U.S. March CPI Commentary: Tariffs Will Have Limited Impact on Inflation; Significant Fed Rate Cuts Could Trigger a Stock Market Rebound

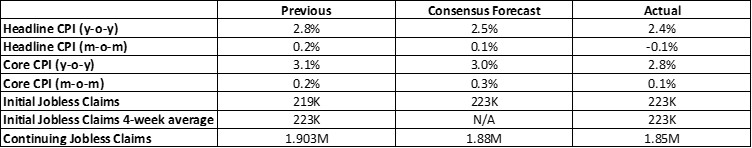

On 10 April 2025, the U.S. released its March Consumer Price Index (CPI) data, revealing a continued slowdown in inflation. Core CPI month-over-month growth eased from 0.2% in February to 0.1% in March, while Headline CPI unexpectedly recorded a negative month-over-month figure of -0.1%. As a result, year-over-year Headline and Core CPI growth stood at 2.4% and 2.8%, respectively, below market expectations of 2.5% and 3.0%, down from February’s 2.8% and 3.1% (Figure 1).

Figure 1: U.S. Inflation and Related Data

Source: Refinitiv, Tradingkey.com

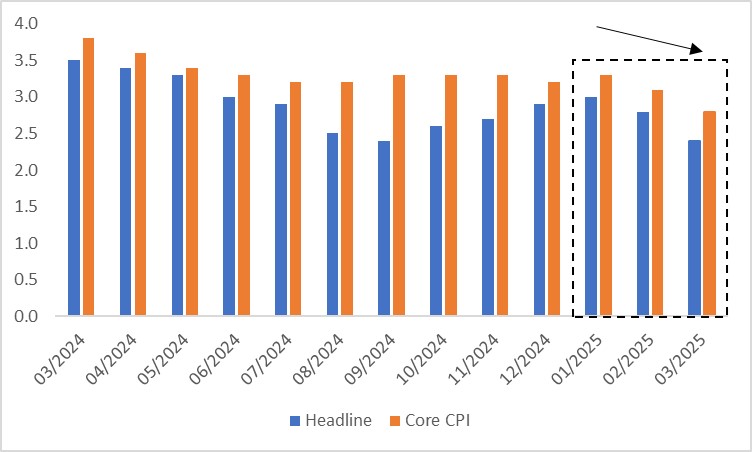

The broader inflation trend shows a clear decline since the start of 2025 when Headline and Core CPI were 3.0% and 3.3% in January (Figure 2). Breaking down the components, declines in air travel, education-related lodging and hotel prices drove the slowdown in Core CPI. Core CPI’s month-over-month growth fell by 0.1 percentage points compared to February, while Headline CPI dropped by 0.3 percentage points, largely due to a significant decrease in energy prices in March.

Figure 2: U.S. CPI (y-o-y, %)

Source: Refinitiv, Tradingkey.com

Two primary factors contributed to this disinflation. First, recent weakness in the U.S. economy has moderated price pressures. Second, the impact of high tariffs has not yet been fully reflected in the March CPI data. On 2 April, President Trump announced a “reciprocal tariff” policy, followed by a “90-day tariff suspension” on 9 April. Despite this, existing tariffs on steel, aluminium, automobiles and Chinese goods remain in place. These elevated tariffs are likely to persist as a hallmark of Trump’s second term. Therefore, many economists anticipate a sharp rise in U.S. inflation from April to June due to these policies. However, we believe ongoing economic softness and a subdued growth outlook will restrain demand-side inflationary pressures, keeping second-quarter inflation below current market expectations.

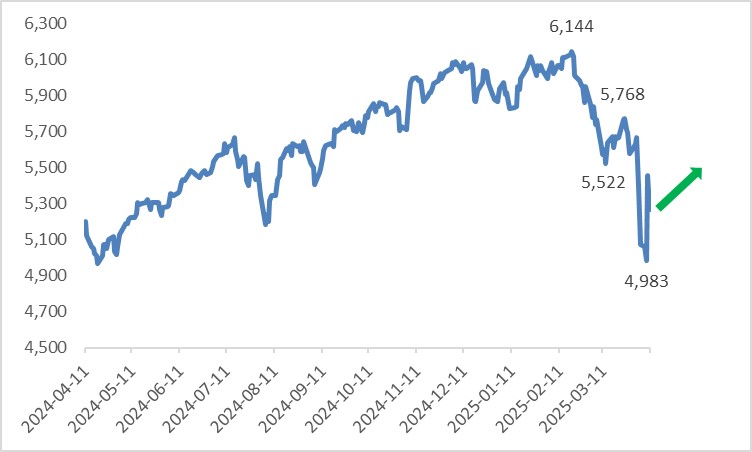

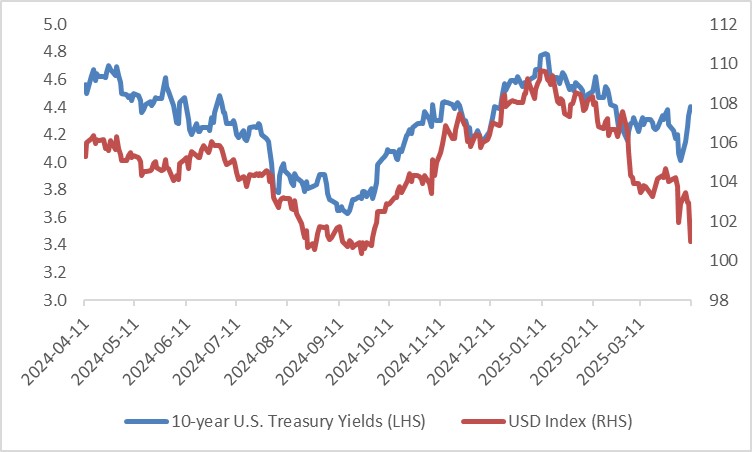

Given this backdrop, we project the Federal Reserve will implement five rate cuts by the end of 2025, exceeding the four cuts implied by the CME FedWatch Tool. Aggressive monetary easing is expected to restore liquidity to U.S. equity markets, potentially sparking a bottoming-out and rebound in stock prices (Figure 3). Recently, U.S. Treasury yields have surged, driven by economic fundamentals and foreign investors reducing their holdings of U.S. debt. Under a looser monetary policy, yields are likely to decline, which could also weaken the U.S. dollar index (Figure 4).

Figure 3: S&P 500 Index

Source: Refinitiv, Tradingkey.com

Figure 4: U.S. Treasury Yields and USD Index

Source: Refinitiv, Tradingkey.com