Fartcoin price prediction as whale sells $5.53 million via DCA strategy

- Fartcoin price upholds gains, rallying over 100% since April 1 to trade above $0.91 on Tuesday.

- A whale places multiple orders to sell Fartcoin using the dollar-cost average strategy, according to Lookonchain data.

- A stable technical structure validates Fartcoin price bullish outlook with the MACD buy signal intact.

- Resistance at $1 could challenge buy-side momentum, while a pullback below $0.90 support may erase April’s gains.

Fartcoin's price edged higher in April, rallying a staggering 102% to $0.91 at the time of writing on Tuesday. The meme coin has stood out as one of the biggest bullish contenders in the last two weeks, with its market capitalization surging by $372 million to $910 million.

Analysts at FXStreet attribute Fartcoin's performance to stability in the broader cryptocurrency market and signs of a sustainable recovery from major assets like Bitcoin (BTC) and Ethereum (ETH), which hover at $85,660 and $1,641 in the early European session.

Fartcoin outperforms peers, targeting $1

Fartcoin went full-blown bullish on breaking resistance at $0.60, validating a cup and handle pattern in the daily timeframe. A strong technical structure and increasing trade volume triggered a massive rally in Fartcoin, eyeing a 66% cup and handle pattern breakout target to $1.00.

The meme coin trades just above $0.91 at the time of writing, showing promising signs of reaching $1.00 in the coming days. The token's momentum is expected to rise as the Moving Average Convergence Divergence (MACD) indicator remains above its centerline, supported by green histograms.

Additionally, the Relative Strength Index (RSI) is nearing overbought territory, reinforcing the robust bullish trend. The upward trajectory of the 50-day and 100-day Exponential Moving Averages (EMAs) indicates that buyers are firmly in control.

FARTCOIN/USD daily chart

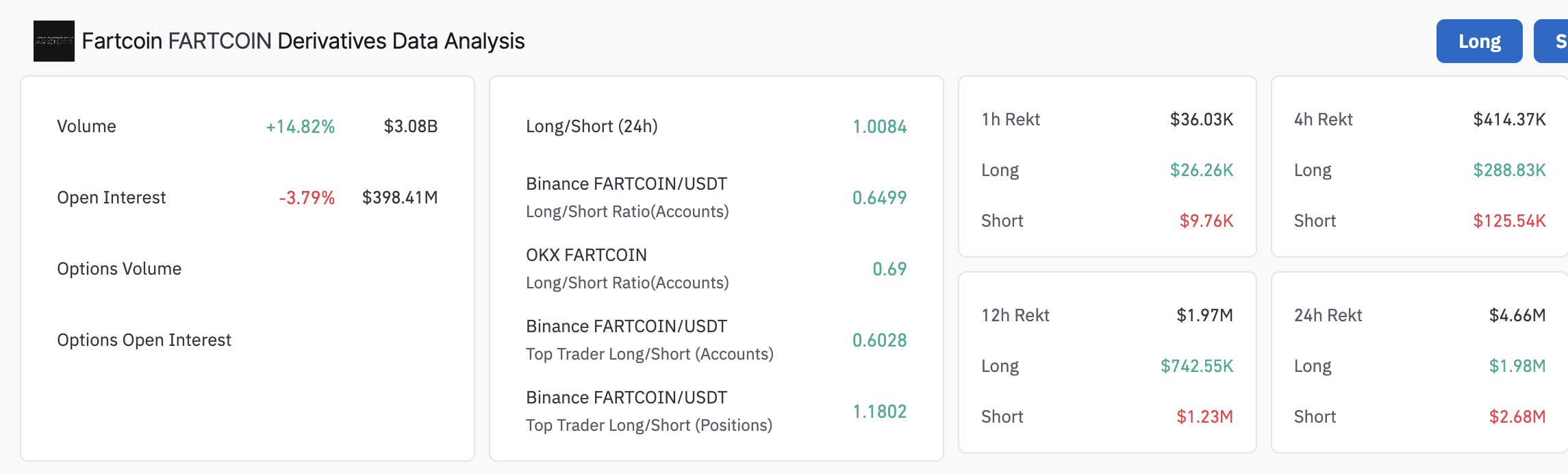

A slightly positive long-to-short ratio of 1.0084 per Coinglass data hints at sentiment around Fartcoin staying bullish. Furthermore, the past 24 hours recorded more short-position liquidations ($2.68 million) than long-position liquidations ($1.98 million). In other words, sellers could be closing their positions, anticipating an extended bullish move in days to come.

Fartcoin derivatives' analysis data | Source: Coinglass

However, traders should stay open to all scenarios, including a reversal in the trend due to profit-taking. This outlook follows on-chain data highlighted by Lookonchain, a platform tracking crypto transactions, focusing on the activities of a whale selling 6.25 million FARTCOIN worth around $5.53 million via the dollar-cost average (DCA) strategy.

If selling pressure increases, surpassing bullish momentum, the probability of the Fartcoin price retracing below the immediate support at $0.90 will surge significantly. More investors may turn to profit-taking, giving up on the meme coin's seemingly short-term potential to reclaim the $1.00 target.