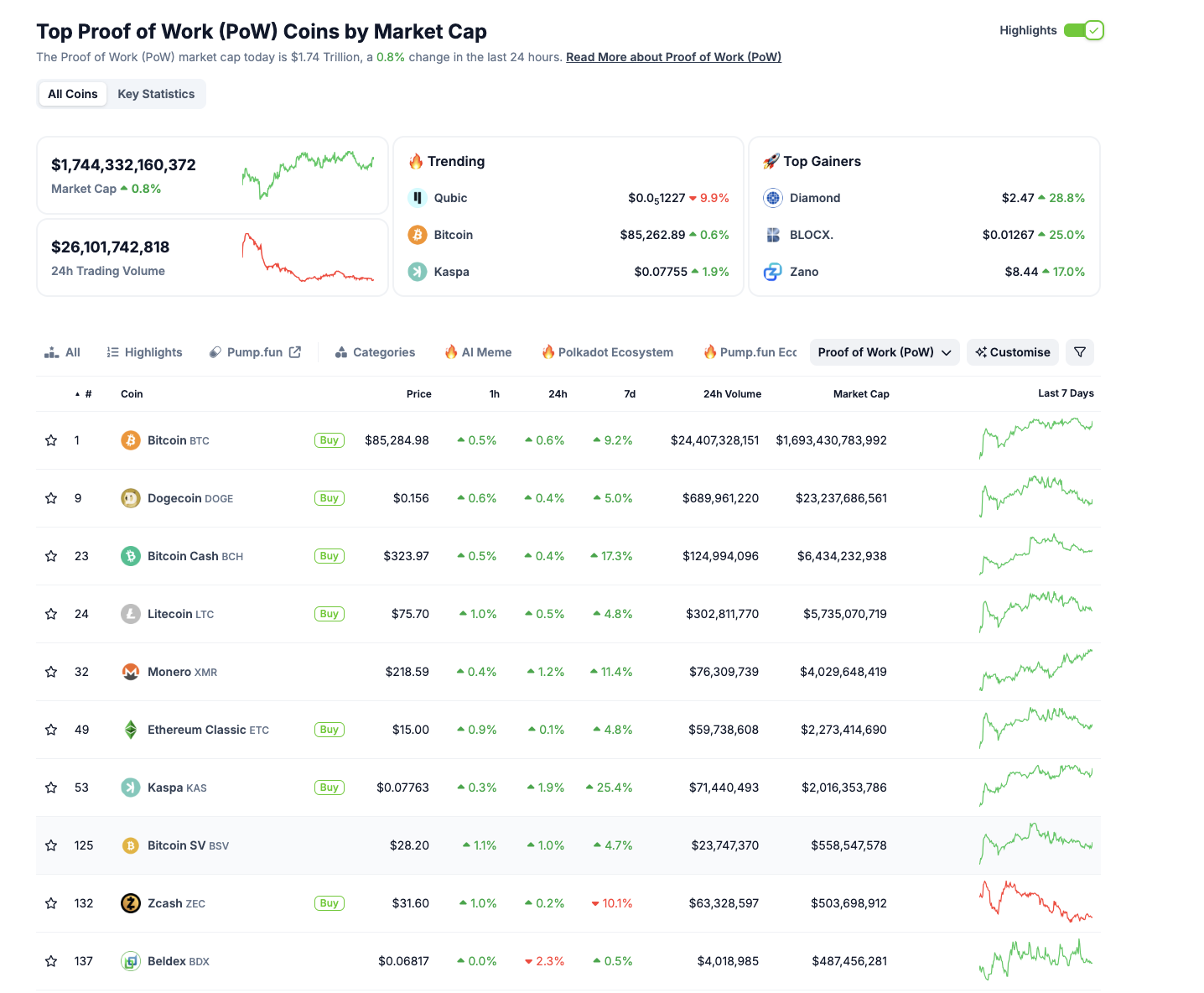

Proof-of-Work Sector Performance, April 16 | Source: Coingecko

According to Coingecko data, PoW sector valuation has exceeded the $1.7 trillion mark, rising 0.8% on Wednesday. Notably, all nine of the top ten PoW altcoins all turned profits on Wednesday as markets reacted to NVDA sell-offs in real time.

The top three largest PoW assets, Dogecoin, Litecoin and Bitcoin Cash, all posted mild gains ranging from 1% to 3%, while only the 10th-ranked Beldex traders held 2.3% losses.

This performance aligns with the narrative that cryptocurrencies are viewed as resistant to global trade and supply chain risks. Hence, more gains could follow if US stock traders continue to seek refuge from the escalating trade war between the US and China.

On the flipside, considering Nvidia’s systemic importance to crypto mining equipment, if the NVDA sell-off intensifies, market sentiment could abruptly flip bullish, putting overleveraged traders at risk.